During this period in the wool market, it seems to be performing as a more predictable beast than usual. Market rallies strongly – growers sell – buyers lose orders because market is “too hot” – market retraces – growers pass-in higher levels – market recovers – buyers receive increased orders – market rallies …….. repeat!!

During this period in the wool market, it seems to be performing as a more predictable beast than usual. Market rallies strongly – growers sell – buyers lose orders because market is “too hot” – market retraces – growers pass-in higher levels – market recovers – buyers receive increased orders – market rallies …….. repeat!!

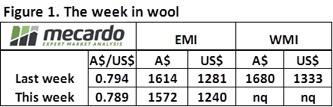

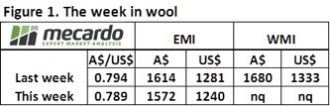

The EMI closed lower again this week, losing another 14 cents in A$ terms to settle at 1,558 cents, while in US$ terms the market corrected 9 cents (figure 1). The WMI had last week out of the sales roster so had to play catch-up to the falls of last week; it was 71 cents lower than the previous close of a fortnight ago.

The underlying story for this week however is positive, the market opened on Wednesday with “red ink” across the board, but a reversal on Thursday was clear, with gains of 10 – 20 cents across all microns and the market finishing on a positive sentiment.

The underlying story for this week however is positive, the market opened on Wednesday with “red ink” across the board, but a reversal on Thursday was clear, with gains of 10 – 20 cents across all microns and the market finishing on a positive sentiment.

Again, it was the finer types (18 MPG and finer) where we saw the stronger competition resulting in a net higher close than last week, especially in Sydney. These types all posted gains, with the comment from AWEX that this was led by the better style wool.

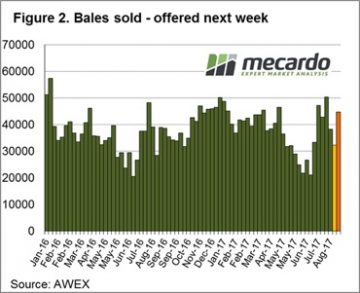

Growers again took an aggressive position to the easing market to pass-in 10% of the offered wool, resulting in 41,261 bales sold for the week, just above the 38,000 average bales cleared per week for this year. This pass-in rate is high when compared to the season average of 7.3% passed in and 5.5% average for last season.

Last season the EMI averaged 1385 cents, with a season average pass-in rate of 5.5%. So far, the EMI average for this season has been 1528, with an average pass-in rate of 7.3% and double digit rates over the last two weeks of 14% & 10% respectively.

The high pass-in rate, and therefore show of confidence by growers, is understandable. With excellent sheep and lamb prices, and the high wool price, wool (sheep) producers are in a good position financially and therefore are prepared to pass-in and hold wool away from the sale on any show of softness in the market.

The week ahead

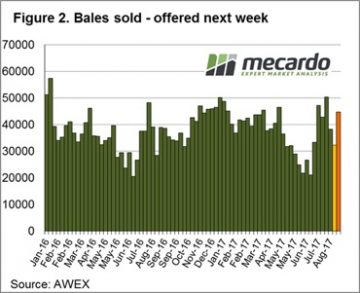

Next week 42,872 bales are rostered (Figure 2). The pattern over recent months of correcting but quickly recover as growers hold wool back from sale was again in evidence this week. This suggests that next week will see a continuation of the positive sentiment evident towards the end of this weeks sales.

Next week 42,872 bales are rostered (Figure 2). The pattern over recent months of correcting but quickly recover as growers hold wool back from sale was again in evidence this week. This suggests that next week will see a continuation of the positive sentiment evident towards the end of this weeks sales.

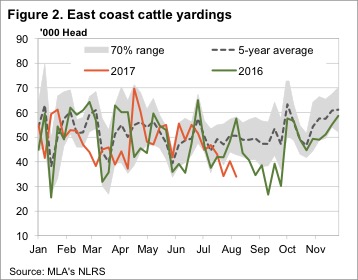

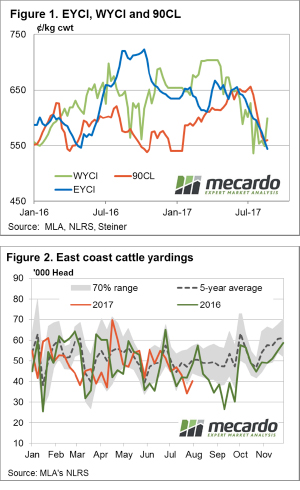

Technical analysis isn’t a strongpoint, but we do know that when the pace of a rally, or a decline, slows, the market is usually getting close to changing direction. Over the 12 weeks to last Friday the EYCI has fallen 112¢ at a rate of 9.3¢ per week (figure 1).

Technical analysis isn’t a strongpoint, but we do know that when the pace of a rally, or a decline, slows, the market is usually getting close to changing direction. Over the 12 weeks to last Friday the EYCI has fallen 112¢ at a rate of 9.3¢ per week (figure 1). Weakening prices amid weakening supply is a pretty good indicator of weaker demand. For young cattle we can blame restockers, who have pulled back after driving the market for two years. For finished cattle the abundance of cattle on feed is helping to keep a lid on finished cattle values.

Weakening prices amid weakening supply is a pretty good indicator of weaker demand. For young cattle we can blame restockers, who have pulled back after driving the market for two years. For finished cattle the abundance of cattle on feed is helping to keep a lid on finished cattle values.

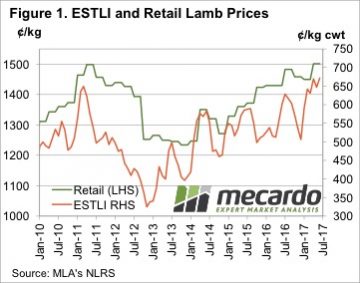

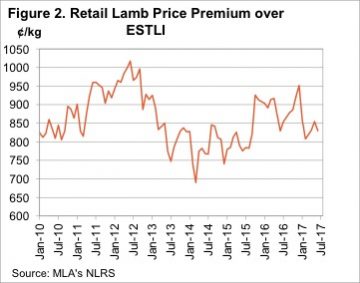

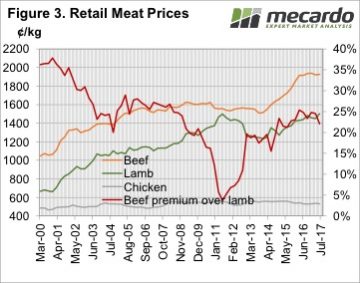

The sharp rise in saleyard and over the hooks lamb prices in the first half of 2017 took a while to translate into strong retail lamb prices, but it did eventually push them to a record. The average retail lamb price increased 51.77¢, or 3.6%, to move to 1501.37¢/kg rwt.

The sharp rise in saleyard and over the hooks lamb prices in the first half of 2017 took a while to translate into strong retail lamb prices, but it did eventually push them to a record. The average retail lamb price increased 51.77¢, or 3.6%, to move to 1501.37¢/kg rwt. Things are a bit different this time. Obviously in real terms lamb remains cheaper than it was in 2011, and compared to its main red meat competitor it is not yet in the expensive range. Figure 3 shows retail beef prices remained strong in the June quarter, and despite the rise in lamb values, beef it still at a 22% premium. In 2011 the beef premium shrunk to just 4%, and this put considerable pressure on lamb demand.

Things are a bit different this time. Obviously in real terms lamb remains cheaper than it was in 2011, and compared to its main red meat competitor it is not yet in the expensive range. Figure 3 shows retail beef prices remained strong in the June quarter, and despite the rise in lamb values, beef it still at a 22% premium. In 2011 the beef premium shrunk to just 4%, and this put considerable pressure on lamb demand. There remains some concern in the expensive red meat prices relative to static cheap chicken prices, and this is being borne out in consumption levels.

There remains some concern in the expensive red meat prices relative to static cheap chicken prices, and this is being borne out in consumption levels.

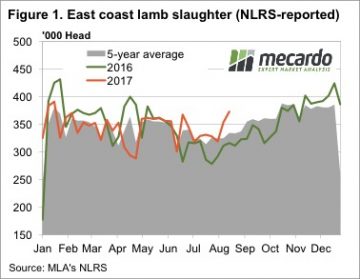

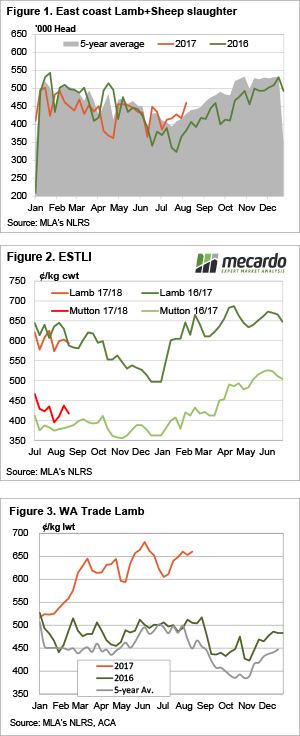

Markets can sometimes defy even the most rusted on seasonal trend. A couple of anomalies caught our eye this week. Figure 1 shows the massive jump in lamb slaughter over the last two weeks, to the point where for the week ending the 18th August, we hit its highest level since the third week of 2017. In fact lamb slaughter last week was the third highest for the year.

Markets can sometimes defy even the most rusted on seasonal trend. A couple of anomalies caught our eye this week. Figure 1 shows the massive jump in lamb slaughter over the last two weeks, to the point where for the week ending the 18th August, we hit its highest level since the third week of 2017. In fact lamb slaughter last week was the third highest for the year. There has been some talk around about slow lamb growth rates impacting on the supply of finished lambs early in the selling season. While this could explain continued strong prices, the high slaughter rates suggest supply is ok, and demand may be pushing prices higher.

There has been some talk around about slow lamb growth rates impacting on the supply of finished lambs early in the selling season. While this could explain continued strong prices, the high slaughter rates suggest supply is ok, and demand may be pushing prices higher. The optimism that was evident following the last two weeks of strong wool market sales suffered a reality check this week. With the market only selling in Melbourne & Sydney, and with the sale conducted on Tuesday & Wednesday due to “Wool Week” activities, it was a sharp correction across all types that occurred.

The optimism that was evident following the last two weeks of strong wool market sales suffered a reality check this week. With the market only selling in Melbourne & Sydney, and with the sale conducted on Tuesday & Wednesday due to “Wool Week” activities, it was a sharp correction across all types that occurred. The response from growers was to pass-in14% of the offered wool, resulting in 32,342 bales sold for the week, well down on the average for this season. It is an interesting situation with the market trading at historic highs and yet we have a pass-in rate that is high by any measure. Growers are clearly comfortable holding out, despite these historically good prices, suggesting their not too concerned that any major correction will occur in the near future.

The response from growers was to pass-in14% of the offered wool, resulting in 32,342 bales sold for the week, well down on the average for this season. It is an interesting situation with the market trading at historic highs and yet we have a pass-in rate that is high by any measure. Growers are clearly comfortable holding out, despite these historically good prices, suggesting their not too concerned that any major correction will occur in the near future. Next week Fremantle rejoins the selling roster and 44,750 bales are rostered (Figure 2). The pattern over recent months has been for the market to rally, then correct but quickly recover as growers hold wool back from sale. This is likely to be the pattern going forward so next week there is an air of optimism from sellers that we can see the market at least hold.

Next week Fremantle rejoins the selling roster and 44,750 bales are rostered (Figure 2). The pattern over recent months has been for the market to rally, then correct but quickly recover as growers hold wool back from sale. This is likely to be the pattern going forward so next week there is an air of optimism from sellers that we can see the market at least hold.

In recent times, there have been accusations of Russian tampering in western politics. In the wheat game, the Russian crop is interfering with our grain pricing! In this week’s comment, we highlight the Black Sea, and its impact on global pricing.

In recent times, there have been accusations of Russian tampering in western politics. In the wheat game, the Russian crop is interfering with our grain pricing! In this week’s comment, we highlight the Black Sea, and its impact on global pricing.

Average trade lamb prices continue to track around the 600¢ mark on the east coast, and higher in the west. Lamb and sheep slaughter has rallied and is sitting well above last year’s mark, but demand appear to be keeping pace with supply.

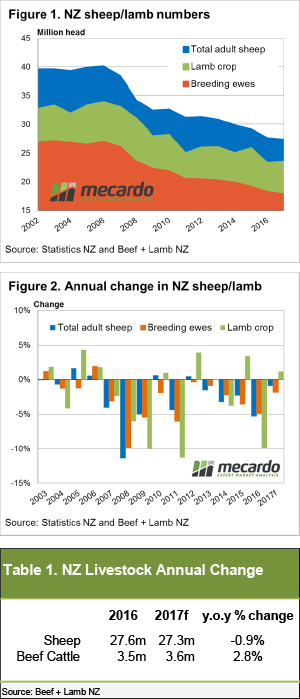

Average trade lamb prices continue to track around the 600¢ mark on the east coast, and higher in the west. Lamb and sheep slaughter has rallied and is sitting well above last year’s mark, but demand appear to be keeping pace with supply. Beef and Lamb NZ’s mid-year stock number survey shows the Kiwi sheep flock and number of breeding ewes continuing to decline into 2017, albeit at a lesser degree than in previous seasons. Although, good pasture and ewe condition throughout the breeding cycle has seen an improvement in the anticipated lamb crop for this year.

Beef and Lamb NZ’s mid-year stock number survey shows the Kiwi sheep flock and number of breeding ewes continuing to decline into 2017, albeit at a lesser degree than in previous seasons. Although, good pasture and ewe condition throughout the breeding cycle has seen an improvement in the anticipated lamb crop for this year. National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

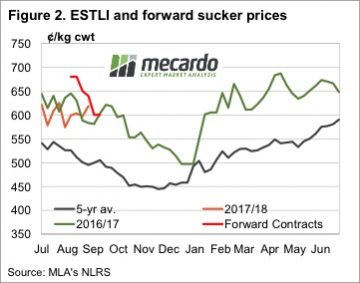

Last week the market kicked off for the season with full force and we expected week 2 to be a little lacklustre in comparison. But no, the Australian Dollar plunged, the auction price peaked and those with the patience to hold on past the first week came out grinning.

Last week the market kicked off for the season with full force and we expected week 2 to be a little lacklustre in comparison. But no, the Australian Dollar plunged, the auction price peaked and those with the patience to hold on past the first week came out grinning.