Meat and Livestock Australia (MLA) released their quarterly projections this week, and while there were some revisions to this year’s projections, the next three years are expected to be largely the same as was projected in January. The herd growth is expected to be a little weaker, but it’s not really showing up in slower herd growth based on the MLA figures.

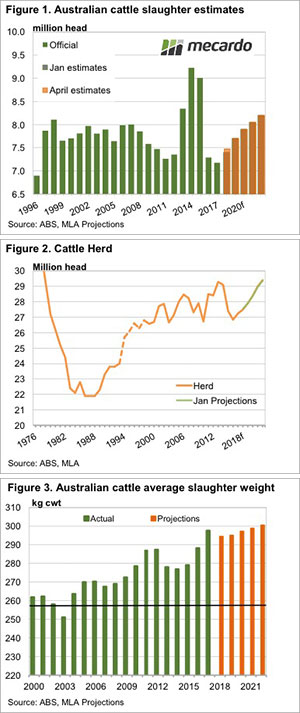

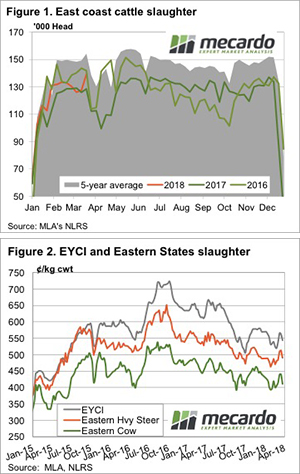

Figure 1 shows the only real major change in MLA’s projections since January, being the increase in slaughter for this year. The strongcattle slaughter to date has seen MLA lift 2018 slaughter by 1% to 7.475 million head. The lift in the slaughter projection doesn’t account for all the extra cattle slaughtered so far, and we think the annual number might be a bit higher than this projection.

While slaughter forecasts are still well below the bumper numbers of 2013-15, it is still the fifth highest of the last 10 years. The higher slaughter this year isn’t expected to result in fewer cattle coming to market over the coming four years. MLA have left forecasts for 2019-2022 unchanged, with the gradual increase in response to an increasing herd.

Similar to slaughter, MLA have left their projections for the size of the herd unchanged. Figure 2 shows minimal change in the forecast growth in the herd. The Australian cattle herd is expected to grow by around 1-2% per year until it reaches a 45 year high in 2022.

It’s highly unlikely that the herd will grow in such a uniform manner, as seasonal conditions often throw projections out the window. The current dry spell is likely to see higher slaughter in the short term, slowing of the herd rebuild, and weaker slaughter in the medium term.

Carcase weights are also expected to grow after having a setback this year. Dry weather and lower numbers of cattle on feed should see average slaughter weights fall this year. MLA are expecting carcase weights to grow to a record high in 2022.

What does it mean/next week?:

As long as cattle remain relatively strong, the herd should continue to grow. The current very strong slaughter is still seeing cattle prices above the pre-2015 records, so we can say that cattle prices are still strong.

MLA obviously expect cattle prices to remain strong, as the herd and carcase weights wouldn’t grow unless there was an incentive to produce more beef. The slaughter projection for this year might be a bit low, and if we end up with higher levels, it should see lower slaughter next year.

Key Points

- MLA’s quarterly projections show a small increase in 2018 slaughter, but no change in later years.

- The herd and carcase weights are expected to grow to at least 40 year highs by 2022.

- The stronger slaughter now might see annual rates surpass projections, taking cattle from the 2019 season.

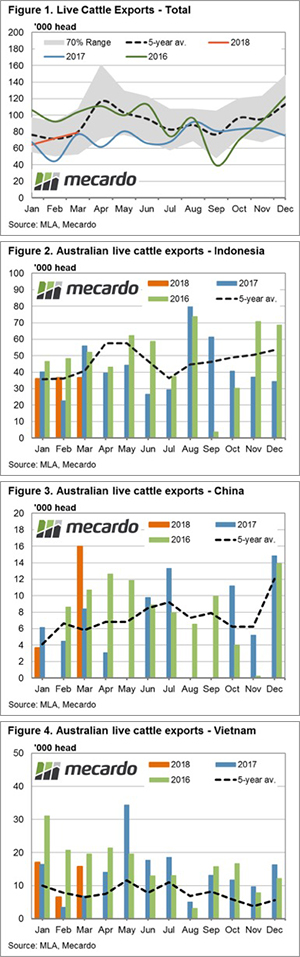

At a time when the live sheep export trade is making headlines for all the wrong reasons the big brother of the industry is quietly getting on with the job. Live cattle exports make up the lion’s share of the total trade out of Australia, with the combined beef and dairy trade representing 1.5 billion of the 1.8 billion annual farm gate returns. This piece takes a quick look at how the key markets are faring so far this season.

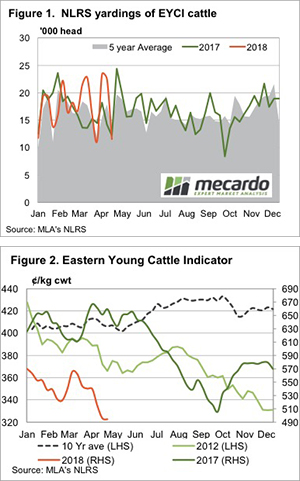

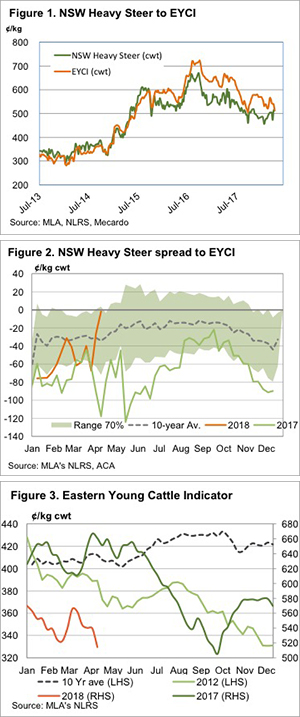

At a time when the live sheep export trade is making headlines for all the wrong reasons the big brother of the industry is quietly getting on with the job. Live cattle exports make up the lion’s share of the total trade out of Australia, with the combined beef and dairy trade representing 1.5 billion of the 1.8 billion annual farm gate returns. This piece takes a quick look at how the key markets are faring so far this season. has been no real rain in April, in addition to the usual increase in young cattle supply in Northern NSW, is helping drive the EYCI lower.

has been no real rain in April, in addition to the usual increase in young cattle supply in Northern NSW, is helping drive the EYCI lower.

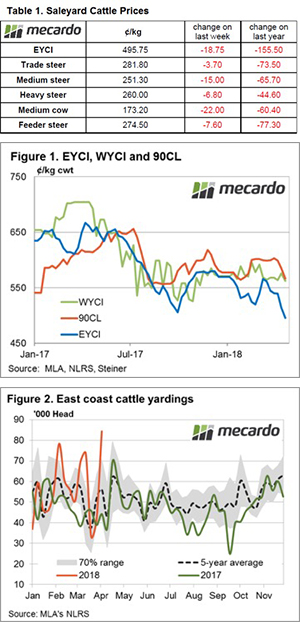

¢ to close at 289.8¢/kg lwt.

¢ to close at 289.8¢/kg lwt.

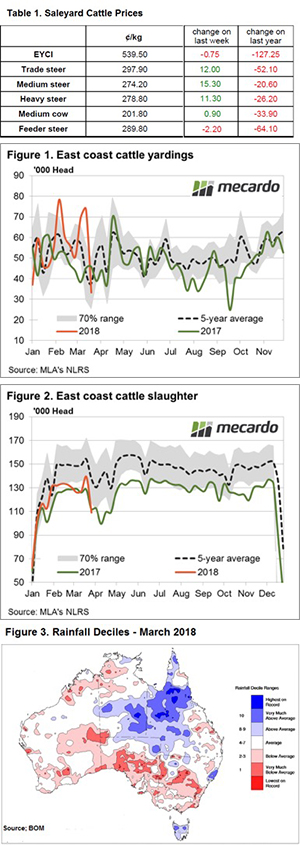

attle processed than the previousweek, and 4.3% more than the 2018 high. In fact, we haven’t seen this many cattle slaughtered in a week since June 2016.

attle processed than the previousweek, and 4.3% more than the 2018 high. In fact, we haven’t seen this many cattle slaughtered in a week since June 2016.

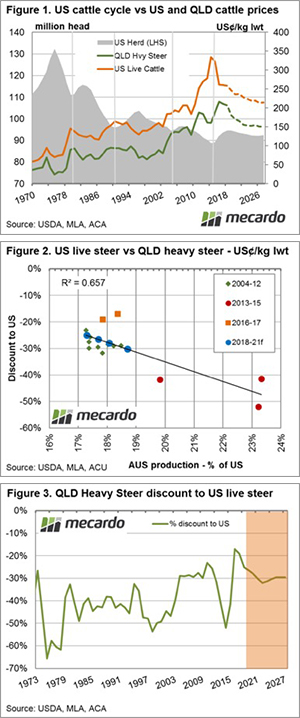

The United States Department of Agriculture (USDA) have released their updated long-term projections for key agricultural markets and they contained some adjustment to forecast herd growth, production and cattle price forecasts. This article takes a look at what these revisions mean for cattle prices and spread relationships between the US and Australia in the coming years.

The United States Department of Agriculture (USDA) have released their updated long-term projections for key agricultural markets and they contained some adjustment to forecast herd growth, production and cattle price forecasts. This article takes a look at what these revisions mean for cattle prices and spread relationships between the US and Australia in the coming years.