It was a big week in the grain markets with the release of crop forecasts from the US and Australia. The market teeters on the edge of a bull market causing a high degree of volatility. In this weeks market comment we take a look at the A$, futures and new crop basis.

It was a big week in the grain markets with the release of crop forecasts from the US and Australia. The market teeters on the edge of a bull market causing a high degree of volatility. In this weeks market comment we take a look at the A$, futures and new crop basis.

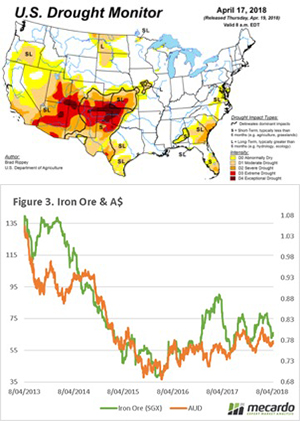

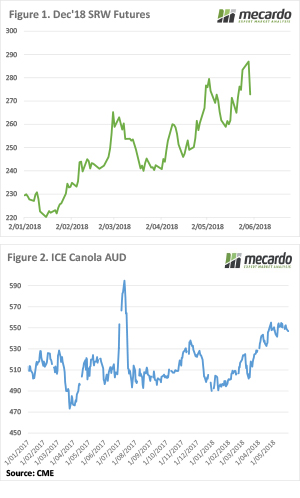

The futures market has been volatile this week (Figure 1), with Chicago spot futures trading in a range of 501.5-534.5¢/bu. The market is currently at $5 below the close on the last Friday. The midweek rally was as a result of the generally bullish data in the WASDE report, especially the sudden fall in Russian production estimates. Gravity, however, had its impact on the market, with traders digesting the WASDE report with concerns related to high ending stocks and uncertainty in the Russian seeding numbers.

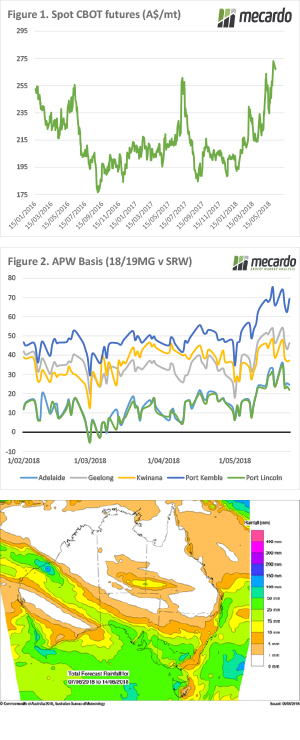

Our greatest concern at present for Australian wheat producers and consumers is the conditions locally, especially in NNSW & QLD. In these regions, the crop has gone into minimal soil moisture and received little in the way of meaningful rainfall. The domestic demand in these areas is high and the likely drop in production will be a primary driver of basis on the east coast.

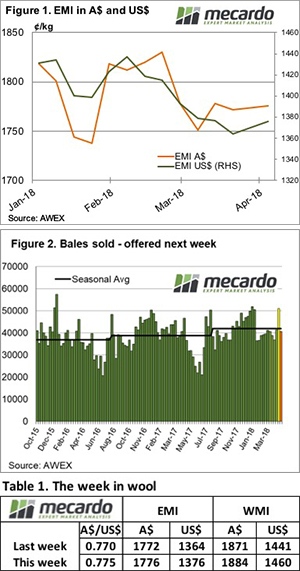

In Figure 2, the new crop basis levels are displayed and we can see the strong increase in levels in the past month as conditions show little sign of improvement. A higher basis level indicates that we should be considering selling physical, however at this point in time, production risk is too high in most places to consider substantial volumes.

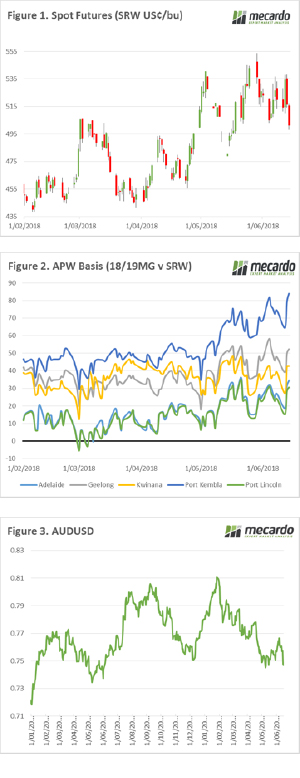

The A$ has taken a nose dive in the past day (Figure 3). This was a result of weak Chinese economic and neutral Australian employment data. A lower A$ makes our export commodities more attractive versus competing origins, on the other hand, it makes our inputs more expensive in local terms.

What does it mean/next week?:

The June/July period tends to have a high degree of volatility as the northern hemisphere heads for harvest. This year with supply and demand teetering on the edge of a neutral/bullish market, it will not be unexpected to see large swings in pricing on futures.

The big risk is to the Australian crop and with the BOM forecasting a drier than average 3 month period, we need to take this into account in our marketing plans.

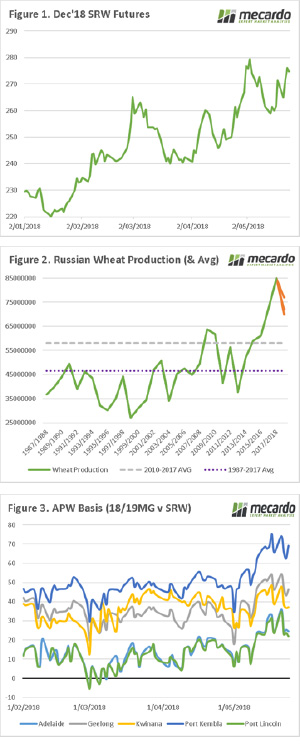

Chicago Soft Red Wheat managed to maintain its upward trend this week. It had an attempt at moving lower but bounced stronger on Wednesday night. Local wheat prices also tried to go lower but found strength on Thursday.

Chicago Soft Red Wheat managed to maintain its upward trend this week. It had an attempt at moving lower but bounced stronger on Wednesday night. Local wheat prices also tried to go lower but found strength on Thursday. The wheat yo-yo continued in the US as they approach harvest. Chicago Soft Red Wheat rallied to new highs this week, before easing back again. The charts are pointing to more upside, but supply will soon start rolling in.

The wheat yo-yo continued in the US as they approach harvest. Chicago Soft Red Wheat rallied to new highs this week, before easing back again. The charts are pointing to more upside, but supply will soon start rolling in.

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

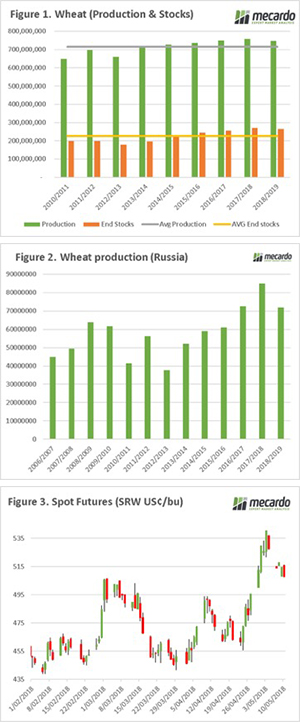

e first of the year to forecast the coming season. Although, with these initial estimates, it is probably worthwhile taking them with a pinch of salt. In figure 1, the global projections for wheat production and end stocks are displayed. These unsurprisingly show a decline in both, with production down year on year 10mmt, and end stocks 6mmt. This is slightly above most trade expectations, but there is still a long way to go.

e first of the year to forecast the coming season. Although, with these initial estimates, it is probably worthwhile taking them with a pinch of salt. In figure 1, the global projections for wheat production and end stocks are displayed. These unsurprisingly show a decline in both, with production down year on year 10mmt, and end stocks 6mmt. This is slightly above most trade expectations, but there is still a long way to go. the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.