There is an old Chinese curse, “May you live in interesting times”, used ironically to suggest that uninteresting times are more life enhancing than interesting ones. It seems our friend Donald, would like to consign us to a lifetime of interesting times.

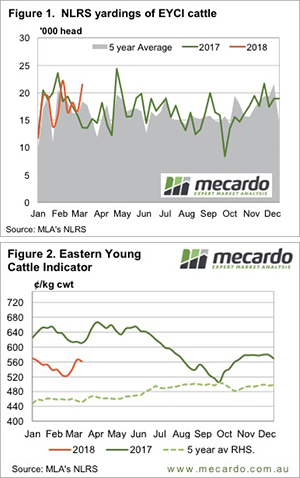

After experiencing strong momentum in March, it seems that gravity has exerted its force on the wheat futures market, with a return to pre-rally levels (figure 1). In recent days much needed rainfall has fallen in US growing regions. It was not unreasonable to expect this fall in the market, especially as the US falls in importance on the international wheat market.

In the Black Sea nations, conditions continue to be promising for the coming season, with winter kill below average. Although the crop will be unlikely to match last year, it will still dominate the export market. Interestingly a Russian government official commented that fertilizer and seed purchases had increased 30% this season.

In figure 2, the basis levels around Australia as a percentage of the overall price has been displayed. During this harvest, basis increased dramatically, becoming a third of the pricing complex in some states. Although since weakened, basis levels remain strong, and protect us from falls in the futures market.

In recent weeks, Trump has been rattling the tariff saber with China. During the Trump election campaign, he ran on a platform of reforms to trade. In his defence, Trump has certainly gone all in, however only time will tell whether this will be to the betterment or detriment to the voters.

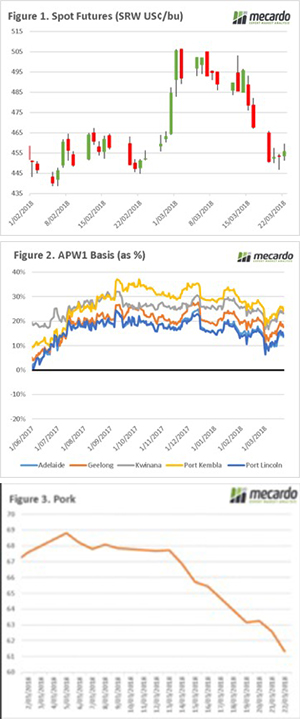

In figure 3,4, & 5 (animated), we can see the futures prices of a number of commodities (pork, soya, soya meal), which all have strong links with China. As we can see these markets have experienced strong falls in recent weeks, as discussions become more heated.

On a regular basis China turns around vessels of soya and corn from the US; perhaps we will see an upsurge of cargo rejections in retaliation.

What is assured, is that we are unlikely to be living in tranquil times for the foreseeable future, and black swans are likely to be a regular occurrence.

What does it mean/next week?:

The ‘tariff war’ is going to place Australia in a difficult diplomatic position, between an important customer and a traditional ally.

However, if handled well by our government could provide a favourable result for Australian industries.

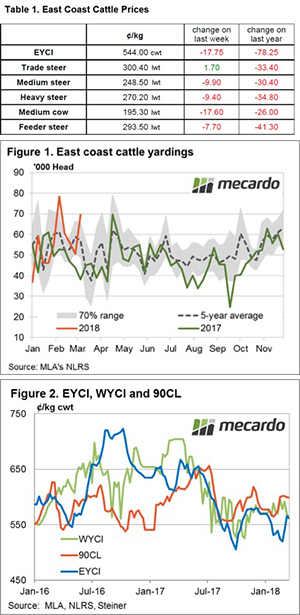

ground, trekking sideways to remain above 300¢/kg lwt. Medium cows taking the biggest hit with an 8% drop to close at 195.3¢/kg lwt – Table 1.

ground, trekking sideways to remain above 300¢/kg lwt. Medium cows taking the biggest hit with an 8% drop to close at 195.3¢/kg lwt – Table 1.

of tighter supply

of tighter supply

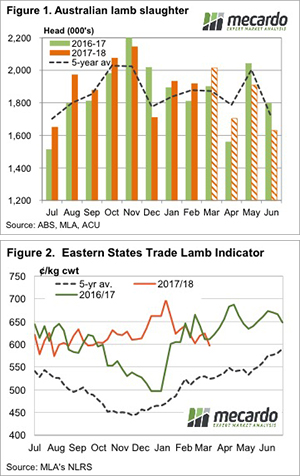

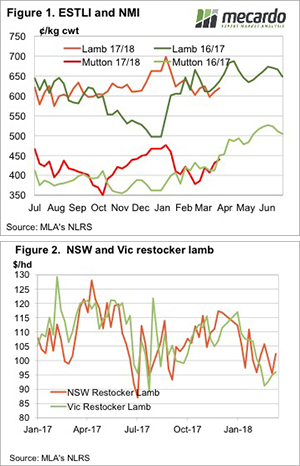

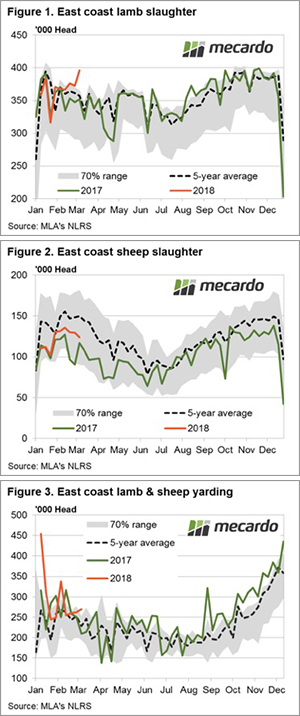

The broad trend in East coast lamb and sheep slaughter numbers continue to be dominated by NSW and Victorian flows at the moment with a spike in lamb slaughter in the previous week, to levels well above normal, unable to dampen prices too vigorously. Similarly, elevated throughput along the East coast for both lamb and sheep was powerless to inhibit demand, particularly for mutton and Merino lamb.

The broad trend in East coast lamb and sheep slaughter numbers continue to be dominated by NSW and Victorian flows at the moment with a spike in lamb slaughter in the previous week, to levels well above normal, unable to dampen prices too vigorously. Similarly, elevated throughput along the East coast for both lamb and sheep was powerless to inhibit demand, particularly for mutton and Merino lamb.