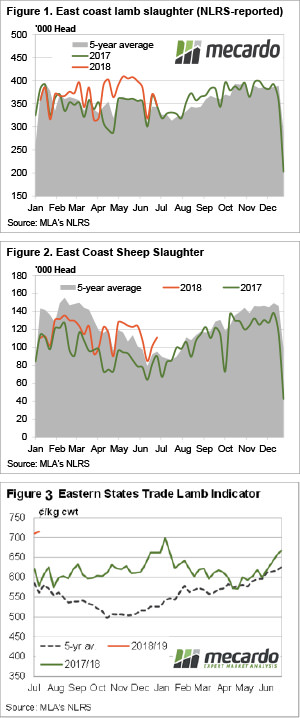

This time last year lamb prices were great, sitting north of 600¢ at record highs. Who would believe prices a year later could be more than 100¢ higher? It seems unbelievable, and still, we have slaughter higher than this time last year.

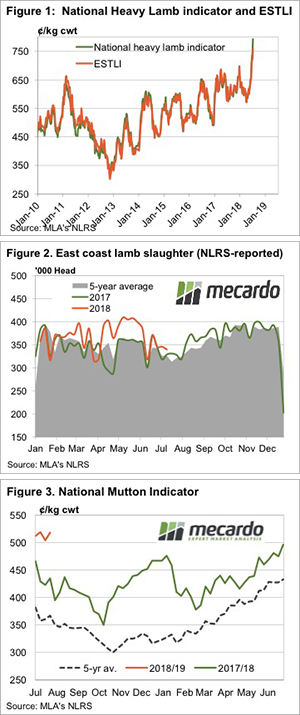

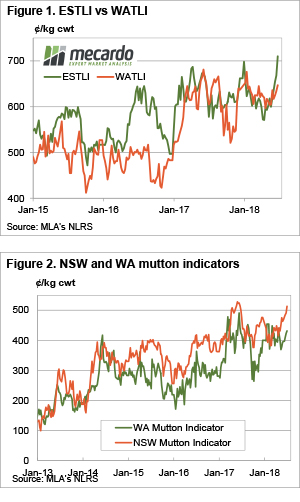

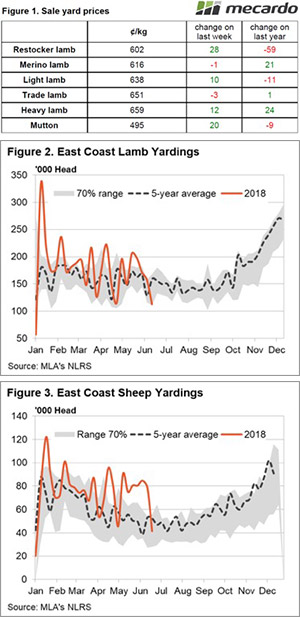

Lamb prices have continued to rise and in the last fortnight, it has been Heavy Lambs which have taken the lead (Figure 1). Heavy lambs gained another 50¢ this week, to within striking distance of 800¢, sitting just below at 793¢/kg cwt. The Eastern States Trade Lamb Indicator (ESTLI) is ‘languishing’ at 758¢ after having gained 34¢ this week.

Supply is not as expected, with lamb slaughter to the week ending the 13th of June actually 3% higher than this time last year (Figure 2). We won’t be able to confirm until more data is available, but slaughter weights must be on the wane. Prices started from light and Merino lambs at 680 and 675¢/kg cwt respectively, with trade and heavy lamb’s streaks ahead.

The strong prices have drawn out a lot of lambs to the market, with very few left to fill the heavy lamb space, which explains the extreme values. Lighter lambs are being sold as soon as they make slaughter weights and as such prices are lower but still at historical records.

Mutton values have stalled just above 500¢, but they too are well ahead of this time last year (Figure 3). Mutton will continue to come to market while the rain stays away, which means prices might not move too much higher until there is some precipitation.

What does it mean/next week?:

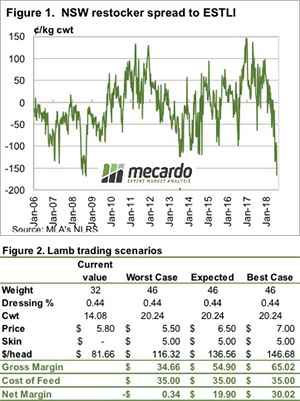

How many producers would have the guts to forgo a trade lamb price of 750¢ in order to put another couple of kilos on and get 790¢? Not many it would seem, but it has paid off over the last month.

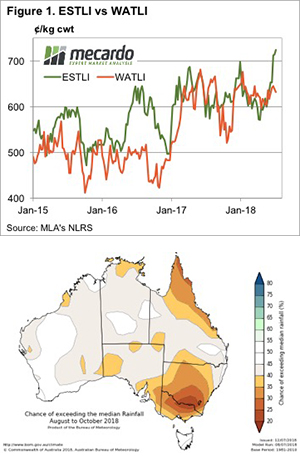

Southern WA, SA and Victoria are in for some follow up rain this week, which is unlikely to help lift sheep and lamb supply. Nothing is on the forecast for NSW, so the sheep will continue to flow while prices are good. The question now is, where are the sheep going to come from when it finally does rain? The sheep/lamb spread could get very narrow.

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels.

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels.

It has been a long week for Mecardo’s resident ‘football’ nut in Ballarat, breaking up a busy week with a late night only to see the Socceroos going down two-nil. This correspondent is more interested in the local brand and is hoping the Demons can emulate the form of lamb and mutton this week, and get back on the rising trend.

It has been a long week for Mecardo’s resident ‘football’ nut in Ballarat, breaking up a busy week with a late night only to see the Socceroos going down two-nil. This correspondent is more interested in the local brand and is hoping the Demons can emulate the form of lamb and mutton this week, and get back on the rising trend.

h of this season.

h of this season.

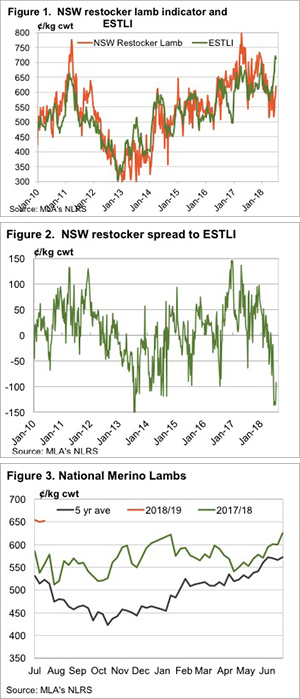

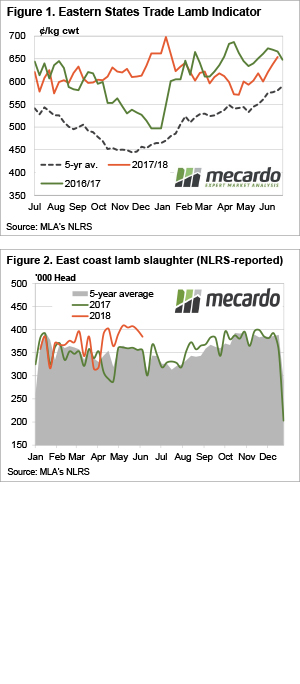

The rain this week probably wasn’t as good as might have been expected. However, whether it’s the rain, or simply declining supply, good lamb prices are rallying and now sit just below the record levels of last year.

The rain this week probably wasn’t as good as might have been expected. However, whether it’s the rain, or simply declining supply, good lamb prices are rallying and now sit just below the record levels of last year.

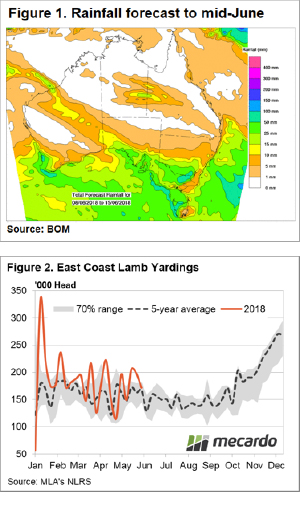

For the first time in a while, there is the prospect of 25-50 mm of rainfall into parts of southern NSW desperate for some relief. Falls are expected to extend into South Australia and Victoria and this has encouraged a drop in lamb throughput levels this week from the elevated trend we have seen during May, in turn providing a boost to lamb prices.

For the first time in a while, there is the prospect of 25-50 mm of rainfall into parts of southern NSW desperate for some relief. Falls are expected to extend into South Australia and Victoria and this has encouraged a drop in lamb throughput levels this week from the elevated trend we have seen during May, in turn providing a boost to lamb prices.

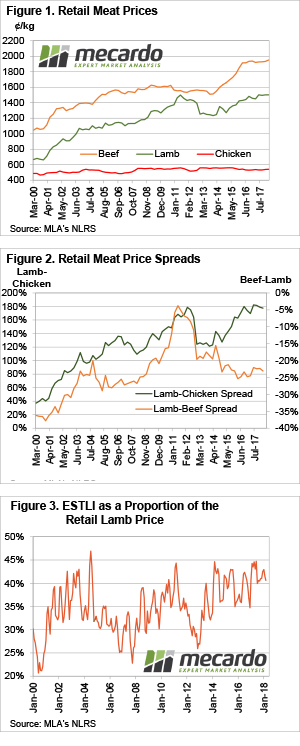

Since hitting a peak back at the start of the year, lamb prices have eased and found somewhat of a base around the 600¢/kg cwt mark. We know that strong demand has been driven by export markets, but there appears to be a limit to how much the local consumer is prepared to pay for their lamb.

Since hitting a peak back at the start of the year, lamb prices have eased and found somewhat of a base around the 600¢/kg cwt mark. We know that strong demand has been driven by export markets, but there appears to be a limit to how much the local consumer is prepared to pay for their lamb.