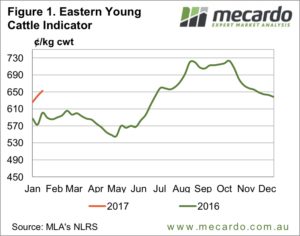

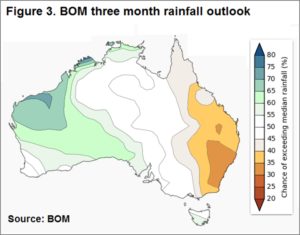

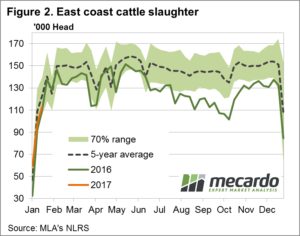

The Eastern Young Cattle Indicator (EYCI) was

marginally softer this week as the Australia Day

holiday and a release from the Bureau of Meteorology

(BOM) showing dryer conditions expected for

February through to April gave buyers reason to pause.

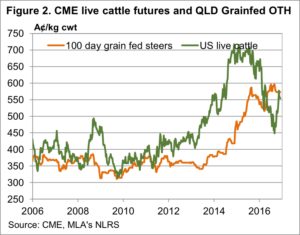

Figure 1 highlights the anticipated rainfall outlook

released from BOM which highlights a reduced

likelihood for rainfall to exceed the seasonal averages

for much of the central and south-eastern region of the

nation. The Bureau is also forecasting a hotter than

average minimum and maximum temperature range

for the same areas of the country anticipated to

experience the dry spell. The dry and hot forecast

appearing to take some of the “heat” out for the cattle

market this week.

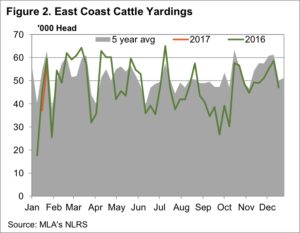

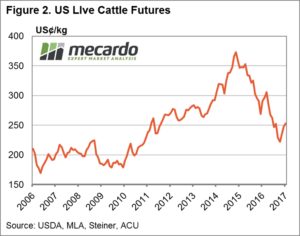

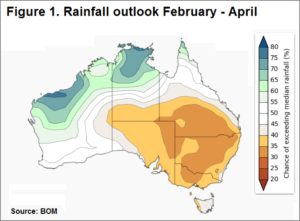

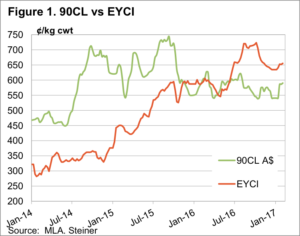

East coast cattle slaughter figures for the week ending

20th January coming in 2.8% higher than for the same

time in 2016 at 112,995 head boosted by Queensland

weekly slaughter figures. Indeed, Queensland was the

only state in the nation to record weekly slaughter

figures above the 2016 levels and above the five-year

average for this time of the year. Despite the boost from

the “Sunshine state” total east coast slaughter is still

tracking 8.2% below the five-year average trend – figure 2.

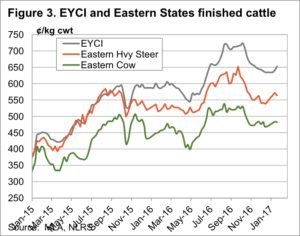

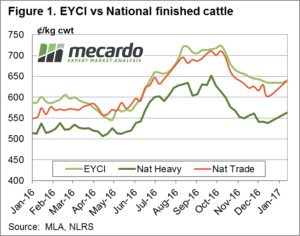

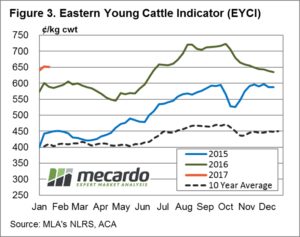

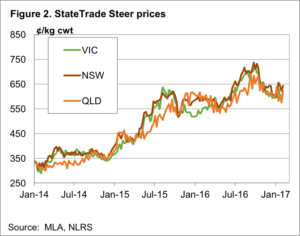

Figure 3 outlines this week’s sideways movement in

EYCI closing just 0.75¢ softer at 651.5¢/kg cwt as

restockers pause to think about the weather implications.

This time last year the MLA released an article looking

at the relationship between movements in the EYCI

over January compared the overall performance over

the season. Interestingly they discovered that 78% of

the time the January performance was mirrored in the

rest of the year’s performance.

The week ahead

The MLA article would seem to suggest that based on this

January’s price movements we are in for a positive price

pattern this year, although not as strong price gains as those

that occurred during 2015 and 2016 – figure 3. As we head

into February eyes will be on the skies, temperature gauges

and the condition of the pasture as this will influence how

aggressive restocker demand will be for cattle and if they

will continue to drive the price direction as much as they

did last season.

ood for us if McDonalds sell more burgers in the US.

ood for us if McDonalds sell more burgers in the US.