There was a lot of talk back at the end of May around the slaughter of 150,000 New Zealand Dairy Cows, and how it might impact manufacturing beef markets. With NZ’s seasonal cow slaughter peak now behind us, we take a look at whether how slaughter rates reacted, and if we might expect the impact to last.

In an effort to wipe out a bacterium that causes a range of infections and diseases in Dairy Cows it was announced at the end of May that 150,000 cow would need to slaughtered from around 200 farms. While cattle were able to be slaughtered for beef production, it hasn’t seen slaughter increase by as much as might be expected.

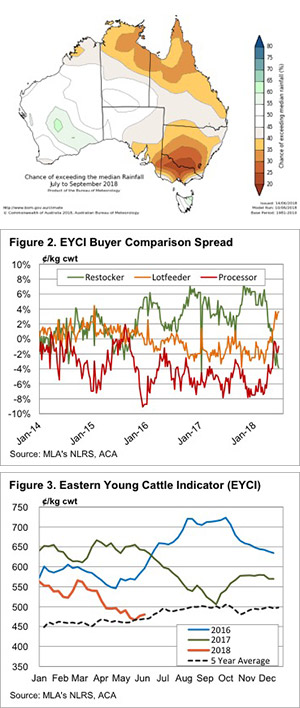

For the period from May to late June has seen total NZ cow slaughter up by just 12,575 head, as shown in figure 1. There have been a few week when NZ cow slaughter has outstripped last year significantly, with the last two reported weeks in June being 43% higher. Perhaps the cull is keeping slaughter rates stronger for longer.

The culled cows will have to be replaced by farmer to maintain milk production. The fact that we haven’t seen a large lift in cow slaughter rates might be attributed to cows which might have been culled leading up to winter, are being held to replace the affected cows.

Retaining cows which might have been culled will have an impact on milk production, with poorer performing cows remaining in the herd. However, for many farmers, keeping or buying older cows will be better than waiting to breed up numbers.

Almost all of New Zealand’s manufacturing beef is exported, so any increase in cow slaughter has an impact on international beef markets. At its peak in April and May NZ cow slaughter breaks even or outstrips Australian cow slaughter levels.

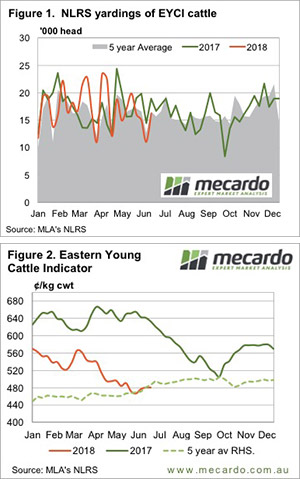

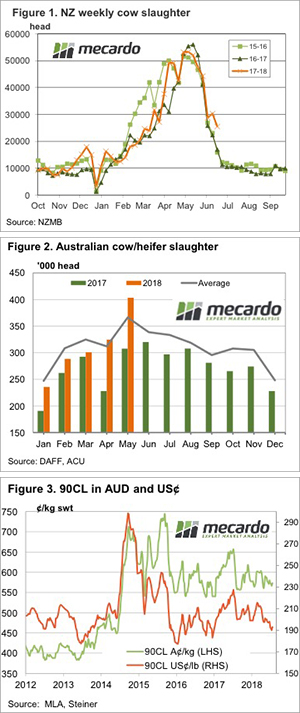

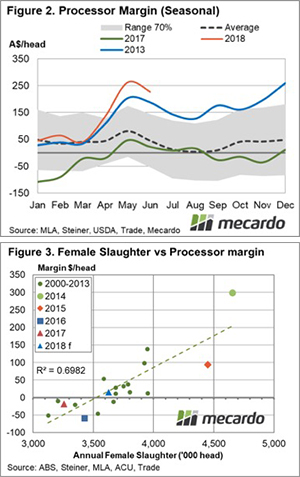

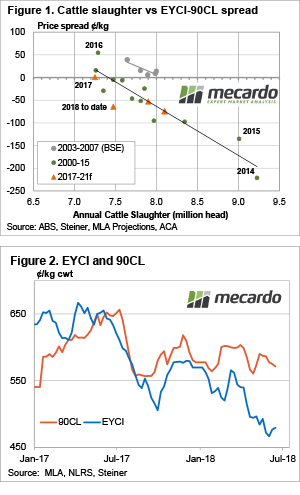

The latest Australian slaughter numbers from the Bureau of Statistics (ABS) show May was a massive month for female slaughter (figure 2). Combined with the increase in supply from New Zealand it was good for cattle producers to see 90CL Frozen Cow export prices holding their ground, as shown in figure 3.

What does it mean/next week?:

Figure 3 also shows the 90CL in US terms, and prices have declined 10% for imported. Obviously the weaker Aussie dollar has helped offset some of the supply driven price declines. And prices haven’t really fallen very far given the lift in supply in recent months.

Looking forward the end of the cull in New Zealand should see a slight tightening in supply for the autumn flush next year, while it has been well documented that some widespread rainfall will see Australian cow supply tighten significantly. This points towards some strong potential for upside in manufacturing export prices, which will feed through to cattle markets.

Key Points

- The NZ Cow cull has had a relatively minor impact on NZ Cow slaughter rates in recent months.

- The lift in Australian cow slaughter in May coinciding with the NZ peak saw strong supplies on the market.

- Manufacturing beef prices have held relatively well, and have upside with tighter supply.

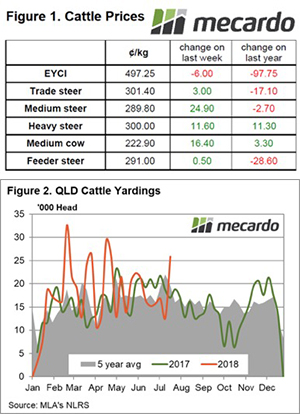

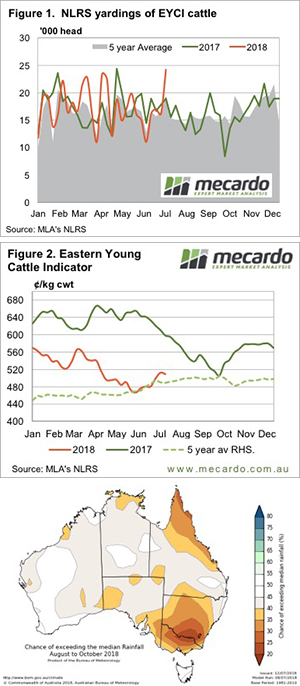

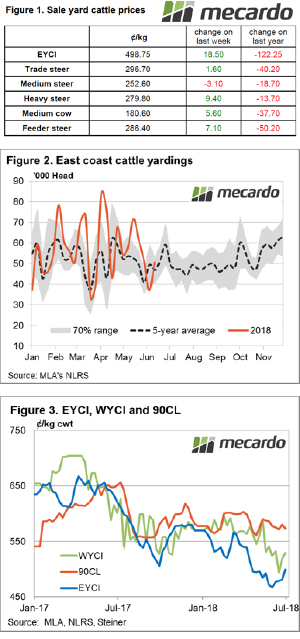

A bit of precipitation and weakening supply has seen cattle prices continue to rally this week, with the Eastern Young Cattle Indicator (EYCI) breaking back through the important 500¢ mark. Slaughter cattle prices also improved, as supply goes into its usual winter hibernation.

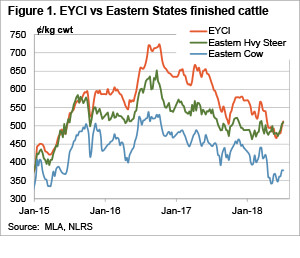

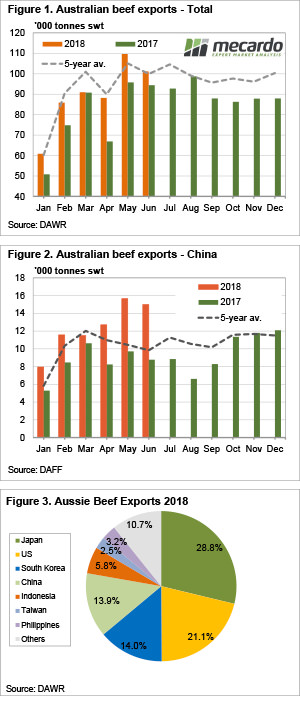

A bit of precipitation and weakening supply has seen cattle prices continue to rally this week, with the Eastern Young Cattle Indicator (EYCI) breaking back through the important 500¢ mark. Slaughter cattle prices also improved, as supply goes into its usual winter hibernation. Cattle slaughter remained relatively strong in June, and this flowed through to export, which, while being down on May were still at their second highest level for the year. China maintained it’s very strong demand for frozen beef, helping keep export prices elevated despite cheaper cattle prices.

Cattle slaughter remained relatively strong in June, and this flowed through to export, which, while being down on May were still at their second highest level for the year. China maintained it’s very strong demand for frozen beef, helping keep export prices elevated despite cheaper cattle prices. The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

It does seem fashionable to take an easy dive now with the World Cup in full flight. Alas, the Socceroos are out and our ovine market commentator was right, I was up bleary-eyed mid-week to see the crashing exit. But at least there is something to cheer about when it comes to cattle prices this week.

It does seem fashionable to take an easy dive now with the World Cup in full flight. Alas, the Socceroos are out and our ovine market commentator was right, I was up bleary-eyed mid-week to see the crashing exit. But at least there is something to cheer about when it comes to cattle prices this week.