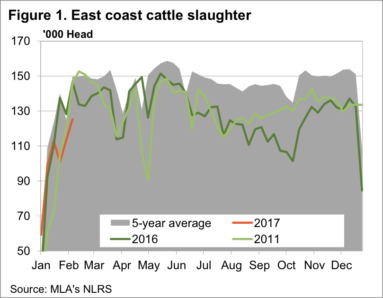

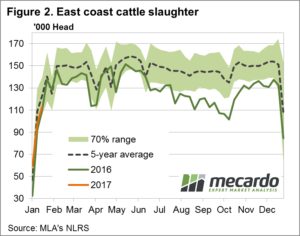

Strong cattle prices have seen more cattle drawn out. With Meat and Livestock Australia’s (MLA’s) weekly slaughter data for last week showing a 2017 high. It seems things settled a bit this week, but rising export meat prices are at least supporting cattle prices.

In last week’s cattle commentary Matt noted the strong yarding’s in Queensland, which resulted in the Eastern Young Cattle Indicator (EYCI) losing 19¢. MLA’s slaughter figures for last week, released on Monday show that the increased supply in the yards was also reflected at processors works.

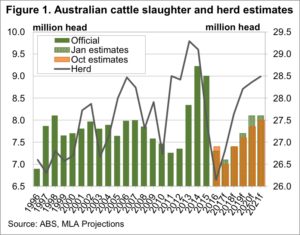

Cattle slaughter on the East Coast for the week was up 11% (figure 1), and just 6% below the same week last year. In Queensland slaughter was up 22% on the previous week, and 10% on last year. Dragging the chain was Victoria and SA, and to a lesser extent, NSW, which were down 29, 27 and 6% on last year respectively.

It remains a bit confounding that the supply dearth is concentrated in the southern states, given that the herd liquidation, and subsequent rebuild, should be concentrated in the north.

It remains a bit confounding that the supply dearth is concentrated in the southern states, given that the herd liquidation, and subsequent rebuild, should be concentrated in the north.

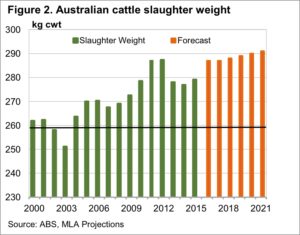

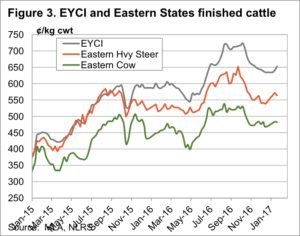

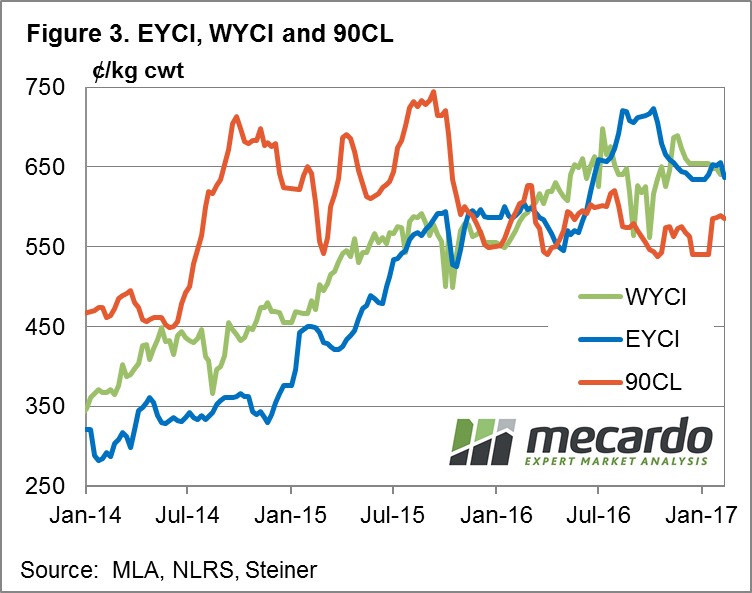

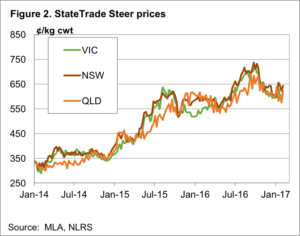

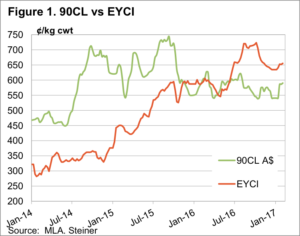

There is some good news on the export front. Frozen Cow 90CL export prices managed to gain some ground this week, hitting a six month high of 591¢/kg swt, (figure 2) despite a rising exchange rate. The EYCI premium to the 90CL has hit an 8 month low of 44¢. Strong support for the EYCI is only 50¢ away.

The week ahead

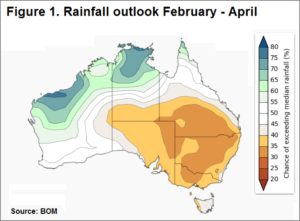

Key cattle areas in Queensland and Northern NSW are expected to get good rain over the coming week. This should reduce yarding’s and provide some support for young cattle prices in the short term.

Finished cattle prices usually rise at this time of year as supply wanes. This usually lasts until mid-April, when prices ease. This will be the first test of the market, but strong export prices will limit downside.

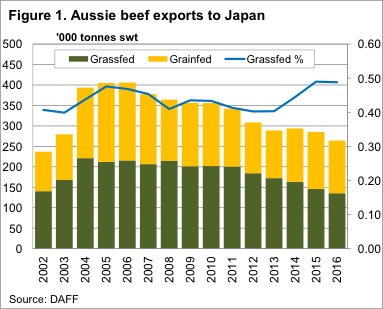

Prices for beef exported to Japan has been easing of late, which is a bit of a concern, given Japan is our major high value export market. With Japanese beef export prices sitting on a key support level, we take a look at what might happen to markets if prices break lower.

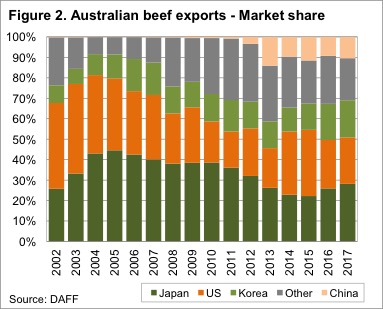

Prices for beef exported to Japan has been easing of late, which is a bit of a concern, given Japan is our major high value export market. With Japanese beef export prices sitting on a key support level, we take a look at what might happen to markets if prices break lower. Australian beef has also found markets other than Japan, where the value is similar. The ‘other’ markets, mainly South East Asian Countries, and China, have increased their share of Australian beef exports to 31% in 2016, up from 12% in 2007 (figure 2).

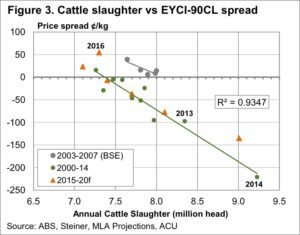

Australian beef has also found markets other than Japan, where the value is similar. The ‘other’ markets, mainly South East Asian Countries, and China, have increased their share of Australian beef exports to 31% in 2016, up from 12% in 2007 (figure 2). Figure 3 shows the price of Grassfed Fullsets exported to Japan, along with the 90CL Frozen Cow exported to the US, and the monthly average National Heavy Steer Indicator. Since November the Grassfed Fullset has fallen nearly 9%.

Figure 3 shows the price of Grassfed Fullsets exported to Japan, along with the 90CL Frozen Cow exported to the US, and the monthly average National Heavy Steer Indicator. Since November the Grassfed Fullset has fallen nearly 9%.

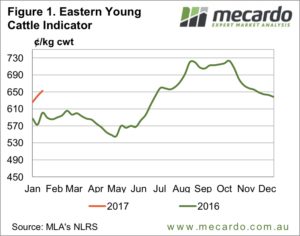

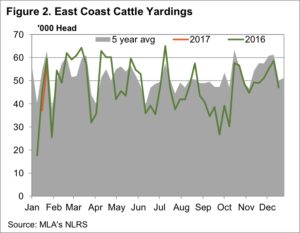

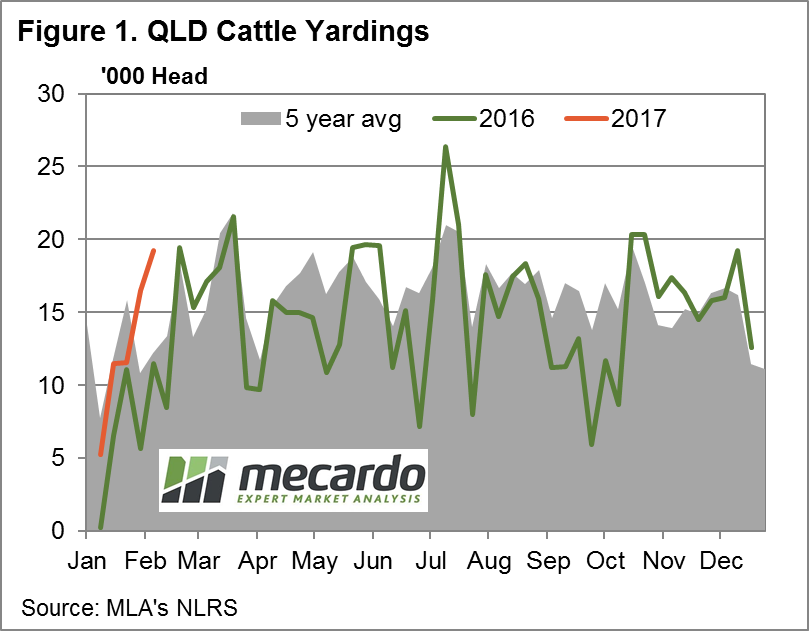

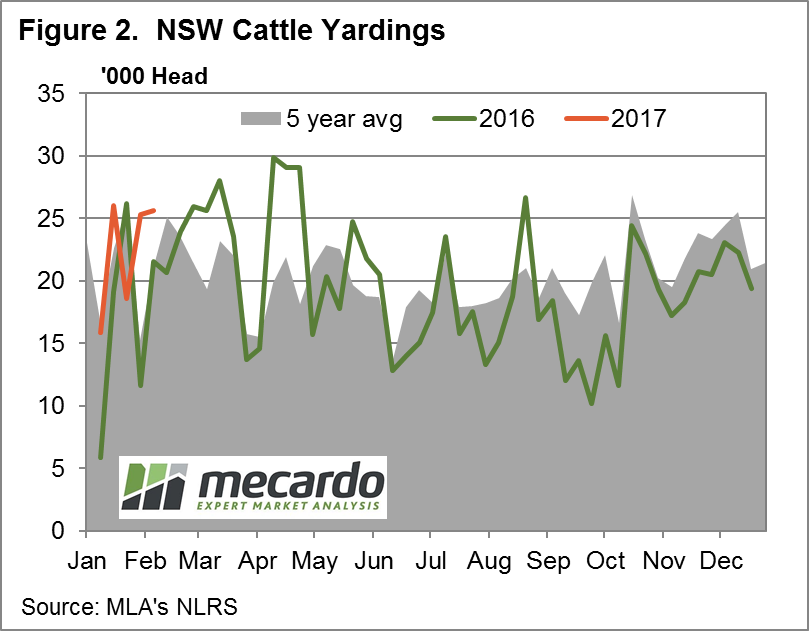

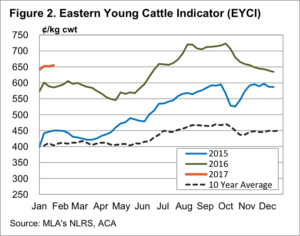

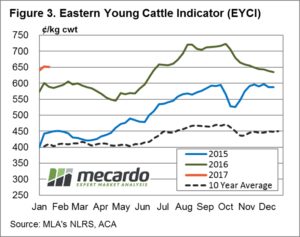

Surging weekly Queensland throughput and above average NSW throughput weighed on cattle prices in these regions dragging down the east coast figures this week with the Eastern Young Cattle Indicator (EYCI) dropping to levels not seen since the start of the season.

Surging weekly Queensland throughput and above average NSW throughput weighed on cattle prices in these regions dragging down the east coast figures this week with the Eastern Young Cattle Indicator (EYCI) dropping to levels not seen since the start of the season. NSW experiencing price declines in all NLRS saleyard categories, apart from Medium and Heavy Steers, with Trade Steers headlining with the biggest percentage decrease, down 6% to 332¢/kg lwt with elevated NSW throughput appearing to contributing to the price pressure – figure 2.

NSW experiencing price declines in all NLRS saleyard categories, apart from Medium and Heavy Steers, with Trade Steers headlining with the biggest percentage decrease, down 6% to 332¢/kg lwt with elevated NSW throughput appearing to contributing to the price pressure – figure 2. Register

Register

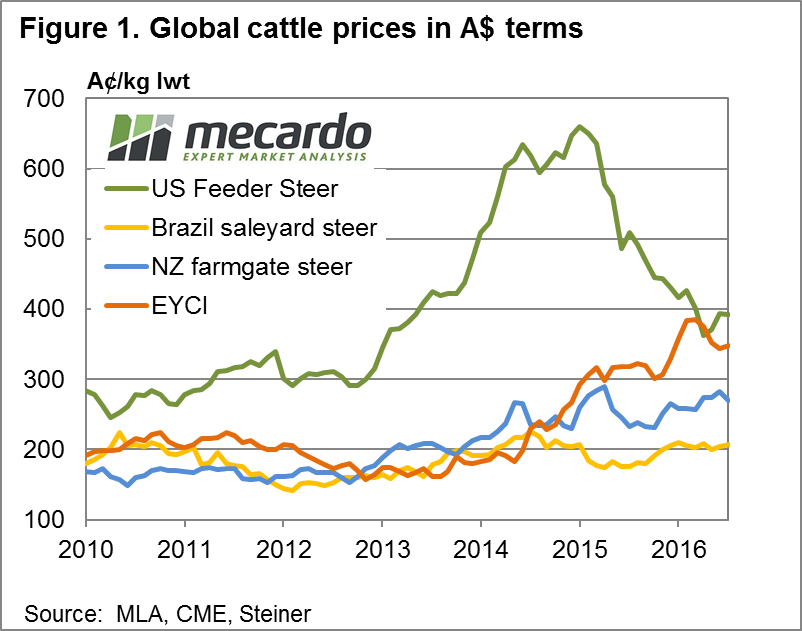

Often at Mecardo we look at local and global cattle price relationships in US$ terms as the US cattle market is one of the key drivers of Australian cattle prices over the longer term. However, in this analysis we flip the magnifying glass to take a look at global prices in our terms.

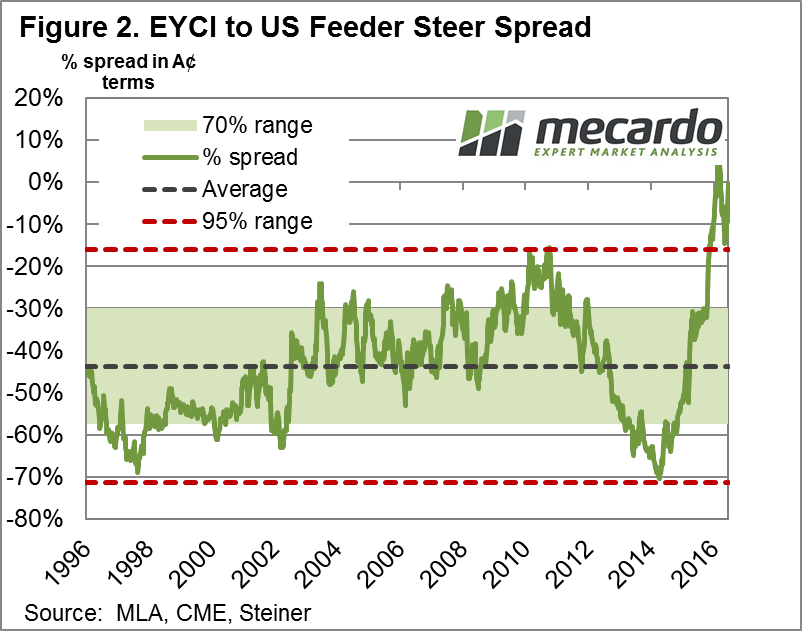

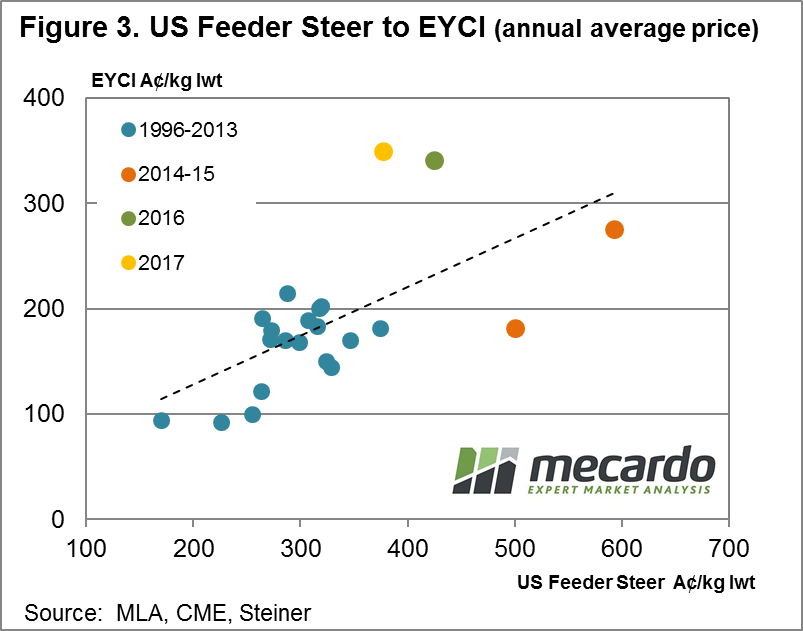

Often at Mecardo we look at local and global cattle price relationships in US$ terms as the US cattle market is one of the key drivers of Australian cattle prices over the longer term. However, in this analysis we flip the magnifying glass to take a look at global prices in our terms. Taking a look at the correlation between US Feeder Steers and the EYCI we can see a moderately strong relationship between the two series when looking at annual average prices expressed in A$ terms – figure 3. Although,

Taking a look at the correlation between US Feeder Steers and the EYCI we can see a moderately strong relationship between the two series when looking at annual average prices expressed in A$ terms – figure 3. Although,  The lift in US prices since October has taken some of the downward pressure off local prices. Although from a longer term historical perspective local prices remain in overvalued territory and have not been helped by a stronger A$ during January.

The lift in US prices since October has taken some of the downward pressure off local prices. Although from a longer term historical perspective local prices remain in overvalued territory and have not been helped by a stronger A$ during January.

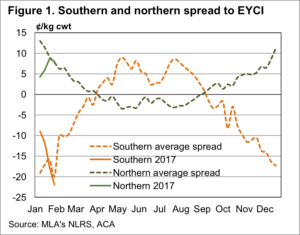

ements suggest this will again be the case, so what does this mean for pricing over the coming months.

ements suggest this will again be the case, so what does this mean for pricing over the coming months. More interesting is what happens from there with the southern spread to the EYCI. Over February, March and April, the southern discount becomes a premium, as the supply of grass finished cattle tightens, as grass supply wanes.

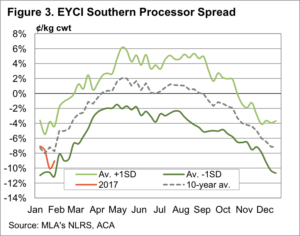

More interesting is what happens from there with the southern spread to the EYCI. Over February, March and April, the southern discount becomes a premium, as the supply of grass finished cattle tightens, as grass supply wanes. It young cattle destined for slaughter, or trade steers and heifers, which are set to benefit the most over the coming months. Figure 3 shows that young cattle sold to processors improve 8% over the late summer and autumn. From the current level of 595¢/kg cwt, a narrowing of the discount to parity, would see the price reach 630-640¢/kg cwt. Prices haven’t been this good since October.

It young cattle destined for slaughter, or trade steers and heifers, which are set to benefit the most over the coming months. Figure 3 shows that young cattle sold to processors improve 8% over the late summer and autumn. From the current level of 595¢/kg cwt, a narrowing of the discount to parity, would see the price reach 630-640¢/kg cwt. Prices haven’t been this good since October.

ood for us if McDonalds sell more burgers in the US.

ood for us if McDonalds sell more burgers in the US.