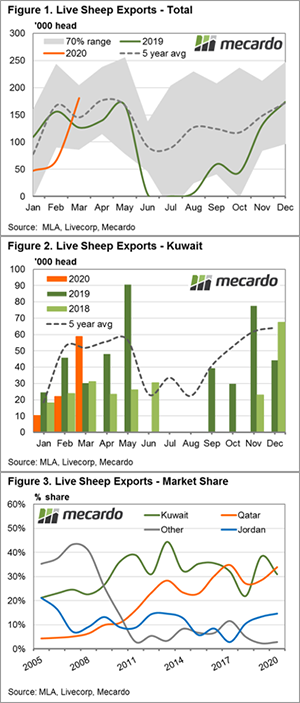

Key points:

- During January and February flows to Qatar and Kuwait were 31% and 54% below trend.

- Australian live sheep export flows to Kuwait for March increased to 58,864 head to see it 14% above the five-year average trend.

- Jordan and the UAE also saw increased flows in March, but Qatar remained below the five-year average seasonal trend.

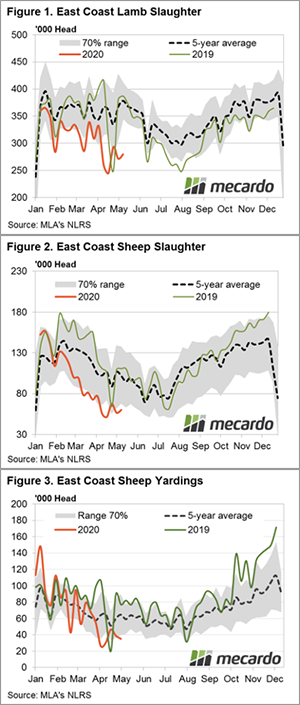

It has been a while since we took a look at the status of live sheep exports so we thought a summary of the first quarter of 2020 was in order. After a slow start to trade volumes the quarter finished with a bang as Kuwait, Jordan and the UAE ramped up demand.

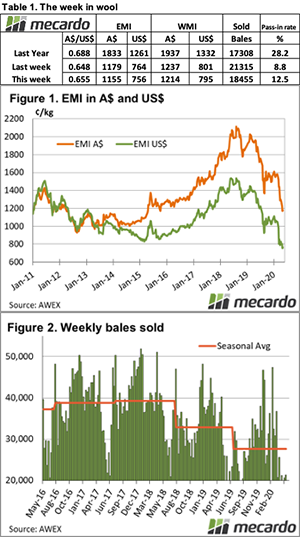

Figure 1 highlights the 2020 trend in Australian live sheep export volumes showing a January/February period trending 54% below the five-year seasonal average. The three top export destinations for Aussie live sheep exports are Qatar, Kuwait and Jordan. During January and February flows to Qatar and Kuwait were 31% and 54% below trend, respectively. While no Australian sheep were shipped to Jordan.

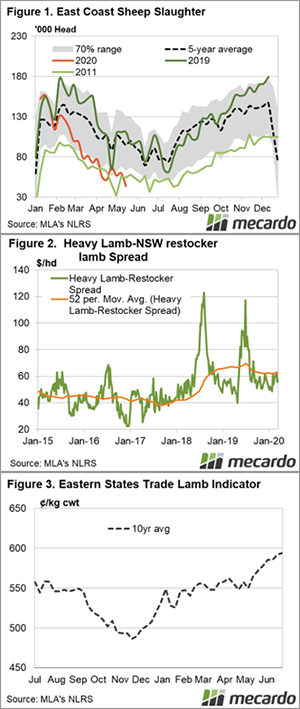

However, March saw a big turnaround. While Qatar remained 15% below the five-year trend for March, there were significant lifts for Kuwait, Jordan and the UAE. Figure 2 displays the Kuwaiti trade in Australian live sheep with flows for March increasing to 58,864 head to see it sit 14% ahead of the five-year average pattern for the month. Jordan saw 43,004 head transported in March, the second highest monthly volume in four years. Meanwhile, the UAE recorded 22,000 head shipped during March to see it 117% above the five-year average monthly trend.

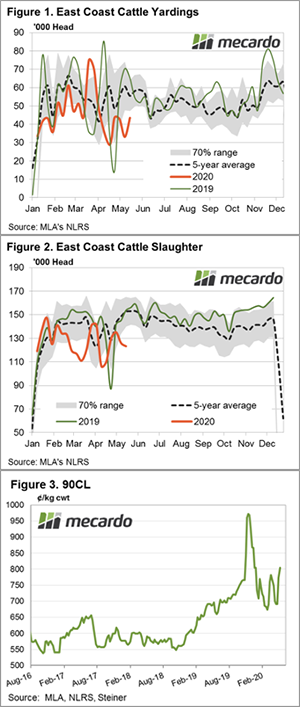

Although Kuwait saw a significant jump in live sheep imported from Australia in March it wasn’t enough to unseat Qatar from the top export destination for the 2020 season. Qatar has received a total of 100,000 head for the first quarter of the year, accounting for 34% of all live sheep exports from Australia. The tally so far this season to Kuwait sits at just over 91,000 head, or 31% of the total flows (Figure 3).

What does it mean?:

After the slow start to 2020, it is pleasing to see live sheep export volumes lift above the average trend in March given there will be another moratorium in the trade over the northern hemisphere summer this season.

COVID-19 lockdown regulations have given employees in retail, tourism and hospitality sectors a taste of what it is like to have your industry ground to a halt for 3-4 months of the year. However, this is a scenario that has impacted employees across the live sheep export supply chain since 2018. Hopefully we see a few more months of above average volumes during April and May to compensate for the live sheep export lockdown when it comes in June.