The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

By the end of the week the market had retraced 80 to 100 cents across all Merino types.

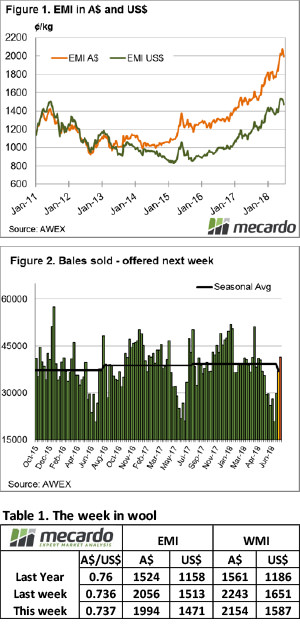

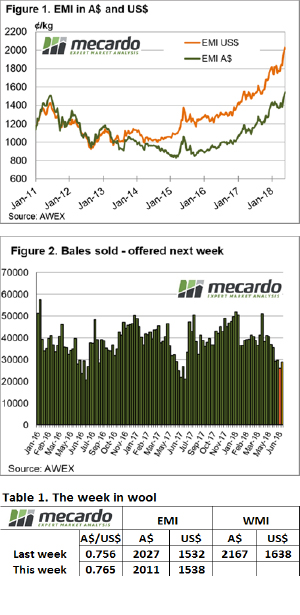

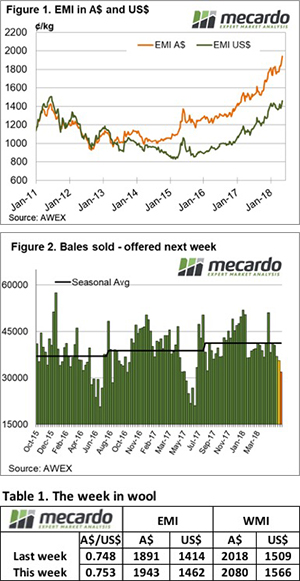

The Eastern Market Indicator gave up 62 cents over the week to settle at 1,994 cents AU$ terms. (Figure 1).

This week the Australian dollar traded steady ending Thursday at 0.737. The EMI was also weaker in US$ terms although not to the same scale as in Au$ terms, closing at 1,471 US cents, down 42 on the week.

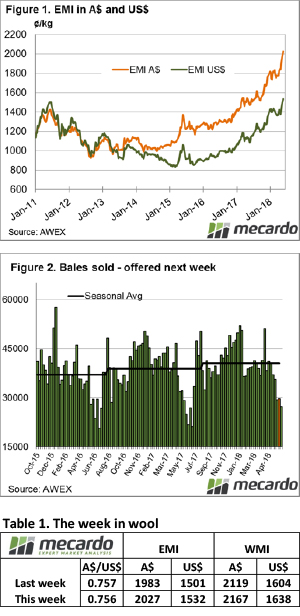

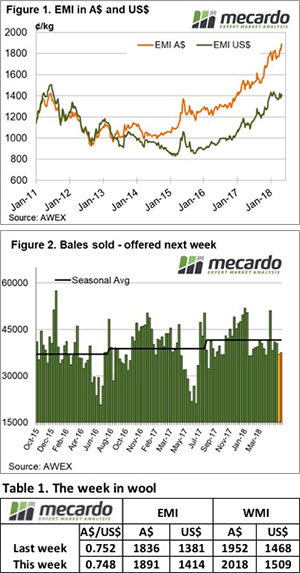

The eagerness of sellers in the past month evaporated this week, with 14.3% passed in on Wednesday and a further 17.2% on Thursday for a total of 15.6% over the week.

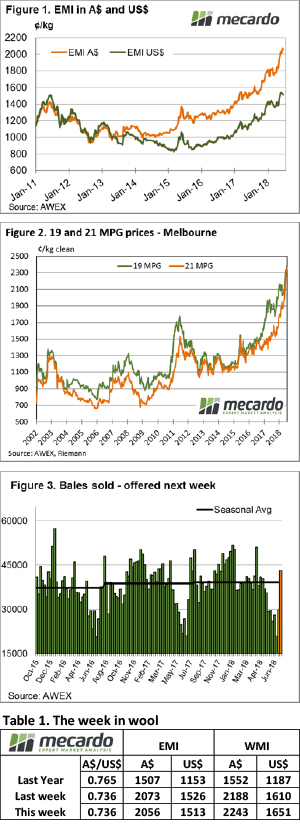

Still, the large offering of 43880 bales resulted in 37,018 bales sold, well above the 27,000 averages for June but in line with the season average of 39,000 per week.

While all categories of Merino fleece were affected, it was the lower style and lots with poor measurements that really struggled, conversely any lots with good specifications were keenly sought. This trend is a replica of previous soft markets.

Contrary to recent sales Crossbreds escaped the full brunt of the market retreat on Wednesday, however took a turn for the worse on Thursday, with declines on the week averaging 30 to 50 cents.

Merino Skirtings eased in line with fleece wool, however lines containing >5% VM found few friends.

Merino Cardings also eased with the Cardings Indicator in Sydney – 10, Melbourne – 10 and Fremantle -5 cents.

The week ahead

Next week all 3 selling centres will be selling, and a reduced offering of 41,431 bales are rostered for sale, significantly lower than this week.

This should take some of the pressure off the market although keen watchers will be looking for any negative trend developing should we see another week like this.

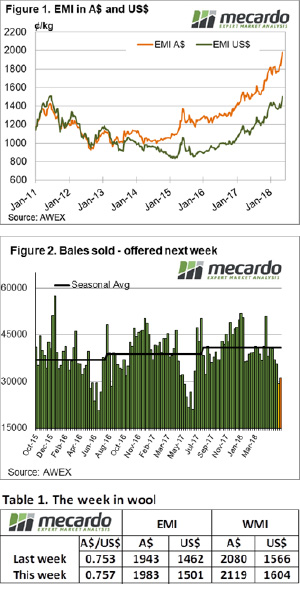

The big upward move in the wool market last week and the return of Fremantle resulted in an increased offering this week, with the market easing slightly.

The big upward move in the wool market last week and the return of Fremantle resulted in an increased offering this week, with the market easing slightly.

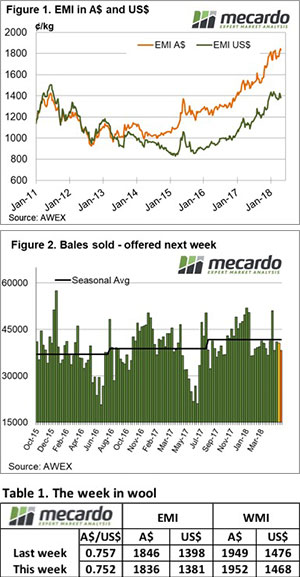

Sometimes good things come in small packages. Well at least was the case in the wool market this week. Fremantle was on recess again, leaving the East Coast to carry the weight and deliver the smallest national offering in nine years at just 20,904 bales. As a result of the lower supply, prices rallied to new heights.

Sometimes good things come in small packages. Well at least was the case in the wool market this week. Fremantle was on recess again, leaving the East Coast to carry the weight and deliver the smallest national offering in nine years at just 20,904 bales. As a result of the lower supply, prices rallied to new heights.  The wool market mended last week’s losses to see a general lift across medium and coarse fibres. Buyer attentions were again diverted away from the finer microns, which saw the price differential between medium and broad microns narrow significantly.

The wool market mended last week’s losses to see a general lift across medium and coarse fibres. Buyer attentions were again diverted away from the finer microns, which saw the price differential between medium and broad microns narrow significantly.

For the last month the wool market has gone from strength to strength, but alas, the upwards stream has come to a halt. That is, unless you look from a US$ perspective. Despite the small offering due to no sales in Fremantle, most categories retracted from the outset on Tuesday.

For the last month the wool market has gone from strength to strength, but alas, the upwards stream has come to a halt. That is, unless you look from a US$ perspective. Despite the small offering due to no sales in Fremantle, most categories retracted from the outset on Tuesday.

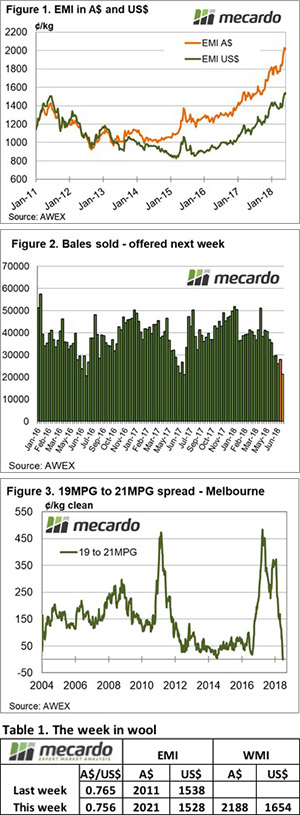

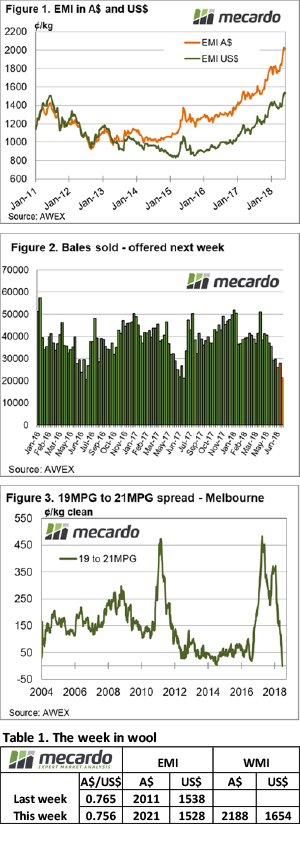

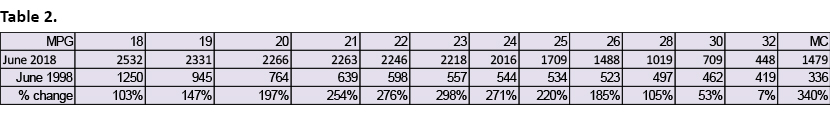

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

Another week, another record. The wool market was again lit up with green across the board. But where one wins, one must loose. We’re seeing the effects of what has been a remarkably strong season play out on supply, and this means buyers are having to fight it out.

Another week, another record. The wool market was again lit up with green across the board. But where one wins, one must loose. We’re seeing the effects of what has been a remarkably strong season play out on supply, and this means buyers are having to fight it out.

going forward.

going forward.