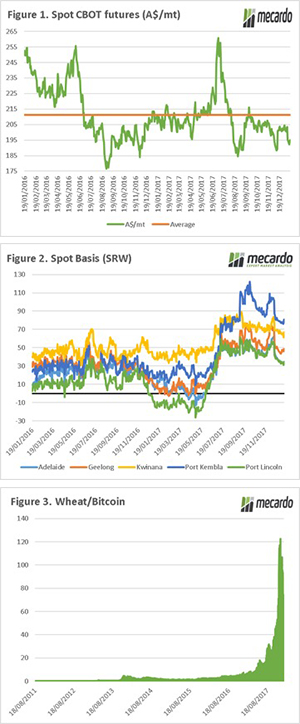

At this time of year, those lucky to have grain on hand will now be deciding whether it is best to sell their grain or hold on for higher prices. There are many ways of deferring pricing, and give exposure to the market at a later date. This short article will provide summaries of easily accessible options.

Storing to sell

Exposure: Basis & Futures

The obvious option for deferring pricing is to hold onto your grain and sell at a later date. This can be carried out either through central storage or through your own on-farm storage system.

Key considerations:

- Remember to calculate your storage costs and interest charges if storing in the system, this amount has to be recouped to make it worthwhile.

- Place a realistic price on your time, capital, fumigation and interest when storing on farm.

- Whether your on-farm storage is in a good enough condition to make it to the targeted sales timeframe.

No Price Established contract (NPE)

Exposure: Basis & Futures

The NPE contract comes under a number of different product names through different providers, however all perform the same function. The purpose of the contract is to provide traders access to grain, when the grower doesn’t like the price. The grower is then given a predetermined timeframe in which to secure their price.

Key considerations:

- Check what the product fee is.

- Is there an advance?

- Check how the pricing is established. What is the methodology if the trader is lower than the market?

- Do not use an NPE if the contract is only based on the trader’s price.

- Maintain a close eye, and remember that it is a time-based contract.

- Check whether storage and handling fees still apply.

More in depth information:

http://blog.mecardo.com.au/grain-canola-npe-contracts-the-simple-facts

Cash and Call

Exposure: Futures

The cash and call strategy involves the use of derivatives, but is not particularly complicated (guide on link below), and can be transacted through most banks or through a broker. The cash and call strategy is suitable when basis levels are strong, and futures are low. At its simplest, the grower sells his physical grain and then takes out a call option, which provides a benefit if the futures market increases in value.

The call option works in a similar way to an insurance, where the grower has a known worst-case scenario, in exchange for paying a premium.

In the Cash and Call strategy, the grower has a known cost (Premium) and for this cost has exposure to future favourable price increases. If the market price of the Call Option does not increase, only the Premium is lost.

Key considerations:

- Is the market structure favouring removing basis exposure, whilst retaining futures potential?

- Does your bank have the capacity to offer these instruments?

- There are no further storage costs in this strategy.

- The market has to climb higher than the premium to provide a positive pay-off.

- The premium will change dependent upon time, and strike price.

- There are some pool providers offering managed products which are based solely on the cash and call strategy.

More details:

http://blog.mecardo.com.au/i-dont-like-the-grain-price-but-i-need-the-cash

Buying a swap/futures contract

Exposure: Futures

The traditional method of utilizing a swap, would be to sell a swap prior to harvest to lock in a futures price, and then unwind the swap by buying back the swap from the bank at or near harvest. Although not common practice amongst farmers, it is possible to buy a swap/future contract.

It is possible with many banks to turn it around and instead of selling a wheat swap, buy a wheat swap. Let’s say for instance the current basis levels were high, and futures were low. It would be possible to sell your physical grain and lock in the basis, at the same time as buying a wheat swap.

The buying of the swap would give an exposure to the futures market. Therefore, if the futures market rallied you would participate in any upside. In an ideal world you would then close out your swap position when you had reached your target price, and with the addition of the basis already captured, would be your overall price.

Key considerations:

- Is the market structure favouring removing basis exposure, whilst retaining futures potential?

- There are no further storage costs in this strategy.

- Some banks will not allow a grower to buy a swap, and those that do will likely want to see a physical sale contract. This is to ensure that the instrument is being used as a hedge and not for speculative activity.

- A direct futures contract with the exchange will be cheaper but has the potential for margin calls.

- Should the market fall further after the swap is taken this strategy has the possibility of loss, further eroding the final overall price.

More details:

http://www.mecardo.com.au/commodities/analysis/turn-grain-swaps-around.aspx

Pools

Exposure: Dependent on pool strategy

Prior to 2008, wheat pools were the primary marketing route for the Australian growers. This has changed dramatically and <30% would be expected to be marketed through managed programs. The breadth of providers and products has however ballooned to fight over the remaining pool participants.

At its most basic, the pool is a product where growers provide a manager with tonnage with the expectation that they will manage this to provide a better return than they could achieve themselves. Typically, an unpriced scheme or product would be considered a financial product and require an Australian Financial Services Licence (AFSL), however an exemption for grain pool has been extended by ASIC.

What to keep in mind when selecting a pool:

- Does the pool strategy meet your requirements and your own view of the market?

- Do you think the pool provider has the experience to operate the pool?

- Does the pool provider have an AFSL? This gives an indication that the provider must take compliance extremely seriously.

- What are the payment schemes, and how do they work with your taxation and cash flow requirements?

- Pool providers put together some flash marketing, ignore this.

- Check past history, but remember that past performance is not an indicator of future performance.

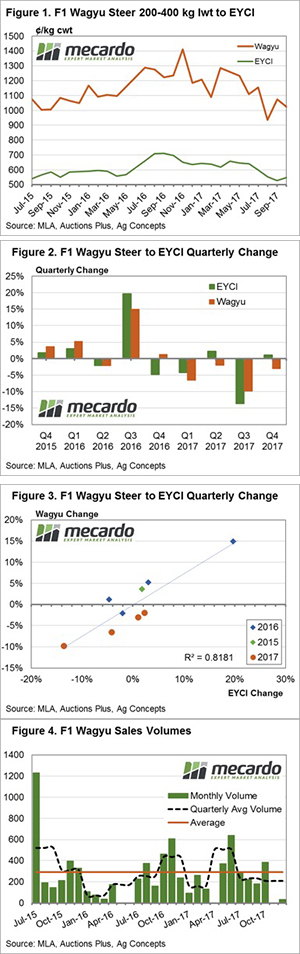

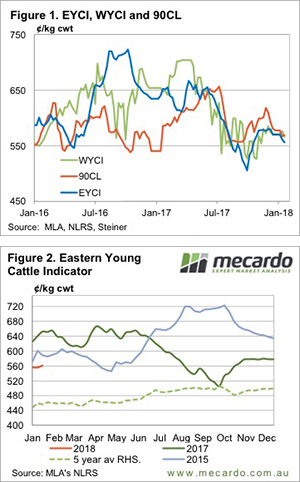

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading!

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading!

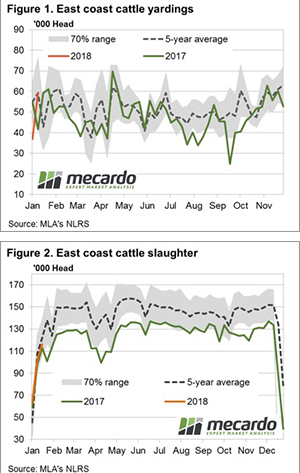

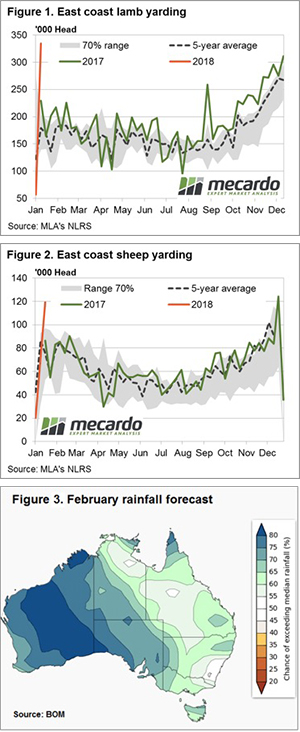

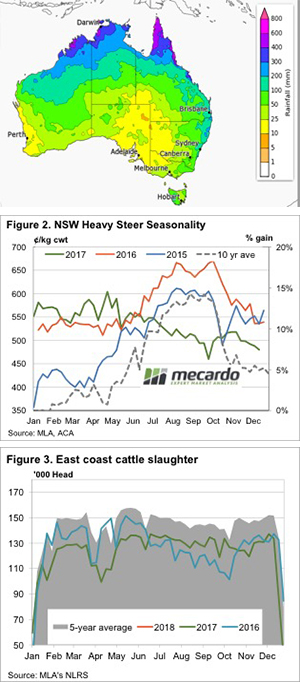

Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

For the first time in over a month we have the full suite of Meat and Livestock Australia (MLA) data to analyse. Even with all the data, the conclusions look the same. Markets are easing slightly thanks to a lack of moisture and a rising Aussie dollar.

For the first time in over a month we have the full suite of Meat and Livestock Australia (MLA) data to analyse. Even with all the data, the conclusions look the same. Markets are easing slightly thanks to a lack of moisture and a rising Aussie dollar. A truck driver asked me when we were going to sell some heavy steers that we have wandering around on some still green country. My flippant response was, ‘when it rains in Queensland and the price goes up’. I then thought I’d better do the numbers and make sure this was a better than 50/50 chance of happening.

A truck driver asked me when we were going to sell some heavy steers that we have wandering around on some still green country. My flippant response was, ‘when it rains in Queensland and the price goes up’. I then thought I’d better do the numbers and make sure this was a better than 50/50 chance of happening.

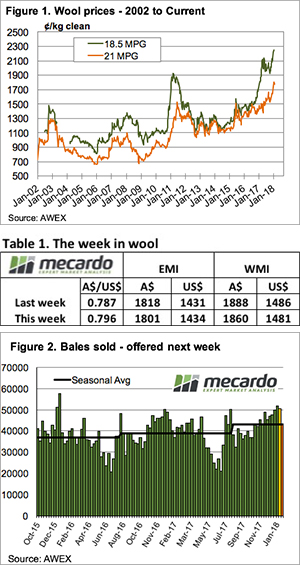

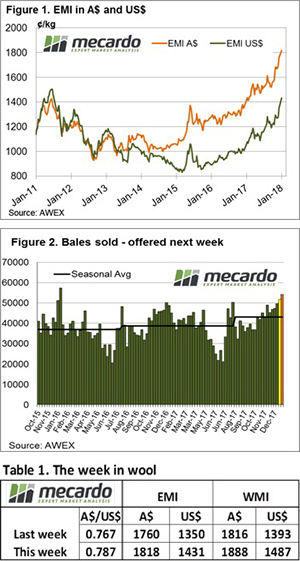

The wool market bubbled along at the higher rates reached last week, however, AWEX reported that this week buyers reverted to a more selective approach, in contrast to the past couple of sales where faults were overlooked.

The wool market bubbled along at the higher rates reached last week, however, AWEX reported that this week buyers reverted to a more selective approach, in contrast to the past couple of sales where faults were overlooked.

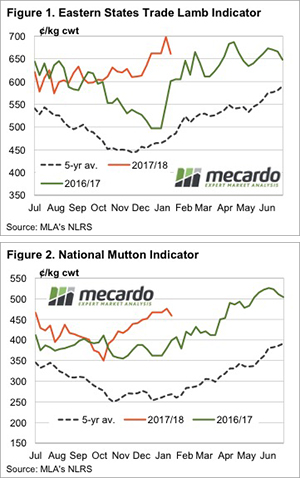

extraordinary record of 698¢/kg cwt. As the week progressed, prices cheapened, lamb indicators back in to line with the 2017 ending values.

extraordinary record of 698¢/kg cwt. As the week progressed, prices cheapened, lamb indicators back in to line with the 2017 ending values. December Merino volume was down 20% compared to 2017.

December Merino volume was down 20% compared to 2017.