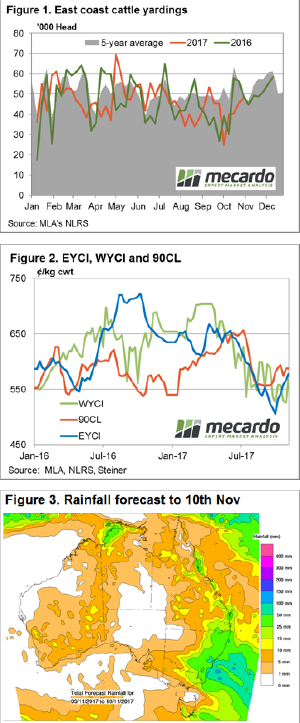

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

We are still coming to grips with Meat and Livestock Australia’s new weekly stats, which come out on a Wednesday, with supply data to last Friday. For yardings figures we find it a little hard to match prices with supply, as we are running about 4 sale days behind.

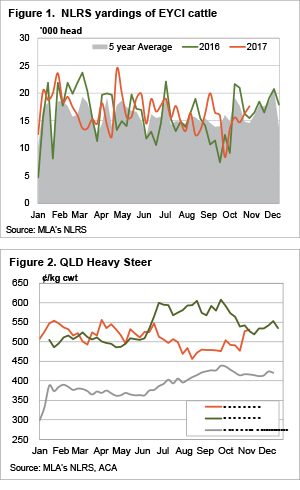

Anyway, what we do know is that young cattle supply in Eastern Young Cattle Indicator (EYCI) saleyards was up 8% in the week to Thursday (figure 1), and this halted the rise in the price, as it stalled at 578¢/kg cwt. In fact, EYCI yardings hit their highest level in 8 weeks. While the EYCI eased marginally, it remains close to its highest level in 15 weeks.

The Queensland Cattle Market Index has been catching our eye, it hit 307.6 points this week. Heavy steers helped to drive the QCMI, as prices rallied 50¢ in the past two weeks to hit a 19 week high of 531¢/kg cwt.

Figure 2 shows that Queensland Heavy Cattle are not far off the price of this time last year, and they are the most expensive heavy cattle in the country. The Queensland 100 day grainfed steer over the hooks indicator ticked 3¢ higher this week, but is languishing behind at 507¢/kg cwt.

The week ahead

It looks like it’s going to be relatively dry for the coming week, on the east coast at least, which might see prices track sideways. There is a little upside left in the slaughter cattle market if export prices remain good, but young cattle markets might find it a little harder to keep rallying without more rain.

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.  It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

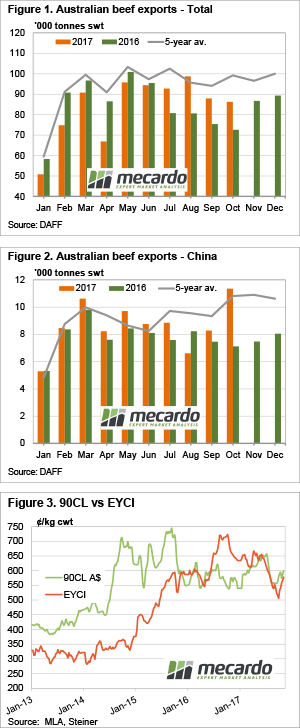

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

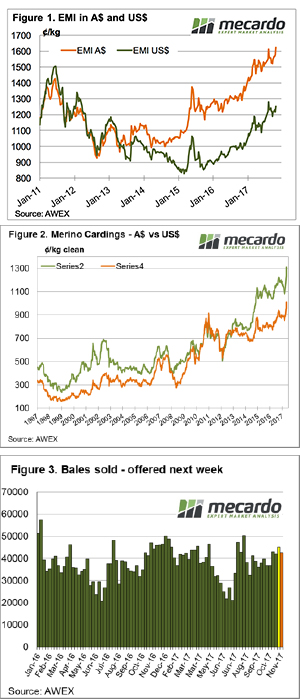

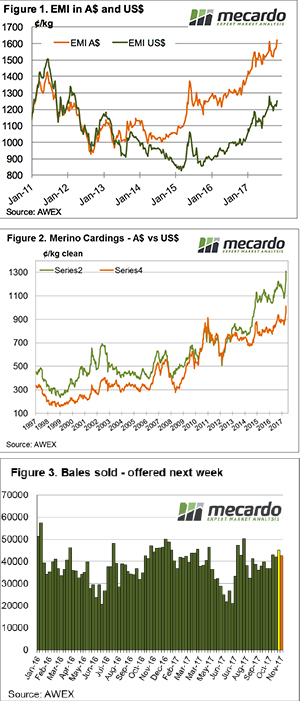

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

Australian is on the cusp of being full blown harvest, with all states (ex Tasmania) showing some activity. In the coming weeks, harvest proper will be upon us, and we will start to see how accurate the crop forecasts have been.

Australian is on the cusp of being full blown harvest, with all states (ex Tasmania) showing some activity. In the coming weeks, harvest proper will be upon us, and we will start to see how accurate the crop forecasts have been.

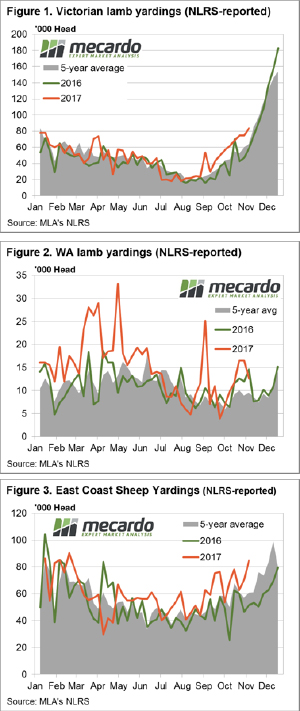

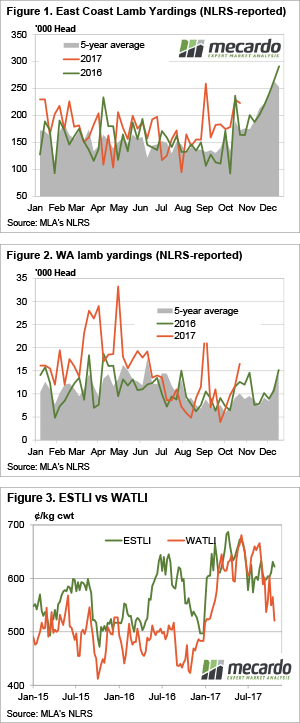

Sheep and lamb yardings had another strong week, with Victorian lambs starting to run. Yet prices continued their solid reluctance to fall, maintaining levels well above last year in the east. Things are easing in the west, but also remain better than last year.

Sheep and lamb yardings had another strong week, with Victorian lambs starting to run. Yet prices continued their solid reluctance to fall, maintaining levels well above last year in the east. Things are easing in the west, but also remain better than last year.

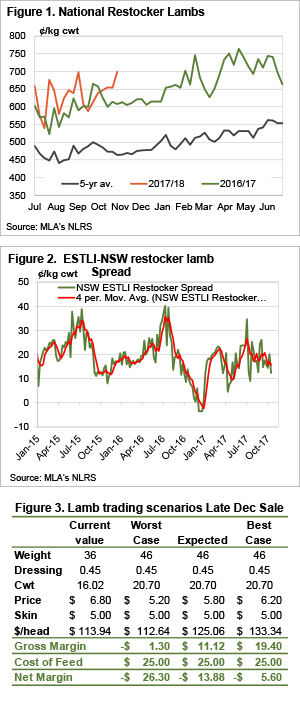

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December.

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December. Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.

Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.  With one of the larger offerings for this year the market performed very strongly this week. Every category posted gains. Records were set with the 19.5 MPG posting its highest level since its 2001 listing, and cardings topping 1300 cents in Melbourne, a record against our records going back to 2002.

With one of the larger offerings for this year the market performed very strongly this week. Every category posted gains. Records were set with the 19.5 MPG posting its highest level since its 2001 listing, and cardings topping 1300 cents in Melbourne, a record against our records going back to 2002.

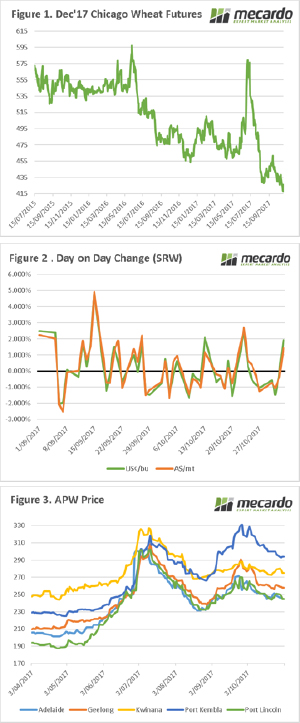

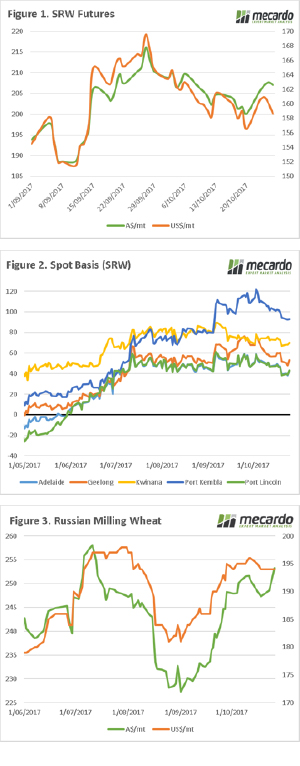

The market continues to follow a similar pattern to recent weeks. In this week’s comment, we look at futures & basis levels. In addition, we look at where our main competitor (Russia) is pricing its wheat.

The market continues to follow a similar pattern to recent weeks. In this week’s comment, we look at futures & basis levels. In addition, we look at where our main competitor (Russia) is pricing its wheat.