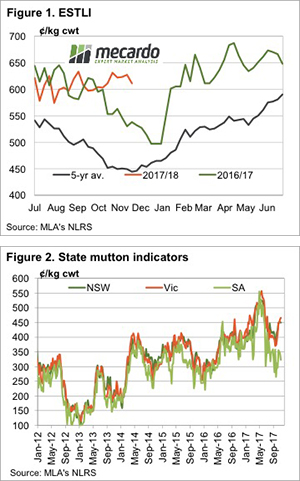

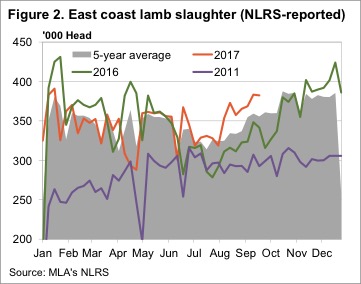

The Eastern States Trade Lamb Indicator (ESTLI) continues to hold its ground in the face of strong lamb throughout figures being recorded in South Australia and Victoria, closing yesterday just 1¢ softer at 610¢. East coast mutton was even more defiant in the face of above average saleyard numbers to see an 8¢ gain to 461¢/kg cwt.

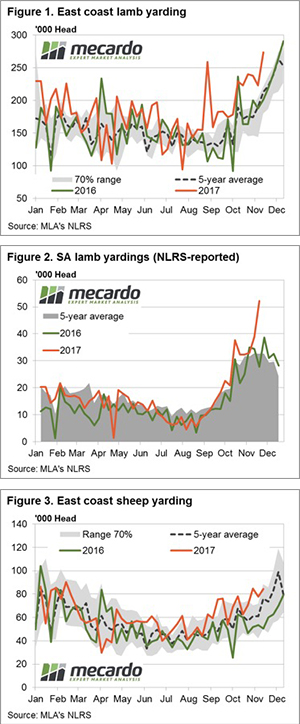

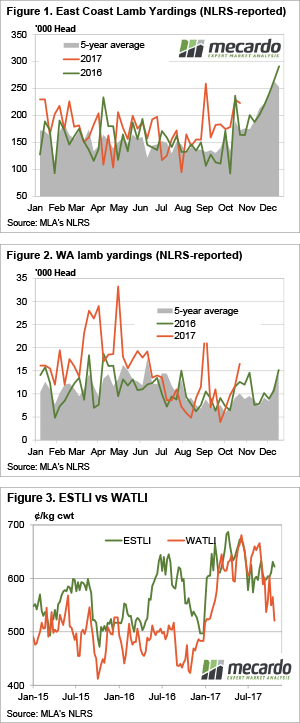

The East coast lamb throughput posted a 22.5% increase on last week and is sitting 28.4% above the five-year average for this time in the season – figure 1. NSW lamb yardings trekked sideways on the week but remain 22% above the seasonal average level. Although the big boost to East coast yardings is coming from SA and Victoria.

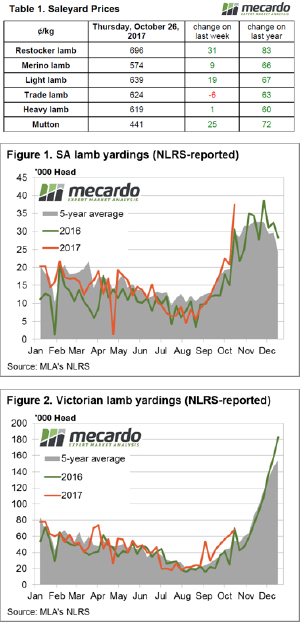

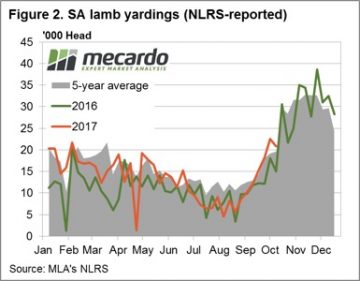

Figure 2 highlights the surge in SA lamb throughput at 52,251 head; the highest weekly lamb yarding recorded since 2008 to see throughput levels soar 60% over the five-year average for this time in the season.

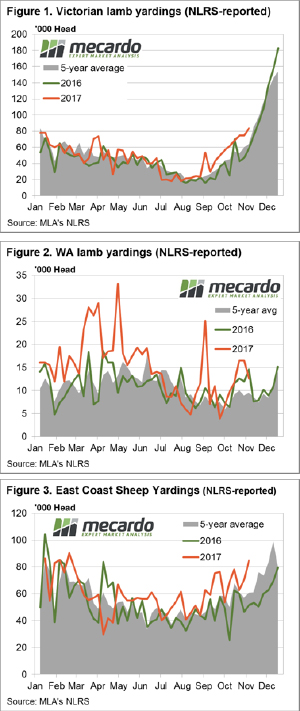

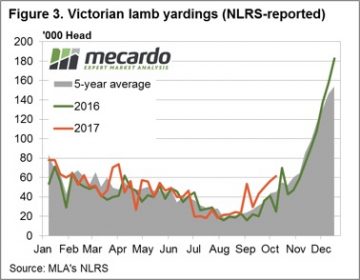

Victoria is adding to the East coast glut of lambs with over 120,000 head recorded at the saleyards this week. Victorian lamb throughput was also higher than the five-year average this week, sitting 23.5% above the seasonal level. The increased numbers are currently dragging down each states respective Trade Lamb saleyard indicator, with Victorian Trade Lambs posting a 3.4% decline (600¢/kg cwt) and SA off 6.1% (574¢/kg cwt), based off the MLA mid-week saleyard report.

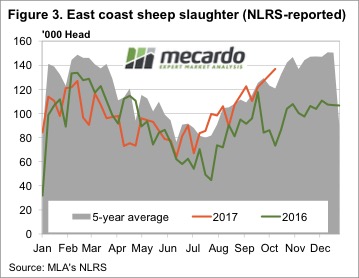

Stronger than average East coast mutton throughput levels were recorded too. This was aided by higher NSW figures, to see an 8.6% increase in saleyard numbers and the trend continuing to trek along the upper band of the normal range – figure 3. NSW mutton yardings were up 15.7% on the week, pressuring NSW mutton at the saleyard to see them ease 4¢ to 400¢/kg. Softer Victorian and SA mutton throughput is providing some support to prices there with Victorian mutton up 20¢ to 420¢ and SA gaining 8¢ to 410¢/kg cwt.

The week ahead

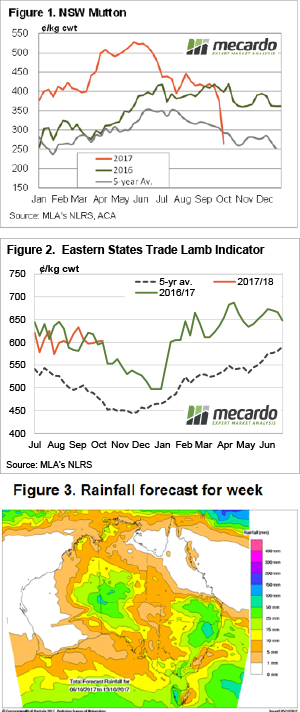

Price support is likely to remain from continued rainfall forecast across much of Victoria and NSW next week, with much to these two states expecting between 25-50mm. Although, increased Victorian yardings are likely as the Spring flush continues, so that will act to help counterbalance the recent and forecast rains.

On balance, the ESTLI is likely to ease into the week ahead to test sub 600¢, but don’t expect a huge drop.

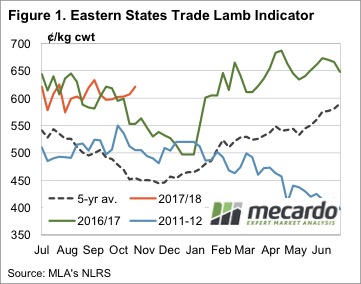

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.

Sheep and lamb yardings had another strong week, with Victorian lambs starting to run. Yet prices continued their solid reluctance to fall, maintaining levels well above last year in the east. Things are easing in the west, but also remain better than last year.

Sheep and lamb yardings had another strong week, with Victorian lambs starting to run. Yet prices continued their solid reluctance to fall, maintaining levels well above last year in the east. Things are easing in the west, but also remain better than last year.

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December.

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December.

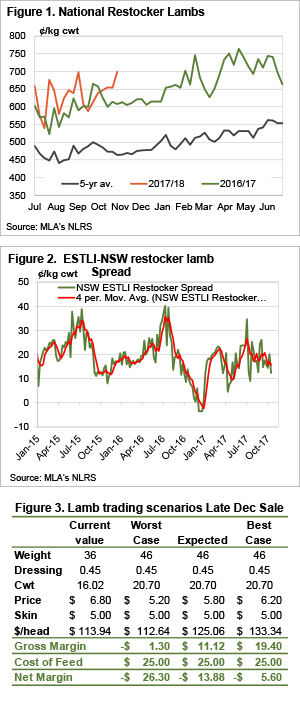

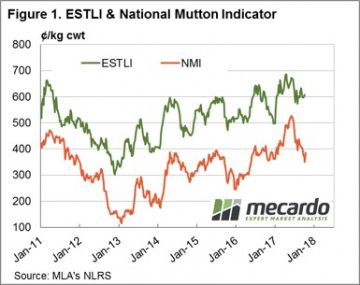

The Eastern States Trade Lamb Indicator (ESTLI) took a bit of a breather this week, staging a slight price decline as South Australian lamb throughput is starting to act as a bit of a headwind. The ESTLI off 6¢ on the week to close at 624¢/kg cwt.

The Eastern States Trade Lamb Indicator (ESTLI) took a bit of a breather this week, staging a slight price decline as South Australian lamb throughput is starting to act as a bit of a headwind. The ESTLI off 6¢ on the week to close at 624¢/kg cwt. Spring in general, and October, in particular, are known for falling lamb prices. We usually see supply increasing as winter and spring lambs hit the market, pushing all sheep and lamb markets lower. The price rally this week is particularly unusual.

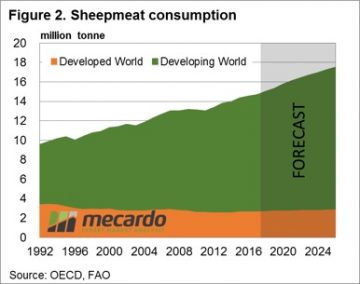

Spring in general, and October, in particular, are known for falling lamb prices. We usually see supply increasing as winter and spring lambs hit the market, pushing all sheep and lamb markets lower. The price rally this week is particularly unusual. After a couple of weeks of intermittent supply data, sheep slaughter has hit 136,925 head (figure 3), the highest level since the end of 2015. Remarkably, mutton prices also rallied this week, the National Mutton Indicator gained 24¢ to sit back at 397¢/kg cwt.

After a couple of weeks of intermittent supply data, sheep slaughter has hit 136,925 head (figure 3), the highest level since the end of 2015. Remarkably, mutton prices also rallied this week, the National Mutton Indicator gained 24¢ to sit back at 397¢/kg cwt. Whether higher prices are enough to draw more lambs to the market while it’s raining is yet to be seen, but we do know that growers who sell lambs in October have never had it so good.

Whether higher prices are enough to draw more lambs to the market while it’s raining is yet to be seen, but we do know that growers who sell lambs in October have never had it so good. Read the earlier analysis

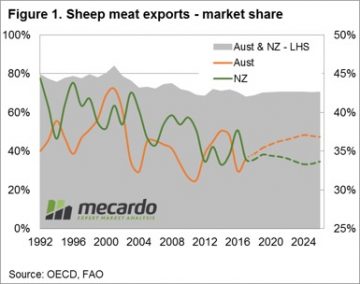

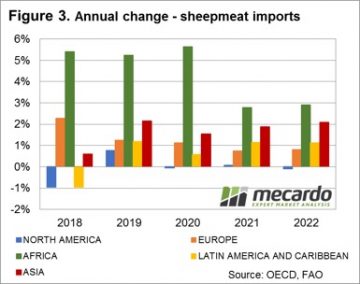

Read the earlier analysis  Turning to global consumption levels we can see that the majority of growth has been, and is expected to continue, coming predominantly from the developing world – figure 2. While sheepmeat consumption levels can be satisfied partially by domestic production the fact remains that for many countries their consumption will outweigh their production and the need to import sheepmeat will be required to satisfy the demand. This is important, particularly in relation to non-goat sheepmeat as the only two significant global exporters of sheep and lamb product are NZ and Australia.

Turning to global consumption levels we can see that the majority of growth has been, and is expected to continue, coming predominantly from the developing world – figure 2. While sheepmeat consumption levels can be satisfied partially by domestic production the fact remains that for many countries their consumption will outweigh their production and the need to import sheepmeat will be required to satisfy the demand. This is important, particularly in relation to non-goat sheepmeat as the only two significant global exporters of sheep and lamb product are NZ and Australia. Further analysis of the breakdown of the forecast Asian sheepmeat import flows shows that much of the growth is anticipated to come from China, Malaysia, Saudi Arabia, Indonesia, and Vietnam. These are already key export destinations for our red meat products and strong trade ties already exist between Australia and these nations.

Further analysis of the breakdown of the forecast Asian sheepmeat import flows shows that much of the growth is anticipated to come from China, Malaysia, Saudi Arabia, Indonesia, and Vietnam. These are already key export destinations for our red meat products and strong trade ties already exist between Australia and these nations.

Despite the beginnings of Spring flush being fairly evident at the saleyard this week, prices managed to gain across all categories of national lamb and sheep markets. Seemingly, a Friday the 13th close to the week a lucky one for ovines.

Despite the beginnings of Spring flush being fairly evident at the saleyard this week, prices managed to gain across all categories of national lamb and sheep markets. Seemingly, a Friday the 13th close to the week a lucky one for ovines.  The firm prices were unable to be weighed down by increased volumes at the saleyard along the East Coast for both lamb and mutton with throughput levels up 2.1% and 28.5%, respectively. The lamb yarding pattern for SA and Victoria continuing to show evidence that the seasonal Spring flush is underway with both states continuing to trend above the 2016 trend, and higher than the long term average for this time of the year – figures 2 and 3.

The firm prices were unable to be weighed down by increased volumes at the saleyard along the East Coast for both lamb and mutton with throughput levels up 2.1% and 28.5%, respectively. The lamb yarding pattern for SA and Victoria continuing to show evidence that the seasonal Spring flush is underway with both states continuing to trend above the 2016 trend, and higher than the long term average for this time of the year – figures 2 and 3.

Lamb prices have defied the odds to remain relatively steady for the fifth week straight. It’s highly unusual for prices to trade in such a narrow range for so long, and there is no doubt they will break out at some stage. Mutton prices haven’t had the same luxury, continuing to slide this week in spite of weather forecasts.

Lamb prices have defied the odds to remain relatively steady for the fifth week straight. It’s highly unusual for prices to trade in such a narrow range for so long, and there is no doubt they will break out at some stage. Mutton prices haven’t had the same luxury, continuing to slide this week in spite of weather forecasts.