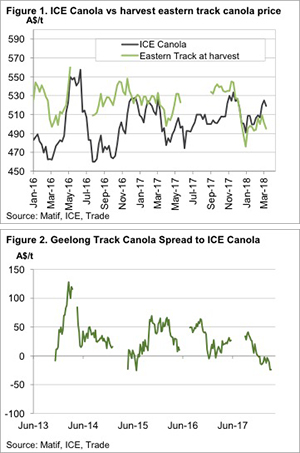

It was steady as she goes for wheat and barley markets, while canola has been on the slide this week. In fact, canola basis weakened further and now sits at levels more expected during a bumper harvest, not a year  of tighter supply

of tighter supply

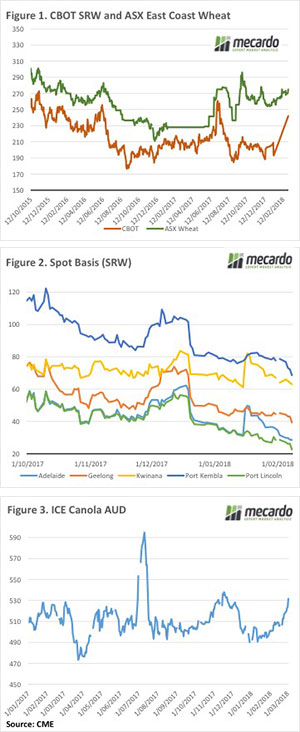

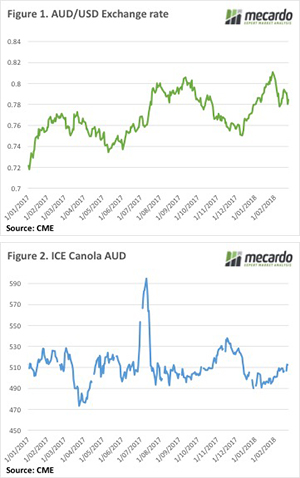

Since the heavy fall in December, local canola prices have had trouble recovering, especially in the south. Figure 1 shows ICE Canolafutures, and the Geelong track price, and basis has widened recently. The strong rally in ICE Canola futures thanks to deteriorating soybean conditions in South America, wasn’t matched by local values.

Figure 2 shows basis at negative $24/t is the lowest level since the middle of June 2015. To take advantage of this growers still holding last year’s canola can sell swaps and hold physical. The would pay off either through ICE Canola falling, or physical prices rising.

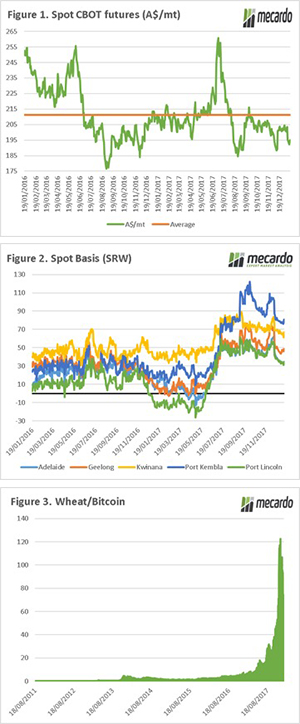

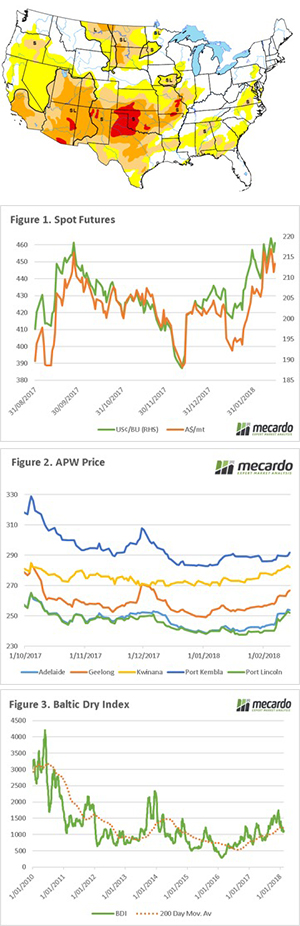

As outlined last week local wheat basis has weakened, also due to rising international futures not being matched by local markets. Having said this, APW in southern markets is $30 stronger than it was at harvest, so it has been a good year for holding.

Whether wheat can find more strength is questionable, we are still hearing it is overpriced in international markets. Basis could improve, but this would come from CBOT falling. Again, it’s a case of selling futures or swaps and holding physical.

What does it mean/next week?:

It’s a rare year when over 10% profit is made from holding wheat from harvest through to March. As such, it might be worth making some sales to take advantage of this, in case current prices disappear as we move towards the northern hemisphere harvest.

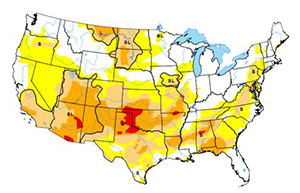

Many growers are holding wheat as a drought hedge, which is fine, but it might be worth taking some cover on futures or options to protect against falling international values. In the case of a delayed autumn break it will be basis that improves, not international prices.

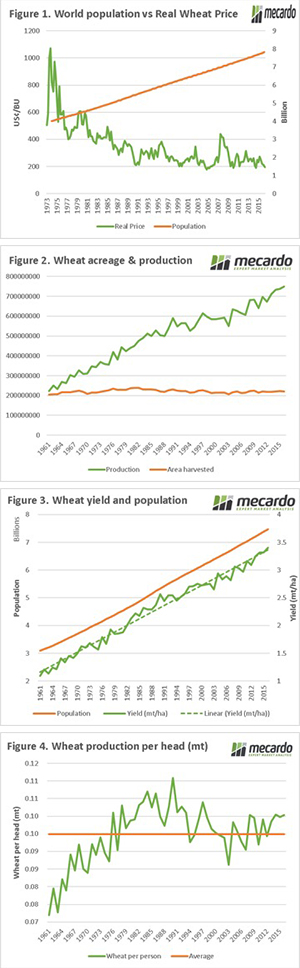

The grain market stands at a cross roads. In the past two years, we have seen concerns in the market which have led to short rallies. Will conditions provide the opportunity for a sustained rally, or will it fizzle out?

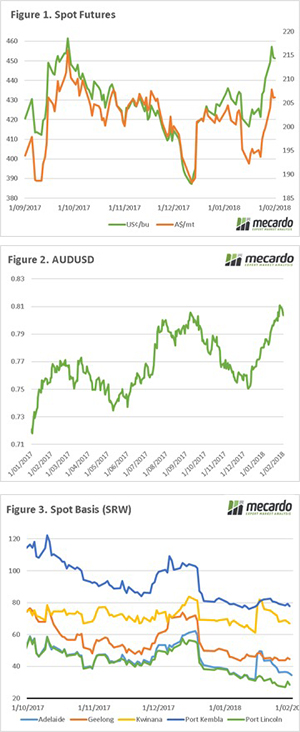

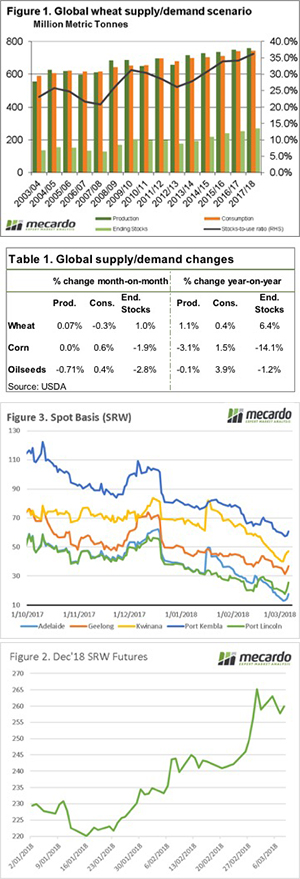

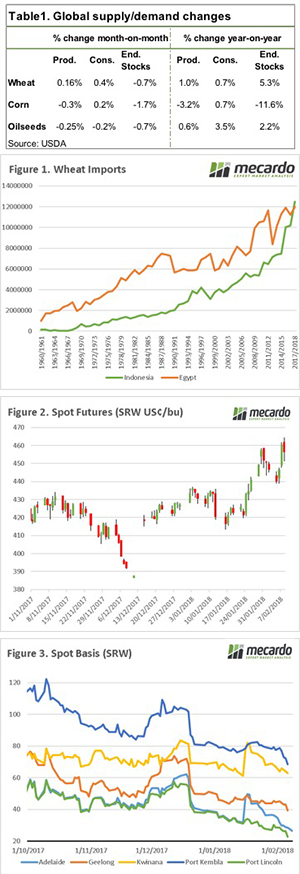

The grain market stands at a cross roads. In the past two years, we have seen concerns in the market which have led to short rallies. Will conditions provide the opportunity for a sustained rally, or will it fizzle out? An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term. Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.