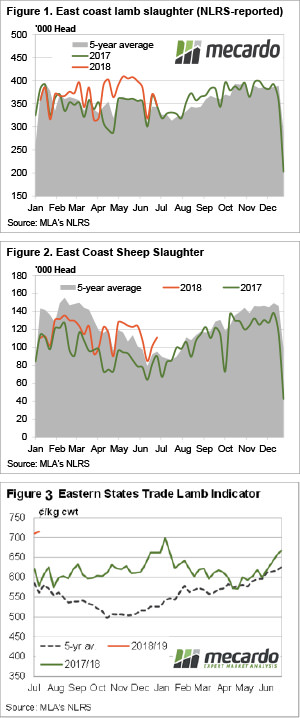

Lamb and sheep markets have hit some solid resistance at the 730¢ and 520¢ mark respectively. There are plenty of reports of processors cutting shifts and slowing production rather than competing harder for lambs. The latest three month forecast doesn’t suggest the supply of finished stock is going increase soon.

You may have noticed that we have had to change the Y-axis on our Eastern States Trade Lamb Indicator (ESTLI) charts. In fact, when we rolled into the new financial year, the ESTLI was literally off the chart. The top of the ESTLI charts are now 750¢, but the rally has slowed and it might not get there in short term. However heavy lambs are not far off, hitting 743¢ this week.

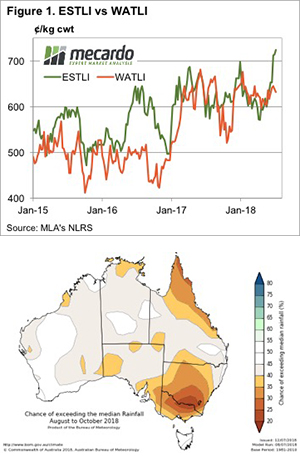

We’ve seen a new record high for the ESTLI, this week gaining 11¢ to reach 724¢/kg cwt (Figure 1). The WA Trade Lamb Indicator is ‘languishing’ at what used to be a very good price of 632¢/kg cwt.

The cheapest lambs in Australia are restocker lambs in WA, with the indicator at 514¢/kg cwt. In SA the restocker lamb Indicator was at 740¢, which makes the trip across the Nullabor viable. We’re not sure where the demand in SA is coming from, but suggest the indicator comes from a small number of lambs.

We heard an anecdote today about store sucker lambs coming from areas north of Adelaide with 1000 on a B-double. This is a lot of light lambs. We have been on about the increased supply of store lambs this week and this sounds like the beginnings.

What does it mean/next week?:

The weather forecast tells us the finished lamb shortage might last a while. There is a 65-80% chance that rainfall will be lower than the median across almost all of Victoria and NSW. There are some key lamb growing areas which are currently going ok, but most with new season lambs hitting the ground now are unlikely to be able to soak up extra supply from the north. It might be time to start thinking about how to finish lambs this year, even if they haven’t been born yet.

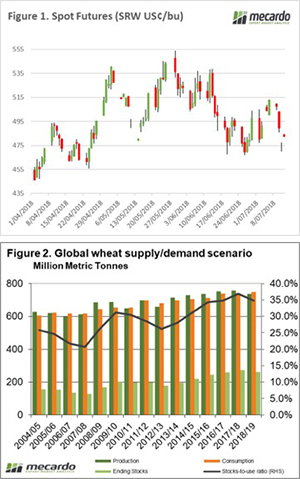

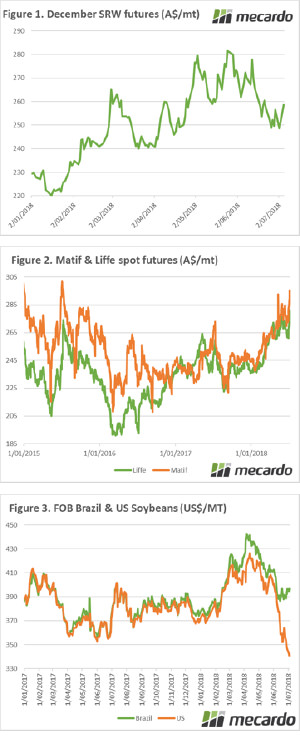

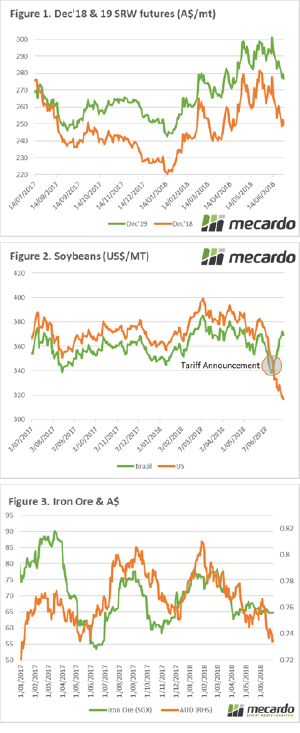

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

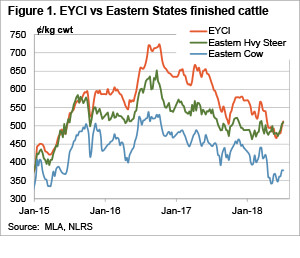

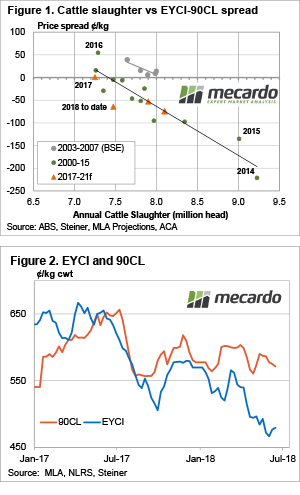

A bit of precipitation and weakening supply has seen cattle prices continue to rally this week, with the Eastern Young Cattle Indicator (EYCI) breaking back through the important 500¢ mark. Slaughter cattle prices also improved, as supply goes into its usual winter hibernation.

A bit of precipitation and weakening supply has seen cattle prices continue to rally this week, with the Eastern Young Cattle Indicator (EYCI) breaking back through the important 500¢ mark. Slaughter cattle prices also improved, as supply goes into its usual winter hibernation.

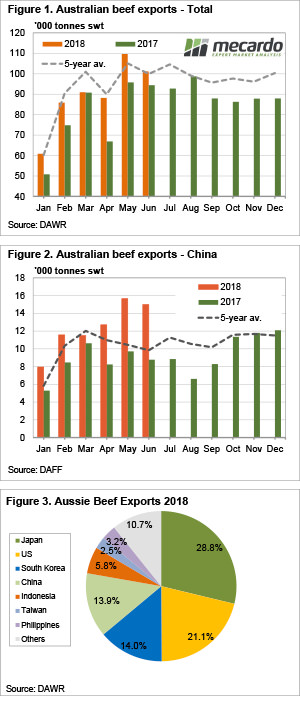

Cattle slaughter remained relatively strong in June, and this flowed through to export, which, while being down on May were still at their second highest level for the year. China maintained it’s very strong demand for frozen beef, helping keep export prices elevated despite cheaper cattle prices.

Cattle slaughter remained relatively strong in June, and this flowed through to export, which, while being down on May were still at their second highest level for the year. China maintained it’s very strong demand for frozen beef, helping keep export prices elevated despite cheaper cattle prices.

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels.

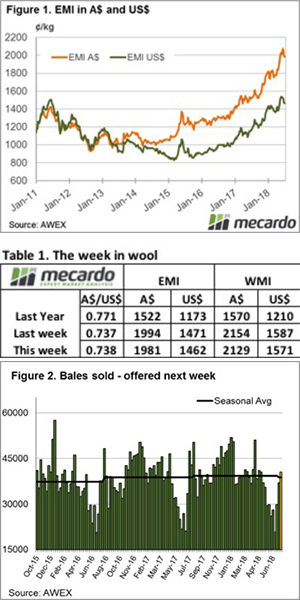

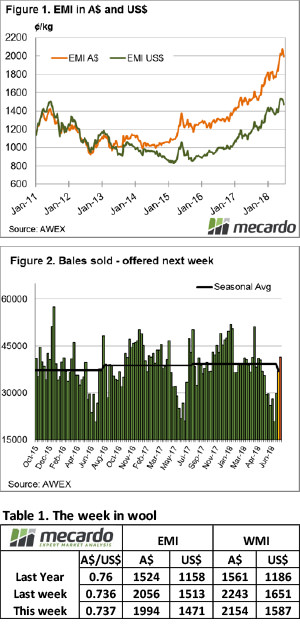

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels. The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.  The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.