Lambs continue to flow to the market, keeping a lid on prices. However, mutton values have been on the rise and narrowing the gap, as despite the dry weather, the supply of sheep is either not there or being held tight.

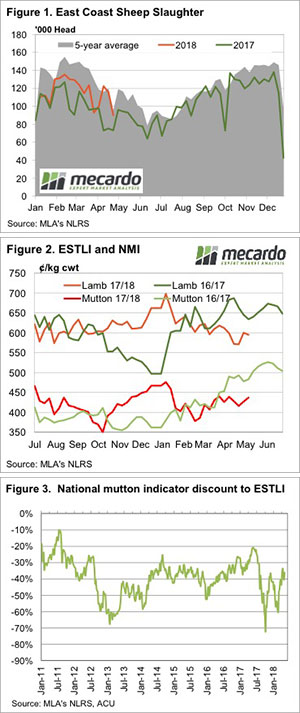

Figure 1 shows that sheep slaughter remains well above last year’s levels, with the short week kill roughly equivalent to the full weeks this time last year. However, the usual autumn slaughter downtrend is in place as supplies remain similar to the five year average.

Lamb slaughter hasn’t been falling, it hit a peak in the week before Anzac day, and last week was 14% above the short weeks at Easter.

The result of lower sheep slaughter, and stronger lamb slaughter, is a narrowing gap between the pricesFigure 2 shows a mild upward trend for mutton since February, with the 10¢ gain this week pushing it to 437¢/kg cwt.

The Eastern States Trade Lamb Indicator (ESTLI) eased marginally this week, losing 5¢ but remaining above the lows hit a fortnight ago.

The mutton discount to the ESTLI has held above 40% for the last three weeks. Mutton isn’t as strong as the 20-30% spread seen this time last year, but given the season, the relative tight supply might tell a story.

Either there are not the sheep out there to sell in response to the dry weather, or growers are confident enough about prices, and profitability to feed sheep through the feed gap.

The week ahead

There is again a little bit of rain moving through Victoria. Enough to confirm a break in some areas where there are a lot of sheep, but likely not widespread enough to see sheep supply tighten dramatically. Lamb supply can’t really rise from here given the extraordinary levels we’ve seen, but prices could continue to track sideways for a little while yet before the winter premiums kick in.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

going forward.

going forward.

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market.

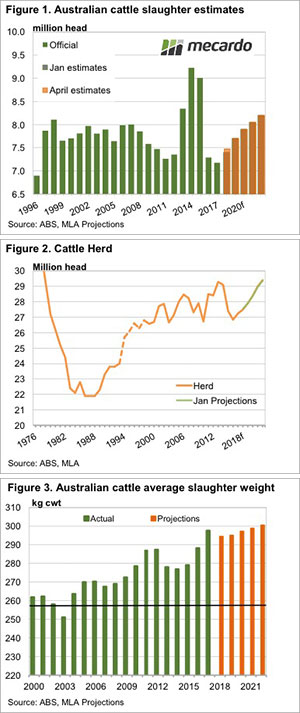

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market. It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.

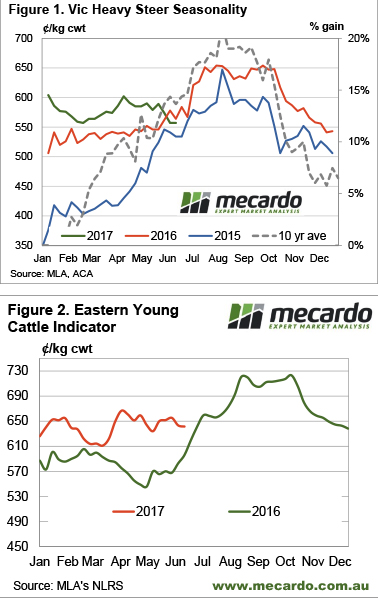

It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices. It hasn’t happened to the Eastern Young Cattle Indicator (EYCI) yet, but we have a few slaughter categories which have moved below year ago levels. It’s been a while since producers were getting less money than the year before, in fact it’s been three years, but is anyone complaining?

It hasn’t happened to the Eastern Young Cattle Indicator (EYCI) yet, but we have a few slaughter categories which have moved below year ago levels. It’s been a while since producers were getting less money than the year before, in fact it’s been three years, but is anyone complaining?

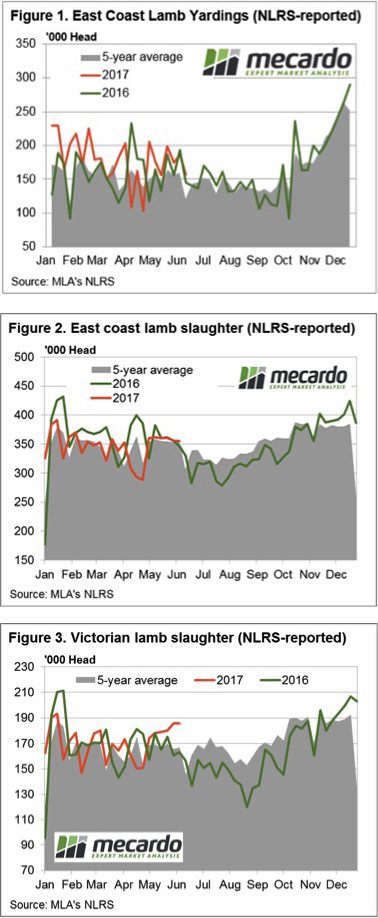

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

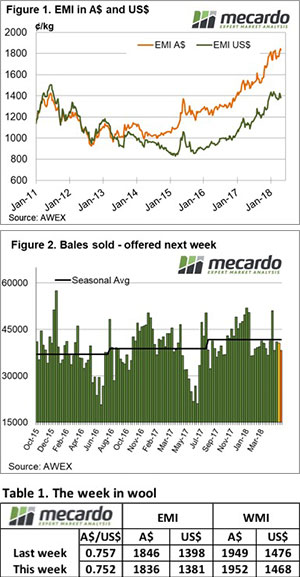

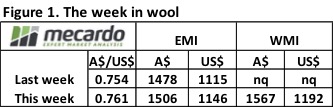

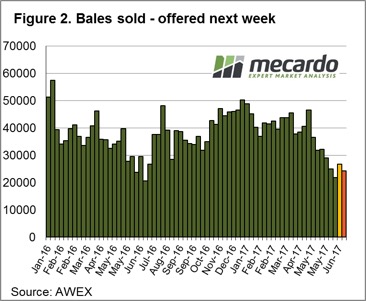

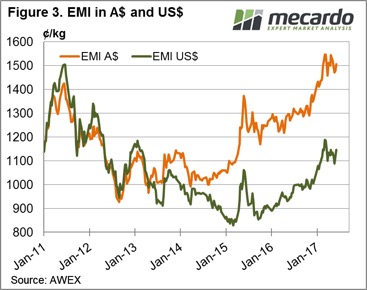

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢. Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level. The week ahead

The week ahead