After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

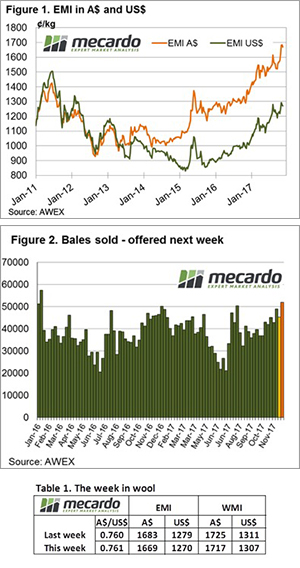

The Eastern Market Indicator (EMI) dropped 14 cents on the week to 1,669¢. The weakening Australian dollar has meant the retraction was not quite as strong in US dollar terms, with just a 9 cent drop to 1,270¢. The Western Market Indicator fell just 8 cents on the week to 1,717¢.

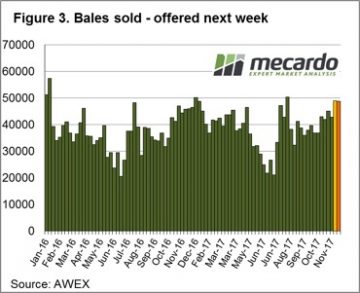

The bale offering this week was substantial at a total of 48,409 bales. With the consistently high trade offering over the last few weeks AWEX reported that it has reached the point where buyers were able to be more selective with their purchases. The word on the ground from exporters suggests that the softening market this week is being led by offshore clients pulling back slightly due to tightening credit. The responding retraction in prices saw a bump in the percentage of wool passed-in this week. It rose 3.2% from last week to 6.4% of bales passed-in.

The finer micron wools still appear to be reacting most to any change in the market. The largest price correction was for 18.5 micron, which dropped 35 to 50 cents in the East over the week. Medium fibre wools (19.5 to 22 micron) lost on average 10 to 30 cents, while crossbred wool again demonstrated its volatility in a wide range of results. The finer crossbreds held slightly, to a loss of 10 to 20 cents, but 28 and 30 micron prices suffered on average 40 to 60 cents drops.

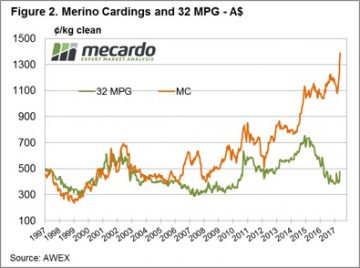

Skirtings followed the movements of the Merino market showing reductions ranging between 20 and 40 cents. The cardings indicator managed to retain some stability in the East on the week, and even posted a gain of 15 cents in the West.

The week ahead

Next week a huge offering of 51,982 bales is tipped across the three selling centres. Significant volumes are expected for Sydney and Fremantle which are providing most of the boost in next week’s offering. Sydney will be holding a designated Australian Superfine Sale on Wednesday and Thursday.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

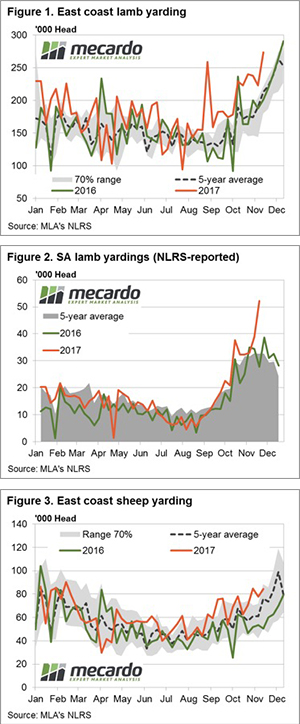

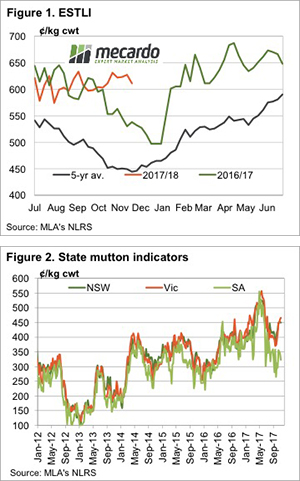

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle.

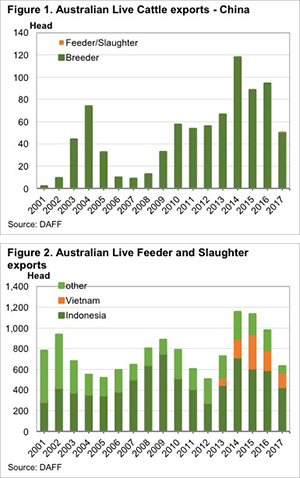

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle. According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

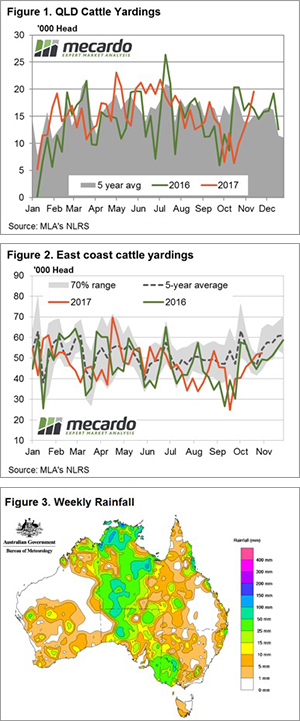

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not? Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced.

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced. Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week.

Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week. The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

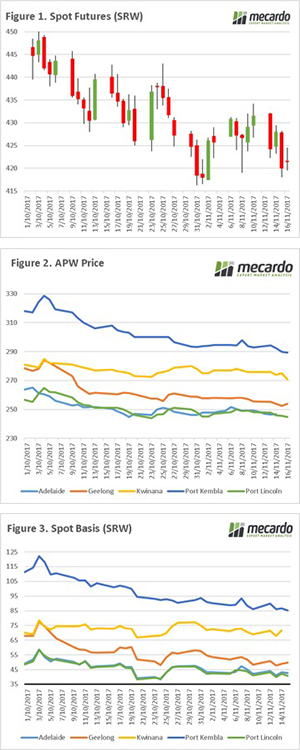

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.