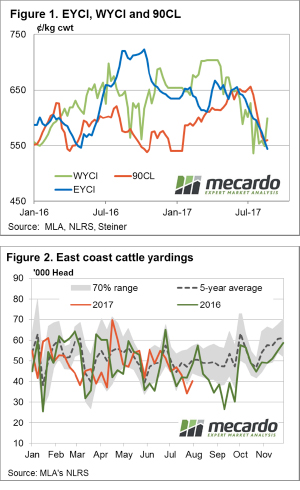

Last week Mecardo looked at when the Eastern Young Cattle Indicator (EYCI) might find a base after a long fall. While prices still eased this week, the rate of decline has slowed, suggesting some support might be found soon.

Technical analysis isn’t a strongpoint, but we do know that when the pace of a rally, or a decline, slows, the market is usually getting close to changing direction. Over the 12 weeks to last Friday the EYCI has fallen 112¢ at a rate of 9.3¢ per week (figure 1).

Technical analysis isn’t a strongpoint, but we do know that when the pace of a rally, or a decline, slows, the market is usually getting close to changing direction. Over the 12 weeks to last Friday the EYCI has fallen 112¢ at a rate of 9.3¢ per week (figure 1).

This week the EYCI lost ‘only’ 4.75¢ to hit yet another 22 month low of 538.75¢/kg cwt. At a dressing percentage of 54%, the EYCI currently sits at 291¢/kg lwt. The National Trade Steer Indicator sits at 299¢/kg lwt, while the National Feeder Steer Indicator is at 300¢. With both Trade and Feeder steers at a premium to the EYCI, it suggests restocker type cattle, and heifers are discounted to the EYCI, to drag the average down.

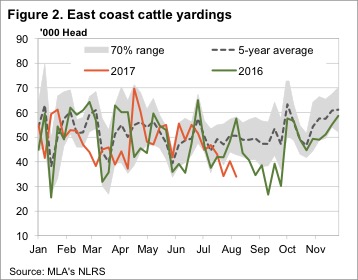

Cattle prices were generally lower despite the weakest yardings for a full week in 11 months (figure 2). It’s interesting to note that at least in the yards cattle supply has been on the decline for nearly two months, and now sit well below last year and the five year average.

Weakening prices amid weakening supply is a pretty good indicator of weaker demand. For young cattle we can blame restockers, who have pulled back after driving the market for two years. For finished cattle the abundance of cattle on feed is helping to keep a lid on finished cattle values.

Weakening prices amid weakening supply is a pretty good indicator of weaker demand. For young cattle we can blame restockers, who have pulled back after driving the market for two years. For finished cattle the abundance of cattle on feed is helping to keep a lid on finished cattle values.

The week ahead

With no real precipitation on the forecast, it’s unlikely we’ll see cattle prices rising any time soon. We do think that we’re likely to see some support soon, and cattle prices tracking sideways for a period. From there we will be looking for a northern wet season to kick-start the market, with 10% upside achievable.

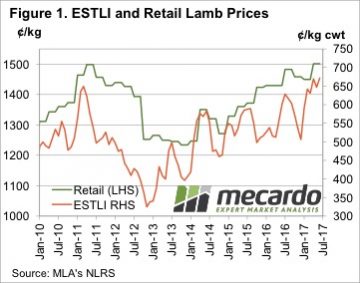

The sharp rise in saleyard and over the hooks lamb prices in the first half of 2017 took a while to translate into strong retail lamb prices, but it did eventually push them to a record. The average retail lamb price increased 51.77¢, or 3.6%, to move to 1501.37¢/kg rwt.

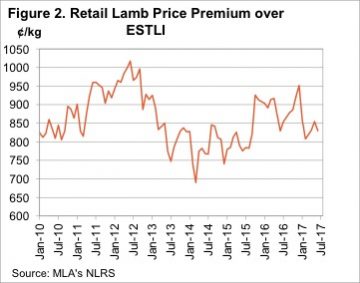

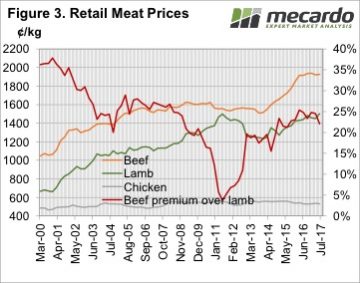

The sharp rise in saleyard and over the hooks lamb prices in the first half of 2017 took a while to translate into strong retail lamb prices, but it did eventually push them to a record. The average retail lamb price increased 51.77¢, or 3.6%, to move to 1501.37¢/kg rwt. Things are a bit different this time. Obviously in real terms lamb remains cheaper than it was in 2011, and compared to its main red meat competitor it is not yet in the expensive range. Figure 3 shows retail beef prices remained strong in the June quarter, and despite the rise in lamb values, beef it still at a 22% premium. In 2011 the beef premium shrunk to just 4%, and this put considerable pressure on lamb demand.

Things are a bit different this time. Obviously in real terms lamb remains cheaper than it was in 2011, and compared to its main red meat competitor it is not yet in the expensive range. Figure 3 shows retail beef prices remained strong in the June quarter, and despite the rise in lamb values, beef it still at a 22% premium. In 2011 the beef premium shrunk to just 4%, and this put considerable pressure on lamb demand. There remains some concern in the expensive red meat prices relative to static cheap chicken prices, and this is being borne out in consumption levels.

There remains some concern in the expensive red meat prices relative to static cheap chicken prices, and this is being borne out in consumption levels.

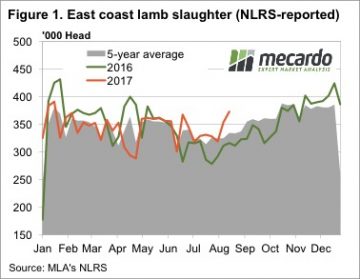

Markets can sometimes defy even the most rusted on seasonal trend. A couple of anomalies caught our eye this week. Figure 1 shows the massive jump in lamb slaughter over the last two weeks, to the point where for the week ending the 18th August, we hit its highest level since the third week of 2017. In fact lamb slaughter last week was the third highest for the year.

Markets can sometimes defy even the most rusted on seasonal trend. A couple of anomalies caught our eye this week. Figure 1 shows the massive jump in lamb slaughter over the last two weeks, to the point where for the week ending the 18th August, we hit its highest level since the third week of 2017. In fact lamb slaughter last week was the third highest for the year. There has been some talk around about slow lamb growth rates impacting on the supply of finished lambs early in the selling season. While this could explain continued strong prices, the high slaughter rates suggest supply is ok, and demand may be pushing prices higher.

There has been some talk around about slow lamb growth rates impacting on the supply of finished lambs early in the selling season. While this could explain continued strong prices, the high slaughter rates suggest supply is ok, and demand may be pushing prices higher. The optimism that was evident following the last two weeks of strong wool market sales suffered a reality check this week. With the market only selling in Melbourne & Sydney, and with the sale conducted on Tuesday & Wednesday due to “Wool Week” activities, it was a sharp correction across all types that occurred.

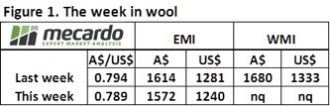

The optimism that was evident following the last two weeks of strong wool market sales suffered a reality check this week. With the market only selling in Melbourne & Sydney, and with the sale conducted on Tuesday & Wednesday due to “Wool Week” activities, it was a sharp correction across all types that occurred. The response from growers was to pass-in14% of the offered wool, resulting in 32,342 bales sold for the week, well down on the average for this season. It is an interesting situation with the market trading at historic highs and yet we have a pass-in rate that is high by any measure. Growers are clearly comfortable holding out, despite these historically good prices, suggesting their not too concerned that any major correction will occur in the near future.

The response from growers was to pass-in14% of the offered wool, resulting in 32,342 bales sold for the week, well down on the average for this season. It is an interesting situation with the market trading at historic highs and yet we have a pass-in rate that is high by any measure. Growers are clearly comfortable holding out, despite these historically good prices, suggesting their not too concerned that any major correction will occur in the near future. Next week Fremantle rejoins the selling roster and 44,750 bales are rostered (Figure 2). The pattern over recent months has been for the market to rally, then correct but quickly recover as growers hold wool back from sale. This is likely to be the pattern going forward so next week there is an air of optimism from sellers that we can see the market at least hold.

Next week Fremantle rejoins the selling roster and 44,750 bales are rostered (Figure 2). The pattern over recent months has been for the market to rally, then correct but quickly recover as growers hold wool back from sale. This is likely to be the pattern going forward so next week there is an air of optimism from sellers that we can see the market at least hold.

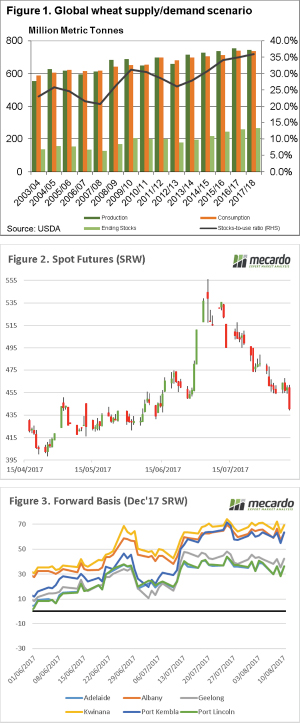

In recent times, there have been accusations of Russian tampering in western politics. In the wheat game, the Russian crop is interfering with our grain pricing! In this week’s comment, we highlight the Black Sea, and its impact on global pricing.

In recent times, there have been accusations of Russian tampering in western politics. In the wheat game, the Russian crop is interfering with our grain pricing! In this week’s comment, we highlight the Black Sea, and its impact on global pricing.

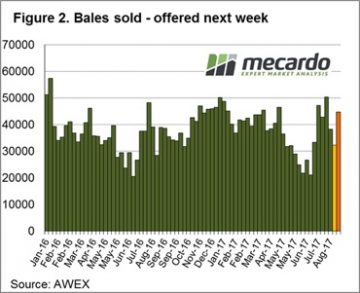

Average trade lamb prices continue to track around the 600¢ mark on the east coast, and higher in the west. Lamb and sheep slaughter has rallied and is sitting well above last year’s mark, but demand appear to be keeping pace with supply.

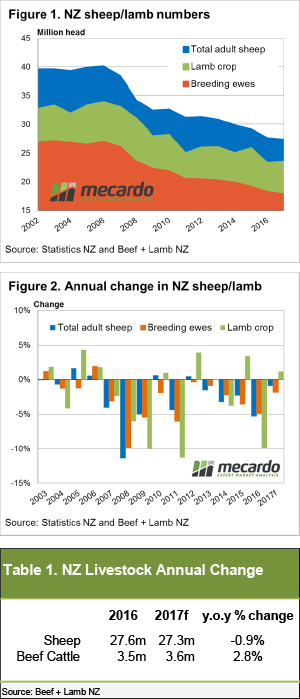

Average trade lamb prices continue to track around the 600¢ mark on the east coast, and higher in the west. Lamb and sheep slaughter has rallied and is sitting well above last year’s mark, but demand appear to be keeping pace with supply. Beef and Lamb NZ’s mid-year stock number survey shows the Kiwi sheep flock and number of breeding ewes continuing to decline into 2017, albeit at a lesser degree than in previous seasons. Although, good pasture and ewe condition throughout the breeding cycle has seen an improvement in the anticipated lamb crop for this year.

Beef and Lamb NZ’s mid-year stock number survey shows the Kiwi sheep flock and number of breeding ewes continuing to decline into 2017, albeit at a lesser degree than in previous seasons. Although, good pasture and ewe condition throughout the breeding cycle has seen an improvement in the anticipated lamb crop for this year. National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

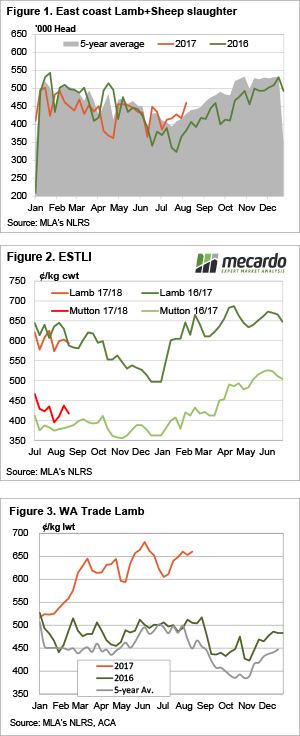

Last week the market kicked off for the season with full force and we expected week 2 to be a little lacklustre in comparison. But no, the Australian Dollar plunged, the auction price peaked and those with the patience to hold on past the first week came out grinning.

Last week the market kicked off for the season with full force and we expected week 2 to be a little lacklustre in comparison. But no, the Australian Dollar plunged, the auction price peaked and those with the patience to hold on past the first week came out grinning. In the past week there has been significant posturing from both the Donald, and North Korea threatening to bring ‘fire and fury’ upon one another. It looks like the USDA might have fired the first salvo, with the release of the August WASDE report. In this week’s comment, we will look at what the fallout has been.

In the past week there has been significant posturing from both the Donald, and North Korea threatening to bring ‘fire and fury’ upon one another. It looks like the USDA might have fired the first salvo, with the release of the August WASDE report. In this week’s comment, we will look at what the fallout has been.