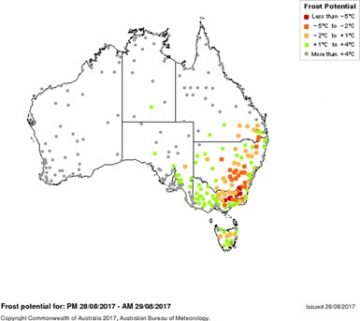

For those into pop culture references, the term ‘Winter is coming’ has been prevalent in recent years. We are officially past winter now, but that hasn’t stopped the frost. Our friends in NSW just can’t seem to get a break this year.

The US were busy celebrating labor day on Monday, well at least those not bracing for (or recovering from) Hurricanes. The market had a strong recovery prior to the holiday, with short sellers taking profits after a continuous decline over the past month (figure 1), however over the past two sessions the market has lost around half of these gains. The market was not helped by the Food and Agriculture Organisation raising its expectations for the global cereals crop to 2.6bmt, which would be the highest on record.

The US were busy celebrating labor day on Monday, well at least those not bracing for (or recovering from) Hurricanes. The market had a strong recovery prior to the holiday, with short sellers taking profits after a continuous decline over the past month (figure 1), however over the past two sessions the market has lost around half of these gains. The market was not helped by the Food and Agriculture Organisation raising its expectations for the global cereals crop to 2.6bmt, which would be the highest on record.

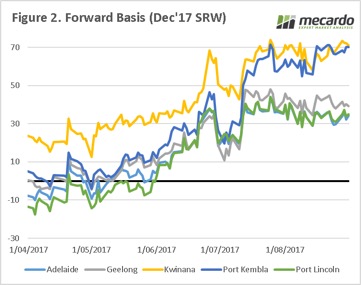

The Australian crop has gone from bad to worse. NSW, which has struggled since seeding with a lack of moisture, has now been impacted by unusually severe frosts. The impact of a likely drop in supply has led prices to follow the theoretical logic of basis perfectly.

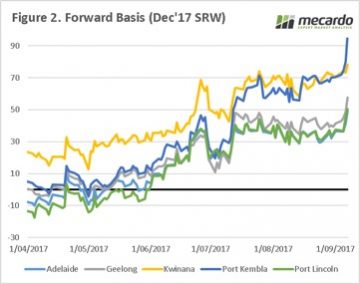

In the past week, we have witnessed basis levels increase dramatically (figure 2). In this data set it is most markedly so in Port Kembla, where the crops are likely to be most impacted. The other zones on the east coast have also risen considerably, and flows are now likely from southern to northern areas.

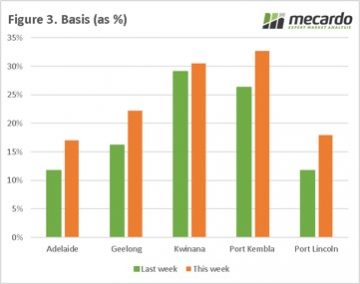

In figure 3, the basis levels as a percentage of the overall price are plotted. As we can see, there have been considerable rises in all zones. The rise was far more sedate in Kwinana, which has for the past 8 weeks maintained at strong levels, and the bulk of issues in the WA crop have been priced in. The basis levels as a percentage of the price in Kwinana and Port Kembla are now at historically high levels.

In figure 3, the basis levels as a percentage of the overall price are plotted. As we can see, there have been considerable rises in all zones. The rise was far more sedate in Kwinana, which has for the past 8 weeks maintained at strong levels, and the bulk of issues in the WA crop have been priced in. The basis levels as a percentage of the price in Kwinana and Port Kembla are now at historically high levels.

Next Week/What does this mean?

We have a double whammy on Tuesday. The USDA and ABARES release their crop estimated for September.

There have been a number of issues in Australia, however I expect ABARES to take a relatively conservative approach to any drops in production.

The key will be the USDA report, will there be any surprises? The recent upgrades to the Russian crop will likely give a bearish edge to the report.

The key will be the USDA report, will there be any surprises? The recent upgrades to the Russian crop will likely give a bearish edge to the report.

This weekly comment marks the first in our planned fortnightly Online Young Cattle Indicator (OYCI) updates as well as a general summary of the broader cattle market over the last week. Interestingly, the spread of the OYCI to the EYCI has narrowed over the month of August.

This weekly comment marks the first in our planned fortnightly Online Young Cattle Indicator (OYCI) updates as well as a general summary of the broader cattle market over the last week. Interestingly, the spread of the OYCI to the EYCI has narrowed over the month of August.

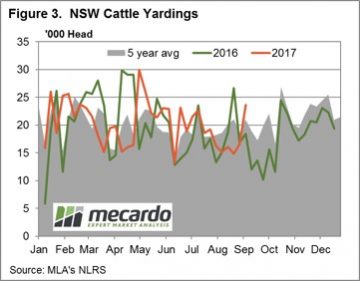

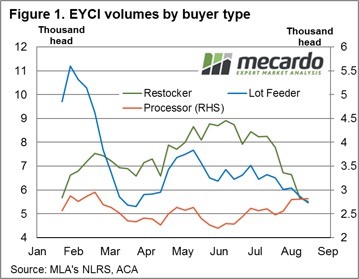

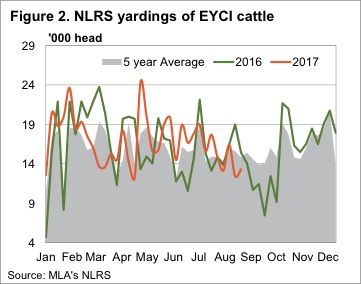

Since the start of Winter there has been a changing dynamic at the saleyard for young cattle purchases. Declines in average volumes have been noted for restockers and lot feeders, on the back of reduced pasture availability and higher feed costs. However, processor purchases have bucked the trend as their margins are stubbornly clinging on to positive territory.

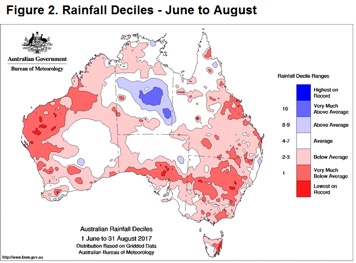

Since the start of Winter there has been a changing dynamic at the saleyard for young cattle purchases. Declines in average volumes have been noted for restockers and lot feeders, on the back of reduced pasture availability and higher feed costs. However, processor purchases have bucked the trend as their margins are stubbornly clinging on to positive territory. Over the season so far, restocker purchases have been averaging around 7,250 head of EYCI cattle per week. However, average purchases for the last month have reduced to 5,500 head as unseasonal dry conditions, highlighted by the rainfall deciles from June to August (figure 2), sap some of the optimism out of restocker demand.

Over the season so far, restocker purchases have been averaging around 7,250 head of EYCI cattle per week. However, average purchases for the last month have reduced to 5,500 head as unseasonal dry conditions, highlighted by the rainfall deciles from June to August (figure 2), sap some of the optimism out of restocker demand. The updated Bureau of Meteorology three-month weather outlook indicates a move to a more neutral condition for much of the country. The BOM expect rainfall to be below average in southwest Australia, above average in parts of southeast Queensland, and has a 50/50 chance of being above or below average elsewhere.

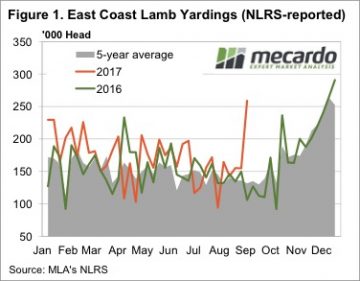

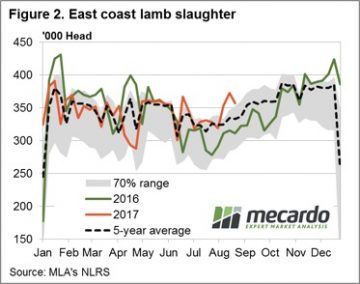

The updated Bureau of Meteorology three-month weather outlook indicates a move to a more neutral condition for much of the country. The BOM expect rainfall to be below average in southwest Australia, above average in parts of southeast Queensland, and has a 50/50 chance of being above or below average elsewhere. It was a rather extraordinary week for lamb supply at saleyards. In NSW lamb prices not only hit a record, but were 28.5% higher than the previous record, at 194,781 head. Lamb yardings in Victoria more than doubled, pushing East Coast yardings to a 67.5% rise for the week.

It was a rather extraordinary week for lamb supply at saleyards. In NSW lamb prices not only hit a record, but were 28.5% higher than the previous record, at 194,781 head. Lamb yardings in Victoria more than doubled, pushing East Coast yardings to a 67.5% rise for the week. It’s hard to see lamb supply maintaining the extraordinary levels of this week, but we don’t expect a fall in yardings to do much to price. New season lambs are now flowing fairly steadily, with the only question being over the weight of lambs. This could see heavy and trade lambs hold their ground to an extent, in the face of easing light and restocker lamb prices.

It’s hard to see lamb supply maintaining the extraordinary levels of this week, but we don’t expect a fall in yardings to do much to price. New season lambs are now flowing fairly steadily, with the only question being over the weight of lambs. This could see heavy and trade lambs hold their ground to an extent, in the face of easing light and restocker lamb prices.

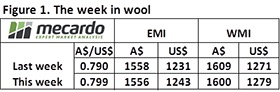

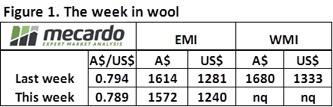

The EMI fell only 2 cents in A$ terms to settle at 1,556 cents, while in US$ terms the market improved 12 cents over the week (figure 1). The WMI was 9 cents lower than the previous close of last week.

The EMI fell only 2 cents in A$ terms to settle at 1,556 cents, while in US$ terms the market improved 12 cents over the week (figure 1). The WMI was 9 cents lower than the previous close of last week. This week was a pretty good result considering a larger offering and a higher A$ could have pushed the market lower following the last couple of weeks of price corrections. It wasn’t the case however, and growers responded by clearing the large offering and only passing in 5.2%.

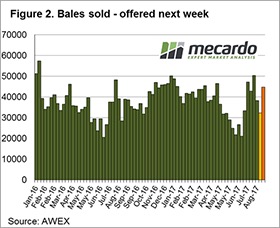

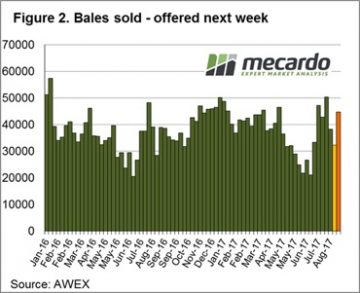

This week was a pretty good result considering a larger offering and a higher A$ could have pushed the market lower following the last couple of weeks of price corrections. It wasn’t the case however, and growers responded by clearing the large offering and only passing in 5.2%. Through the looking glass into next week, another large offering of 44,281 bales are rostered for sale in all three selling centres (Figure 2). The solid performance this week in the face of a large offering and stronger A$ bodes well for next week.

Through the looking glass into next week, another large offering of 44,281 bales are rostered for sale in all three selling centres (Figure 2). The solid performance this week in the face of a large offering and stronger A$ bodes well for next week.

In nautical terms, ‘Dead Calm’ is completely still sea, with the absence of wind or waves. The grain market could be considered to be in a period of dead calm, with the market waiting for some wind or waves in the form of substantial new data to blow us either way.

In nautical terms, ‘Dead Calm’ is completely still sea, with the absence of wind or waves. The grain market could be considered to be in a period of dead calm, with the market waiting for some wind or waves in the form of substantial new data to blow us either way. In contrast, Victoria seems to be the jewel in the crown and after having covered part of the state in recent days the crop looks to be in almost perfect condition, appearing to be on track for well above average yields.

In contrast, Victoria seems to be the jewel in the crown and after having covered part of the state in recent days the crop looks to be in almost perfect condition, appearing to be on track for well above average yields. In two weeks, we will have the September WASDE report released, along with the ABARES report. The question will be whether the trade has priced in any downgrade, or whether any likely downgrades will cause a stir.

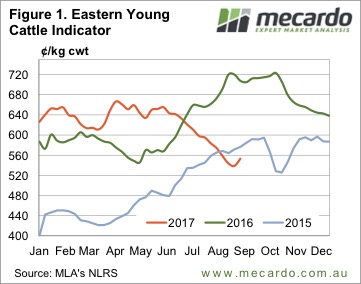

In two weeks, we will have the September WASDE report released, along with the ABARES report. The question will be whether the trade has priced in any downgrade, or whether any likely downgrades will cause a stir. Young cattle prices gained some ground this week, for the first time in some while. The Eastern Young Cattle Indicator (EYCI) has fallen for 12 weeks without any real break. This week the break came, with the EYCI gaining 14¢ to move back to 553¢/kg cwt. Is it a dead cat bounce or a sustainable rally?

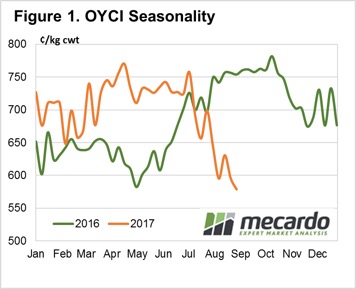

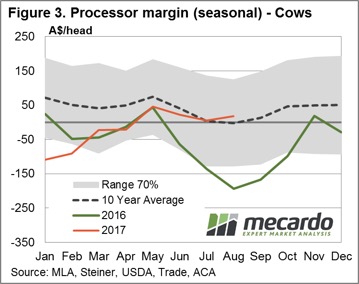

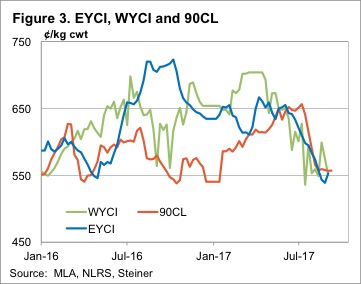

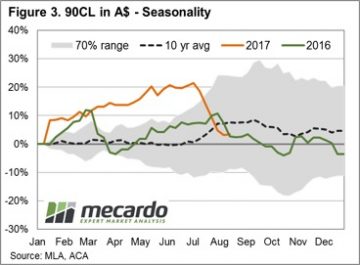

Young cattle prices gained some ground this week, for the first time in some while. The Eastern Young Cattle Indicator (EYCI) has fallen for 12 weeks without any real break. This week the break came, with the EYCI gaining 14¢ to move back to 553¢/kg cwt. Is it a dead cat bounce or a sustainable rally? The 90CL Frozen Cow price has tracked sideways for the fourth week in a row and both the EYCI and Western Young Cattle Indicator (WYCI) have met it at around 555¢. Figure 3 suggests it’s hard to argue that falling beef export prices aren’t driving the cattle price.

The 90CL Frozen Cow price has tracked sideways for the fourth week in a row and both the EYCI and Western Young Cattle Indicator (WYCI) have met it at around 555¢. Figure 3 suggests it’s hard to argue that falling beef export prices aren’t driving the cattle price.

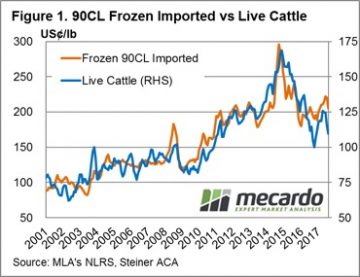

At Mecardo we regularly refer to the 90CL frozen cow indicator as a key beef export price benchmark when undertaking analysis of the domestic market prices in relation to overseas markets. This is because a strong long-term correlation exists between indices like the Eastern Young Cattle Indicator (EYCI) and the 90CL. We often get asked to explain what the 90CL actually is and what influences its movement – this will be addressed in this piece.

At Mecardo we regularly refer to the 90CL frozen cow indicator as a key beef export price benchmark when undertaking analysis of the domestic market prices in relation to overseas markets. This is because a strong long-term correlation exists between indices like the Eastern Young Cattle Indicator (EYCI) and the 90CL. We often get asked to explain what the 90CL actually is and what influences its movement – this will be addressed in this piece. Therefore, it should come as no surprise that the influence of the broader US cattle market on the price of the 90CL is fairly strong. Indeed, as highlighted in figure 1, the movement of US Live Cattle futures is closely mirrored by the movement in the 90CL. Analysis of the monthly average price of US Live Cattle to the 90CL since 2001 shows a correlation measure of 0.9139 which suggests that nearly all of the movement in the 90CL can be explained by the fluctuations of the US Live Cattle market.

Therefore, it should come as no surprise that the influence of the broader US cattle market on the price of the 90CL is fairly strong. Indeed, as highlighted in figure 1, the movement of US Live Cattle futures is closely mirrored by the movement in the 90CL. Analysis of the monthly average price of US Live Cattle to the 90CL since 2001 shows a correlation measure of 0.9139 which suggests that nearly all of the movement in the 90CL can be explained by the fluctuations of the US Live Cattle market. Compared to current US Live Cattle levels the 90CL in US terms seems a little overvalued, and the normal annual pattern heading into the remainder of the season shows that the 90CL usually begins to decline beyond the US grilling season peak around July/August.

Compared to current US Live Cattle levels the 90CL in US terms seems a little overvalued, and the normal annual pattern heading into the remainder of the season shows that the 90CL usually begins to decline beyond the US grilling season peak around July/August.

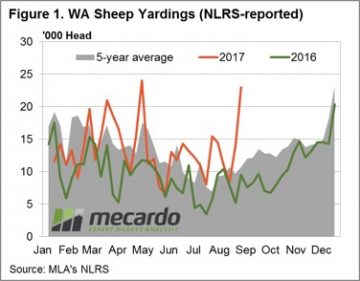

Figure 1 highlights the reaction of Western mutton producers this week to the robust prices for sheep and lamb prices being experienced recently, as covered by our

Figure 1 highlights the reaction of Western mutton producers this week to the robust prices for sheep and lamb prices being experienced recently, as covered by our

During this period in the wool market, it seems to be performing as a more predictable beast than usual. Market rallies strongly – growers sell – buyers lose orders because market is “too hot” – market retraces – growers pass-in higher levels – market recovers – buyers receive increased orders – market rallies …….. repeat!!

During this period in the wool market, it seems to be performing as a more predictable beast than usual. Market rallies strongly – growers sell – buyers lose orders because market is “too hot” – market retraces – growers pass-in higher levels – market recovers – buyers receive increased orders – market rallies …….. repeat!! The underlying story for this week however is positive, the market opened on Wednesday with “red ink” across the board, but a reversal on Thursday was clear, with gains of 10 – 20 cents across all microns and the market finishing on a positive sentiment.

The underlying story for this week however is positive, the market opened on Wednesday with “red ink” across the board, but a reversal on Thursday was clear, with gains of 10 – 20 cents across all microns and the market finishing on a positive sentiment. Next week 42,872 bales are rostered (Figure 2). The pattern over recent months of correcting but quickly recover as growers hold wool back from sale was again in evidence this week. This suggests that next week will see a continuation of the positive sentiment evident towards the end of this weeks sales.

Next week 42,872 bales are rostered (Figure 2). The pattern over recent months of correcting but quickly recover as growers hold wool back from sale was again in evidence this week. This suggests that next week will see a continuation of the positive sentiment evident towards the end of this weeks sales.