There’s no doubt that combining passion, hard work and hands on experience, whilst putting the customer first bodes well when establishing a career in Agrifinance. That’s exactly what Stockco’s Business Manager, Caitlin Pearlman has done and brings a wealth of experience from working in some of Australia’s largest banks and the Agribusiness Banking Sector for the last nine years. Focused on the future, Caitlin has been appointed to continue the growth of Stockco’s business in Australia by bringing technology and innovative processes to assist grazier and feedlot operations access Stockco’s fast and simple livestock finance products.

There’s no doubt that combining passion, hard work and hands on experience, whilst putting the customer first bodes well when establishing a career in Agrifinance. That’s exactly what Stockco’s Business Manager, Caitlin Pearlman has done and brings a wealth of experience from working in some of Australia’s largest banks and the Agribusiness Banking Sector for the last nine years. Focused on the future, Caitlin has been appointed to continue the growth of Stockco’s business in Australia by bringing technology and innovative processes to assist grazier and feedlot operations access Stockco’s fast and simple livestock finance products.

Your background has been in Agribusiness Banking, what has been some of your career highlights?

There’s been quite a few, but being involved in building an Agribusiness brand and team from the ground up at a regional Australian Bank that didn’t have a specialised, dedicated Agri banking sector. It proved that you don’t have to have all the latest bells and whistles to have satisfied clients. You just need to put the client at the centre of everything you do. Be available, capable and understand their business.

What prompted you to make the move from Agribusiness Banking to StockCo?

Having worked in the Agribusiness Banking sector since 2009 with both the Commonwealth Bank of Australia and Bank of Queensland (with a two year stint in London in between to get the travel bug out of my system) I wanted a change from banking, but didn’t want to leave the agricultural aspect of my work behind. My family run a dry land grain and beef operation in North West NSW and it’s always had an influence on my life and the choices I make.

Having gained insight into StockCo’s business through their relationship with BOQ, I felt their values and business model were the perfect fit and I am very excited to become a part of the StockCo team. I’ve previously worked with StockCo’s CEO Richard Brimblecombe and COO Tim Pryor and knew I was joining an experienced team who have a huge amount of enthusiasm for StockCo.

What do you hope to achieve in your role as Business Manager for StockCo?

It’s a multifaceted role and I’m sure it will evolve as I settle into the position. I’m hoping to cast a fresh eye over current procedures and compliance practices to see if there’s anything that we can streamline or any valuable data we can extract. Development of an online portal StockCo’s customers can log onto is also high on my agenda. I’ll be working with Tim, Richard and our distribution partners to help take StockCo to a level where every grazier and feedlot operation in Australia associates the StockCo brand with a fast and simple livestock finance product. They will know we can work alongside their existing bank to free up working capital to help them to concentrate on building equity or perhaps expand, whatever their plans may be.

It’s an exciting time for Australia’s livestock industries, what do you see as the biggest opportunities and challenges?

The entrance of the next generation into the livestock industry is a complex challenge. With land ownership structures changing and corporations seeing value in agriculture the barriers to entry are high. Traditional banking finance is struggling to evolve with the more economical option to lease land instead of owning it. That’s where I see StockCo coming into play, helping the younger generation get a foot in the door with livestock finance.

In terms of opportunities, technology is the buzz word of the agricultural industry. The use of drones to measure pasture biomass, NLIS, real time tracking of weights, movements, grazing habits along with software packages that analyse this data alongside the business accounts. When used effectively they allow livestock producers to maximise their productivity and returns.

What advice would you have for a university graduate who is passionate about Australian Agriculture and is looking to establish a career in agribusiness?

If you’re already passionate, then half the work is done. Show people in the industry your passion. Start networking. Polish up your LinkedIn profile. Start connecting with people in the industry. Don’t know what area of agriculture you want to be in? Apply for a variety of graduate and entry positions. Don’t be fussy. Going through the application process is valuable experience. If you are offered a position you really don’t think is suitable, you can always say no. Banking graduate positions are a very good stepping stone as they not only expose you to a myriad of different agricultural industries (aquaculture, horticulture, cropping and livestock to name a few) but you also get exposure to the different areas within the Bank.

Can’t land that coveted graduate position? Get a year’s hands on experience on a property or look for seasonal positions within your Government’s Department of Agriculture. I had a job during the summer break collecting heliothis moth eggs in cotton crops, another summer I was working for an agronomist. Volunteer your time, do extra jobs on the side. You’ll stand out in the next round of interviews by showing your entrepreneurial side and that you’re willing to put in the extra effort to land the position.

Learn more about the StockCo team here.

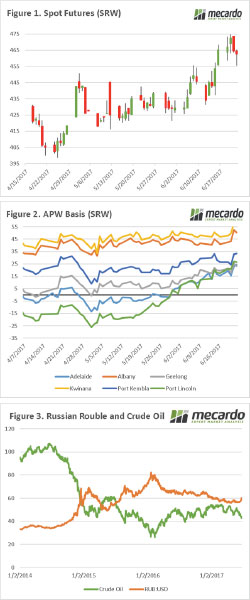

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

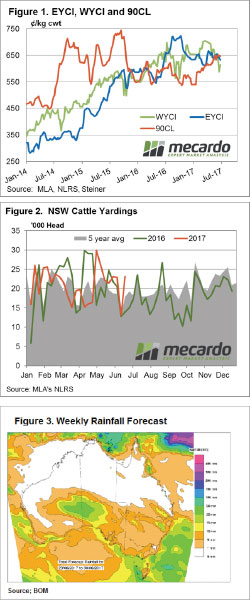

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.

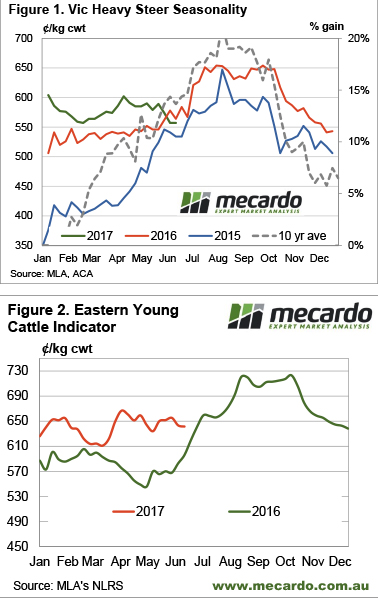

Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

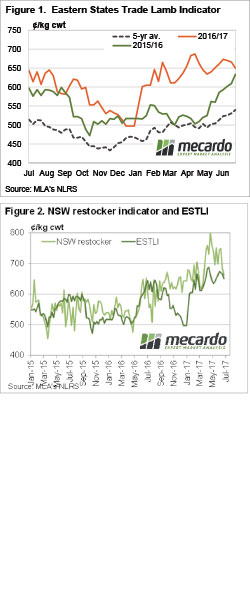

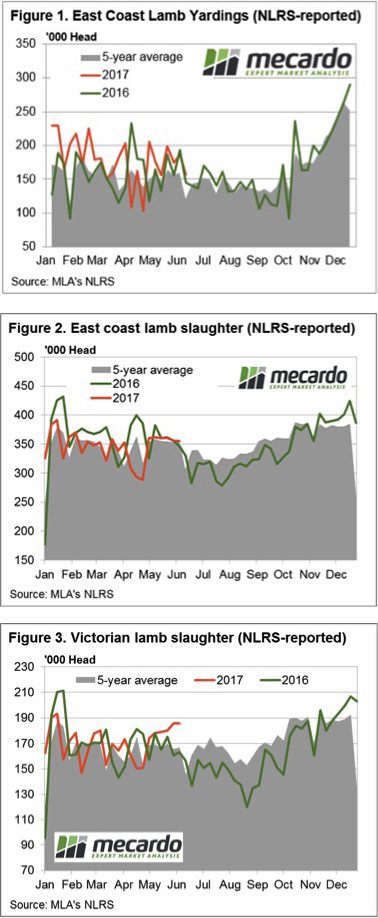

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market.

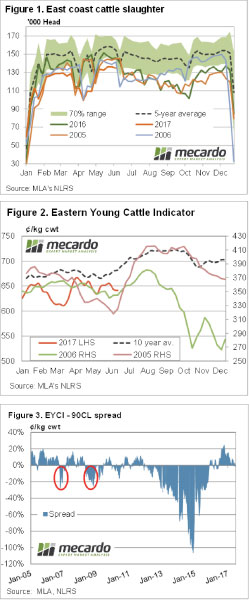

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market. It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.

It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices. It hasn’t happened to the Eastern Young Cattle Indicator (EYCI) yet, but we have a few slaughter categories which have moved below year ago levels. It’s been a while since producers were getting less money than the year before, in fact it’s been three years, but is anyone complaining?

It hasn’t happened to the Eastern Young Cattle Indicator (EYCI) yet, but we have a few slaughter categories which have moved below year ago levels. It’s been a while since producers were getting less money than the year before, in fact it’s been three years, but is anyone complaining?

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.