The Australian Bureau of Agricultural and Resource Economics (ABARES) have put out their quarterly Agricultural Commodities Report, and amongst the numbers there were some interesting sheep and lamb forecasts. This week we take a look at whether lamb prices can achieve another year on year increase, as predicted by ABARES.

The Australian Bureau of Agricultural and Resource Economics (ABARES) have put out their quarterly Agricultural Commodities Report, and amongst the numbers there were some interesting sheep and lamb forecasts. This week we take a look at whether lamb prices can achieve another year on year increase, as predicted by ABARES.

We’ll get to the price forecasts, but first some interesting supply numbers. ABARES are producing financial year forecasts, which are not directly compatible with Meat and Livestock Australia’s (MLA) calendar year forecasts, but the differences are interesting.

ABARES are expecting a solid jump in the sheep flock this financial year, with the June 30 2018 flock pegged at 73.2 million head. A flock of just above 73 million head would be a 3.2% increase on the June 2017 numbers, on the back of a 5% increase over the last year (figure 1).

MLA are forecasting a sheep flock of just 68 million head at the end of 2017 and 71 million for the end of 2018, so ABARES are much more bullish on the flock rebuild, forecasting a flock around 2 million head higher, and at a five year high.

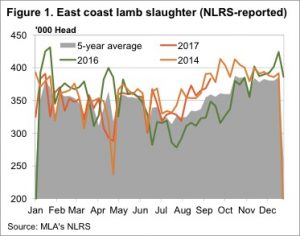

ABARES expect the stronger flock to translate into stronger lamb slaughter. Figure 1 shows that 2016-17 slaughter was at a three year low, but is expected to increase 2%, to almost match the 2014-15 lamb slaughter number.

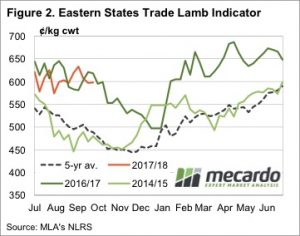

Normally a forecast of a larger flock, and higher slaughter, would be accompanied by a lower price forecast. ABARES are actually expecting lamb prices to rise, with the average for 17/18 to post a 5.6% increase to set a new record high of 625¢/kg cwt.

Figure 2 shows how lamb slaughter and financial year average prices have been related over recent years. Demand has been increasing regularly, but the 16-17 price rise was due to tighter supply, not increased demand.

If ABARES slaughter forecast is correct, we’ll have to see demand increase to reach an annual average of 625¢/kg cwt. Back in 14-15, when lamb slaughter was similar to that forecast for the coming year, prices were back at 518¢/kg cwt.

Key points:

- ABARES quarterly commodity report is forecasting a five year high flock and increased slaughter rates.

- The report also forecast a rise in lamb prices, despite higher supply.

- An annual average of 625¢ would see highs over 700¢, and lows at around 550¢.

What does this mean?

If lamb prices average 625¢ in 2017-18 it will be a great year for lamb growers. Normally the Eastern States Trade Lamb Indicator (ESTLI) ranges around 75¢ around the average. The ABARES forecast would see the ESTLI reach highs of 700¢, and lows of 550¢, which is great money during the peak supply period.

Unfortunately we think the ABARES forecast might be a bit strong, and prices might average a bit lower. We have however seen solid price resilience so far this spring in the face of increasing slaughter, so perhaps demand is stronger. Though it’s unlikely to be strong enough to counteract the higher slaughter rates forecast by ABARES.

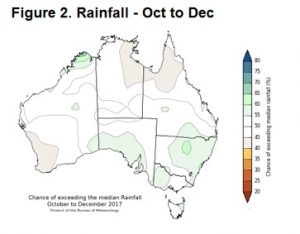

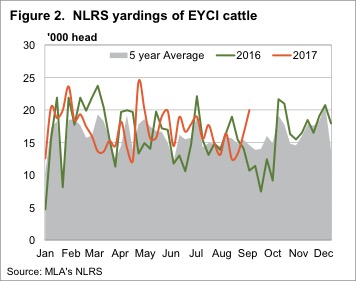

It was only in mid-July that the Eastern Young Cattle Indicator (EYCI) broke through 600¢. The downward spiral now has the EYCI looking down the barrel of a number with a four in the front. There has finally been some positive news on the climatic front, however, which could and should provide some support, if it eventuates.

It was only in mid-July that the Eastern Young Cattle Indicator (EYCI) broke through 600¢. The downward spiral now has the EYCI looking down the barrel of a number with a four in the front. There has finally been some positive news on the climatic front, however, which could and should provide some support, if it eventuates. It was feeder steers which managed to defy the trend this week, gaining 8 and 7¢ in NSW and Victoria respectively, to move back to 286 and 283¢/kg lwt. It was trade steers that drove the EYCI lower.

It was feeder steers which managed to defy the trend this week, gaining 8 and 7¢ in NSW and Victoria respectively, to move back to 286 and 283¢/kg lwt. It was trade steers that drove the EYCI lower.

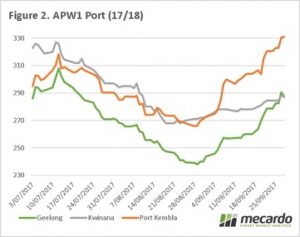

The country sits on tender hooks, as we come to the end of September. The forecasts for the crop from ABARES and USDA seem to be wholly optimistic, and will see severe downward revisions after a terrible month for much of the growing regions.

The country sits on tender hooks, as we come to the end of September. The forecasts for the crop from ABARES and USDA seem to be wholly optimistic, and will see severe downward revisions after a terrible month for much of the growing regions. The A$, although still high compared to the last year has dropped back below 79¢, helping the local price. In the past month we have seen iron ore futures (figure 3), start to slip which put pressure on the A$. As China drops demand after an intensive import program over the past few months will we see a further slide back down to 75¢

The A$, although still high compared to the last year has dropped back below 79¢, helping the local price. In the past month we have seen iron ore futures (figure 3), start to slip which put pressure on the A$. As China drops demand after an intensive import program over the past few months will we see a further slide back down to 75¢

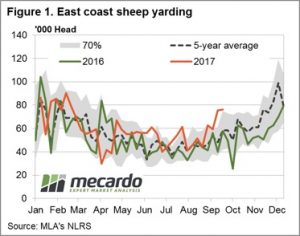

Fairly erratic moves to the state mutton prices this week but they all evened each other out to see the National Mutton Indicator just 3¢ softer to 370¢/kg cwt. Marginal prices changes the order of the week it seems with the Eastern States Trade Lamb Indicator continuing to dance around the $6 area, posting a 5¢ gain to close at 603¢/kg cwt.

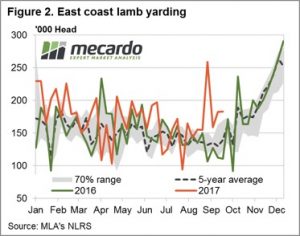

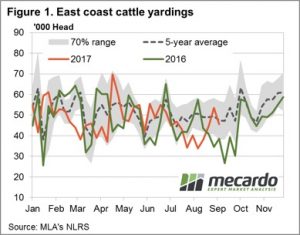

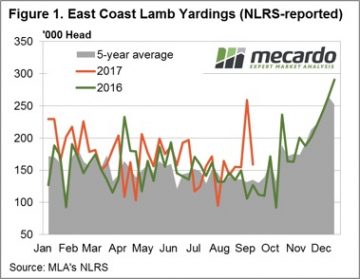

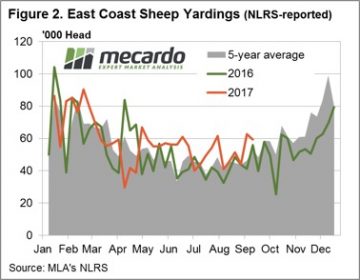

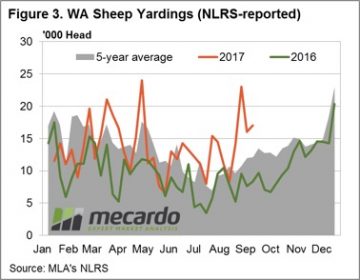

Fairly erratic moves to the state mutton prices this week but they all evened each other out to see the National Mutton Indicator just 3¢ softer to 370¢/kg cwt. Marginal prices changes the order of the week it seems with the Eastern States Trade Lamb Indicator continuing to dance around the $6 area, posting a 5¢ gain to close at 603¢/kg cwt. East coast lamb throughput showing a similar story to sheep throughput with yardings remaining above the 70% range and quite elevated for this time of the year – figure 2. The high sheep throughput being held up by above average numbers at saleyards mainly centred in NSW. The lamb throughput supported by NSW and Victorian flows, the only two states with yarding figures trekking above average for this time of the season.

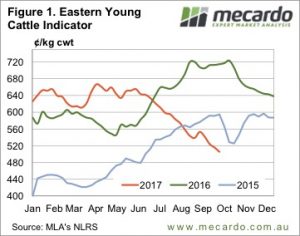

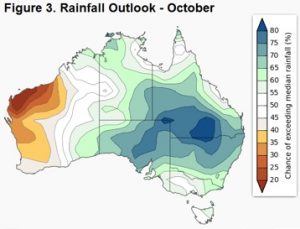

East coast lamb throughput showing a similar story to sheep throughput with yardings remaining above the 70% range and quite elevated for this time of the year – figure 2. The high sheep throughput being held up by above average numbers at saleyards mainly centred in NSW. The lamb throughput supported by NSW and Victorian flows, the only two states with yarding figures trekking above average for this time of the season. The recent Victorian lamb yarding pattern suggest the beginning of the Spring flush is underway which is likely to start to see some price pressures for the ESTLI in the coming weeks. Although, the updated Bureau of Meteorology rainfall outlook for October (figure 3) signals a move to a much wetter NSW which will provide some welcome relief to producers there and price support on dips.

The recent Victorian lamb yarding pattern suggest the beginning of the Spring flush is underway which is likely to start to see some price pressures for the ESTLI in the coming weeks. Although, the updated Bureau of Meteorology rainfall outlook for October (figure 3) signals a move to a much wetter NSW which will provide some welcome relief to producers there and price support on dips. The headline Eastern Young Cattle Indicator (EYCI) finished softer again this week, but not before staging a slight gain off the mid-week low of 513.50¢/kg cwt as saleyard throughput numbers decline in the face of the lower prices.

The headline Eastern Young Cattle Indicator (EYCI) finished softer again this week, but not before staging a slight gain off the mid-week low of 513.50¢/kg cwt as saleyard throughput numbers decline in the face of the lower prices.

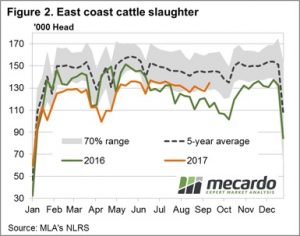

The lamb market is throwing up some interesting data at the moment. Meat and Livestock Australia’s (MLA) weekly slaughter data is telling us lamb slaughter is at a record for this time of year, yet prices remain historically strong.

The lamb market is throwing up some interesting data at the moment. Meat and Livestock Australia’s (MLA) weekly slaughter data is telling us lamb slaughter is at a record for this time of year, yet prices remain historically strong. In 2014 rising lamb supplies saw prices fall heavily in August, and stay there until December. Apart from prices easing from extreme highs in June, we still haven’t really seen prices deteriorate in response to stronger supply.

In 2014 rising lamb supplies saw prices fall heavily in August, and stay there until December. Apart from prices easing from extreme highs in June, we still haven’t really seen prices deteriorate in response to stronger supply. In the last few years the 400,000 head mark has been the trigger point for heavy falls in prices. Lamb slaughter appears to be headed that way, but could just as easily track sideways for a month or so. Does this this mean prices will also track sideways? It’s hard to say, but demand appears to be very resilient.

In the last few years the 400,000 head mark has been the trigger point for heavy falls in prices. Lamb slaughter appears to be headed that way, but could just as easily track sideways for a month or so. Does this this mean prices will also track sideways? It’s hard to say, but demand appears to be very resilient.

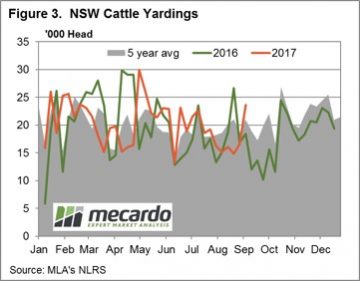

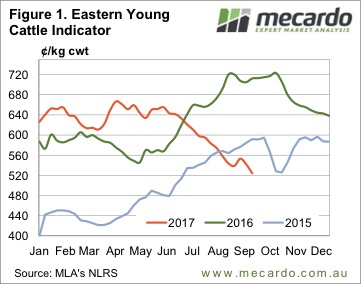

A couple of weeks ago we wrote in this column that the Eastern Young Cattle Indicator (EYCI), and cattle prices in general, might have found a floor. Turns out we were wrong. Figure 1 shows the EYCI falling below the spring lows of 2015, and heading towards 500¢.

A couple of weeks ago we wrote in this column that the Eastern Young Cattle Indicator (EYCI), and cattle prices in general, might have found a floor. Turns out we were wrong. Figure 1 shows the EYCI falling below the spring lows of 2015, and heading towards 500¢. Over in WA the Western Young Cattle Indicator (WYCI) has also weakened, but only eased 6¢ to 589¢/kg cwt. Unlike the EYCI, which is sitting 26% below this time last year, the WYCI is just 4.7% lower, so things aren’t too bad for WA producers.

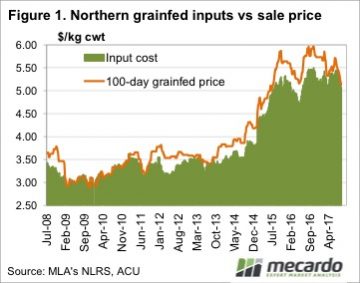

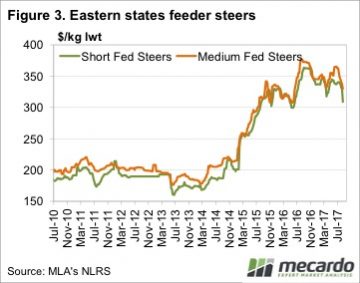

Over in WA the Western Young Cattle Indicator (WYCI) has also weakened, but only eased 6¢ to 589¢/kg cwt. Unlike the EYCI, which is sitting 26% below this time last year, the WYCI is just 4.7% lower, so things aren’t too bad for WA producers. Grainfed cattle prices have fallen in line with the rest of the market, with the consistent decline putting pressure on lotfeeder margins. With pressure on lotfeeder margins comes lower feeder cattle prices, although, on a relative scale, they are performing ok.

Grainfed cattle prices have fallen in line with the rest of the market, with the consistent decline putting pressure on lotfeeder margins. With pressure on lotfeeder margins comes lower feeder cattle prices, although, on a relative scale, they are performing ok. The situation is a bit different now, compared to 2009-2011. Back then cattle on feed numbers were low, with cattle going through feedlots at break-even to keep the doors open. Currently there are plenty of cattle on feed, and we have seen over the past couple of years that weak margins don’t last long.

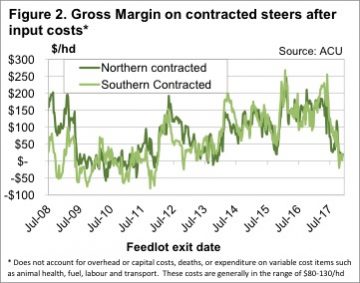

The situation is a bit different now, compared to 2009-2011. Back then cattle on feed numbers were low, with cattle going through feedlots at break-even to keep the doors open. Currently there are plenty of cattle on feed, and we have seen over the past couple of years that weak margins don’t last long. It’s not unusual to see tight feeder cattle supply causing low lotfeeder margins at this time of year. The question is what happen when supply improves in September and October. Under current grainfed cattle and grain prices, feeder prices will have to fall 20¢/kg lwt for lotfeeder margins to improve back to $100/head. Figure 2 shows that $100/head is more in line with recent history.

It’s not unusual to see tight feeder cattle supply causing low lotfeeder margins at this time of year. The question is what happen when supply improves in September and October. Under current grainfed cattle and grain prices, feeder prices will have to fall 20¢/kg lwt for lotfeeder margins to improve back to $100/head. Figure 2 shows that $100/head is more in line with recent history. Mild price declines across the board noted for all categories of national saleyard lamb and sheep this week despite lower numbers at the saleyard. The headline Eastern States Trade Lamb Indicator (ESTLI) down 2.6% to close at 597¢/kg cwt, while National Mutton off just 1.2% to 400¢/kg as gains in NSW and Tasmanian mutton offset falls elsewhere.

Mild price declines across the board noted for all categories of national saleyard lamb and sheep this week despite lower numbers at the saleyard. The headline Eastern States Trade Lamb Indicator (ESTLI) down 2.6% to close at 597¢/kg cwt, while National Mutton off just 1.2% to 400¢/kg as gains in NSW and Tasmanian mutton offset falls elsewhere.  National saleyard lamb categories all softer this week with falls noted between 1-4%, Merino lamb leading the decline with a 3.8% drop to 539¢/kg cwt. National Trade and Heavy lambs the better performers, only down 1.8% (596¢) and 1.6% (601¢), respectively. The lower prices on the back of a reduced saleyard offering indicative of slightly weaker demand.

National saleyard lamb categories all softer this week with falls noted between 1-4%, Merino lamb leading the decline with a 3.8% drop to 539¢/kg cwt. National Trade and Heavy lambs the better performers, only down 1.8% (596¢) and 1.6% (601¢), respectively. The lower prices on the back of a reduced saleyard offering indicative of slightly weaker demand.

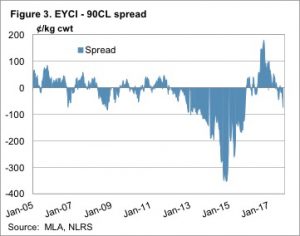

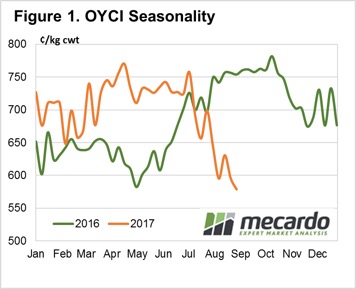

This weekly comment marks the first in our planned fortnightly Online Young Cattle Indicator (OYCI) updates as well as a general summary of the broader cattle market over the last week. Interestingly, the spread of the OYCI to the EYCI has narrowed over the month of August.

This weekly comment marks the first in our planned fortnightly Online Young Cattle Indicator (OYCI) updates as well as a general summary of the broader cattle market over the last week. Interestingly, the spread of the OYCI to the EYCI has narrowed over the month of August.