Wool was the hot topic of industry conversation again this week but it wasn’t enough to distract the market from deciding on what fibres it wants to support. Results were particularly mixed with fine fibres attracting premiums whilst the rest of the categories felt losses.

Wool was the hot topic of industry conversation again this week but it wasn’t enough to distract the market from deciding on what fibres it wants to support. Results were particularly mixed with fine fibres attracting premiums whilst the rest of the categories felt losses.

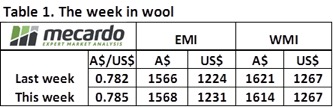

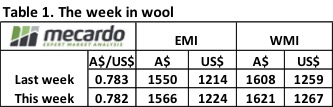

Overall, the market indicators held reasonably still considering there were very mixed results between categories. The Eastern Market Indicator (EMI) improved slightly on last week, gaining 2¢ to 1,568¢ in Aus$, while in US$ terms it rose 7¢ (figure 1). Western Australia fared worse off with the Western Market Indicator (WMI) falling 7¢ to 1,614¢.

There was a distinct preference split between fibre categories across the country this week. The total market has been moving in sync for much of the last few months so this divergence could be a return to greater differentiation between the activity of wool types. Finer fibres of 19 microns and under all received price gains on last week, up to 45¢. Buyers were clearly chasing the finer microns as reflected in the solid trend of the finer the micron the increase in price gains to the week.

On the other hand, medium to coarse wools of 19.5 to 23 MPG weren’t as readily sought after. Prices fell on average 20 to 30 ¢ by the weeks close. Crossbred wool followed the lead of the medium to coarse Merino fibres, losing ground across the board. The harshest fall was in 28 MPG at an average drop of 30¢ in both Fremantle and Sydney markets.

On the other hand, medium to coarse wools of 19.5 to 23 MPG weren’t as readily sought after. Prices fell on average 20 to 30 ¢ by the weeks close. Crossbred wool followed the lead of the medium to coarse Merino fibres, losing ground across the board. The harshest fall was in 28 MPG at an average drop of 30¢ in both Fremantle and Sydney markets.

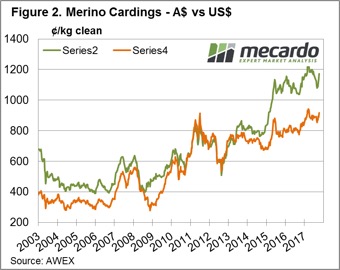

Again, the finer fleece led by example to the skirtings and cardings market. Improvements were on average 20 to 35¢ for cardings indicators and generally ranged from 30 to 60 cents for skirtings. .

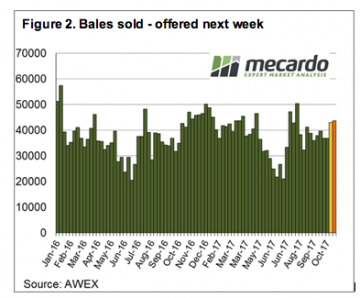

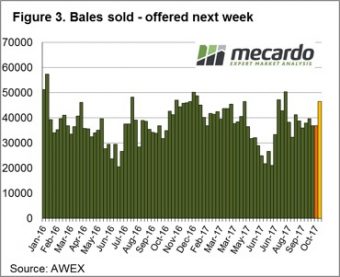

45,792 bales were traded this week, with a pass-in rate of 6%. We’re still seeing the offering at much higher levels compared to this time last year (up 11.8% for week 16 this year), reflecting the performance of this season.

The week ahead

The number of bales on offer next week is expected to drop down to a listing of 43,764 for the three selling centres over Wednesday and Thursday (figure 2). The focus on micron this week might be an indication of where the market is starting to move to. Some strong forward prices in the 18.5 and 19 micron wools where buyers were willing to pay a premium out to next year suggest that preference for the finer wool is likely to grow.

The number of bales on offer next week is expected to drop down to a listing of 43,764 for the three selling centres over Wednesday and Thursday (figure 2). The focus on micron this week might be an indication of where the market is starting to move to. Some strong forward prices in the 18.5 and 19 micron wools where buyers were willing to pay a premium out to next year suggest that preference for the finer wool is likely to grow.

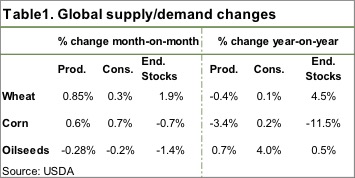

The Australian Bureau of Agricultural Resource Economics and Sciences (ABARES) made an interesting move this week, warning of crop downgrades. Meanwhile the United States Department of Agriculture (USDA) made their monthly predictions.

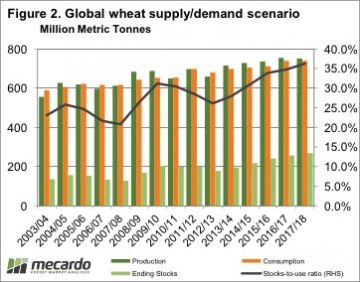

The Australian Bureau of Agricultural Resource Economics and Sciences (ABARES) made an interesting move this week, warning of crop downgrades. Meanwhile the United States Department of Agriculture (USDA) made their monthly predictions. Global wheat production was lifted 5.3mmt thanks to improving production in the EU and India. The USDA did downgrade the Australian crop by 1mmt to 21.5mmt. Figure 2 shows we are still well and truly on track for a record carryout for 17/18.

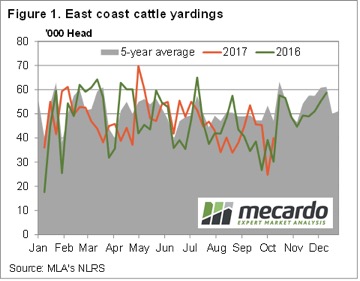

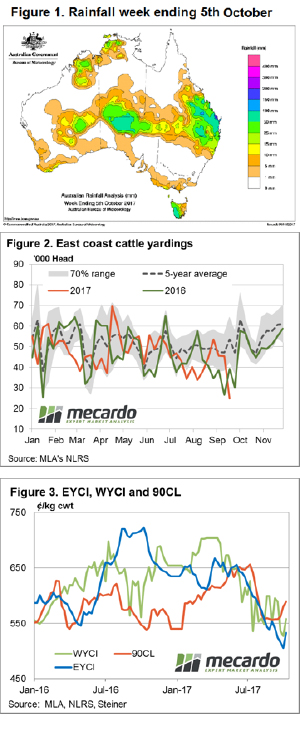

Global wheat production was lifted 5.3mmt thanks to improving production in the EU and India. The USDA did downgrade the Australian crop by 1mmt to 21.5mmt. Figure 2 shows we are still well and truly on track for a record carryout for 17/18. There was a significant jump in yardings this week, but this failed to dampen cattle prices, which continued to rally. In fact, it seems to be rain that is doing the opposite of dampening prices, with prices finding strength, almost across the board.

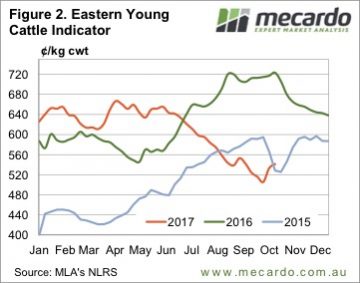

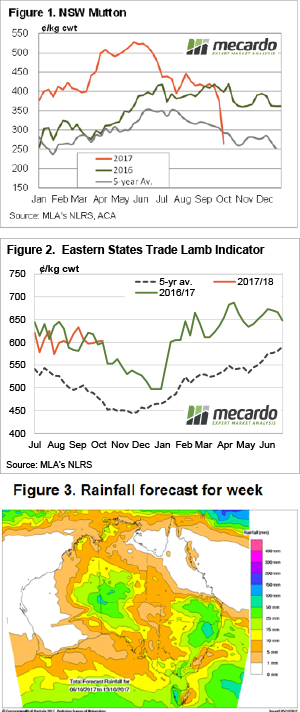

There was a significant jump in yardings this week, but this failed to dampen cattle prices, which continued to rally. In fact, it seems to be rain that is doing the opposite of dampening prices, with prices finding strength, almost across the board. The Eastern Young Cattle Indicator (EYCI) continued to rally, but the pace slowed. The EYCI gained 8¢ this week, to lift it to the levels of five weeks ago, at 541.25¢/kg cwt (Figure 2).

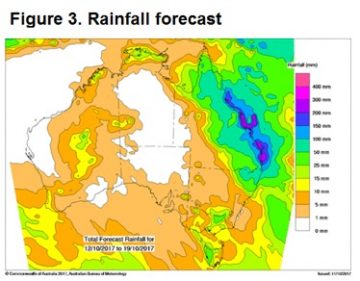

The Eastern Young Cattle Indicator (EYCI) continued to rally, but the pace slowed. The EYCI gained 8¢ this week, to lift it to the levels of five weeks ago, at 541.25¢/kg cwt (Figure 2). The forecast says there is more to come for at least half of Queensland (figure 3), and this suggests that there is only one way for cattle prices to go next week, especially young cattle prices.

The forecast says there is more to come for at least half of Queensland (figure 3), and this suggests that there is only one way for cattle prices to go next week, especially young cattle prices. Read the earlier analysis

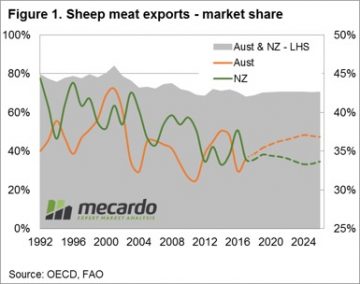

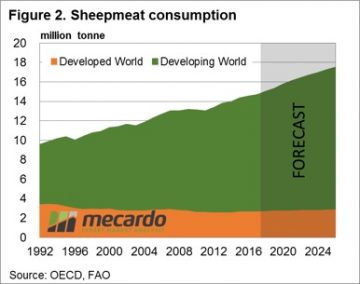

Read the earlier analysis  Turning to global consumption levels we can see that the majority of growth has been, and is expected to continue, coming predominantly from the developing world – figure 2. While sheepmeat consumption levels can be satisfied partially by domestic production the fact remains that for many countries their consumption will outweigh their production and the need to import sheepmeat will be required to satisfy the demand. This is important, particularly in relation to non-goat sheepmeat as the only two significant global exporters of sheep and lamb product are NZ and Australia.

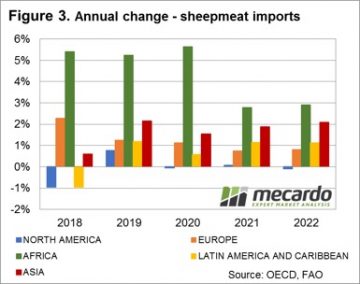

Turning to global consumption levels we can see that the majority of growth has been, and is expected to continue, coming predominantly from the developing world – figure 2. While sheepmeat consumption levels can be satisfied partially by domestic production the fact remains that for many countries their consumption will outweigh their production and the need to import sheepmeat will be required to satisfy the demand. This is important, particularly in relation to non-goat sheepmeat as the only two significant global exporters of sheep and lamb product are NZ and Australia. Further analysis of the breakdown of the forecast Asian sheepmeat import flows shows that much of the growth is anticipated to come from China, Malaysia, Saudi Arabia, Indonesia, and Vietnam. These are already key export destinations for our red meat products and strong trade ties already exist between Australia and these nations.

Further analysis of the breakdown of the forecast Asian sheepmeat import flows shows that much of the growth is anticipated to come from China, Malaysia, Saudi Arabia, Indonesia, and Vietnam. These are already key export destinations for our red meat products and strong trade ties already exist between Australia and these nations.

Despite the beginnings of Spring flush being fairly evident at the saleyard this week, prices managed to gain across all categories of national lamb and sheep markets. Seemingly, a Friday the 13th close to the week a lucky one for ovines.

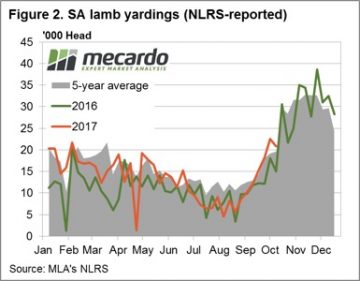

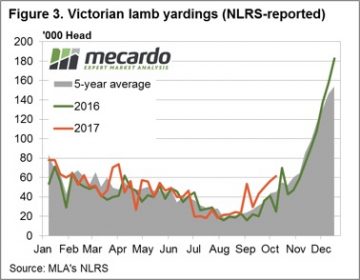

Despite the beginnings of Spring flush being fairly evident at the saleyard this week, prices managed to gain across all categories of national lamb and sheep markets. Seemingly, a Friday the 13th close to the week a lucky one for ovines.  The firm prices were unable to be weighed down by increased volumes at the saleyard along the East Coast for both lamb and mutton with throughput levels up 2.1% and 28.5%, respectively. The lamb yarding pattern for SA and Victoria continuing to show evidence that the seasonal Spring flush is underway with both states continuing to trend above the 2016 trend, and higher than the long term average for this time of the year – figures 2 and 3.

The firm prices were unable to be weighed down by increased volumes at the saleyard along the East Coast for both lamb and mutton with throughput levels up 2.1% and 28.5%, respectively. The lamb yarding pattern for SA and Victoria continuing to show evidence that the seasonal Spring flush is underway with both states continuing to trend above the 2016 trend, and higher than the long term average for this time of the year – figures 2 and 3.

The continued good news regarding the wool market is providing a positive setting for wool producers; with some now locking in prices for future clips and making decisions to expand production. A quick look at relative prices shows the EMI is 248 cents higher year-on-year, while in US$ terms it is up 231 cents.

The continued good news regarding the wool market is providing a positive setting for wool producers; with some now locking in prices for future clips and making decisions to expand production. A quick look at relative prices shows the EMI is 248 cents higher year-on-year, while in US$ terms it is up 231 cents. This week the market opened strongly on Wednesday then settled into a “firm” trend resulting in a good result for sellers; and they responded by only Passing-in 3.3% of the 38,103 bales offered- well below the season average of 7.3%.

This week the market opened strongly on Wednesday then settled into a “firm” trend resulting in a good result for sellers; and they responded by only Passing-in 3.3% of the 38,103 bales offered- well below the season average of 7.3%. The scramble for “low mid break” lots resulted in these types at times posting extreme prices. AWEX report that up to 70 cent premiums are evident for wool with the “right” specifications. This is a response to the

The scramble for “low mid break” lots resulted in these types at times posting extreme prices. AWEX report that up to 70 cent premiums are evident for wool with the “right” specifications. This is a response to the  Despite an increasing offering that is normal as Spring shearing clips arrive, it is difficult to see anything but positive times (at least in the short term) for wool.

Despite an increasing offering that is normal as Spring shearing clips arrive, it is difficult to see anything but positive times (at least in the short term) for wool.

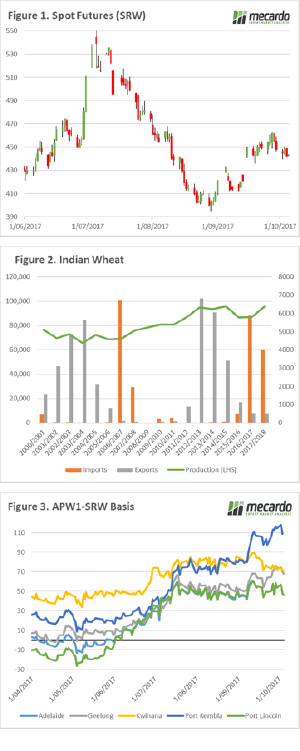

Futures markets edged lower this week, but were balanced by a fall in the Aussie dollar. In this week’s comment, we look at rumours of increased import duties in India, and local premiums over Chicago futures.

Futures markets edged lower this week, but were balanced by a fall in the Aussie dollar. In this week’s comment, we look at rumours of increased import duties in India, and local premiums over Chicago futures.

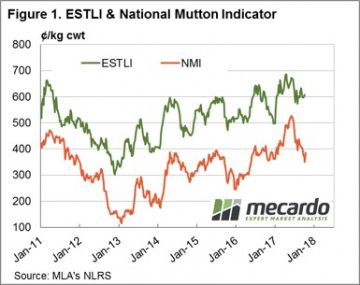

Lamb prices have defied the odds to remain relatively steady for the fifth week straight. It’s highly unusual for prices to trade in such a narrow range for so long, and there is no doubt they will break out at some stage. Mutton prices haven’t had the same luxury, continuing to slide this week in spite of weather forecasts.

Lamb prices have defied the odds to remain relatively steady for the fifth week straight. It’s highly unusual for prices to trade in such a narrow range for so long, and there is no doubt they will break out at some stage. Mutton prices haven’t had the same luxury, continuing to slide this week in spite of weather forecasts.

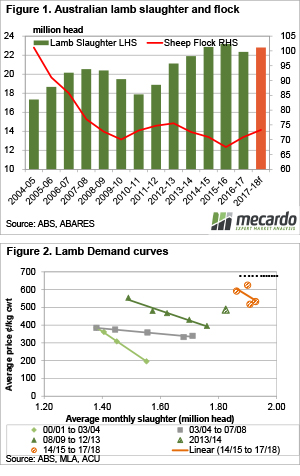

The Australian Bureau of Agricultural and Resource Economics (ABARES) have put out their quarterly Agricultural Commodities Report, and amongst the numbers there were some interesting sheep and lamb forecasts. This week we take a look at whether lamb prices can achieve another year on year increase, as predicted by ABARES.

The Australian Bureau of Agricultural and Resource Economics (ABARES) have put out their quarterly Agricultural Commodities Report, and amongst the numbers there were some interesting sheep and lamb forecasts. This week we take a look at whether lamb prices can achieve another year on year increase, as predicted by ABARES. The Mecardo team have been suggesting a price bounce was imminent for the last few weeks given the rainfall forecast, recovery in export prices and falling supply at the saleyards. But as the old trading adage goes, “even a broken clock gets it right twice a day” so we won’t puff out our chests too much on this one.

The Mecardo team have been suggesting a price bounce was imminent for the last few weeks given the rainfall forecast, recovery in export prices and falling supply at the saleyards. But as the old trading adage goes, “even a broken clock gets it right twice a day” so we won’t puff out our chests too much on this one.