As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

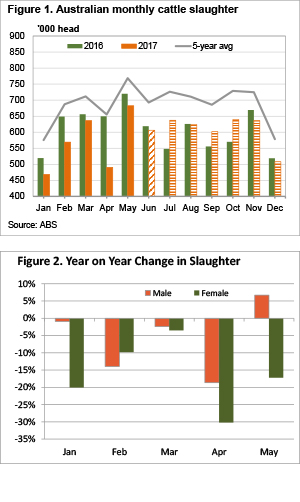

MLA’s latest cattle projection forecasts, released in April, pegged 2017 national cattle slaughter at 7.1 million head. According to the Australian Bureau of Statistics (ABS) the first five months of 2017 saw 2.84 million head of cattle go over the hooks. According to MLA’s weekly slaughter figures June cattle slaughter was around 2% behind 2016.

Figure 1 shows that using the ABS figures, and MLA’s numbers for June, has 2017 slaughter trading well behind 2016. Our estimate puts cattle slaughter for the first half of 2017 at 3.45 million head, 9.4% lower than 2016. More importantly, the total number of cattle slaughtered to the end of June is just 48.6% of MLA’s annual forecast.

For July to December we have applied average seasonality to the number of cattle which still need to be slaughtered to reach 7.1 million head. For the July to December period cattle slaughter will have to lift 5% on last year’s levels.

July 2016 was a very low slaughter month, as were September and October, when compared to the five year average. This is why figure 1 has most of the increased slaughter for the second half of the year in those months.

Figure 2 shows that the herd rebuild in the first five months saw the year on year decline in female slaughter outstrip their male counterparts. Up until May female cattle slaughter was down 16%, while male slaughter was down just 6%. Male slaughter was actually higher than last year in May.

On face value we can say that if supply is to pick up in the second half of the year, were more likely to see an increase in cows and heifers, than steers or bullocks.

Key points:

- Cattle slaughter for the first half of 2017 has been 9.4% lower than 2016, and not on track to meet forecasts.

- If Australian cattle slaughter is to meet forecasts, it will have to be 5% higher than last year.

- An increase in cattle supply is likely to see prices remain below 2016 over the coming months.

What does this mean?

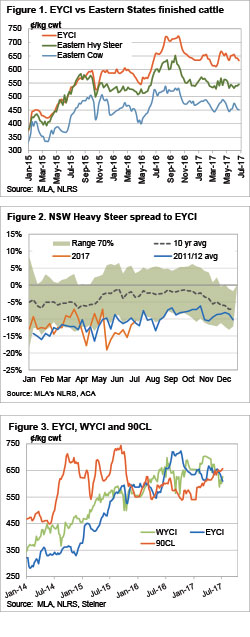

Simple economic theory says that higher supply, and steady demand, will result in lower prices. We are already seeing lower prices than last year in cattle markets, but the question is, how much lower can prices go? Given where export beef markets are sitting, and the fact we should be hitting the seasonal low point for cattle supply, it’s hard to see too much further downside in the short term.

However, if it remains dry we head into September, the increased supply could push the EYCI back towards the low 500¢ level. Downside is likely to be stronger for cows, while heavy slaughter steers are likely to fare better, as supplies haven’t been held back as hard in the first half of the year.

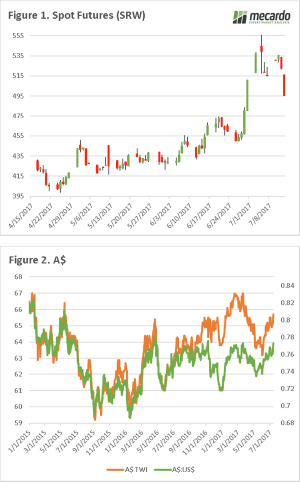

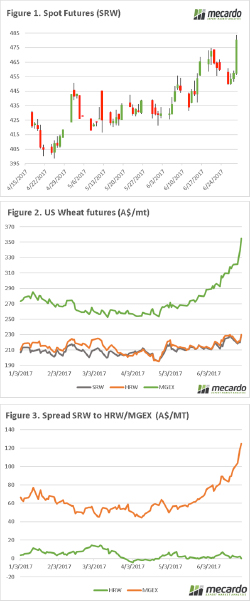

This week we saw the USDA release their July World Agricultural Supply and Demand estimates, the market has reacted to this news. In this update, we take a short look at Chicago futures & the dollar.

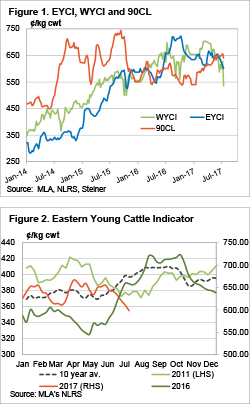

This week we saw the USDA release their July World Agricultural Supply and Demand estimates, the market has reacted to this news. In this update, we take a short look at Chicago futures & the dollar. The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

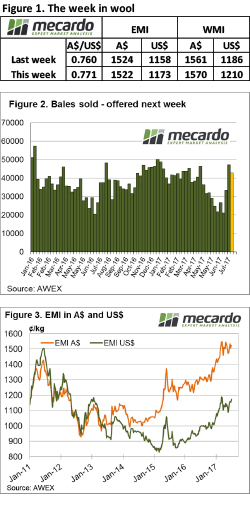

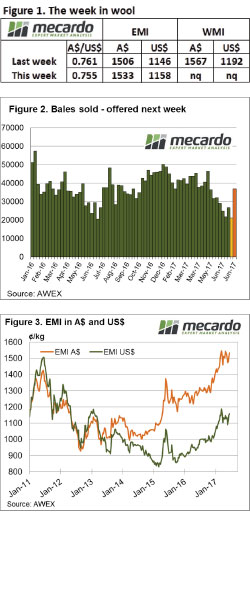

It seems wool growers are selling as soon as the wool is shorn, with another large offering coming forward. Despite this, the market performed well despite receiving no help from a rising A$. AWEX report that W.A.’s unseasonaly dry weather has seen growers bringing forward shearing causing the increase in supply this week.

It seems wool growers are selling as soon as the wool is shorn, with another large offering coming forward. Despite this, the market performed well despite receiving no help from a rising A$. AWEX report that W.A.’s unseasonaly dry weather has seen growers bringing forward shearing causing the increase in supply this week.

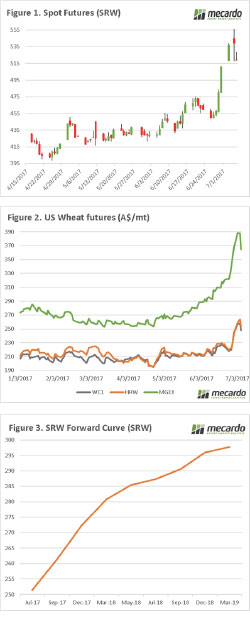

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

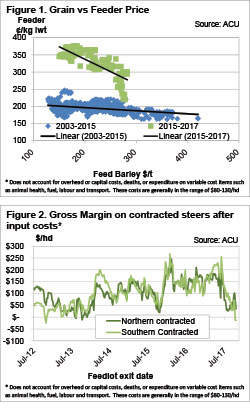

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

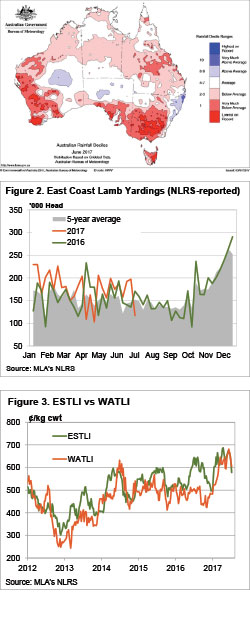

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak.

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak. It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come?

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come?