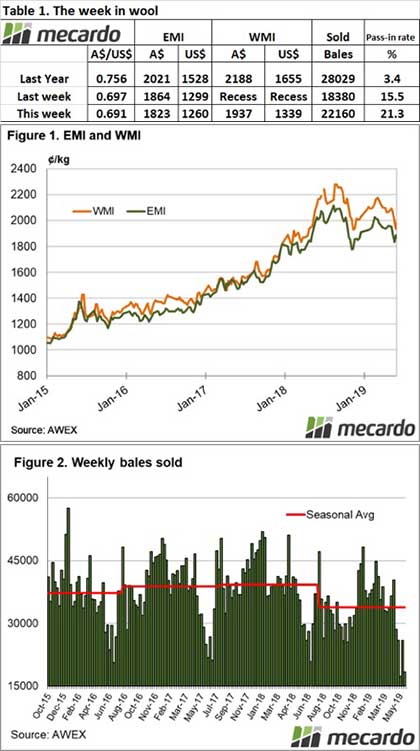

The wool market resumed after the winter recess selling in all three centres but it was an opening that many feared. Demand was negatively affected by the global uncertainty focused on the US/China trade dispute.

Most buyers would have called on their northern hemisphere customers over the break, and clearly the message they received was adverse for prices.

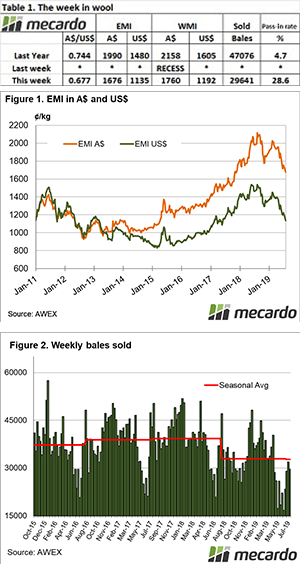

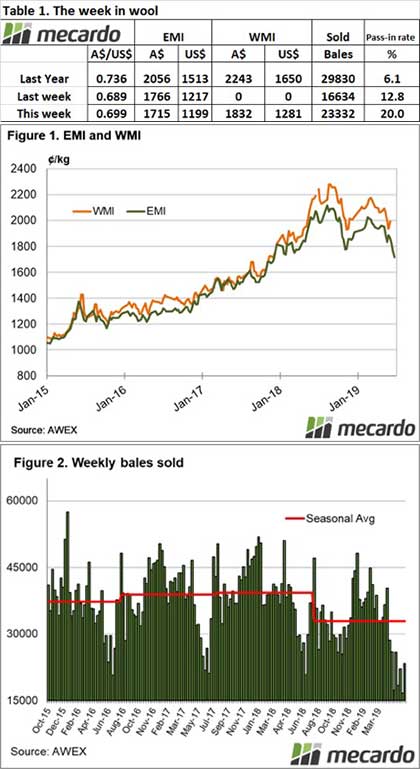

The Eastern Market Indicator (EMI) told the story, losing 31 cents on the opening day and a further 47 cents on Thursday, while the Western Market Indicator (WMI) gave up 134 cents across the two days of selling to close at 1,676 cents. With the significant drop in the AUD over the week, this put the EMI in US terms at 1,135 cents.

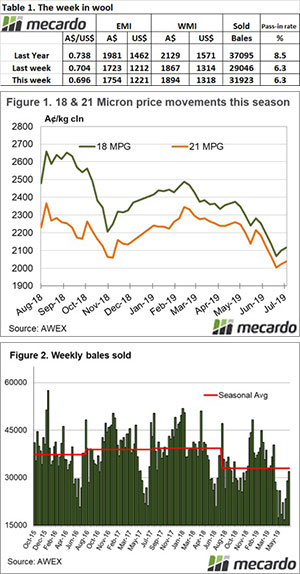

It was only the Cardings sector that posted positive results, with falls of 100 cents plus not uncommon across the MPG categories.

Added to the negative sentiment was the national pass-in rate, 25.8% on day 1 followed by 31.8% on Thursday. In fact, Fremantle auctions passed-in more than half of the wool growers offered for the week.

While this result was not entirely unexpected, it still provided a shock to the market. It also reinforced the maxim that reduced supply may lift prices in the short term if buyers are “squeezed”, but in the end, it is demand that will sustain a market.

The conclusion for now is that buyers are lacking the incentive to purchase, with stocks at mills mounting as global consumer confidence wanes.

41,543 bales were offered for sale across the three selling centres. However, with the pass in rate of 25.8% just 29,641 bales were sold. While the year on year offering for this week was up by 7,774 bales, the combined offering this season is 27,533 bales less than the first three weeks last season.

The dollar value for the week was $51.06 million, for a combined value so far this season of $164.22 billion.

The week ahead

While the correction of this week on the surface should attract demand, the magnitude of the falls could well induce buyers to wait it out to see where this market settles. It is a brave commentator who would call the bottom of the market, so we take a “wait & see” approach.

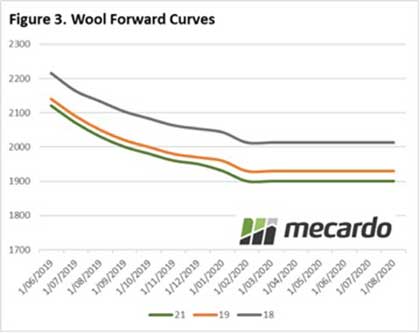

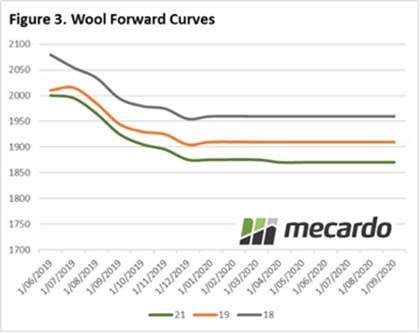

Nine trades were dealt on the forwards market this week, most of them in 19 micron wool, a bit of a slap in the face after predicting quieter markets, but healthy for the forwards market.

Nine trades were dealt on the forwards market this week, most of them in 19 micron wool, a bit of a slap in the face after predicting quieter markets, but healthy for the forwards market.