There is an old Chinese curse, “May you live in interesting times”, used ironically to suggest that uninteresting times are more life enhancing than interesting ones. It seems our friend Donald, would like to consign us to a lifetime of interesting times.

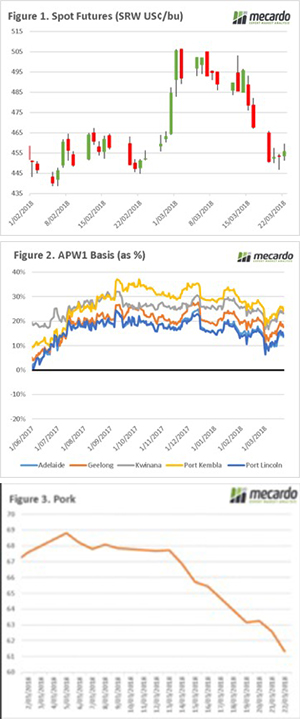

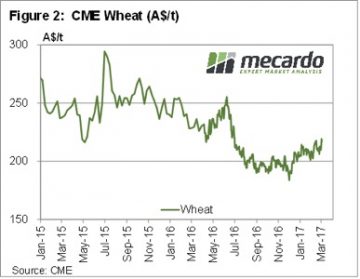

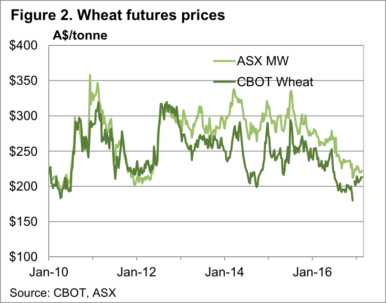

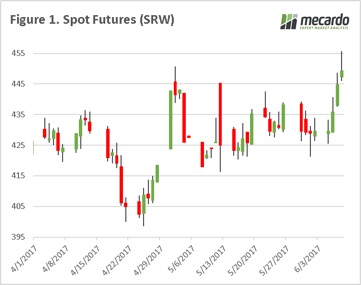

After experiencing strong momentum in March, it seems that gravity has exerted its force on the wheat futures market, with a return to pre-rally levels (figure 1). In recent days much needed rainfall has fallen in US growing regions. It was not unreasonable to expect this fall in the market, especially as the US falls in importance on the international wheat market.

In the Black Sea nations, conditions continue to be promising for the coming season, with winter kill below average. Although the crop will be unlikely to match last year, it will still dominate the export market. Interestingly a Russian government official commented that fertilizer and seed purchases had increased 30% this season.

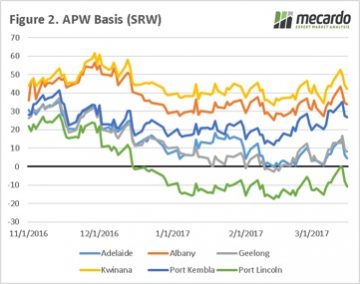

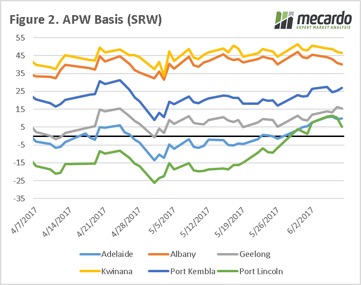

In figure 2, the basis levels around Australia as a percentage of the overall price has been displayed. During this harvest, basis increased dramatically, becoming a third of the pricing complex in some states. Although since weakened, basis levels remain strong, and protect us from falls in the futures market.

In recent weeks, Trump has been rattling the tariff saber with China. During the Trump election campaign, he ran on a platform of reforms to trade. In his defence, Trump has certainly gone all in, however only time will tell whether this will be to the betterment or detriment to the voters.

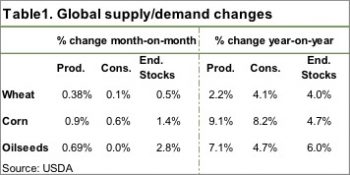

In figure 3,4, & 5 (animated), we can see the futures prices of a number of commodities (pork, soya, soya meal), which all have strong links with China. As we can see these markets have experienced strong falls in recent weeks, as discussions become more heated.

On a regular basis China turns around vessels of soya and corn from the US; perhaps we will see an upsurge of cargo rejections in retaliation.

What is assured, is that we are unlikely to be living in tranquil times for the foreseeable future, and black swans are likely to be a regular occurrence.

What does it mean/next week?:

The ‘tariff war’ is going to place Australia in a difficult diplomatic position, between an important customer and a traditional ally.

However, if handled well by our government could provide a favourable result for Australian industries.

Early this week wheat futures fell on the back of lack of fresh data, and encouraging crop conditions in eastern Europe. The generally benign conditions and the large global surplus is keeping a dampener on large upside potential. The market fell around 15¢/bu ($5.7USD/mt), before regaining strength to hold currently 8¢/bu ($2.3USD/mt) above last Friday (figure 1).

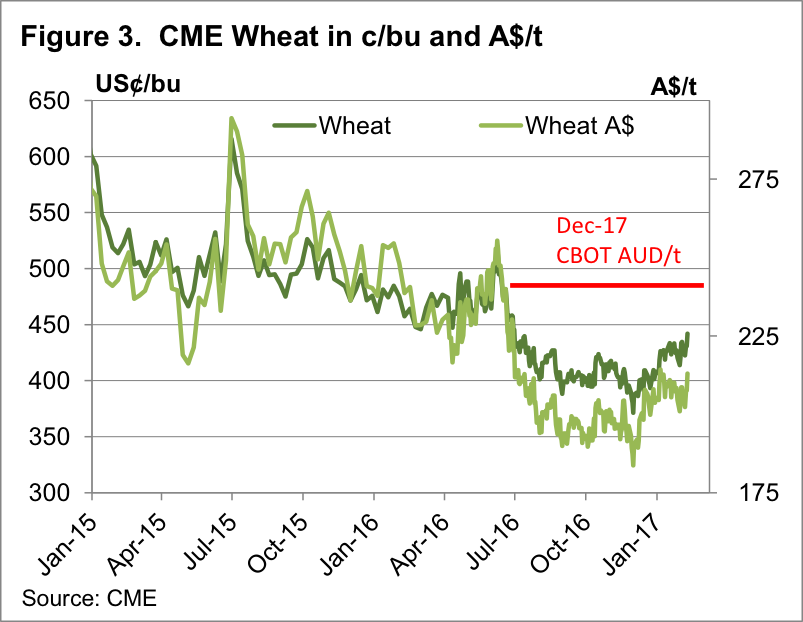

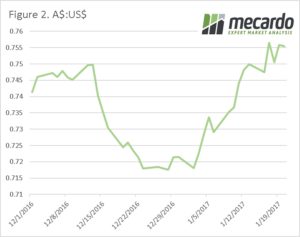

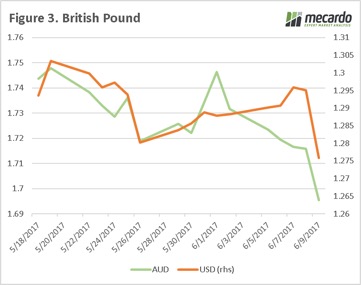

Early this week wheat futures fell on the back of lack of fresh data, and encouraging crop conditions in eastern Europe. The generally benign conditions and the large global surplus is keeping a dampener on large upside potential. The market fell around 15¢/bu ($5.7USD/mt), before regaining strength to hold currently 8¢/bu ($2.3USD/mt) above last Friday (figure 1). This week the US fed jacked up their interest rates by 25 points, typically this would put pressure on the Australian dollar however this was not the case. The Australian dollar rose to above 77¢ (figure 3), and the AUD trade weighted index rose dramatically.

This week the US fed jacked up their interest rates by 25 points, typically this would put pressure on the Australian dollar however this was not the case. The Australian dollar rose to above 77¢ (figure 3), and the AUD trade weighted index rose dramatically. There are some concerns in the US related to dry weather, and eyes will be on weather forecasts pointing toward a deluge in the coming weeks. If this eventuates it will lead to an improvement in US crop potential.

There are some concerns in the US related to dry weather, and eyes will be on weather forecasts pointing toward a deluge in the coming weeks. If this eventuates it will lead to an improvement in US crop potential. It’s a bit unusual to get large shifts in supply or demand in the WASDE report at this end of the growing season. Most world crops are all but in the bin, with just South American summer crops, corn and soybeans still to be harvested.

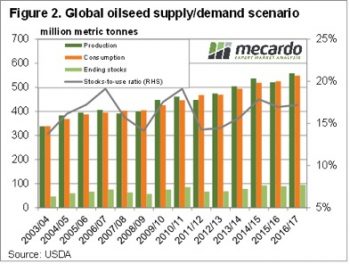

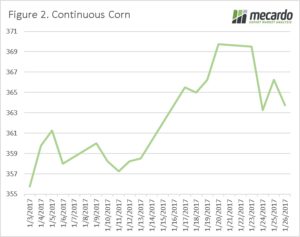

It’s a bit unusual to get large shifts in supply or demand in the WASDE report at this end of the growing season. Most world crops are all but in the bin, with just South American summer crops, corn and soybeans still to be harvested. The USDA also lifted Brazilian corn production, increasing 5mmt, and Argentina by 1mmt. This increased world ending stocks by 1.4% thanks to some increases in consumption. This sees the global stocks to use ratio still marginally lower than last year, which should provide some price support.

The USDA also lifted Brazilian corn production, increasing 5mmt, and Argentina by 1mmt. This increased world ending stocks by 1.4% thanks to some increases in consumption. This sees the global stocks to use ratio still marginally lower than last year, which should provide some price support.

There were rumours this week that there might be some form of ‘Executive Order’ regarding the amount of Ethanol to be produced in the US. Without boring you with the details, the market took the view that Trump was going to increase the demand for ethanol, which means more corn and oilseeds will be required in the US to make it.

There were rumours this week that there might be some form of ‘Executive Order’ regarding the amount of Ethanol to be produced in the US. Without boring you with the details, the market took the view that Trump was going to increase the demand for ethanol, which means more corn and oilseeds will be required in the US to make it. The grim weather outlook released last week might add a bit of strength to grain prices. From now on many grower will take the view that grain in store is a good drought hedge, with prices likely to have a lift if the autumn break is late, or worst case, non-existent.

The grim weather outlook released last week might add a bit of strength to grain prices. From now on many grower will take the view that grain in store is a good drought hedge, with prices likely to have a lift if the autumn break is late, or worst case, non-existent.

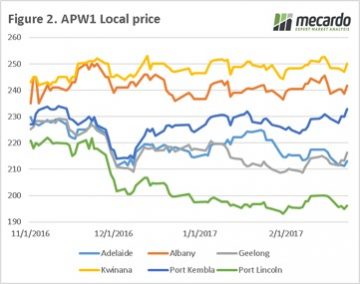

The futures market has improved since the start of harvest, but locally that hasn’t transpired into higher prices. In this week’s comment, we look at the direction of the market since the beginning of November, and where the winners and losers have been.

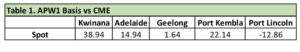

The futures market has improved since the start of harvest, but locally that hasn’t transpired into higher prices. In this week’s comment, we look at the direction of the market since the beginning of November, and where the winners and losers have been. When we look at a local level, at the physical APW1 price (figure 2), the trend across most ports has been for the market to trade in a narrow band and is currently sitting at similar levels to the start of November. The glaring exceptions are Adelaide, Port Lincoln and Geelong which are trading substantially below their start of harvest pricing levels.

When we look at a local level, at the physical APW1 price (figure 2), the trend across most ports has been for the market to trade in a narrow band and is currently sitting at similar levels to the start of November. The glaring exceptions are Adelaide, Port Lincoln and Geelong which are trading substantially below their start of harvest pricing levels. All eyes on the weather. Locally the BOM point towards it being drier than normal for the next three months, which will start to zap away some of that beneficial subsoil moisture that has been retained from the wet winter and spring.

All eyes on the weather. Locally the BOM point towards it being drier than normal for the next three months, which will start to zap away some of that beneficial subsoil moisture that has been retained from the wet winter and spring.

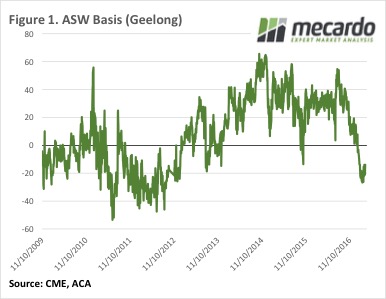

Most of the talk this week has been around ASW, especially in Victoria. With the Shipping Stems showing multiple boats are coming into Melbourne, Geelong and Portland over the coming month, looking for wheat, buyers are having to lift prices to secure supplies.

Most of the talk this week has been around ASW, especially in Victoria. With the Shipping Stems showing multiple boats are coming into Melbourne, Geelong and Portland over the coming month, looking for wheat, buyers are having to lift prices to secure supplies. Plenty of ASW has been bought on CLEAR Grain Exchange, and direct through brokers at around $200/t Port in Geelong and Portland. Port Adelaide has seen action on ASW between $190 and $200/t. In the Melbourne Port Zone ASW had been up to $205/t.

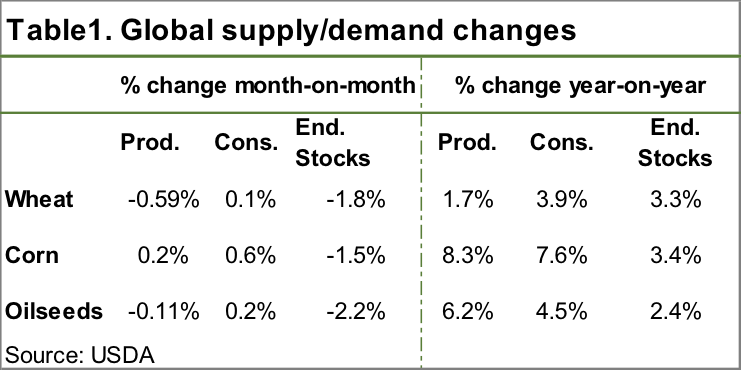

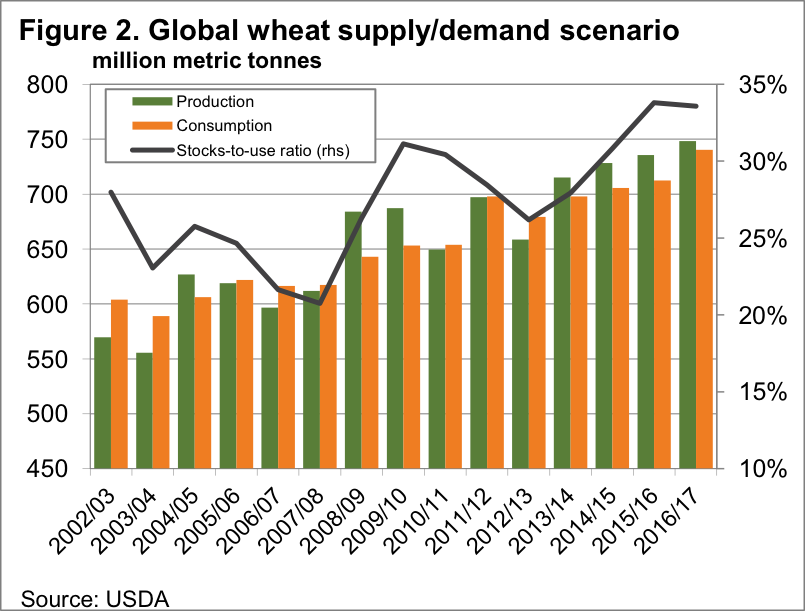

Plenty of ASW has been bought on CLEAR Grain Exchange, and direct through brokers at around $200/t Port in Geelong and Portland. Port Adelaide has seen action on ASW between $190 and $200/t. In the Melbourne Port Zone ASW had been up to $205/t. World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year.

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year. In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016.

In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016. In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market.

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market. East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing.

East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing. The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.