The percentage price spread premium between the Eastern States Trade Lamb Indicator (ESTLI) and the National Mutton Indicator (NMI) has been narrowing in recent months. It is not unusual to see this occur during the middle of the season. However, the Mecardo team were wondering how much of an impact the price differential has on Australia’s export volumes of lamb and mutton. Is there any substitution effect at play as the relative price of the two sheep meat exports varies?

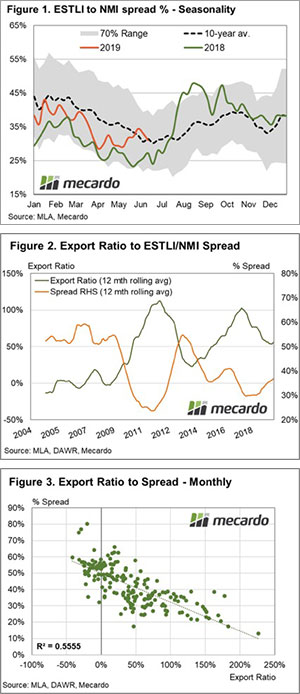

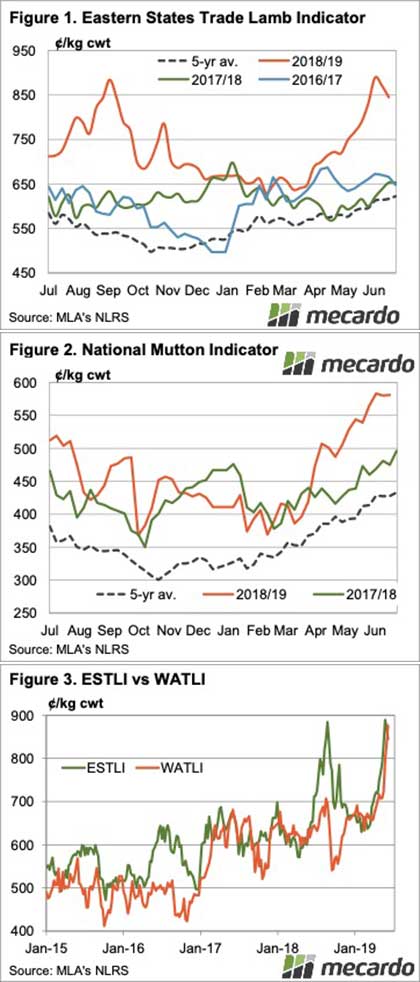

The percentage price spread premium between the ESTLI and NMI has been broadly following its normal seasonal pattern of narrowing throughout the first half of the year, drifting from a high of 43% in January to a low of 28% over April (Figure 1).

As the seasonal pattern demonstrates, it is not uncommon to see the spread premium at its narrowest during winter and it can dip towards the 20-25% spread region. Conversely, peaks toward 50-55% are achievable at the start and end of the season.

We have noted that occasionally month to month export flows to countries like China, that takes both lamb and mutton from Australia, show some signs of substitution. Export trade figures from April to May show that for China lamb volumes increased 10.6% while mutton exports declined 31%.

Indeed, across all trade destinations for the April to May period the total volume of lamb exports increased by 1,999 tonnes swt while mutton exports declined by 2,291 tonnes swt. It begged the question – Is there a relationship between the price differential between lamb and mutton and relative trade volumes?

Analysis of the 12-month rolling average of the percentage spread premium and the export ratio between lamb and mutton volumes shows there is a link. Since 2004, when the percentage spread premium exceeded 50%, lamb export volumes could not get beyond 50% more than mutton export volumes. Similarly, when the percentage spread premium dipped below 30% lamb export volumes expanded to close to double mutton export volumes (Figure 2).

What does it mean?

Monthly correlation analysis between the percentage spread premium and export ratio shows a moderately strong inverse relationship between the two data series, with an R2 of 0.5555 (Figure 3). When the price spread is high, signalling relatively expensive lamb, the trade flows favour mutton and in relative terms, lamb exports weaken. Conversely, when the spread is lower (relatively cheaper lamb) the trade flows favour lamb and lamb export volumes are relatively higher.

Given the low flock numbers presently and historically high prices encouraging increased production/flock rebuilding as soon as climatic conditions allow, there is a reasonable chance that we will see price spreads between the ESTLI and NMI remain toward the lower end of the normal range in the coming seasons. This will be particularly evident when the flock rebuild is able to get underway in earnest and it provides a promising outlook for lamb exporters and producers with lambs that meet the export specifications as the trade flows will favour lamb.

Key points:

- The percentage price spread premium between the ESTLI and NMI has narrowed from January to June, broadly following the normal seasonal trend.

- Historic trends show that when the percentage price spread premium dips below 30% trade flows favour lamb and when the spread extends above 50% they favour mutton.

- Correlation analysis on a monthly basis confirms a moderately strong relationship between price spreads and trade flows.

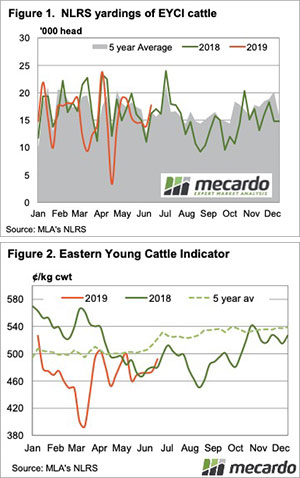

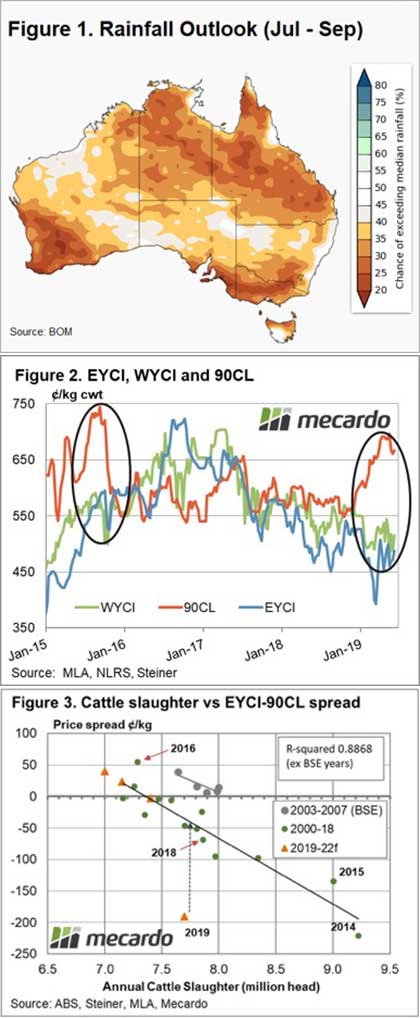

Restocker Steer prices between Victoria and NSW showing the impact of the recent Victoria rains with Victorian Restocker Steers commanding a 30¢ premium over NSW to record a 38¢ gain on the week to close at 258.4¢/kg lwt. Despite the rainfall in Victoria in recent weeks the longer-term outlook is worrying.

Restocker Steer prices between Victoria and NSW showing the impact of the recent Victoria rains with Victorian Restocker Steers commanding a 30¢ premium over NSW to record a 38¢ gain on the week to close at 258.4¢/kg lwt. Despite the rainfall in Victoria in recent weeks the longer-term outlook is worrying.