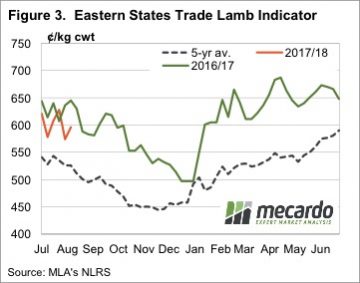

Some big moves again in East coast lamb and sheep yardings this week, heavily influenced by NSW flows, but for the most part prices around the country finished firmer. The headline, Eastern States Trade Lamb Indicator rising 1.3% to break back above 600¢ – although stronger gains were noted across other categories of lamb across the country.

Some big moves again in East coast lamb and sheep yardings this week, heavily influenced by NSW flows, but for the most part prices around the country finished firmer. The headline, Eastern States Trade Lamb Indicator rising 1.3% to break back above 600¢ – although stronger gains were noted across other categories of lamb across the country.

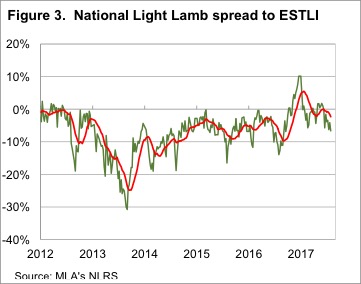

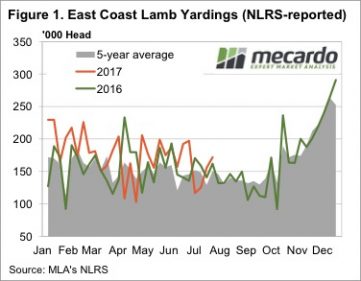

Figure 1 highlights the sharp rebound in lamb throughput at East coast saleyards this week, with a gain of 74% to see just shy of 165,000 head of lamb exchanged. The rebound driven by a surge in lamb throughput in NSW which posted a whopping 108% increase in numbers on the week. It is reasonable to argue that the size of the NSW gain is a bit distorted as the previous week’s numbers were much lower than normal, however the 138,000 head of NSW lamb throughput this week is still 37% above the five-year average for this time of the year.

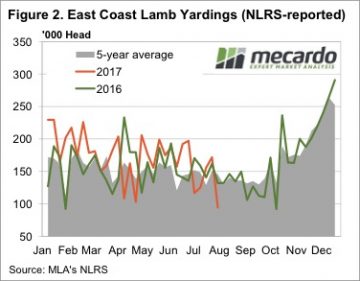

A similar, but opposite story for sheep yardings along the Eastern seaboard. Figure 2 demonstrates the 33% decline in sheep throughput on the week to see 41,000 head at the sale yard, to see it pretty much in line with longer term average levels. NSW again the driving force behind the lower sheep numbers with a 67% decline noted here this week, although the 33,000-odd head reported still 30% above the five-year average in NSW for this time of the season.

The volatile supply figures did little to dampen most lamb and sheep prices though, with national categories showing Restocker Lambs the only category to post a decline on the week – down 5.3% to $75 per head, dragged down by an 18% drop in WA Restockers. National Merino’s, this week’s winner with an 8.5% rise to 564¢/kg cwt – boosted by strong gains to Merino Lambs in Victoria and SA, up 20% and 16%, respectively. National mutton stronger this week too, up 5.4% to 431¢/kg cwt, as a rebound in Victorian and NSW mutton prices assist the national indicator.

The week ahead

A softer $A, now below 79US¢, flowing through to higher export demand a good sign for the weeks ahead as live export wether prices post a 10.8% gain on the week to close at $140 per head. In other weather news, forecast rainfall for the week ahead shows some good falls to lamb rearing regions of the nation, with NSW the only state to miss out on falls above 5mm. Despite the dry patches in NSW the rainfall to the rest of the country should continue to be broadly supportive of prices in the short term.

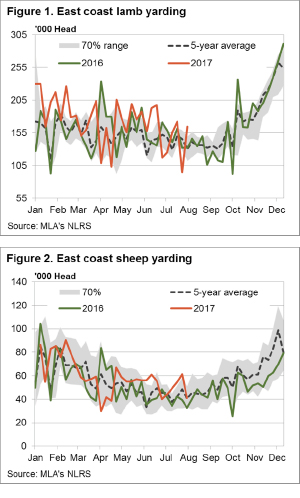

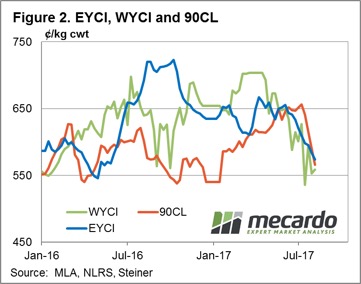

The slide in cattle prices continued this week, with more help from lower export prices, pushing the EYCI back to two year lows for this time of year. Rainfall across NSW and Victoria doesn’t seem to have helped the cause yet, as supply continues to outweigh demand.

The slide in cattle prices continued this week, with more help from lower export prices, pushing the EYCI back to two year lows for this time of year. Rainfall across NSW and Victoria doesn’t seem to have helped the cause yet, as supply continues to outweigh demand.

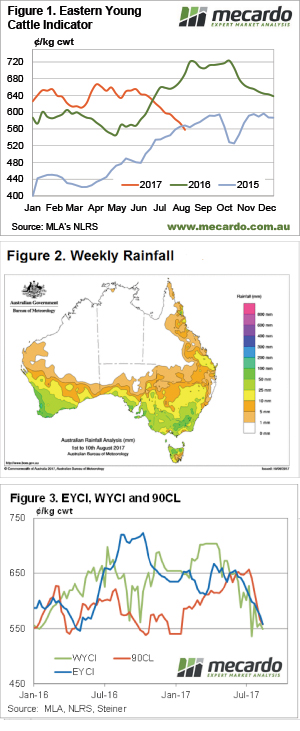

The three-week recess seemed to create pent up demand from the processors, with the larger offering and stronger A$ unable to dampen competition – the wool market had a good week. AWEX reported that buyers were bidding strongly from the outset to fill orders secured over the break.

The three-week recess seemed to create pent up demand from the processors, with the larger offering and stronger A$ unable to dampen competition – the wool market had a good week. AWEX reported that buyers were bidding strongly from the outset to fill orders secured over the break.

The first week in August. This month is one of the most important in the cropping year, as we will have increased certainty on the rest of the world’s crop, and start to gain greater clarity on how good (or bad) Australia is going to be come December. It is the knife edge time of year.

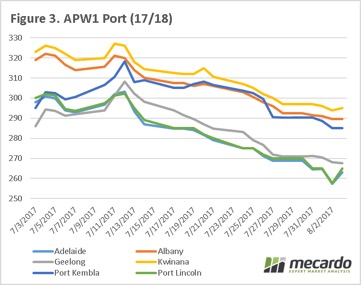

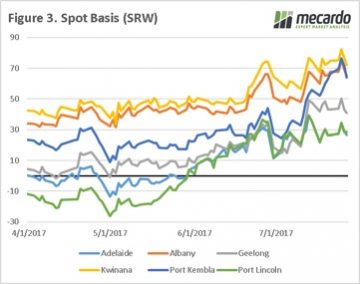

The first week in August. This month is one of the most important in the cropping year, as we will have increased certainty on the rest of the world’s crop, and start to gain greater clarity on how good (or bad) Australia is going to be come December. It is the knife edge time of year. At a local level flat price around the country have fallen since a peak on the 11th of July (figure 3). During the first week of July all port zones were able to achieve historically competitive prices, however few growers have taken advantage of the prices available. Since the 11th, across all ports in figure 3, the price has dropped by $32 per mt.

At a local level flat price around the country have fallen since a peak on the 11th of July (figure 3). During the first week of July all port zones were able to achieve historically competitive prices, however few growers have taken advantage of the prices available. Since the 11th, across all ports in figure 3, the price has dropped by $32 per mt.

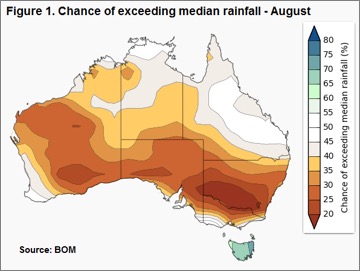

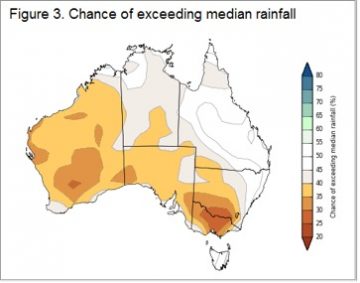

Figure 1 highlights the chance of rainfall exceeding the median levels for this time of year, and it looks particularly unfriendly to southern NSW. Despite much of Queensland enjoying a rosier picture, cattle prices here were among the softest this week with QLD Heavy and Feeder steers bearing the brunt of the negative sentiment – off 6.6% (260¢/kg lwt) and 6.2% (308¢/kg lwt) respectively. Meanwhile, Victorian saleyards registered Feeder steers and Trade steers as their weakest two categories, down 6.2% (301¢/kg lwt) and 4.2% (302¢/kg lwt) between them. In defiance of the BOM outlook the NSW markets were reasonably flat on the week, apart from Medium Cows, marked down 4.3% to 208¢/kg lwt.

Figure 1 highlights the chance of rainfall exceeding the median levels for this time of year, and it looks particularly unfriendly to southern NSW. Despite much of Queensland enjoying a rosier picture, cattle prices here were among the softest this week with QLD Heavy and Feeder steers bearing the brunt of the negative sentiment – off 6.6% (260¢/kg lwt) and 6.2% (308¢/kg lwt) respectively. Meanwhile, Victorian saleyards registered Feeder steers and Trade steers as their weakest two categories, down 6.2% (301¢/kg lwt) and 4.2% (302¢/kg lwt) between them. In defiance of the BOM outlook the NSW markets were reasonably flat on the week, apart from Medium Cows, marked down 4.3% to 208¢/kg lwt. Some reasonable rainfall is noted for much of WA and Victoria next week, but much of the rest of the country is expected to miss out again. A key factor for the EYCI to find a bit of a base in the next few weeks will be the movement in the 90CL and the A$.

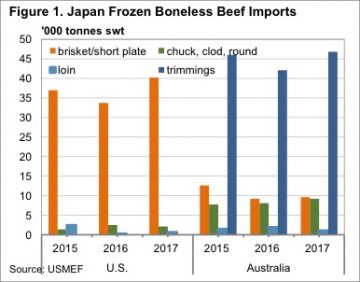

Some reasonable rainfall is noted for much of WA and Victoria next week, but much of the rest of the country is expected to miss out again. A key factor for the EYCI to find a bit of a base in the next few weeks will be the movement in the 90CL and the A$. According to the US Meat Export Federation (USMEF), who have produced an excellent fact sheet, a vast majority of US frozen beef exports to Japan are grainfed brisket and short plate cuts. These cuts are used in gyudon beef bowl chain restaurants.

According to the US Meat Export Federation (USMEF), who have produced an excellent fact sheet, a vast majority of US frozen beef exports to Japan are grainfed brisket and short plate cuts. These cuts are used in gyudon beef bowl chain restaurants.

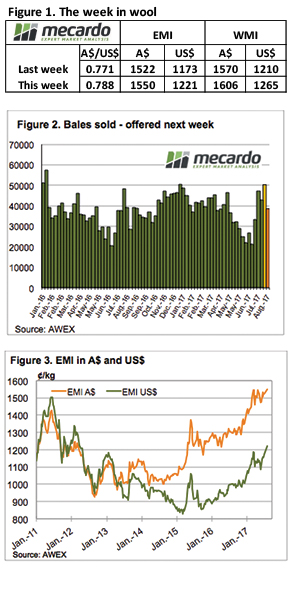

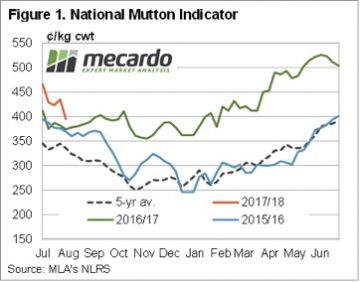

While mutton markets have participated in the decline in ovine markets since mid-June, unlike lamb markets, mutton values have managed to remain strong relative to last year’s levels. Figure 1 shows the National Mutton Indicator (NMI), which last week fell to a six month low of 395¢/kg cwt.

While mutton markets have participated in the decline in ovine markets since mid-June, unlike lamb markets, mutton values have managed to remain strong relative to last year’s levels. Figure 1 shows the National Mutton Indicator (NMI), which last week fell to a six month low of 395¢/kg cwt. In 2016 the mutton market eased a little, but found solid support at 350¢ as the good season and flock rebuild supported prices. From 2012-2015 the NMI averaged 230¢/kg cwt in October, so it’s the exception for mutton to be valued at better than 300¢ in the spring.

In 2016 the mutton market eased a little, but found solid support at 350¢ as the good season and flock rebuild supported prices. From 2012-2015 the NMI averaged 230¢/kg cwt in October, so it’s the exception for mutton to be valued at better than 300¢ in the spring. Obviously there is no guarantee that Australian sheep areas will have a dry spring. The BOM have been in pretty good form this year, and their latest forecast doesn’t paint a rosy picture (figure 3). Simply based on historical mutton prices during strong supply, we would put the NMI in the 200-250¢/kg cwt range.

Obviously there is no guarantee that Australian sheep areas will have a dry spring. The BOM have been in pretty good form this year, and their latest forecast doesn’t paint a rosy picture (figure 3). Simply based on historical mutton prices during strong supply, we would put the NMI in the 200-250¢/kg cwt range.

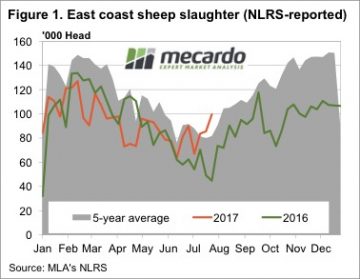

Figure 1 shows the rapid increase in sheep slaughter over the past month. This is a sure sign of moisture stress for sheep growers. Lambs can’t be offloaded as they are not ready, so it is sheep which are hitting the market, most likely wethers. Sheep slaughter for the week ending the 28th July was the more than double the same week in 2016, and the highest level since 2013, but only marginally beating 2014.

Figure 1 shows the rapid increase in sheep slaughter over the past month. This is a sure sign of moisture stress for sheep growers. Lambs can’t be offloaded as they are not ready, so it is sheep which are hitting the market, most likely wethers. Sheep slaughter for the week ending the 28th July was the more than double the same week in 2016, and the highest level since 2013, but only marginally beating 2014.

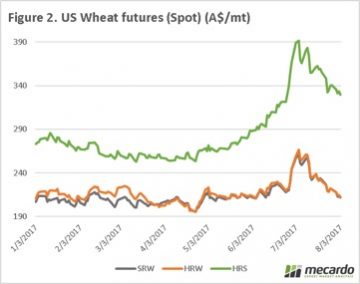

At global level, we have seen further deterioration of Chicago wheat futures, with the spot market falling to as low as 474¢/bu, from a high at the end of June of 539¢/bu (figure 1). The market has lost 3/4 of its gains in ¢/bu since the rally in the end of June. The fall in SRW wheat is not unexpected as weather issues around the world are more a quality than quantity issue at present, and with beneficial rains being received throughout the US, risk to this crop has reduced and priced into the market.

At global level, we have seen further deterioration of Chicago wheat futures, with the spot market falling to as low as 474¢/bu, from a high at the end of June of 539¢/bu (figure 1). The market has lost 3/4 of its gains in ¢/bu since the rally in the end of June. The fall in SRW wheat is not unexpected as weather issues around the world are more a quality than quantity issue at present, and with beneficial rains being received throughout the US, risk to this crop has reduced and priced into the market.

The last of the strong prices for 2017 seems to have drawn out the last of the old season lambs this week. Figure 1 shows a sharp jump in lamb yardings this over the last two weeks, with nearly 172,000 head yarded this week. Given the lower slaughter space on offer at the moment, it was enough to send prices sharply lower.

The last of the strong prices for 2017 seems to have drawn out the last of the old season lambs this week. Figure 1 shows a sharp jump in lamb yardings this over the last two weeks, with nearly 172,000 head yarded this week. Given the lower slaughter space on offer at the moment, it was enough to send prices sharply lower.