It’s an age old question, and one that is rarely put through a rational economic test. It’s probably of more interest to school children on farms than farmers. But with four mismothered lambs currently residing in a small enclosure in our yard, I thought it was time to work it out. Is it actually worth bottle raising stray lambs?

Any sheep breeder who goes around ewes would have found mismothered lambs. Most are left in the hope that the mother will come back and pick them up, but we know that even in the best managed twinning mobs this doesn’t always happen.

So the kids want a pet lamb, we buy a bag of milk powder and get going on raising the most expensive lamb on the property.

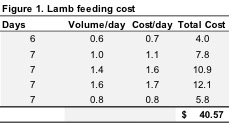

We paid $58 for a 10kg bag of Maxcare lamb milk replacer. It is mixed at a ratio of 190g which makes a litre of milk. Can you believe this comes to $1.11 per litre. That’s right, powdered lambs milk is more expensive than supermarket milk. It probably reflects the actual value, rather than being used as a loss leader.

The recommended feeding rates are shown in figure 1, along with the cost per day and week of feeding. Over the 34 days of milk feeding, lambs should reach a weight of 12-18kgs at a cost of $40.57. This doesn’t include labour, as all farm kids know their labour is free.

Even 18kgs liveweight is a very light lambs, and is at the lighter end of where lambs are normally weaned. Lambs will need to be weaned onto high quality pasture or hay and pellets to keep them growing at a reasonable rate.

Pellets and hay at 300g per day for a month will add another $5-10 in costs for another month which would get the lambs to a saleable weight of 18-22kgs. Not many bottle reared lambs will be sold at this age or weight, but kids might can ask mum and dad for $60-90 per head depending on breed, based on what very light lambs are making on Auctionsplus at the moment. The best lambs to rear are first cross or maternal ewes.

What does it mean/next week?:

The numbers show that there is a little bit of money to made in bottle rearing lambs if you don’t take labour into account. Currently as lambs move up the weight scale their value increases strongly, but the rational economist would wonder why you would rear a lamb to 20kgs when you can buy them for $60. Obviously you can’t just buy one lamb very easily or this cheaply.

You can tell the kids that if they can rear a lamb there is likely to be $10-30 in it for them, but maybe don’t tell them which are the best lambs to rear, or they might start chasing ewes away in first cross or maternal twinning paddock.

Key Points

- There are a lot of lambs reared on bottles, but it’s a

costly exercise coming at around $40 for milk.

costly exercise coming at around $40 for milk. - Further high quality feed is required to get lambs to saleable weights, but there is a small profit in it before labour.

- Obviously rearing ewes is a more profitable exercise, but mismothered lambs can’t always be chosen.

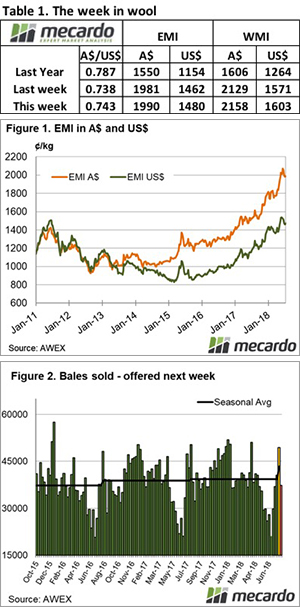

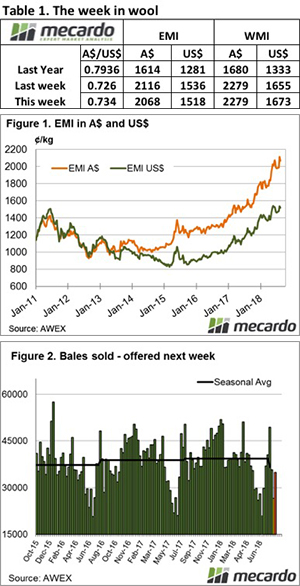

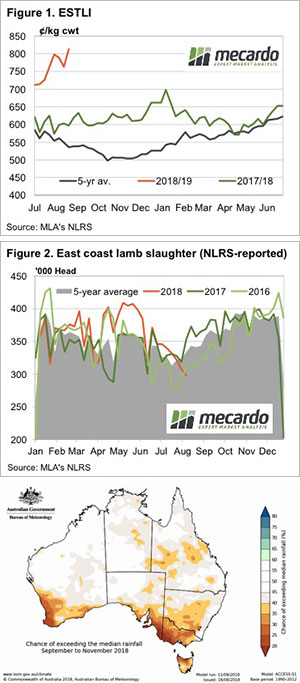

the start and never looked back, gaining 126 cents for the week, to settle at 2116 cents AU$ (Figure 1).

the start and never looked back, gaining 126 cents for the week, to settle at 2116 cents AU$ (Figure 1).