Sheep and lamb markets made a bit of a comeback this week. Lower prices had the usual impact, seeing more growers keep their sheep at home, forcing processors to pay a bit more for lambs and sheep.

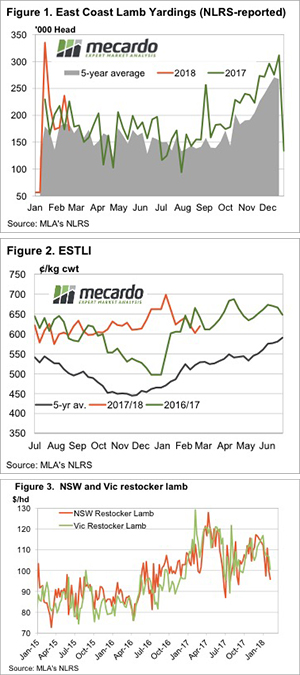

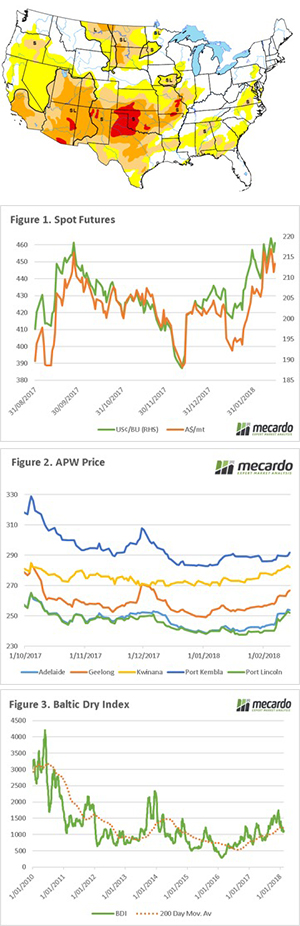

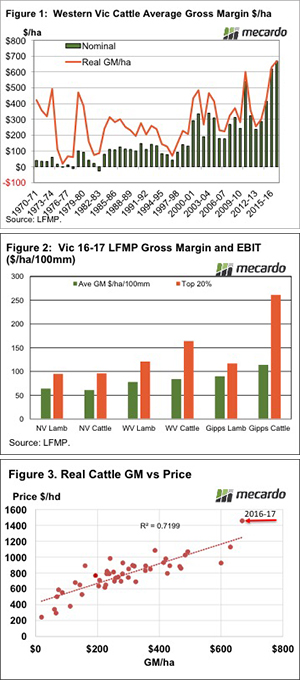

The spectre of rain, and of course lower prices put a fair drag on supply this week. Producers baulked at lower prices, with lamb yardings falling 27% to their lowest full week level since mid-September (figure 1). Sheep yardings took a similar fall, but have been weaker at times this year.

It’s nice when economics work the way they are supposed to. The lower supply saw prices move higher, the Eastern States Trade Lamb Indicator (ESTLI) gained 19¢ to close Thursday at 619¢/kg cwt (figure 2).

Lamb prices are in fact, very similar to last year. However, last year they had jumped 100¢ from December and any lamb that was ready was coming to market, there just wasn’t many finished lambs. This year prices have tanked from December, and growers don’t like lambs at 600¢. It interesting how price expectations can change in a year.

Restocker lamb prices have fallen in line with the ESTLI (figure 3). Lower prices now don’t necessarily mean prices will be steady through autumn, but the market always reacts the same way. If we have indeed seen the price low, it might be a good time to buy store lambs.

Over in the West sheep are the most expensive in Australia, the indicator at 400¢/kg cwt, while Merino lambs had an extraordinary jump, gaining 126¢ to 635¢/kg cwt.

The week ahead

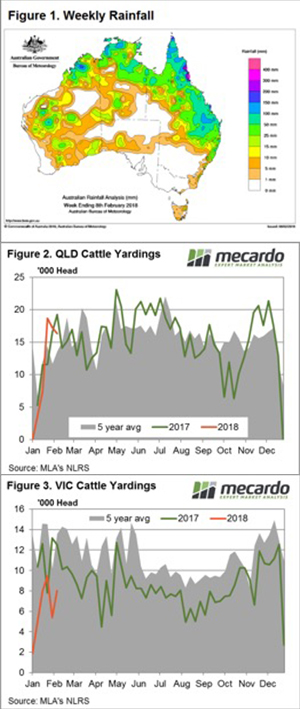

Again it is forecast to rain in Queensland, but some key parts of Northern NSW might get some too this time. After a dry summer this might be the trigger for a supply pull back, with the ripple effect flowing south.

We don’t expect a strong jump in lamb prices this week, but it’s also hard to see supply ramping up far enough to see values fall back below 600¢.

Key Points

Key Points

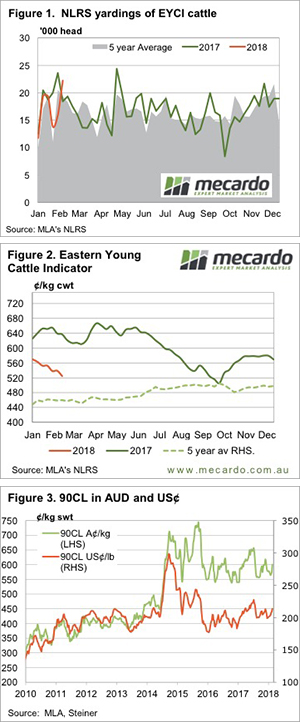

Young cattle yardings are building. This week Eastern Young Cattle Indicator (EYCI) yardings hit an 8 month high, and prices reacted accordingly, drifting lower, and heading back towards the low set in the spring.

Young cattle yardings are building. This week Eastern Young Cattle Indicator (EYCI) yardings hit an 8 month high, and prices reacted accordingly, drifting lower, and heading back towards the low set in the spring.

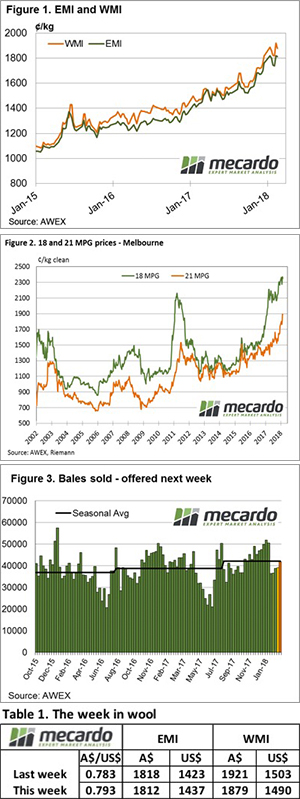

The grain market stands at a cross roads. In the past two years, we have seen concerns in the market which have led to short rallies. Will conditions provide the opportunity for a sustained rally, or will it fizzle out?

The grain market stands at a cross roads. In the past two years, we have seen concerns in the market which have led to short rallies. Will conditions provide the opportunity for a sustained rally, or will it fizzle out?

Strong throughput numbers for both lamb and mutton across the nation this week saw falls recorded in all national sale yard indicators, ranging between 3$ to 9 %. The headline Eastern States Trade Lamb Indicator (ESTLI) dropping 9.4% to close at 601/kg, while mutton was equally weak, off 8.8% to 385¢.

Strong throughput numbers for both lamb and mutton across the nation this week saw falls recorded in all national sale yard indicators, ranging between 3$ to 9 %. The headline Eastern States Trade Lamb Indicator (ESTLI) dropping 9.4% to close at 601/kg, while mutton was equally weak, off 8.8% to 385¢.

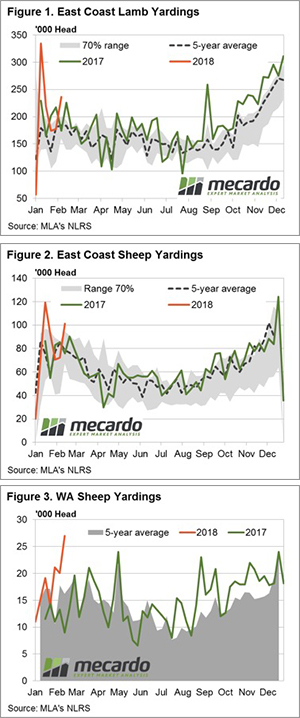

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

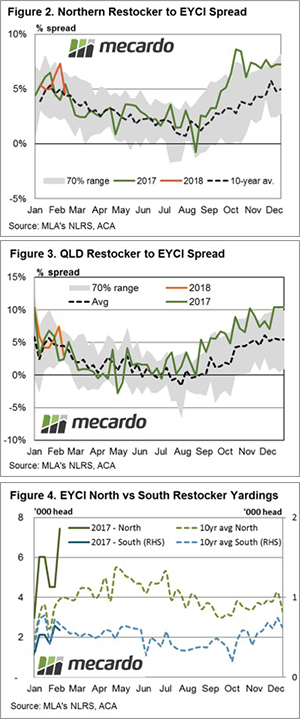

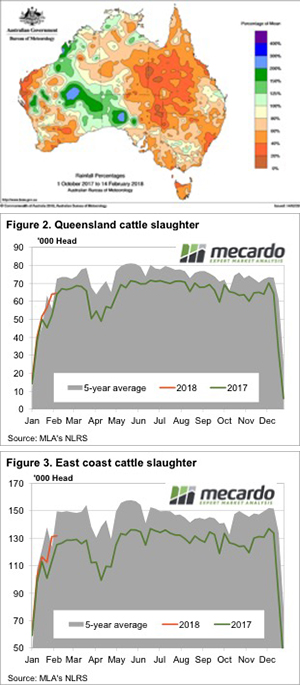

Some very solid rainfall in Queensland this week, yet this was unable to inspire trade cattle prices there as high throughput weighs on the market. In contrast, NSW and Victoria broadly missed out on any rain yet surprisingly throughput was below average and trade cattle prices firmed.

Some very solid rainfall in Queensland this week, yet this was unable to inspire trade cattle prices there as high throughput weighs on the market. In contrast, NSW and Victoria broadly missed out on any rain yet surprisingly throughput was below average and trade cattle prices firmed.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.