It has been a decade since the Sheep’s Back to Mill was updated. The Sheep’s Back to Mill publication is a record of the cost of harvesting, testing selling and shipping greasy wool in Australia to overseas mills. One of the components of this publication is the proportion of the wool clip which passes through rehandles/bulk class facilities. This article takes a look at wool preparation in the clip, which in turn determines how much wool passes through rehandling facilities.

The latest Sheep’s Back to Mill (for 2009-2010) is available here. Traditionally this publication develops the cost of rehandle (‘bulk class’) by using the AWTA fee applied to the proportion of the clip sold in this manner. This method underestimates the cost of putting wool through a rehandle.

There is often a mismatch between the grower being paid out on rehandle wool and when the rehandle wool (which is aggregated with like wool from other growers) is sold. For this reason and the extra work involved, the broker will make a margin on the rehandle wool. It is a grey area that is not transparent and rehandles are profit centres in the broking business, so the less wool put through rehandles the better for growers. The counter-argument is that farmers can end up with parcels of wool (bags and butts) which are not large enough to make up a sale lot. Such small lots are legitimately aggregated into sale lots in good rehandles.

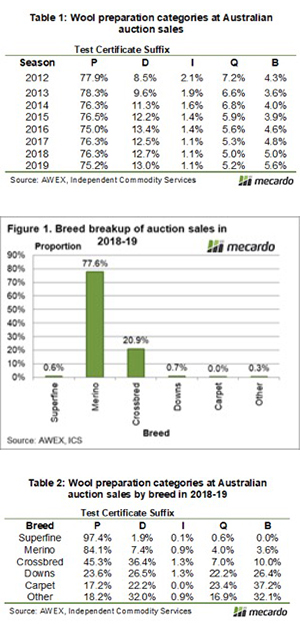

At Australian auction sales, wool is offered with an IWTO approved test certificate which shows the wool preparation standard for the lot (commonly known as the ‘cert type’). Table 1 shows the proportion of wool sold (clean basis) at auction during the past eight seasons by ‘cert type’. P certificate wool is a classed grower lot that meets the AWEX Code of Practice (COP) standard while the D certificate is a grower lot that does not meet the AWEX COP. I stands for Interlot wool. The Q and B suffix denote wool which has gone through a rehandle. Q certificate wool meets the AWEX Code of Practice while B certificate wool does not. Table 1 shows that between 10% and 11% of the Australian clip sold at auction passes through rehandles.

Figure 1 provides a breakup of wool sold at auction in 2018-19 by breed on a clean basis. Merino (and superfine) accounted for 78% of wool sold while crossbred accounted for 21%. Downs, carpet and other categories (such as runs with) accounted for 1% of the sales volume.

Table 2 breaks each breed up by wool preparation category. Some 7.6% of Merino wool (nearly 8 bales in one hundred) was processed through rehandles, with 17% of crossbred wool handled through rehandles. Note also the low level of P wool preparation standard for crossbred (45%) which reflects the decline in the standard of crossbred wool preparation in recent years.

What does this mean?

Some eight bales in one hundred of the Merino clip are processed by rehandles, which as an average seems high. Rehandles are not a charity – they have a cost. Marketing begins on the farm with judicious packaging of wool for sale, which meets the AWEX Code of Practice, not in Paris or Milan.