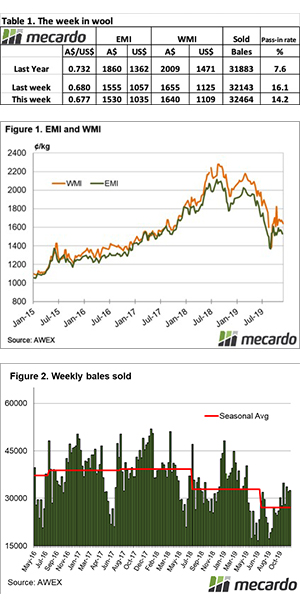

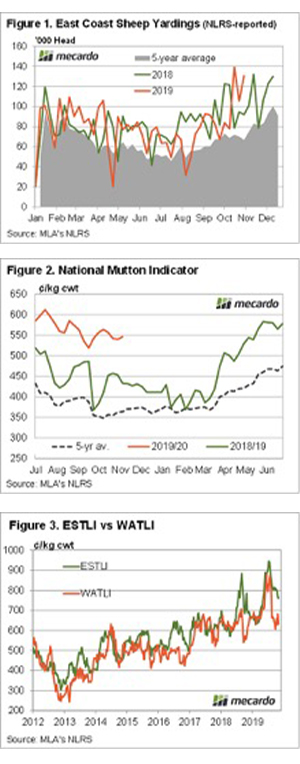

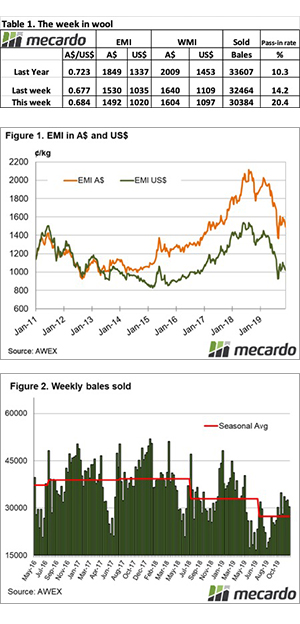

A strong offering had the typical effect on wool prices, the market sliding another step lower this week. Growers protested the downward trajectory in hordes with passed in rates hitting 20.4% to see a total of 7,765 bales returning to brokers’ stores.

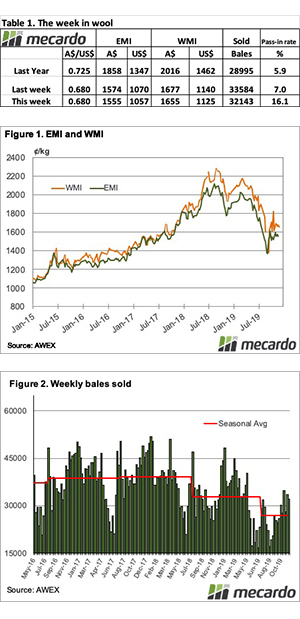

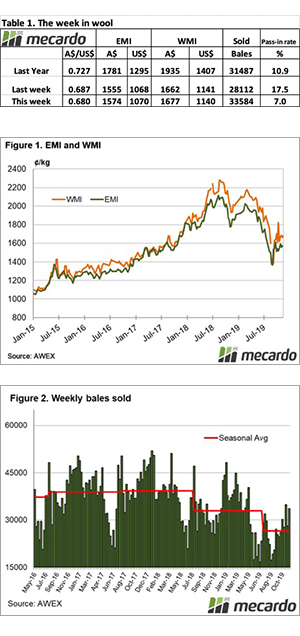

The Eastern Market Indicator (EMI) lost 38 cents for the week to close at 1,492 cents. The AU$ opened strongly which played into the lack of buying enthusiasm. The AU$ rose 0.07 cents for the week to US $0.684. In US terms, this pushed the EMI down just 15 cents to 1,020 cents.

The Western Market Indicator experienced falls in line with the eastern markets. The WMI dropped 36 cents for the week to finish at 1,604 cents. AWEX reported that lesser style wools did not fare well in this week’s market. Buyers continually discounted their pricing levels and by the end of the series, had fallen 50 to 80 cents.

The national offering was 322 bales higher this week for a total of 38,149 bales. However, the high passed in rates meant the number of bales sold was down by over 2,000 on last week’s volumes. Just 30,384 bales were cleared to the trade for the week. This season’s bale clearance continues to lag well behind 2018 at a difference of 100,281 bales. The average weekly bales volume is currently 5,164 behind last year.

The dollar value for the week was $50 million flat, with the average bale value sitting at $1,645, drifting $19 per bale below last week’s average. The combined value so far this season is $945.47 million.

The crossbred sector fell across all microns, losing 20 to 45 cents. Oddments were the only category to record gains. The Merino Cardings Indicators rose by an average of 2 cents across the three selling centres.