This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

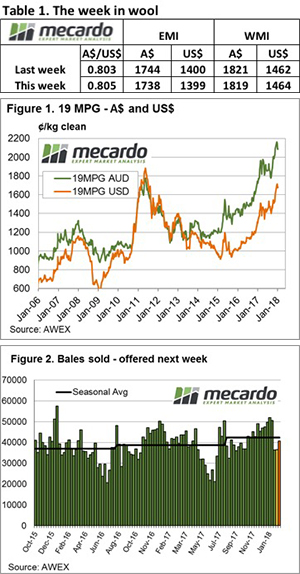

A small catalogue of Merino fleece wool (AWEX reported the smallest Merino fleece offering since March 2016), and growers preparedness to pass-in around 8% of the offering eventually forced the hand of buyers.

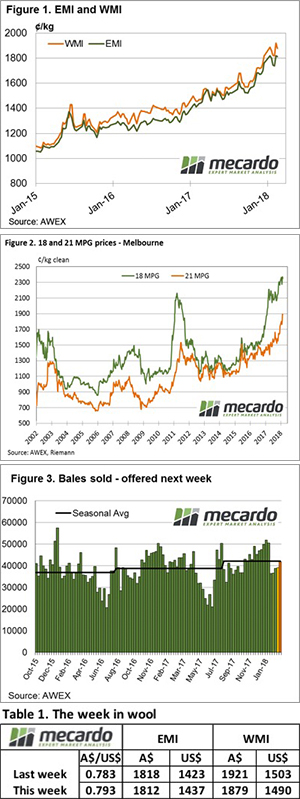

Of the 42,500 bales originally offered, only 39,201 sold. The Pass-in rate was 7.8% or 3,318 bales.

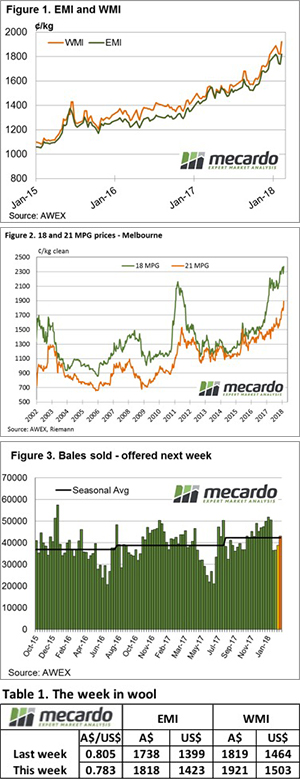

The A$ was quoted up for the week to sit above US$0.79 at the close of selling. This contributed to the Eastern Market Indicator (EMI) falling by $0.06 for the week to close at 1812¢. After last week’s massive 102cents lift, The Western Market Indicator (WMI) gave back 42 cents to finish at 1879 cents.

The underlying strength in the market was evidenced by the EMI rising US$0.14 for the week due to currency movements.

Again, we have seen evidence that by passing-in lots, sellers are able to exert influence in the market to support wool prices when the market softens. Buyers have little option but to bid the market up to fill orders as there are scarce supplies of wool floating around the system.

In general, Cardings and Crossbred types had a good week, posting gains in all centres except for W.A., although in the West any types finer than 17 microns experienced “extreme” demand with up to 100 cent increases.

Growers need to take care with “off-type” wool; lines with low staple strength, high mid-breaks or excessive VM levels are the most effected in the current market. When the market rallies and buyers are scrambling to fill orders, faults are over-looked and prices for lesser quality wools are excellent.

However, when the market eases, these types are the most effected. Conversely, wool exhibiting good measurement holds value in an easing market due to the shortage of these types to fill existing orders.

The week ahead

Sales are scheduled for all three centres next week, with Melbourne selling on Tuesday, Wednesday & Thursday while Sydney & Fremantle will only offer on Wed & Thur.

A total of 41,815 bales is rostered, only 1,000 bales less than this week’s offering but more than the clearance of 39,000.

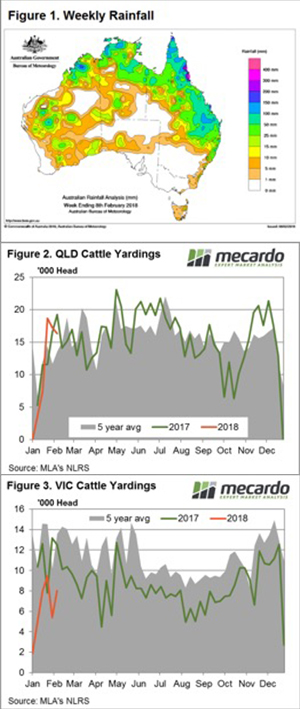

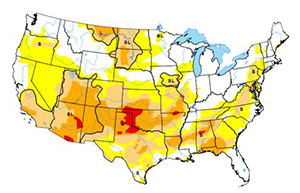

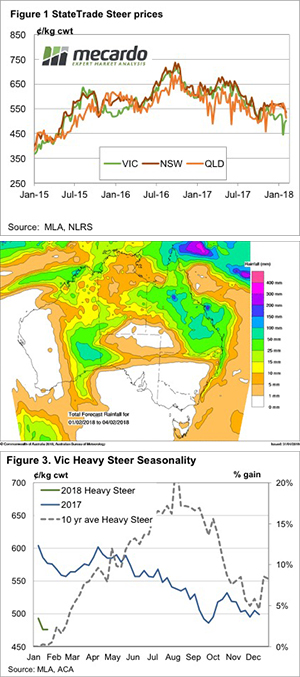

Some very solid rainfall in Queensland this week, yet this was unable to inspire trade cattle prices there as high throughput weighs on the market. In contrast, NSW and Victoria broadly missed out on any rain yet surprisingly throughput was below average and trade cattle prices firmed.

Some very solid rainfall in Queensland this week, yet this was unable to inspire trade cattle prices there as high throughput weighs on the market. In contrast, NSW and Victoria broadly missed out on any rain yet surprisingly throughput was below average and trade cattle prices firmed.

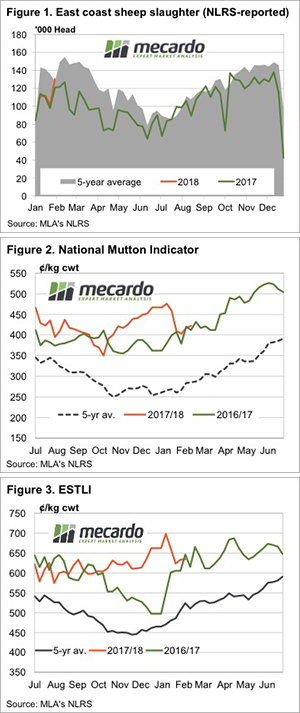

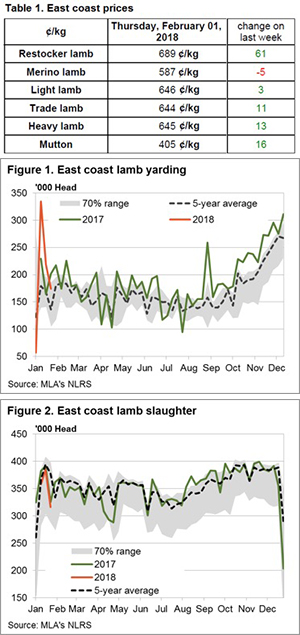

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

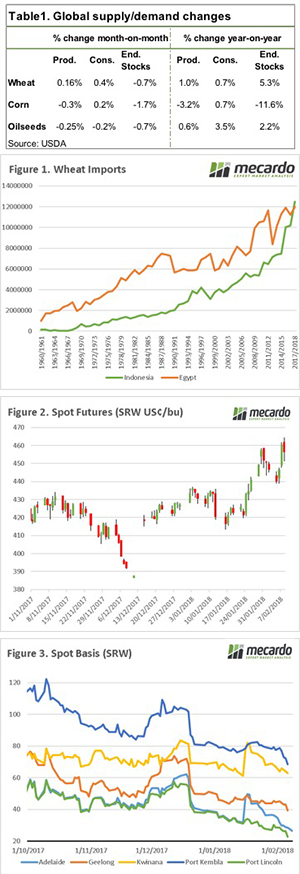

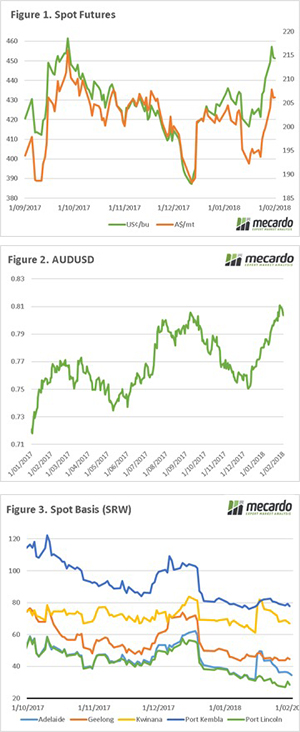

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.