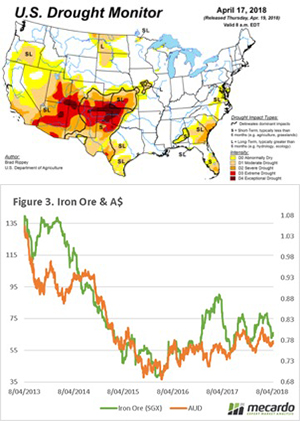

After an exciting two weeks previously in the grain market, we keep a largely directionless week. The market continues to keep a close eye on the weather around the world, with the wheat production in an increasingly fragile position.

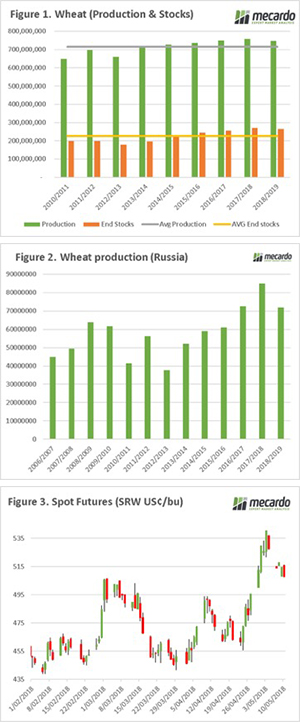

Overnight the USDA released the may WASDE report. The may report is th e first of the year to forecast the coming season. Although, with these initial estimates, it is probably worthwhile taking them with a pinch of salt. In figure 1, the global projections for wheat production and end stocks are displayed. These unsurprisingly show a decline in both, with production down year on year 10mmt, and end stocks 6mmt. This is slightly above most trade expectations, but there is still a long way to go.

e first of the year to forecast the coming season. Although, with these initial estimates, it is probably worthwhile taking them with a pinch of salt. In figure 1, the global projections for wheat production and end stocks are displayed. These unsurprisingly show a decline in both, with production down year on year 10mmt, and end stocks 6mmt. This is slightly above most trade expectations, but there is still a long way to go.

One thing to keep an eye on is Russian wheat production, as we all know they have been one of the most important factor in global trade. The USDA forecast at 72mmt, a huge reduction from last years 85mmt. Although this must be put in perspective, 17/18 was a record production year in Russia, and even with such a large fall, production is estimated at 3rd highest on record.

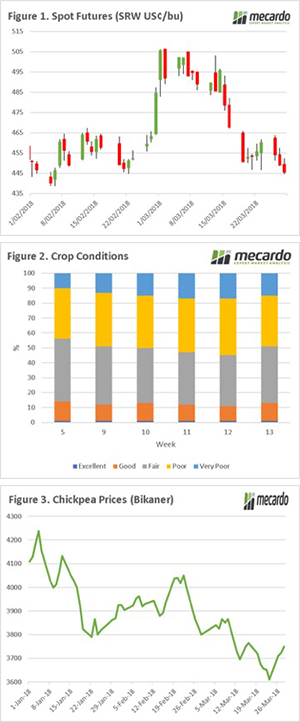

The futures market fell at the end of last week, but since has been largely directionless (figure 3). The market is remaining at substantially more attractive levels than it was at the beginning of April. The market and farmers are still watching and waiting on weather forecasts, which will determine the production for the coming year.

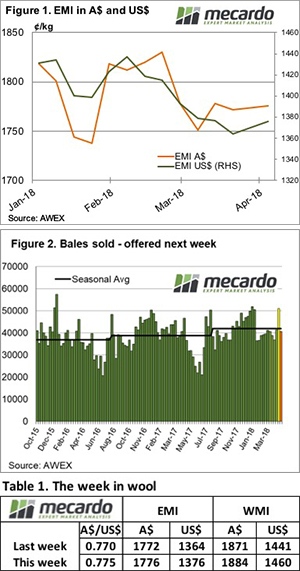

What does it mean/next week?:

The cold snap which has brought rain (and snow) to the east coast has largely been limited to VIC and east SA. The country is in dire need of rain, especially in NSW and Victoria.

From all account, it looks like farmers are reassessing their planting intentions, and canola will be the loser.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

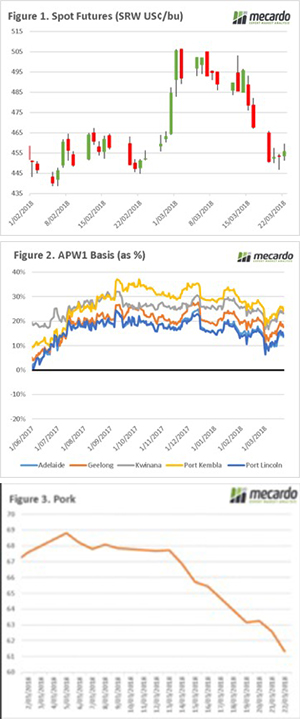

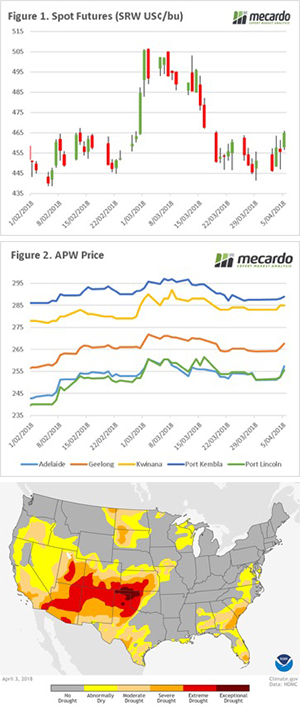

as a result of bearish data in the WASDE (more on that later), and the increasingly tense stand off between US & Syria/Russia. However, prices remain 3% higher than the close last Thursday, and 8% up on the start of the month (figure 1). So in this case we are definitely lucky, to have much higher prices than the start of the month.

as a result of bearish data in the WASDE (more on that later), and the increasingly tense stand off between US & Syria/Russia. However, prices remain 3% higher than the close last Thursday, and 8% up on the start of the month (figure 1). So in this case we are definitely lucky, to have much higher prices than the start of the month.

The wheat market has continued to decline, with three sessions in a row the market has accumulated a fall of 3% since the close on Friday last week (figure 1), placing the futures market at 2-month lows. The trade continues to digest the improving weather conditions in the US, and lower than expected exports (leading to higher end stocks).

The wheat market has continued to decline, with three sessions in a row the market has accumulated a fall of 3% since the close on Friday last week (figure 1), placing the futures market at 2-month lows. The trade continues to digest the improving weather conditions in the US, and lower than expected exports (leading to higher end stocks).