Meat and Livestock Australia (MLA) slaughter figures

confirmed that January lamb supply has been tighter

than usual. The result has been very strong summer

lamb prices, at a time when the market has tracked

sideways in recent years.

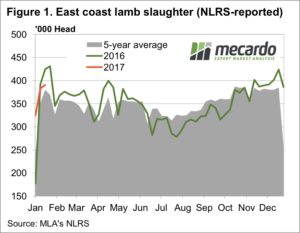

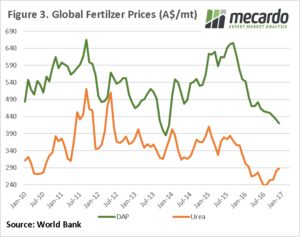

Figure 1 shows east coast lamb slaughter for the week

ending the 20th of January was well below last year.

The 18% reduction in numbers seems to have been due

to the good spring, which saw many lambs finish early

and hit the market in December, leaving a dearth of

numbers in January.

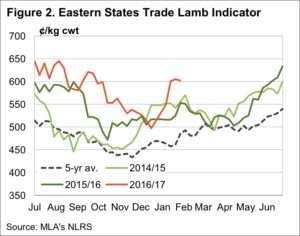

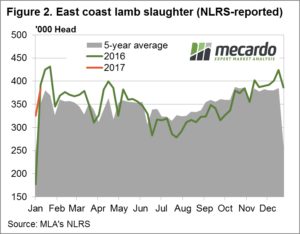

The result has been the best January lamb prices since

2011, with the Eastern States Trade Lamb Indicator

(ESTLI) managing to spend its third week above 600¢.

The ESTLI did ease slightly this week, but only 2¢ to

finish at 602¢/kg cwt. Mutton values took more of a hit,

losing 12¢ to hit 395¢/kg cwt as supply improved.

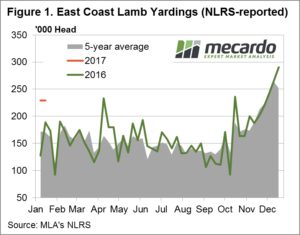

The question now for lamb markets is whether they can

maintain the strong levels. The five year average would

suggest they can, but figure 2 shows that in the last two

years February has seen the ESTLI ease. Lower prices in

February are likely due to domestic demand waning after

Australia Day and supply improving as shorn lambs start

to come back to the market.

As always the price trend will depend on how many lambs

are actually out there, and as indicated by survey results,

it could be fewer this year, so lamb prices could find some

solid support in the 560-580¢/kg cwt range.

The Week Ahead

We expect prices to ease over the coming weeks, but not

by much. Lamb producers not likely to be forced to sell in

the short terms, so may hold out for stronger prices if we

see any correction.

Mutton values should recover from this week’s correction,

it’s hard to see more supply coming forward given the feed

situation and the wool price.

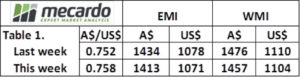

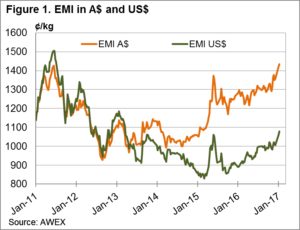

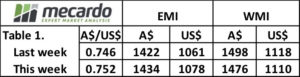

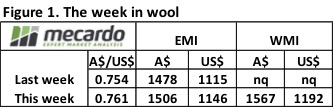

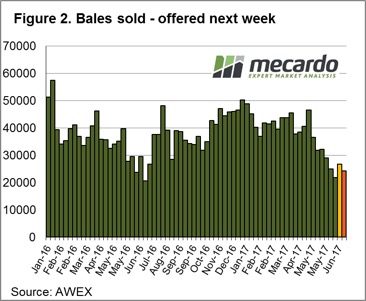

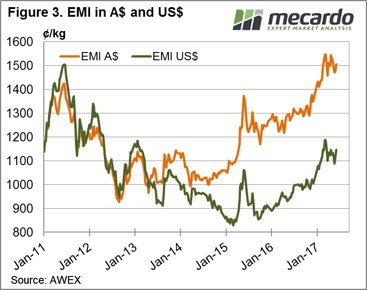

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

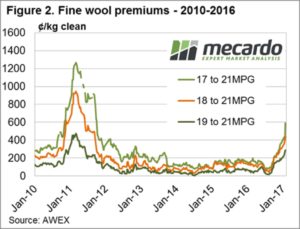

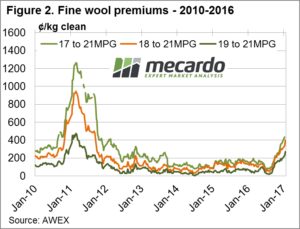

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢. Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

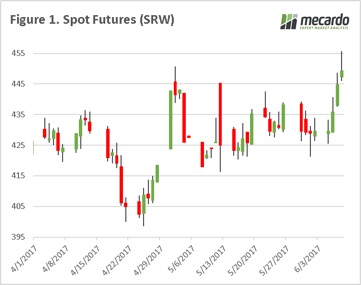

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market.

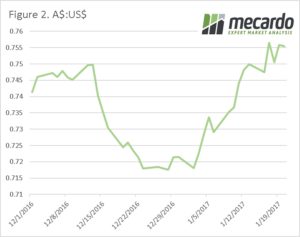

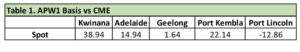

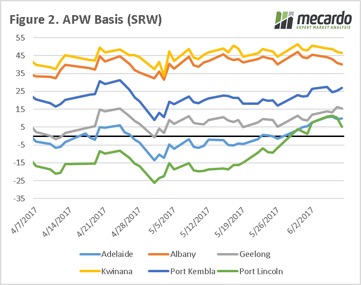

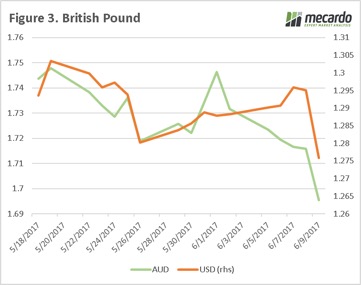

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market. East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing.

East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing. The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

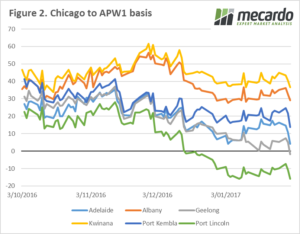

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.