- South West Victorian Cattle Producers had their best year in 47 years of the Livestock Farm Monitor Project.

- The top 20% of cattle producers in the South West and Gippsland made huge margins.

- Lower prices are likely to see gross margins weaken this year, slowing herd rebuilding.

A couple of weeks ago we took a look at some Victorian benchmarking data outlining the profitability of sheep and wool enterprises. Cattle producers were also included in the data, and given the high prices we shouldn’t be surprised that they had their best year in the last 47. That makes it two years in a row.

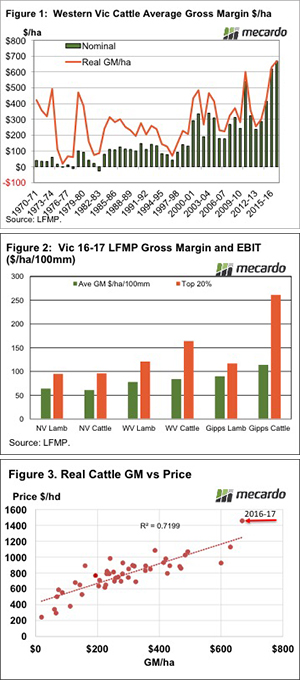

Figure one shows the long term data for South West Victoria, with strong prices seeing 2016-17 eclipsing the 2015-16 numbers by $38/ha. The extraordinary gross margins of $668/ha were up 6% on last year in real terms, and miles ahead of any other year except for 2010-11.

Other regions showed similar strong performance. Figure 2 shows that Northern Victoria had a slightly lower cattle gross margin per 100mm of rainfall than the south west, while Gippsland was the best performed, with $90/ha/100mm.

The most striking bar in figure 2 is the performance of the top 20% of cattle producers in Gippsland, they achieved gross margins of $261/ha/100mm. The top 20% of Western Victorian Cattle producers were no slouches, but were nearly $100 behind Gippsland, at $164/ha/100mm.

Figure 2 also shows us the ‘average’ cattle producers did a bit better than lamb producers in the South West and Gippsland, but marginally worse in Northern Victoria. The top 20% of cattle producers were streaks ahead of their lamb counterparts in Western Victoria and Gippsland, but in Northern Victoria, they made just $1 more.

Along with high prices, the season was also favourable as it all came together for cattle producers. However, figure 3 shows that cattle gross margins were maybe not as strong as prices might suggest. The 2016-17 point is above the trend line, which suggests gross margins should be somewhere near the top 20% in Gippsland.

Cattle producers are likely to have taken the opportunity to spend some money on ‘repairs and maintenance’, increasing variable costs and pulling gross margins lower than where they might be under normal spending patterns.

What does it mean/next week?:

With the fall in cattle prices since last winter, cattle producers are unlikely to continue the run of higher gross margins in 2017-18. With weaner cattle prices back around the $1000/head mark, gross margins might fall back to $500/ha in South West Victoria. Still a great margin, just not as good as the last two years.

Expected weakening in cattle margins, and continued strong sheep, lamb and wool prices, will halt any shift back towards cattle which might have been brought on by recent high prices. At least in the south the herd rebuilt might slow.

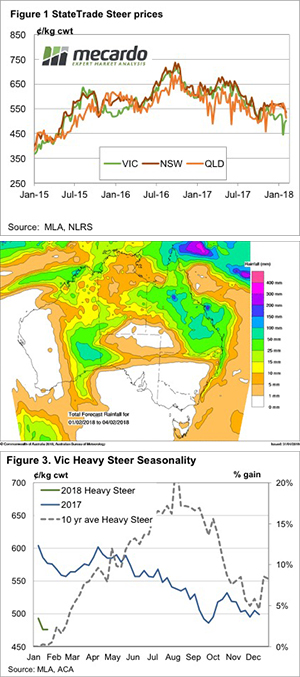

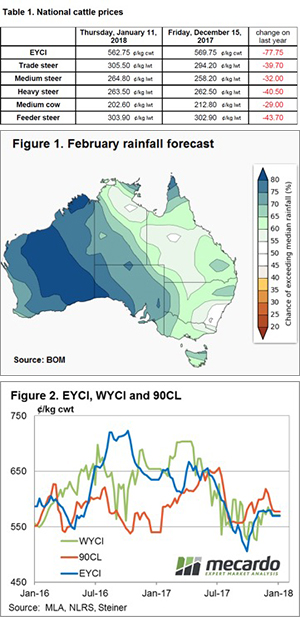

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.

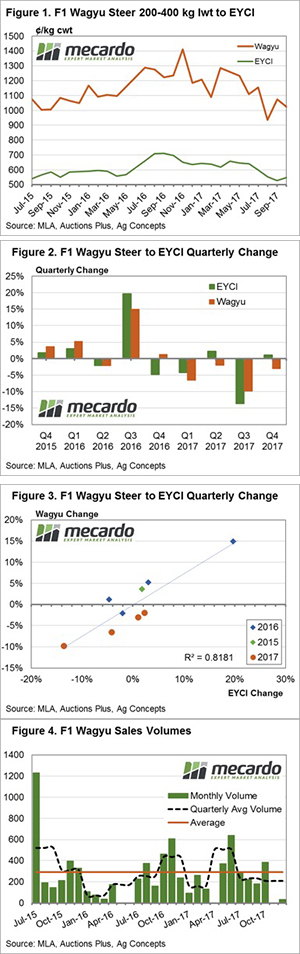

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside. On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading!

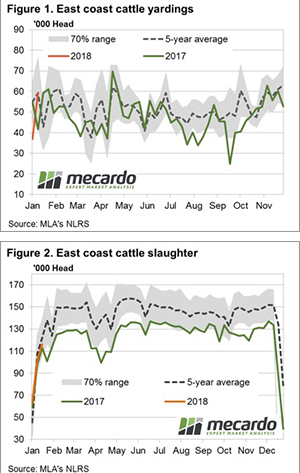

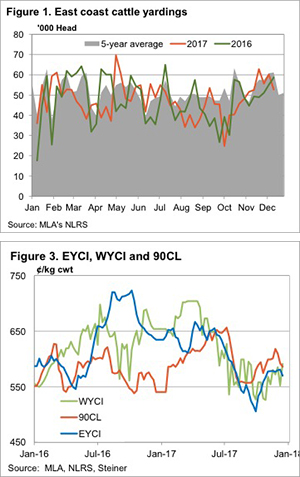

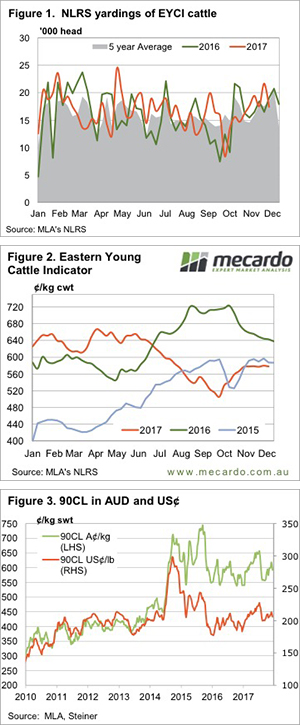

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading! Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

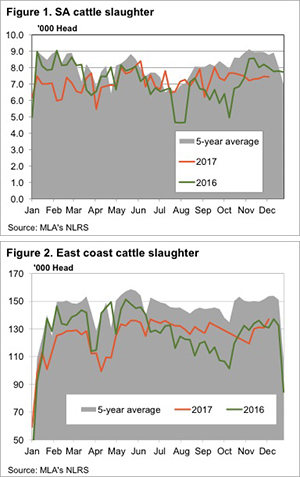

Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices. A truck driver asked me when we were going to sell some heavy steers that we have wandering around on some still green country. My flippant response was, ‘when it rains in Queensland and the price goes up’. I then thought I’d better do the numbers and make sure this was a better than 50/50 chance of happening.

A truck driver asked me when we were going to sell some heavy steers that we have wandering around on some still green country. My flippant response was, ‘when it rains in Queensland and the price goes up’. I then thought I’d better do the numbers and make sure this was a better than 50/50 chance of happening. lotfeeder and restocker activity fairly prevalent. Many saleyards did not have the full compliment of processor and export buyers in attendance and both quality of stock present and price movement reported as being fairly mixed.

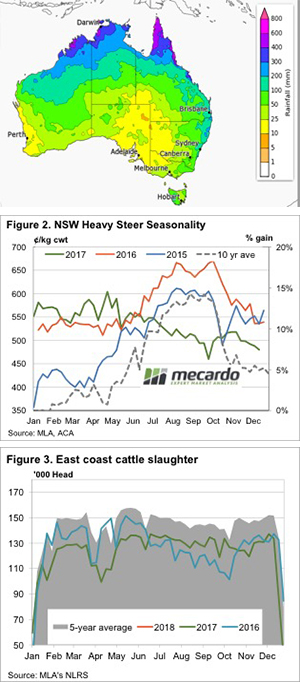

lotfeeder and restocker activity fairly prevalent. Many saleyards did not have the full compliment of processor and export buyers in attendance and both quality of stock present and price movement reported as being fairly mixed. cattle per week at Murray Bridge. While this is a very large, 65-70% of MLA’s reported weekly kill for South Australia (figure 1), it accounts for just under 4% of east coast slaughter (figure 2).

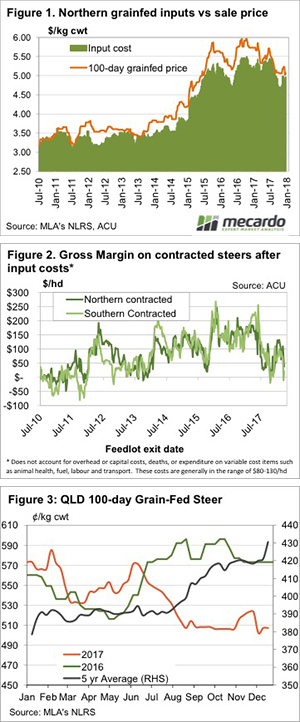

cattle per week at Murray Bridge. While this is a very large, 65-70% of MLA’s reported weekly kill for South Australia (figure 1), it accounts for just under 4% of east coast slaughter (figure 2). general. After a small, and short-lived, bounce back to the 520¢ level in late November, the Queensland 100 day Grainfed Steer price has resumed its downward trend, finishing the 2017 at 507¢/kg cwt.

general. After a small, and short-lived, bounce back to the 520¢ level in late November, the Queensland 100 day Grainfed Steer price has resumed its downward trend, finishing the 2017 at 507¢/kg cwt. b markets, prices are higher, yet supply is stronger. An interesting conundrum.

b markets, prices are higher, yet supply is stronger. An interesting conundrum. did fall away from the 7 month highs of last week, but remained relatively strong (figure 1). Seemingly demand was a little weaker. The EYCI tracked sideways, finishing Thursday at 579.25¢/kg cwt, and has now spent 6 weeks around this level.

did fall away from the 7 month highs of last week, but remained relatively strong (figure 1). Seemingly demand was a little weaker. The EYCI tracked sideways, finishing Thursday at 579.25¢/kg cwt, and has now spent 6 weeks around this level.