A mixed week across the states for ovine markets as price increases for most categories of lamb and sheep in NSW and Victorian saleyards wiped away by losses in SA to see most national categories of lamb close flat.

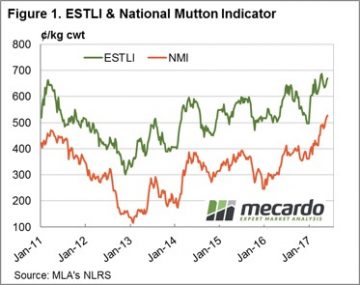

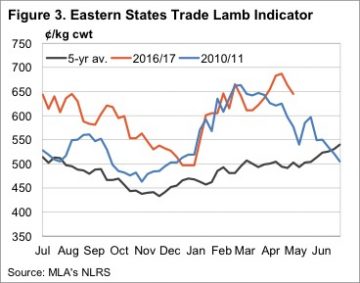

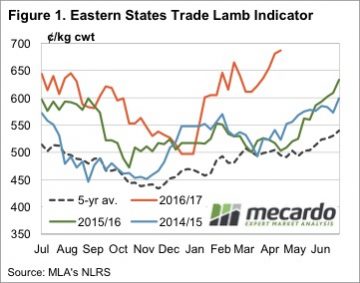

The Eastern States Trade Lamb Indicator (ESTLI) marginally higher, climbing to 671¢/kg cwt to post a 1.2% rise. National Mutton not as robust, but still a positive result, with a 0.8% lift to 527¢/kg cwt – figure 1. More impressive for mutton the 3.3% increase in Natio nal OTH prices to see it probe toward the $5 mark, closing just shy at 490¢/kg. WA Trade lamb mirroring the ESTLI percentage gains to see it up 1.1% to 664¢/kg cwt, while WA mutton recovering strongly to see an 8.6% rise to 453¢.

nal OTH prices to see it probe toward the $5 mark, closing just shy at 490¢/kg. WA Trade lamb mirroring the ESTLI percentage gains to see it up 1.1% to 664¢/kg cwt, while WA mutton recovering strongly to see an 8.6% rise to 453¢.

In Victoria, restocker and trade lambs leading the charge higher with 6.1% ($116 per head) and 2.7% (695¢/kg cwt) improvements on the week, respectively. Light lambs (up 2.3% to 680¢) and mutton (up 2.5% to 542¢) the two best performers for NSW – other than the cockroaches on Wednesday night. SA lamb and sheep mirroring the dismal cane toad’s effort getting thumped across the board and displaying lacklustre quality. SA light lambs and mutton the worst of the pack, down 11.4% (608¢) and 11% (471¢), respectively. Indeed, SA OTH prices posting a premium to the saleyard prices this week with trade/heavy lambs achieving 660¢ and mutton at 480¢.

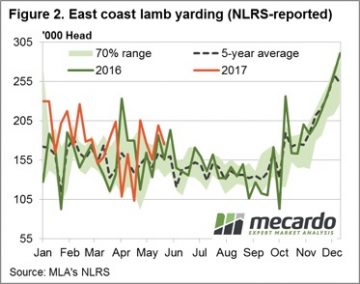

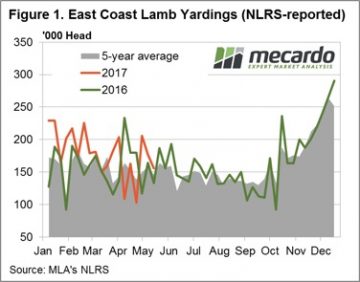

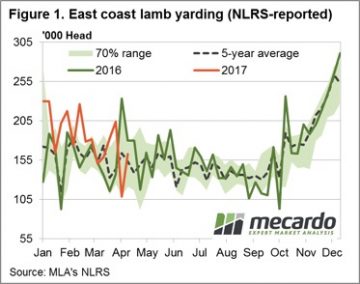

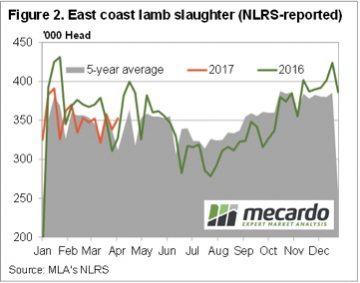

East coast lamb throughput retraced 12% this week to see just over 175,000 head reported through the saleyards. The softer offering broadly supportive of prices, although SA lamb numbers were up 18.7% in contrast to the other East coast states – perhaps another reason for the SA price weakness displayed. Despite the softer week on week East coast lamb throughput the trend is still tracking above the five-year average and higher than this time last year – figure 2. This suggest the current solid prices are drawing out a bit of supply but not enough to curb the recent price gains.

East coast lamb throughput retraced 12% this week to see just over 175,000 head reported through the saleyards. The softer offering broadly supportive of prices, although SA lamb numbers were up 18.7% in contrast to the other East coast states – perhaps another reason for the SA price weakness displayed. Despite the softer week on week East coast lamb throughput the trend is still tracking above the five-year average and higher than this time last year – figure 2. This suggest the current solid prices are drawing out a bit of supply but not enough to curb the recent price gains.

The week ahead

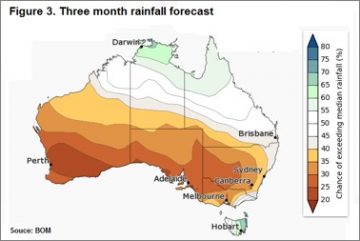

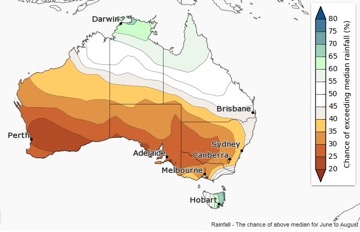

A good sign for robust offshore demand noted with live export wethers up 26% on the week to hit $136 per head out of Muchea. Finally, in weather news of a different kind the Bureau of Meteorology released their next instalment of the three-month outlook showing a drier than normal Winter for much of the sheep rearing regions of the country.

A good sign for robust offshore demand noted with live export wethers up 26% on the week to hit $136 per head out of Muchea. Finally, in weather news of a different kind the Bureau of Meteorology released their next instalment of the three-month outlook showing a drier than normal Winter for much of the sheep rearing regions of the country.

Although, given the tight supply this year and the remnants of the favourable seasonal conditions experienced last year a drier Winter period is unlikely to cause too many headwinds for sheep and lamb prices in the coming month.

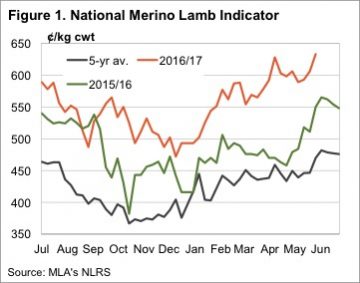

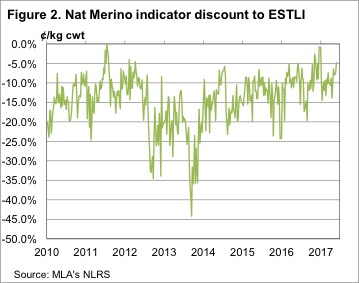

If ever there was a year to have held onto sheep and lambs, this was it. We are only in May and Merino lambs have moved further into uncharted territory, the National Merino Lamb Indicator this week hitting 633¢/kg cwt (figure 1).

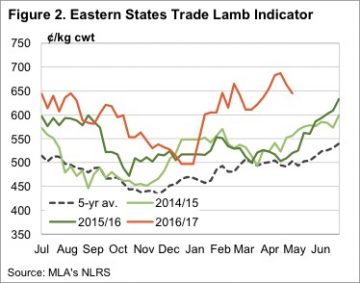

If ever there was a year to have held onto sheep and lambs, this was it. We are only in May and Merino lambs have moved further into uncharted territory, the National Merino Lamb Indicator this week hitting 633¢/kg cwt (figure 1). It looks like restocker demand is pushing mutton prices along, they are 40% stronger than this time last year. The ESTLI is ‘just’ 16% higher than last year.

It looks like restocker demand is pushing mutton prices along, they are 40% stronger than this time last year. The ESTLI is ‘just’ 16% higher than last year. If we do see drier than normal conditions, it should mean lighter lambs, sold earlier, and weaker prices. Rainfall could continue to defy the forecasts, but there is some significant downside price risk come late winter.

If we do see drier than normal conditions, it should mean lighter lambs, sold earlier, and weaker prices. Rainfall could continue to defy the forecasts, but there is some significant downside price risk come late winter.

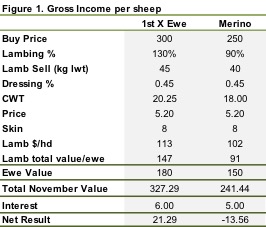

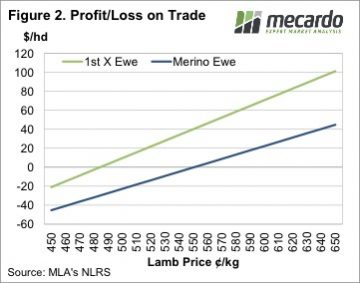

There is plenty of talk about store sheep being expensive, but are they overpriced? It depends on your definition, but one way to look at it is to look at whether ewes bought now are going to be worth more in six months’ time, or worth less.

There is plenty of talk about store sheep being expensive, but are they overpriced? It depends on your definition, but one way to look at it is to look at whether ewes bought now are going to be worth more in six months’ time, or worth less. For those looking to buy or sell scanned in lamb sheep the question is whether the cost of running the sheep through to November is higher than the net result. For merinos all businesses would incur more than in costs in lambing down and marking lambs. For the first cross ewes cost or running may not outweigh the profit on the trade so they might be a better purchase.

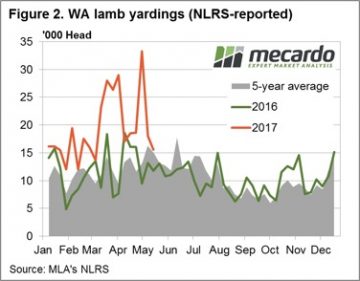

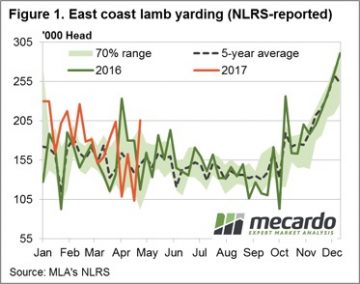

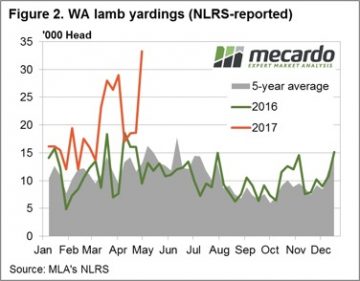

For those looking to buy or sell scanned in lamb sheep the question is whether the cost of running the sheep through to November is higher than the net result. For merinos all businesses would incur more than in costs in lambing down and marking lambs. For the first cross ewes cost or running may not outweigh the profit on the trade so they might be a better purchase. All states, except Tasmania, saw a decline in lamb throughput this week evident in the yarding figures for the East coast (Figure 1) and in Western Australia (Figure 2). East coast lamb yarding down 12% to just under 156,000 head reported through the saleyards, while WA lamb throughput saw a decline of 13.8%.

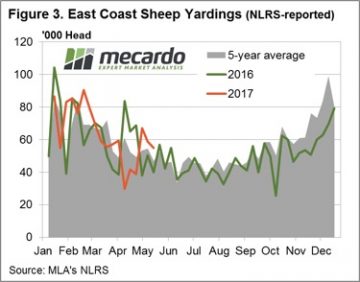

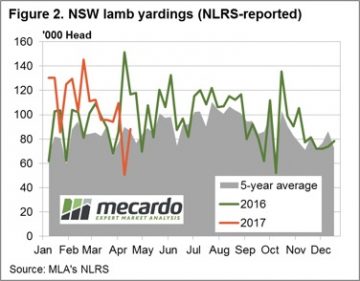

All states, except Tasmania, saw a decline in lamb throughput this week evident in the yarding figures for the East coast (Figure 1) and in Western Australia (Figure 2). East coast lamb yarding down 12% to just under 156,000 head reported through the saleyards, while WA lamb throughput saw a decline of 13.8%. East coast Mutton throughput impacted by soft NSW figures where an 11% fall in NSW flowed through to a price gain of 1.6% for sheep in that state and a broader drop in the East coast throughput for the week – figure 3. Not the case in WA and SA, where increased mutton yardings translated into double digit percentage price falls to see both state mutton prices back below 500¢.

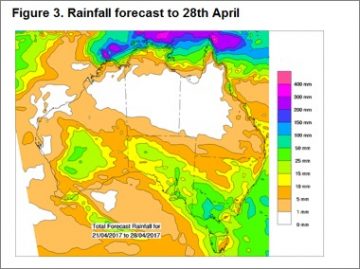

East coast Mutton throughput impacted by soft NSW figures where an 11% fall in NSW flowed through to a price gain of 1.6% for sheep in that state and a broader drop in the East coast throughput for the week – figure 3. Not the case in WA and SA, where increased mutton yardings translated into double digit percentage price falls to see both state mutton prices back below 500¢. A forecast of steady rain for the weekend and early part of next week to much of the sheep producing regions of the country and the prospect of tightening of supply, as the weather cools further, should continue to provide support to lamb and sheep prices.

A forecast of steady rain for the weekend and early part of next week to much of the sheep producing regions of the country and the prospect of tightening of supply, as the weather cools further, should continue to provide support to lamb and sheep prices.

If you told a sheep grower back in November you’d give them 530¢ for lambs in May, they would have considered it. If you told them you’d give them that for mutton, they’d have laughed at you. But here we are, with the Victorian Mutton Indicator at 530¢/kg cwt.

If you told a sheep grower back in November you’d give them 530¢ for lambs in May, they would have considered it. If you told them you’d give them that for mutton, they’d have laughed at you. But here we are, with the Victorian Mutton Indicator at 530¢/kg cwt. Mutton yardings were also strong relative to last year, but down on last week. The National Mutton Indicator (NMI) reacted by gaining 22¢ to hit a new record of 503¢/kg cwt. This is the first time the NMI has broken 500¢ (figure 2).

Mutton yardings were also strong relative to last year, but down on last week. The National Mutton Indicator (NMI) reacted by gaining 22¢ to hit a new record of 503¢/kg cwt. This is the first time the NMI has broken 500¢ (figure 2). It seems unlikely lamb or sheep supply is going to improve in the short term, with the tap to turn on sometime in August. What happens from there depends on the season, but we can expect to see price decline fairly rapidly once lambs start to hit the market.

It seems unlikely lamb or sheep supply is going to improve in the short term, with the tap to turn on sometime in August. What happens from there depends on the season, but we can expect to see price decline fairly rapidly once lambs start to hit the market.

As pointed out in

As pointed out in  A different story in the West though with solid prices enough to draw out supply as the pattern of lamb yarding in WA shows so far this season tracking well above the five-year average pattern and the 2016 trend – figure 2. Prices in the West responding in an anticipated to the 78% jump in lamb yardings on the week, fashion according to the laws of economics, with the WA Trade Lamb Indicator (WATLI) down 7.5% to 596¢/kg cwt. The elevated east coast lamb yardings having an impact on the Eastern States Trade Lamb Indicator (ESTLI) too, albeit to a lesser degree than out West, with a slight fall of 1.7% recorded on the week to see it close yesterday at 634¢/kg cwt.

A different story in the West though with solid prices enough to draw out supply as the pattern of lamb yarding in WA shows so far this season tracking well above the five-year average pattern and the 2016 trend – figure 2. Prices in the West responding in an anticipated to the 78% jump in lamb yardings on the week, fashion according to the laws of economics, with the WA Trade Lamb Indicator (WATLI) down 7.5% to 596¢/kg cwt. The elevated east coast lamb yardings having an impact on the Eastern States Trade Lamb Indicator (ESTLI) too, albeit to a lesser degree than out West, with a slight fall of 1.7% recorded on the week to see it close yesterday at 634¢/kg cwt.

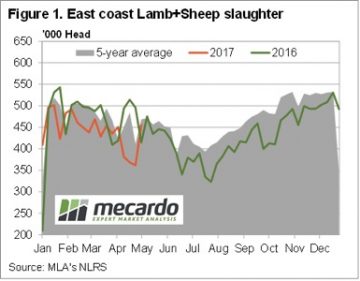

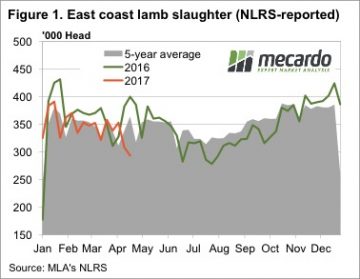

One of the most interesting numbers found this week was MLA’s weekly lamb slaughter for the week ending the 21st of April. Lamb slaughter came in at just 293,342 head, the lowest level since July last year. In the week ending the 21st Lamb slaughter fell 5%, and also sat 5% below the Easter levels of 2016.

One of the most interesting numbers found this week was MLA’s weekly lamb slaughter for the week ending the 21st of April. Lamb slaughter came in at just 293,342 head, the lowest level since July last year. In the week ending the 21st Lamb slaughter fell 5%, and also sat 5% below the Easter levels of 2016. Not all lamb prices fell this week, Merino lambs gained 19¢ on the east coast, while light lambs were up 12¢. Neither quite managed to hit record highs, but are not far off at 611¢ and 673¢/kg cwt for Merino and Light lambs respectively.

Not all lamb prices fell this week, Merino lambs gained 19¢ on the east coast, while light lambs were up 12¢. Neither quite managed to hit record highs, but are not far off at 611¢ and 673¢/kg cwt for Merino and Light lambs respectively.

A rebound in East coast yardings post the Easter break, particularly out of NSW, sees the Eastern States Trade Lamb Indicator (ESTLI) take a breather this week. The ESTLI posting a 2.9% drop to 667¢/kg cwt. Not so for National Mutton, bucking the trend with a 1.9% gain to 495¢ – dragged higher by gains to Western Australian sheep.

A rebound in East coast yardings post the Easter break, particularly out of NSW, sees the Eastern States Trade Lamb Indicator (ESTLI) take a breather this week. The ESTLI posting a 2.9% drop to 667¢/kg cwt. Not so for National Mutton, bucking the trend with a 1.9% gain to 495¢ – dragged higher by gains to Western Australian sheep. Despite the higher supply, restocker lambs in NSW and Victoria gaining some ground up 10.4% and 6.6%, respectively. NSW restockers now fetching $119 per head, while Victorian restockers are enjoying a $126 per head level. The higher NSW yardings having most impact on Heavy and Trade lambs in that state down 4.2% (641¢/kg) and 1.4% (656¢/kg), correspondingly. The two softest categories of Victorian lamb for the week were Merino, falling 5.2% to 616¢, and Light lambs, down 3.5% to 660¢. Trade lambs the star performer in SA, the only category of sheep in that state to post a gain this week, up 4.2% to 614¢.

Despite the higher supply, restocker lambs in NSW and Victoria gaining some ground up 10.4% and 6.6%, respectively. NSW restockers now fetching $119 per head, while Victorian restockers are enjoying a $126 per head level. The higher NSW yardings having most impact on Heavy and Trade lambs in that state down 4.2% (641¢/kg) and 1.4% (656¢/kg), correspondingly. The two softest categories of Victorian lamb for the week were Merino, falling 5.2% to 616¢, and Light lambs, down 3.5% to 660¢. Trade lambs the star performer in SA, the only category of sheep in that state to post a gain this week, up 4.2% to 614¢. Another short week ahead with the ANZAC break and some decent rainfall to much of the sheep regions of the nation (figure 3) should see prices hold, or perhaps firm slightly. As outlined in the sheep/lamb analysis piece this week longer term fundamentals will continue to support any price dips seen in sheep and lamb markets for much of the current season.

Another short week ahead with the ANZAC break and some decent rainfall to much of the sheep regions of the nation (figure 3) should see prices hold, or perhaps firm slightly. As outlined in the sheep/lamb analysis piece this week longer term fundamentals will continue to support any price dips seen in sheep and lamb markets for much of the current season. The pace of the rally in the Eastern States Trade Lamb Indicator (ESTLI) slowed this week, but it still went up. The ESTLI finished Wednesday at 687¢/kg cwt (figure 1). While the stronger prices of the last month might have something to do with a demand spike, it’s more likely to be underlying tight supply supporting values.

The pace of the rally in the Eastern States Trade Lamb Indicator (ESTLI) slowed this week, but it still went up. The ESTLI finished Wednesday at 687¢/kg cwt (figure 1). While the stronger prices of the last month might have something to do with a demand spike, it’s more likely to be underlying tight supply supporting values. Driving MLA’s figures were results from the February MLA/AWI survey with the key figures being 34% of producers intending to increase flocks, and 59% intending to maintain. Of those intending to increase the flock, 56% are going to retain more replacement ewes. This basically means that of the fewer lambs born in 2016 and 2017, fewer are going to be available for slaughter.

Driving MLA’s figures were results from the February MLA/AWI survey with the key figures being 34% of producers intending to increase flocks, and 59% intending to maintain. Of those intending to increase the flock, 56% are going to retain more replacement ewes. This basically means that of the fewer lambs born in 2016 and 2017, fewer are going to be available for slaughter.

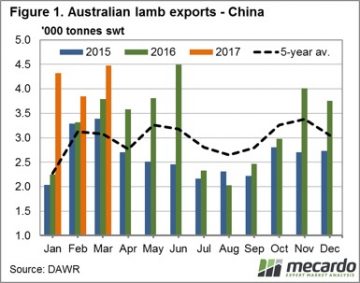

Figure 1 shows the lamb export volumes for 2017 sitting at 49% above the seasonal five year average levels for this quarter. Volumes increased again for March to 4,477 tonnes swt, just shy of the record high in June 2016. This is deviating from the usual March drop that occurs towards the seasonal trough.

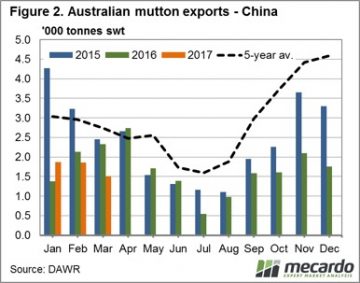

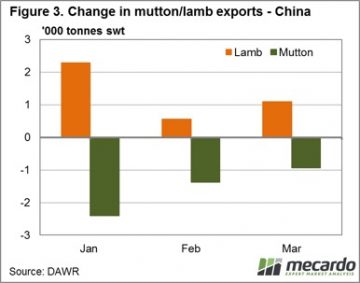

Figure 1 shows the lamb export volumes for 2017 sitting at 49% above the seasonal five year average levels for this quarter. Volumes increased again for March to 4,477 tonnes swt, just shy of the record high in June 2016. This is deviating from the usual March drop that occurs towards the seasonal trough. To delve a little deeper into the question, in Figure 3 we have lined up the change in mutton and lamb export volumes from 2015 to 2017 for the season so far. Interestingly, we can see that where mutton volume has dropped off very closely aligns with increases in lamb consignments. Particularly in the months of January and March, there is a near exact shift in volumes from the one sheep meat to the other.

To delve a little deeper into the question, in Figure 3 we have lined up the change in mutton and lamb export volumes from 2015 to 2017 for the season so far. Interestingly, we can see that where mutton volume has dropped off very closely aligns with increases in lamb consignments. Particularly in the months of January and March, there is a near exact shift in volumes from the one sheep meat to the other. Our current sheep meat export prices may also be playing a part in the changing trade trends within China. Over the last season, the basis of the spread between mutton and lamb has narrowed significantly. In 2015, we had the price of mutton at around 50% of lamb but now we’re seeing the mutton price close in.

Our current sheep meat export prices may also be playing a part in the changing trade trends within China. Over the last season, the basis of the spread between mutton and lamb has narrowed significantly. In 2015, we had the price of mutton at around 50% of lamb but now we’re seeing the mutton price close in.