Last week we reported “whispers of nervousness” among exporters, well this week they could be called “loud comments”, perhaps not “shouts” at this stage but the mood has swung over the past two selling weeks. The question is should we be concerned or is this a response/reaction to the strong prices that have been evidenced in 2017?

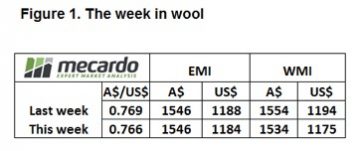

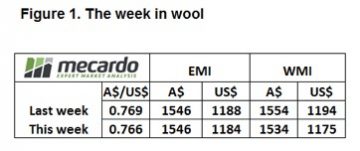

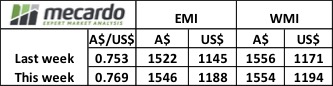

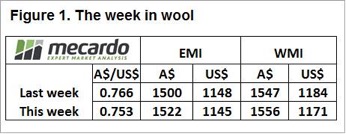

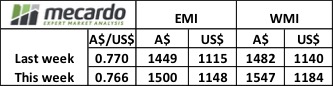

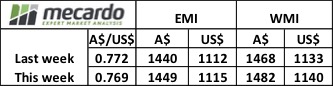

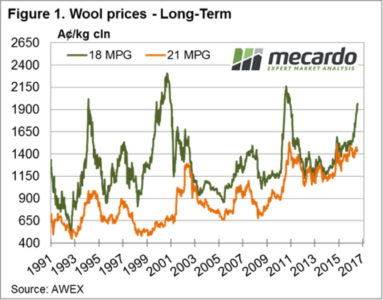

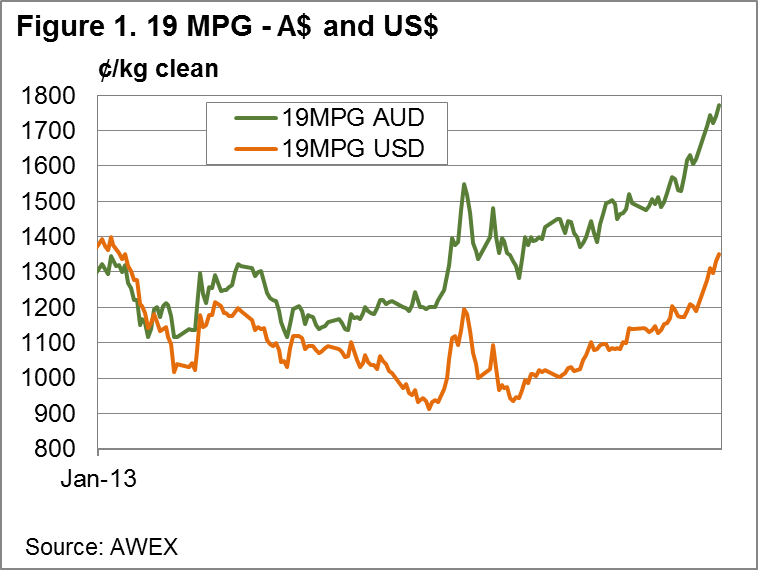

The EMI closed down 44 cents in A$ terms at 1502¢ and also softer in US$ terms at 1151¢, down 33¢. In the West, the indicator was off slightly more with a 46¢ decline in A$. terms. – figure 1.

The EMI closed down 44 cents in A$ terms at 1502¢ and also softer in US$ terms at 1151¢, down 33¢. In the West, the indicator was off slightly more with a 46¢ decline in A$. terms. – figure 1.

Growers & brokers reacted by lifting the pass-in rate to 16.4%; W.A. particularly aggressive with a 25.3% rate.

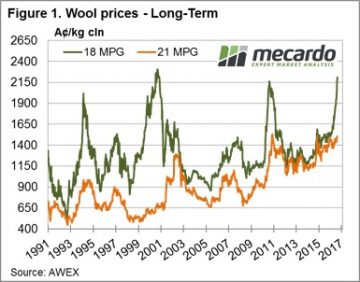

To keep it in perspective though, the 18 MPG in Melbourne had 17 consecutive weeks of gains beginning in January this year. The market improved by 615 cents, before the correction this week where 59 cents was wiped off in Melbourne & Fremantle and 89 cents in Sydney.

Over the same period the 21 MPG lifted 140 cents before giving back 90 cents over the past 2 weeks.

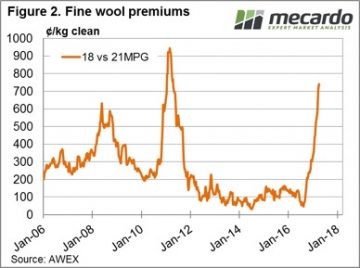

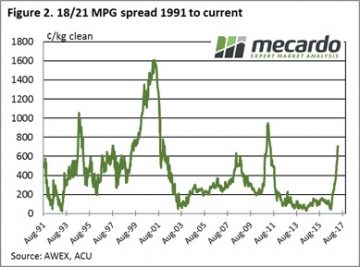

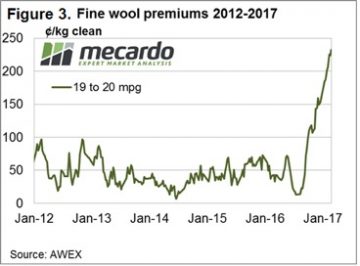

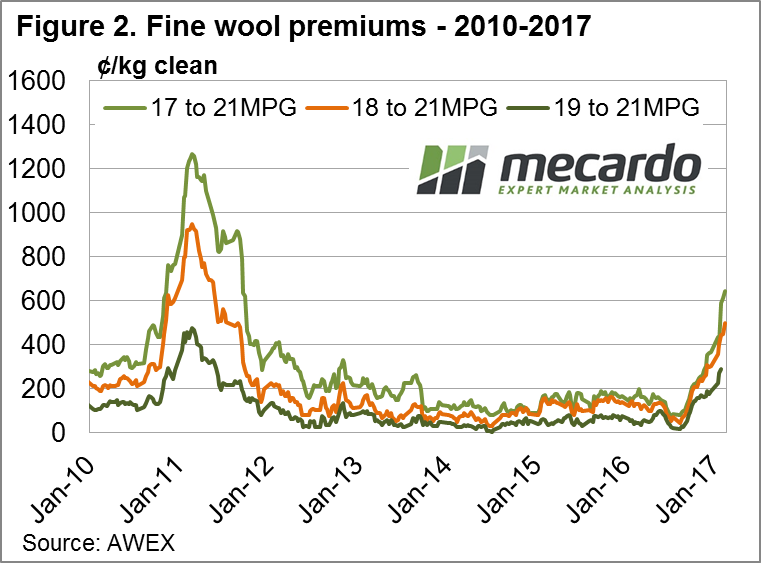

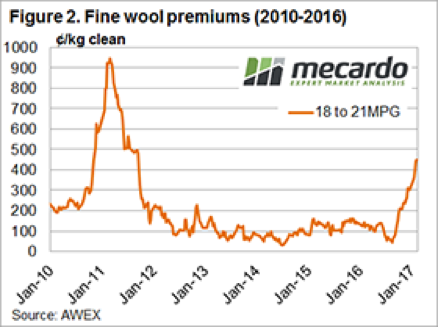

On a slightly different tack, the 18 – 21 MPG Basis (or 18 MPG premiums over 21 MPG) has lifted from 242 cents in January to 740 cents this week; a lift of 498 cents this year. The improving fine wool basis is a clear signal that the fine wool doldrums of the past 7 – 8 years are behind us. Previously the fine wool rallies have been short & sharp, we will need to watch closely over the next 12 months to be alert to any future retracements.

On a slightly different tack, the 18 – 21 MPG Basis (or 18 MPG premiums over 21 MPG) has lifted from 242 cents in January to 740 cents this week; a lift of 498 cents this year. The improving fine wool basis is a clear signal that the fine wool doldrums of the past 7 – 8 years are behind us. Previously the fine wool rallies have been short & sharp, we will need to watch closely over the next 12 months to be alert to any future retracements.

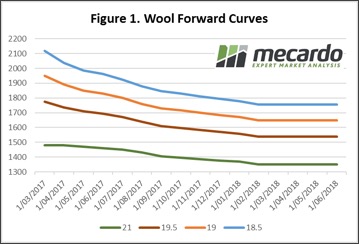

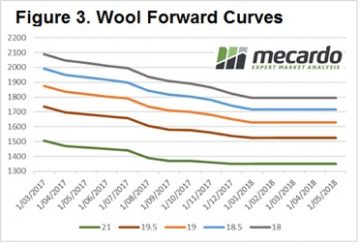

The market correction is a timely reminder that the wool market is volatile and that prices don’t always go up (or down!). The Wool Forward market has been active, and it should be noted that forward prices are always more attractive on a rising market, compared to the same market level on the way down.

We also know that it is difficult to decide to forward sell on a rising market; perhaps it will be even better next week?

With the market at record levels (still!!), it is a good time to look at the forward price relative to your expected shearing and also in relation to your financial budget. Reducing risk and locking in profit generally makes sense, but in this environment, it is even more compelling.

With the market at record levels (still!!), it is a good time to look at the forward price relative to your expected shearing and also in relation to your financial budget. Reducing risk and locking in profit generally makes sense, but in this environment, it is even more compelling.

The week ahead

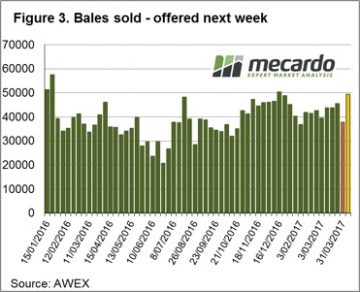

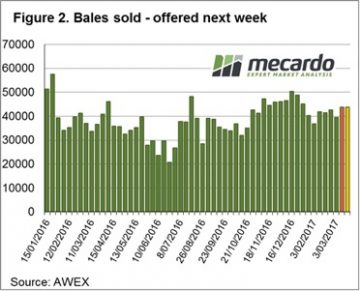

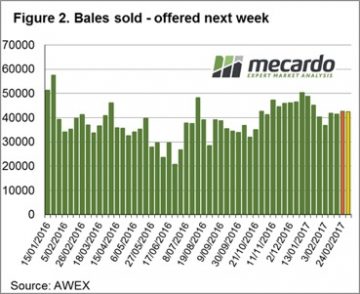

Next week we have just over 49,000 bales listed for sale with trading schedule two days. While it is expected that the full extent of this offering will not all eventuate, this year the most bales sold in a week was the first sale back after the Christmas break where 48,800 bales were cleared.

Reports around the sale this week however, are that this is only a “hick-up” to the market, not a serious concern. Stocks are still reported as “very tight” along all sections of the wool pipeline. We tend to agree that the market is not under great pressure, and with growers prepared to pass-in large volumes the market should find support.

Reports around the sale this week however, are that this is only a “hick-up” to the market, not a serious concern. Stocks are still reported as “very tight” along all sections of the wool pipeline. We tend to agree that the market is not under great pressure, and with growers prepared to pass-in large volumes the market should find support.

A bit of a mixed market this week with the very fine end still surging forward but some beginning whispers of nervousness among exporters at the auctions this week starting to creep in, although this may begin to be eased by a softening A$.

A bit of a mixed market this week with the very fine end still surging forward but some beginning whispers of nervousness among exporters at the auctions this week starting to creep in, although this may begin to be eased by a softening A$.  Given the higher volumes on offer, the reaction of the market as a whole not too bad with the 20-22 micron categories taking the most heat. A total of 45,507 bales sold out of 49,214 on offer resulting in a slightly higher pass in rate of 7.5%

Given the higher volumes on offer, the reaction of the market as a whole not too bad with the 20-22 micron categories taking the most heat. A total of 45,507 bales sold out of 49,214 on offer resulting in a slightly higher pass in rate of 7.5% Next week we have just under 47,000 bales listed for sale with trading schedule two days. A drop in volumes on offer for week 40 and 41 toward the lower 40,000 region could see further gains in price in the coming week, particularly if the A$ can slide back towards 75¢US.

Next week we have just under 47,000 bales listed for sale with trading schedule two days. A drop in volumes on offer for week 40 and 41 toward the lower 40,000 region could see further gains in price in the coming week, particularly if the A$ can slide back towards 75¢US. This was a big week for prices on top of a stellar run over the past few sales. The EMI lifted 24 cents, but with a stronger Au$ it was 43 cents higher in US$ terms. To pick a MPG category, 18.5 was quoted +80 cents in Melbourne, +95 cents in Sydney and +59 cents in Fremantle over the week.

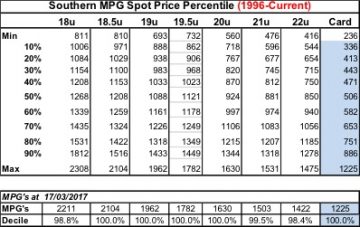

This was a big week for prices on top of a stellar run over the past few sales. The EMI lifted 24 cents, but with a stronger Au$ it was 43 cents higher in US$ terms. To pick a MPG category, 18.5 was quoted +80 cents in Melbourne, +95 cents in Sydney and +59 cents in Fremantle over the week. One way to put perspective on where prices are relative to the past is via Percentile Tables. Since 1996 only 18, 21 & 22 MPG have reached higher levels, that is for 100% of the time since 1996 the market has been lower than the current price for all other Merino micron types. No doubt a fitting reward for those that have stayed the course and are now selling wool at very exciting prices.

One way to put perspective on where prices are relative to the past is via Percentile Tables. Since 1996 only 18, 21 & 22 MPG have reached higher levels, that is for 100% of the time since 1996 the market has been lower than the current price for all other Merino micron types. No doubt a fitting reward for those that have stayed the course and are now selling wool at very exciting prices. Coupled with the virtual non-existence of any wool stocks either on farm, in brokers stores or in mills; then the outlook has little supply pressures ahead.

Coupled with the virtual non-existence of any wool stocks either on farm, in brokers stores or in mills; then the outlook has little supply pressures ahead. The market in Fremantle closed a little softer for 20.5 and coarser wool so some caution for the 2 day sale next week. A increased offering of 51,200 bales is rostered for next week, over 10,000 up on this week’s clearance of 39,800. In subsequent weeks though, AWEX is forecasting back to 42,000 bales per week.

The market in Fremantle closed a little softer for 20.5 and coarser wool so some caution for the 2 day sale next week. A increased offering of 51,200 bales is rostered for next week, over 10,000 up on this week’s clearance of 39,800. In subsequent weeks though, AWEX is forecasting back to 42,000 bales per week. Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook.

Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook. Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year.

Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year. The ongoing strong auction is providing good opportunities in the forward market with

The ongoing strong auction is providing good opportunities in the forward market with

The broad-based demand evident in the higher EMI in both local and US$ terms, gaining 51A¢ and 33US¢, respectively. The EMI not the only indicator to crack $15 this week with the WMI posting a 65A¢ rise, or 44¢ in US$ terms – Figure 1.

The broad-based demand evident in the higher EMI in both local and US$ terms, gaining 51A¢ and 33US¢, respectively. The EMI not the only indicator to crack $15 this week with the WMI posting a 65A¢ rise, or 44¢ in US$ terms – Figure 1. Some exporter reports of just not having access to enough wool to sell at the moment really fuelling the surge. A total of 40,626 bales offered this week with 39,461 sold on the red-hot demand kept the pass in rate contained to 2.9% – Figure 2.

Some exporter reports of just not having access to enough wool to sell at the moment really fuelling the surge. A total of 40,626 bales offered this week with 39,461 sold on the red-hot demand kept the pass in rate contained to 2.9% – Figure 2.

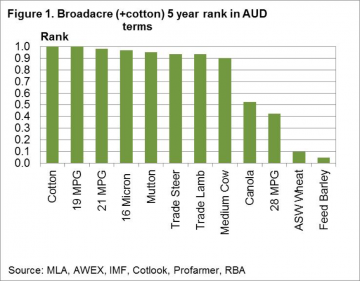

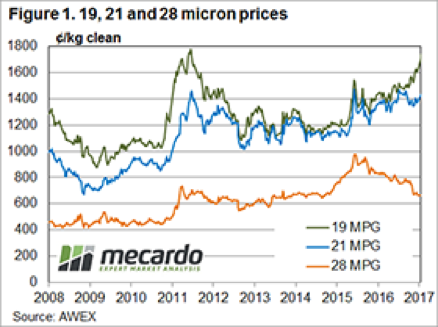

Figure 1 shows the January 2017 five year price rank for a range of broad acre (plus cotton) commodities grown in Australia. The price rank is looked at in Australian dollar terms, as farmers here in Australia see the prices.Basically the news is all good for livestock products (wool and meat) with the exception of crossbred wool (represented here by the 28 MPG). Five year price ranks are all in the top decile, meaning they have traded at lower levels for 90% of more of the past five years. Cotton also is trading in the top decile. At the other end of the scale lie canola, wheat and barley, with canola performing reasonably well by trading at median levels. Wheat and barley are in the bottom decile for the past five years.

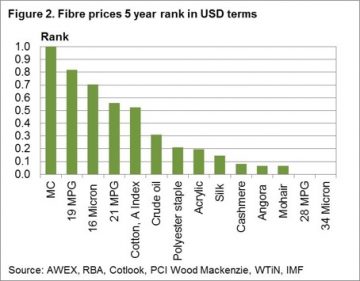

Figure 1 shows the January 2017 five year price rank for a range of broad acre (plus cotton) commodities grown in Australia. The price rank is looked at in Australian dollar terms, as farmers here in Australia see the prices.Basically the news is all good for livestock products (wool and meat) with the exception of crossbred wool (represented here by the 28 MPG). Five year price ranks are all in the top decile, meaning they have traded at lower levels for 90% of more of the past five years. Cotton also is trading in the top decile. At the other end of the scale lie canola, wheat and barley, with canola performing reasonably well by trading at median levels. Wheat and barley are in the bottom decile for the past five years. The next step is to look at these commodity prices from outside of Australia. In this case we use US dollar five year percentiles and break the commodities into groups. Figure 2 looks at fibres, including wool from Australia and a range of other apparel fibres. The price ranks range from a high top decile performance by the Merino Cardings indicator through to bottom decile performances by cashmere, angora, mohair and crossbred wool. The merino combing indicators perform well (ranging from the sixth to the ninth decile) well above oil and the synthetic fibres. Cotton comes in close to the 21 MPG in the sixth decile. The longer the disparity continues between the high merino rankings and lower rankings for the major fibres, the more likely some demand will shift out of merino (especially the broader side of 19 micron) to alternative fibres.

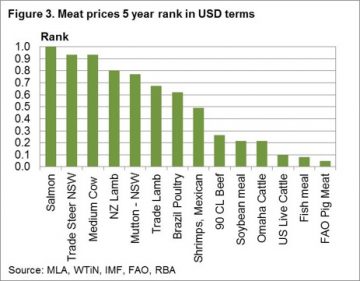

The next step is to look at these commodity prices from outside of Australia. In this case we use US dollar five year percentiles and break the commodities into groups. Figure 2 looks at fibres, including wool from Australia and a range of other apparel fibres. The price ranks range from a high top decile performance by the Merino Cardings indicator through to bottom decile performances by cashmere, angora, mohair and crossbred wool. The merino combing indicators perform well (ranging from the sixth to the ninth decile) well above oil and the synthetic fibres. Cotton comes in close to the 21 MPG in the sixth decile. The longer the disparity continues between the high merino rankings and lower rankings for the major fibres, the more likely some demand will shift out of merino (especially the broader side of 19 micron) to alternative fibres. Figure 3 looks at meat and protein prices from around the world. Salmon is the best performer followed by Australian beef and Australasian sheep meat prices. At the other end of the rankings are range of US beef quotes, along with fishmeal and the FAO pig meat index. The big discrepancy between Australian and US beef price ranks indicates some risk to Australian prices if US prices do not lift.

Figure 3 looks at meat and protein prices from around the world. Salmon is the best performer followed by Australian beef and Australasian sheep meat prices. At the other end of the rankings are range of US beef quotes, along with fishmeal and the FAO pig meat index. The big discrepancy between Australian and US beef price ranks indicates some risk to Australian prices if US prices do not lift. The EMI was up A$0.09, while in US$ terms it improved 3 cents with the Au$ quoted slightly lower for the week. Cardings continue to out-perform, with all 3 selling centres reporting strong increases and the relative Cardings indicators all nudging 1200 cents. (Fig 1.) Note that before 2011 the Cardings indicator rarely bobbed above 600 cents.

The EMI was up A$0.09, while in US$ terms it improved 3 cents with the Au$ quoted slightly lower for the week. Cardings continue to out-perform, with all 3 selling centres reporting strong increases and the relative Cardings indicators all nudging 1200 cents. (Fig 1.) Note that before 2011 the Cardings indicator rarely bobbed above 600 cents. Two points regarding clip preparation are worth noting as the wool market dynamics continue to evolve. These points are at the extreme ends of the micron spectrum with change noted in the fine & superfine market as well as the X Bred market.

Two points regarding clip preparation are worth noting as the wool market dynamics continue to evolve. These points are at the extreme ends of the micron spectrum with change noted in the fine & superfine market as well as the X Bred market. This week Riemann traded solid volumes, with a spread of trades across the 18.5, 19 and 21 MPG types, and for settlements from March 2017 out to July 2018. Price levels were seen as attractive to growers looking to capture some of the market momentum for future clips.

This week Riemann traded solid volumes, with a spread of trades across the 18.5, 19 and 21 MPG types, and for settlements from March 2017 out to July 2018. Price levels were seen as attractive to growers looking to capture some of the market momentum for future clips.

AWEX report a “good solid market over three selling days”; again it was the fine wool leading higher while the rest of the market held firm. Crossbreds also finally found some support and reversed their long downward spiral to see the 28 MPG improve by 19 cents.

AWEX report a “good solid market over three selling days”; again it was the fine wool leading higher while the rest of the market held firm. Crossbreds also finally found some support and reversed their long downward spiral to see the 28 MPG improve by 19 cents. While 47,000 bales were originally listed, only 45,400 bales were eventually offered with 41,500 sold into a market resulting in a 7.6% Passed In rate. The PI rate was skewed somewhat with growers in Fremantle passing 13.5%.

While 47,000 bales were originally listed, only 45,400 bales were eventually offered with 41,500 sold into a market resulting in a 7.6% Passed In rate. The PI rate was skewed somewhat with growers in Fremantle passing 13.5%. As

As

The good news for the wool market continued; again, it was the fine wool that was the stand-out and led the market. Sydney had a designated fine wool sale; this came at the perfect time for NSW fine wool growers resulting in the Merino fleece and skirtings component having an almost total clearance with only 1.6% Passed In, compared to the national PI rate of 6.7%. The EMI was up A$0.15, while in US$ terms it was 9 cents better.

The good news for the wool market continued; again, it was the fine wool that was the stand-out and led the market. Sydney had a designated fine wool sale; this came at the perfect time for NSW fine wool growers resulting in the Merino fleece and skirtings component having an almost total clearance with only 1.6% Passed In, compared to the national PI rate of 6.7%. The EMI was up A$0.15, while in US$ terms it was 9 cents better. The last time 18MPG basis was at this level was July 2011 (Fig 2). Of further note is that in July 2016 (last year) it was quoted in Melbourne at 52 cents. Is that a 900% increase in less than 12 months?

The last time 18MPG basis was at this level was July 2011 (Fig 2). Of further note is that in July 2016 (last year) it was quoted in Melbourne at 52 cents. Is that a 900% increase in less than 12 months? The response from three wool brokers this week when asked about the wool market was unanimous – it’s extremely good if you have wool 19 micron and finer, its good if you are in the “bread and butter” 20 to 22 micron range, and it’s terrible if you have crossbred types. This reinforces the concept that the wool market is not homogenous, it’s made up of a variety different markets.

The response from three wool brokers this week when asked about the wool market was unanimous – it’s extremely good if you have wool 19 micron and finer, its good if you are in the “bread and butter” 20 to 22 micron range, and it’s terrible if you have crossbred types. This reinforces the concept that the wool market is not homogenous, it’s made up of a variety different markets. Fine wool has finally come out of the shadows and remerged to show good premiums over the mainstream types, the concern with the trade now is that this incentive for fine wool producers to continue with this specialty product has come too late for some. The fine wool premium as shown in Fig 2, identifies that the 18 premium over 21 MPG is now at a record not seen since September 2011

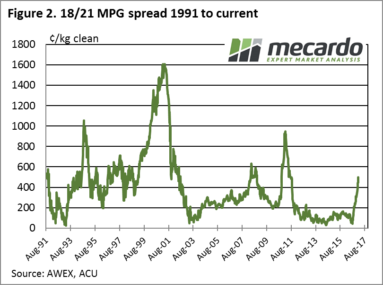

Fine wool has finally come out of the shadows and remerged to show good premiums over the mainstream types, the concern with the trade now is that this incentive for fine wool producers to continue with this specialty product has come too late for some. The fine wool premium as shown in Fig 2, identifies that the 18 premium over 21 MPG is now at a record not seen since September 2011