While lamb and sheep prices have reacted to the rain in Victoria and New South Wales, the heavy falls didn’t make it to Northern NSW and Queensland. As a lot of cattle come out of this area at this time of year, national indicators were stagnant.

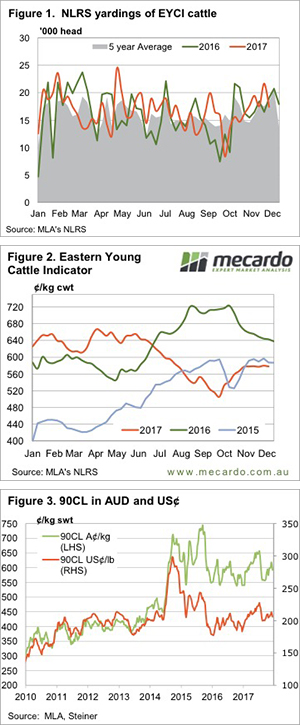

Eastern Young Cattle Indicator (EYCI) yardings did fall away from the 7 month highs of last week, but remained relatively strong (figure 1). Seemingly demand was a little weaker. The EYCI tracked sideways, finishing Thursday at 579.25¢/kg cwt, and has now spent 6 weeks around this level.

did fall away from the 7 month highs of last week, but remained relatively strong (figure 1). Seemingly demand was a little weaker. The EYCI tracked sideways, finishing Thursday at 579.25¢/kg cwt, and has now spent 6 weeks around this level.

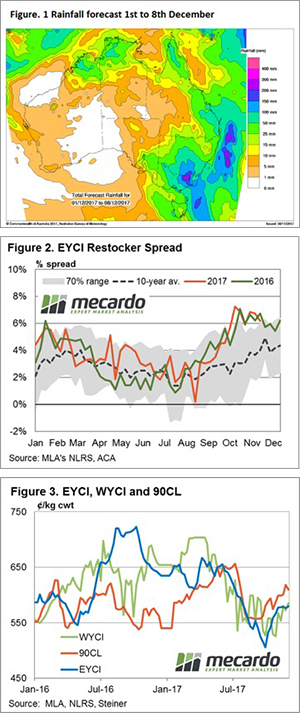

It’s probably not surprising, but the major mover in cattle markets this week was the Victorian Restocker Indicator (VRI). The VRI rallied 36¢, or 12% to 305¢/kg lwt, but remains well behind it’s Queensland and NSW counterparts, which sit at 359 and 328¢ respectively.

We thought the rain might cause some transport disruptions, and hence stronger prices for slaughter cattle. But like the EYCI, slaughter cattle values were largely steady, or even lower in some cases. Trade steers seemed to be the hardest hit.

Export beef prices also eased this week, which might explain some of the lower slaughter cattle values. The 90CL Frozen Cow Indicator fell 17¢ (figure 3), or 2.5% to a 6-week low of 592¢/kg swt on the back of weaker demand from the US. There are also reports New Zealand cattle slaughter is ramping up, which it does seasonally, and increases supplies of lean beef.

The week ahead

With just two weeks to go until the Christmas break, it seems cattle prices are set to track sideways into the end of the year. We won’t have wait long after that for a significant move in cattle prices, as we generally get one over the Christmas break. A good rain in Queensland can kick prices higher, and dry weather might see prices ease.

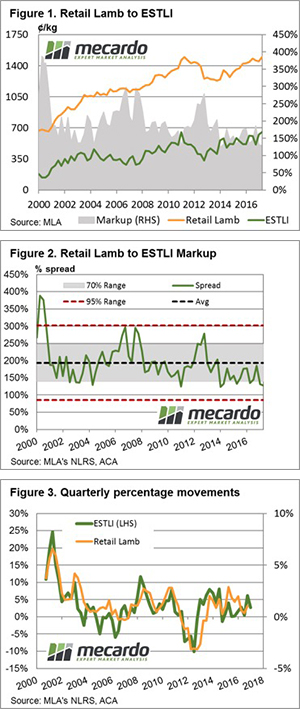

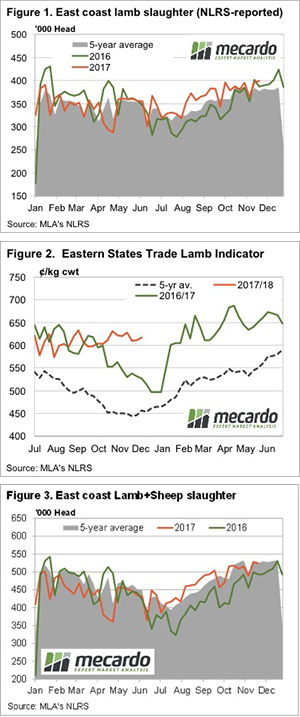

It will come as no surprise that retail lamb prices follow the saleyard and with lamb prices holding their ground into Spring this piece takes a look at what that may mean for the end consumer into the coming season.

It will come as no surprise that retail lamb prices follow the saleyard and with lamb prices holding their ground into Spring this piece takes a look at what that may mean for the end consumer into the coming season.

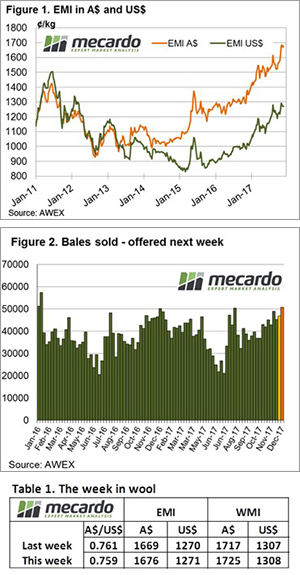

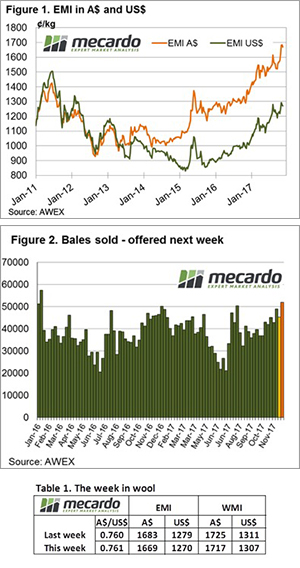

With the Christmas recess looming the market regained some upward pressure this week as exporters tried to lock in their requirements. Fine and medium fibre prices built up gradually across the sales, while most of the crossbred market moved into negative territory.

With the Christmas recess looming the market regained some upward pressure this week as exporters tried to lock in their requirements. Fine and medium fibre prices built up gradually across the sales, while most of the crossbred market moved into negative territory. Forecast rain in the South-East corner of near biblical proportions for the week ahead keeps restocker interest high at the saleyard and young cattle prices across the country firm slightly in response.

Forecast rain in the South-East corner of near biblical proportions for the week ahead keeps restocker interest high at the saleyard and young cattle prices across the country firm slightly in response.

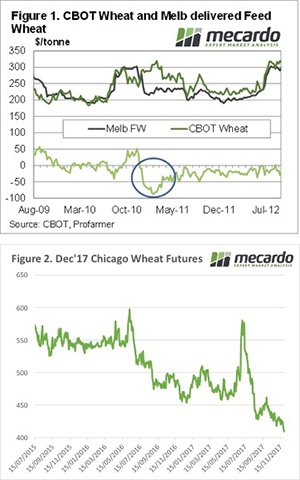

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.