Every quarter the Australian Bureau of Statistics survey retail meat prices as part of the construction of the Consumer Price Index. Meat and Livestock Australia (MLA) have a formula for converting the numbers from the indices into average retail prices. Given the levels of saleyard lamb prices in the June quarter, it should come as no surprise to see that at a retail level, lamb has never been more expensive.

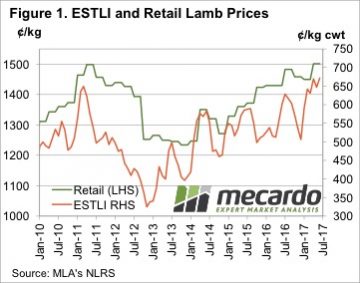

The sharp rise in saleyard and over the hooks lamb prices in the first half of 2017 took a while to translate into strong retail lamb prices, but it did eventually push them to a record. The average retail lamb price increased 51.77¢, or 3.6%, to move to 1501.37¢/kg rwt.

The sharp rise in saleyard and over the hooks lamb prices in the first half of 2017 took a while to translate into strong retail lamb prices, but it did eventually push them to a record. The average retail lamb price increased 51.77¢, or 3.6%, to move to 1501.37¢/kg rwt.

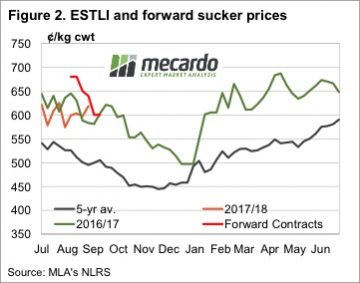

The retail lamb price in the June quarter sat 4.2% above the same time last year. This was dwarfed by the increase in saleyard lamb prices. During the June quarter in 2017, the Eastern States Trade Lamb Indicator (ESTLI) averaged 106¢/kg cwt higher than 2016. This equated to a 19% rise, so we can see that obviously the rise in saleyard values has not been fully passed on to retail values.

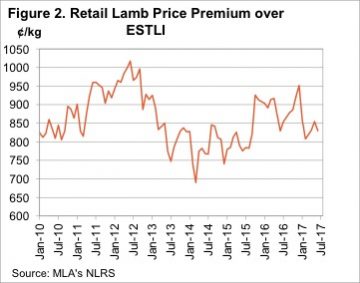

However, things were not as bad as they have been in the June quarter for retailers. For the two years from July 2013 to June 2015 retail lamb prices averaged a premium to the ESTLI of 792¢/kg (figure 2). In the June quarter this year the premium was 839¢.

During the very strong price period in early 2011 retail lamb prices didn’t quite break the $15 mark, pulling up at 1498.47¢ in the June quarter. During this period there were reports that the high retail prices were impacting lamb consumption at domestic and export level, and we subsequently saw a sharp fall in lamb prices.

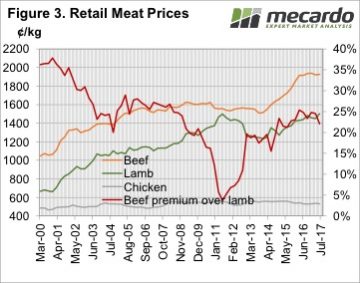

Things are a bit different this time. Obviously in real terms lamb remains cheaper than it was in 2011, and compared to its main red meat competitor it is not yet in the expensive range. Figure 3 shows retail beef prices remained strong in the June quarter, and despite the rise in lamb values, beef it still at a 22% premium. In 2011 the beef premium shrunk to just 4%, and this put considerable pressure on lamb demand.

Things are a bit different this time. Obviously in real terms lamb remains cheaper than it was in 2011, and compared to its main red meat competitor it is not yet in the expensive range. Figure 3 shows retail beef prices remained strong in the June quarter, and despite the rise in lamb values, beef it still at a 22% premium. In 2011 the beef premium shrunk to just 4%, and this put considerable pressure on lamb demand.

Key points:

- Retail lamb prices reached a new record high in nominal terms in the June quarter.

- The retail lamb price premium to saleyard prices fell, but it has been lower in the past.

- Beef still commands a strong premium to lamb at retail level, so pressure on price from consumer level is unlikely.

What does this mean?

At this stage it looks unlikely that we’ll see a push back from consumer level to record high retail lamb prices, given that it is still competitive relative to beef, and the margin to saleyard values is still well above levels we’ve seen in the past.

There remains some concern in the expensive red meat prices relative to static cheap chicken prices, and this is being borne out in consumption levels.

There remains some concern in the expensive red meat prices relative to static cheap chicken prices, and this is being borne out in consumption levels.

The issue will come when lamb supply recovers, and this extra meat has to find a market. If export market can’t take it we might see lamb prices ease at retail and then saleyard level in order to claw back some market share from the white meats.

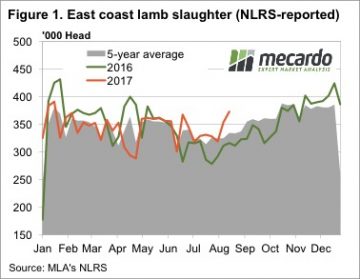

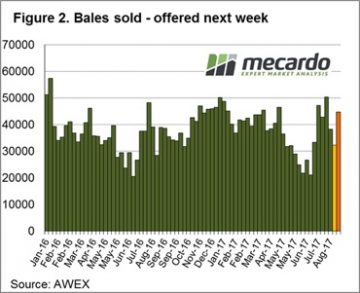

Markets can sometimes defy even the most rusted on seasonal trend. A couple of anomalies caught our eye this week. Figure 1 shows the massive jump in lamb slaughter over the last two weeks, to the point where for the week ending the 18th August, we hit its highest level since the third week of 2017. In fact lamb slaughter last week was the third highest for the year.

Markets can sometimes defy even the most rusted on seasonal trend. A couple of anomalies caught our eye this week. Figure 1 shows the massive jump in lamb slaughter over the last two weeks, to the point where for the week ending the 18th August, we hit its highest level since the third week of 2017. In fact lamb slaughter last week was the third highest for the year. There has been some talk around about slow lamb growth rates impacting on the supply of finished lambs early in the selling season. While this could explain continued strong prices, the high slaughter rates suggest supply is ok, and demand may be pushing prices higher.

There has been some talk around about slow lamb growth rates impacting on the supply of finished lambs early in the selling season. While this could explain continued strong prices, the high slaughter rates suggest supply is ok, and demand may be pushing prices higher. The optimism that was evident following the last two weeks of strong wool market sales suffered a reality check this week. With the market only selling in Melbourne & Sydney, and with the sale conducted on Tuesday & Wednesday due to “Wool Week” activities, it was a sharp correction across all types that occurred.

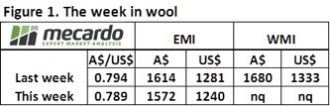

The optimism that was evident following the last two weeks of strong wool market sales suffered a reality check this week. With the market only selling in Melbourne & Sydney, and with the sale conducted on Tuesday & Wednesday due to “Wool Week” activities, it was a sharp correction across all types that occurred. The response from growers was to pass-in14% of the offered wool, resulting in 32,342 bales sold for the week, well down on the average for this season. It is an interesting situation with the market trading at historic highs and yet we have a pass-in rate that is high by any measure. Growers are clearly comfortable holding out, despite these historically good prices, suggesting their not too concerned that any major correction will occur in the near future.

The response from growers was to pass-in14% of the offered wool, resulting in 32,342 bales sold for the week, well down on the average for this season. It is an interesting situation with the market trading at historic highs and yet we have a pass-in rate that is high by any measure. Growers are clearly comfortable holding out, despite these historically good prices, suggesting their not too concerned that any major correction will occur in the near future. Next week Fremantle rejoins the selling roster and 44,750 bales are rostered (Figure 2). The pattern over recent months has been for the market to rally, then correct but quickly recover as growers hold wool back from sale. This is likely to be the pattern going forward so next week there is an air of optimism from sellers that we can see the market at least hold.

Next week Fremantle rejoins the selling roster and 44,750 bales are rostered (Figure 2). The pattern over recent months has been for the market to rally, then correct but quickly recover as growers hold wool back from sale. This is likely to be the pattern going forward so next week there is an air of optimism from sellers that we can see the market at least hold.

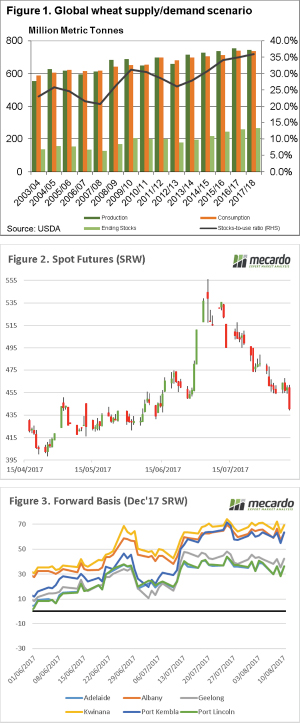

In recent times, there have been accusations of Russian tampering in western politics. In the wheat game, the Russian crop is interfering with our grain pricing! In this week’s comment, we highlight the Black Sea, and its impact on global pricing.

In recent times, there have been accusations of Russian tampering in western politics. In the wheat game, the Russian crop is interfering with our grain pricing! In this week’s comment, we highlight the Black Sea, and its impact on global pricing.

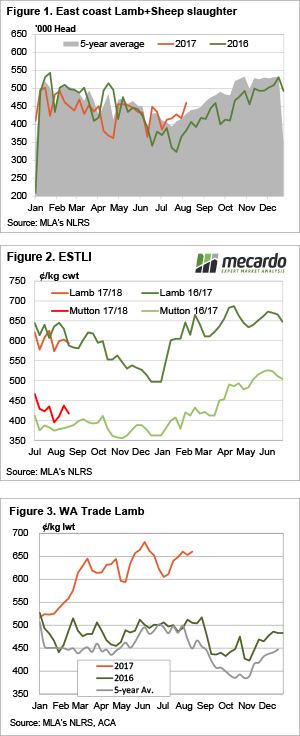

Average trade lamb prices continue to track around the 600¢ mark on the east coast, and higher in the west. Lamb and sheep slaughter has rallied and is sitting well above last year’s mark, but demand appear to be keeping pace with supply.

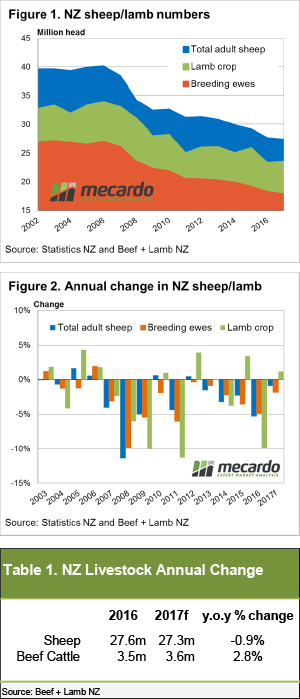

Average trade lamb prices continue to track around the 600¢ mark on the east coast, and higher in the west. Lamb and sheep slaughter has rallied and is sitting well above last year’s mark, but demand appear to be keeping pace with supply. Beef and Lamb NZ’s mid-year stock number survey shows the Kiwi sheep flock and number of breeding ewes continuing to decline into 2017, albeit at a lesser degree than in previous seasons. Although, good pasture and ewe condition throughout the breeding cycle has seen an improvement in the anticipated lamb crop for this year.

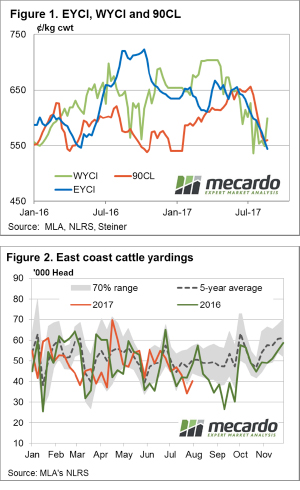

Beef and Lamb NZ’s mid-year stock number survey shows the Kiwi sheep flock and number of breeding ewes continuing to decline into 2017, albeit at a lesser degree than in previous seasons. Although, good pasture and ewe condition throughout the breeding cycle has seen an improvement in the anticipated lamb crop for this year. National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

Last week the market kicked off for the season with full force and we expected week 2 to be a little lacklustre in comparison. But no, the Australian Dollar plunged, the auction price peaked and those with the patience to hold on past the first week came out grinning.

Last week the market kicked off for the season with full force and we expected week 2 to be a little lacklustre in comparison. But no, the Australian Dollar plunged, the auction price peaked and those with the patience to hold on past the first week came out grinning. In the past week there has been significant posturing from both the Donald, and North Korea threatening to bring ‘fire and fury’ upon one another. It looks like the USDA might have fired the first salvo, with the release of the August WASDE report. In this week’s comment, we will look at what the fallout has been.

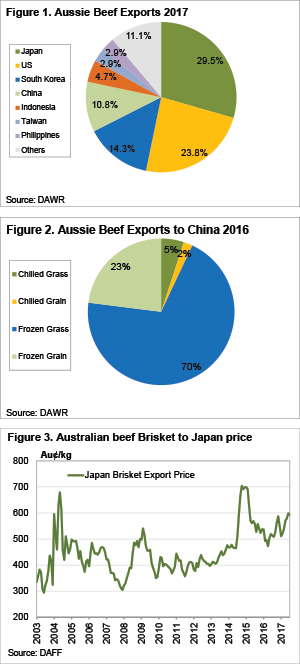

In the past week there has been significant posturing from both the Donald, and North Korea threatening to bring ‘fire and fury’ upon one another. It looks like the USDA might have fired the first salvo, with the release of the August WASDE report. In this week’s comment, we will look at what the fallout has been. Last week we wrote about how the increasing tariffs on US Beef entering Japan is expected to have a small positive impact on export beef, and cattle prices. Obviously the support hasn’t been strong enough to stop price falling, but is the China import ban causing the fall?

Last week we wrote about how the increasing tariffs on US Beef entering Japan is expected to have a small positive impact on export beef, and cattle prices. Obviously the support hasn’t been strong enough to stop price falling, but is the China import ban causing the fall?