In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

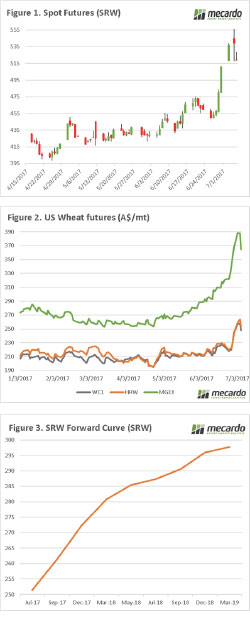

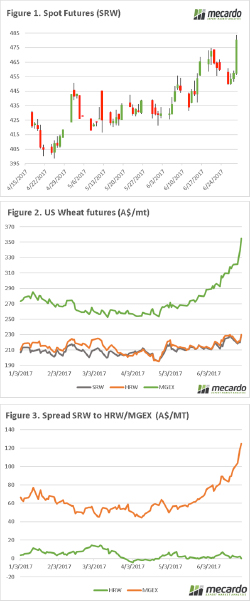

The wheat market has had a stellar performance, with the SRW contracts rising an average of 87¢/bu since the start of last week (across the 6 nearby contracts). The market however lost around a 20¢ (figure 1) overnight. The market had become quite overbought in recent days, and it seems that speculators in the market have started to take some of their profits.

In figure 2, the three main US futures (spot) contracts are displayed. In this chart we can see that the rally for most of June was largely in MGEX spring wheat futures, before some flows into SRW. The reality is that the worst weather issues are currently around the high protein wheat (mgex), which globally is likely to be in demand, however we still sit on ample low protein wheat.

Although the market has fallen, it is still at an attractive level compared to the period since harvest. There are ample opportunities, for the grower looking further forward. As discussed in the analysis piece “Should we lock a far forward swap”, the high carry in the market place allows us to lock in close to a $300mt swap for 16 months time.

In reality, we do not know what will happen between now and then, there could be massive or miniscule harvests in 2018. However, starting the 2018/19 season at those levels traditionally would be attractive.

Next Week

The USDA will release their WASDE report in the middle of the week, which will likely see a reduction in crops in US, Australia and Western Europe. However, to what extent is the question, and what difference will that make to overall stocks.

The US crop condition will likely also show a reduction in crop condition, but with harvest in full swing it is likely with a negative result expected that this is priced in.

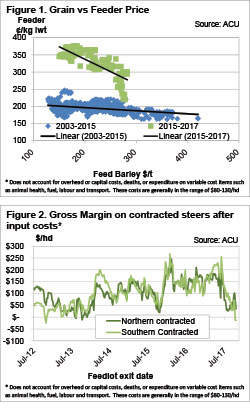

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

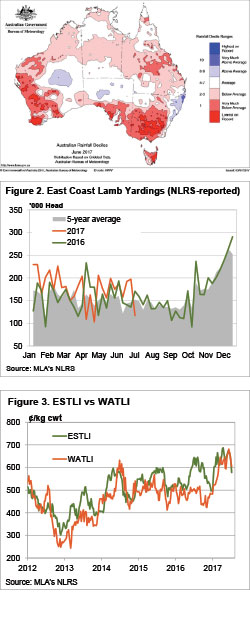

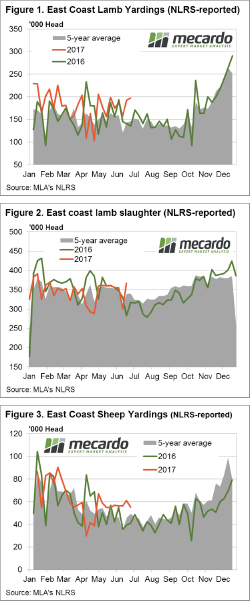

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak.

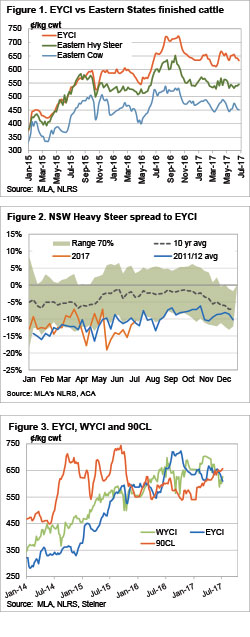

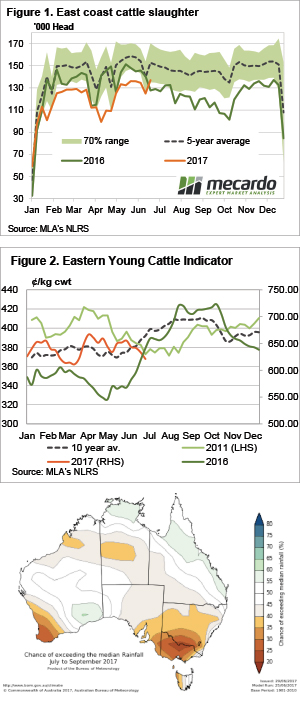

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak. It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

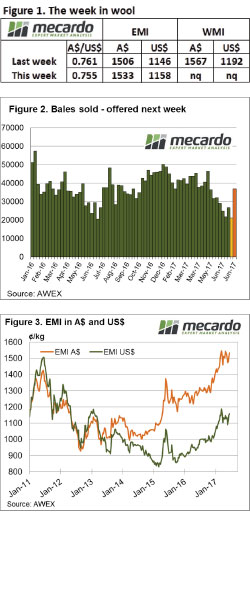

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come?

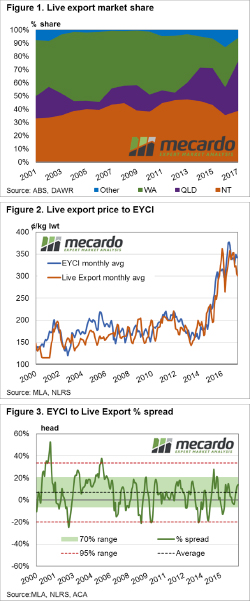

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come? It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle.

It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle. On the radio in today the weather report included a brief from BOM saying that June has been the driest in Victoria since records began and its taking its toll on the price of lamb and sheep. East coast figures show price falls in all categories other than Restocker lambs on the week and Light, Heavy and Trade lambs are now trading lower than this time last year.

On the radio in today the weather report included a brief from BOM saying that June has been the driest in Victoria since records began and its taking its toll on the price of lamb and sheep. East coast figures show price falls in all categories other than Restocker lambs on the week and Light, Heavy and Trade lambs are now trading lower than this time last year. Here’s a quiz question. When was the last time the Eastern Young Cattle Indicator (EYCI) finished June lower than it started? You’ll have to read the article to find out….

Here’s a quiz question. When was the last time the Eastern Young Cattle Indicator (EYCI) finished June lower than it started? You’ll have to read the article to find out….

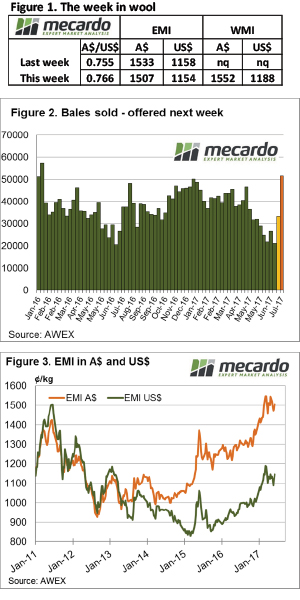

The fragility of the wool market was evident this week in what was the final sale for the financial year where increased supply (Fremantle back selling again) and a rising A$ pushed all types lower however, the strong Crossbred types showed some resilience. The EMI shed some weight nearing 1500¢, down 26¢ to 1507¢ and also falling a more modest 4US¢ to 1154US¢.

The fragility of the wool market was evident this week in what was the final sale for the financial year where increased supply (Fremantle back selling again) and a rising A$ pushed all types lower however, the strong Crossbred types showed some resilience. The EMI shed some weight nearing 1500¢, down 26¢ to 1507¢ and also falling a more modest 4US¢ to 1154US¢.