Cattle markets found a little support this week, with the Eastern Young Cattle Indicator (EYCI) finishing relatively steady. Weaker yardings and marginally stronger export prices provided some support.

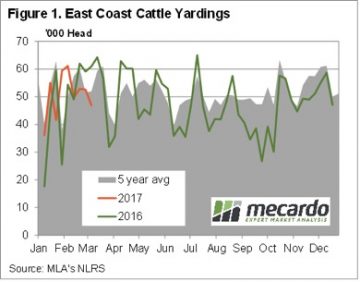

East Coast cattle yardings fell to 6 week lows this week, as lower prices deterred growers from sending cattle to the yards. Figure 1 shows that yardings this week were down 10% for the week, and 23% on the same time last year. With the public holiday next week in Victoria, yardings are likely to be lower again.

East Coast cattle yardings fell to 6 week lows this week, as lower prices deterred growers from sending cattle to the yards. Figure 1 shows that yardings this week were down 10% for the week, and 23% on the same time last year. With the public holiday next week in Victoria, yardings are likely to be lower again.

Despite the steady EYCI, which this week sits at 614.25¢/kg cwt, there were some big market movements. In Queensland Trade Steers fell 70¢ to 490¢/kg cwt. In NSW Trade Steers were up 14¢ to 624¢/kg cwt. We won’t see a 134¢ spread between cattle in NSW and Queensland for long, with the rest of the market suggesting the price should meet somewhere around 550-600¢ level.

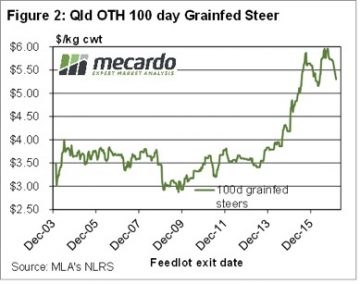

Not helping the market at the moment is the sharp fall in Grainfed cattle prices. Figure 2 shows the Queensland Over the Hooks 100 day Grainfed steer, and it’s not pretty. Since the start of the year 100 day Grainfed cattle prices have fallen consistently, and have now lost 40¢, or 7%, to sit at a 10 month low of 530¢/kg cwt.

We’ll have more on how this might impact young cattle markets in our analysis next week.

In the West the rain and dearth of supply has the market sitting well above the east coast. While there were no quotes from saleyards, over the hooks yearling cattle remain in the 580-630¢ range.

In the West the rain and dearth of supply has the market sitting well above the east coast. While there were no quotes from saleyards, over the hooks yearling cattle remain in the 580-630¢ range.

The week ahead

There is a bit of rain on the forecast for the coming week, especially for south east Queensland and northern NSW. A bit of rain should support cattle prices for a little while, but there should be a strong supply of young cattle, and slaughter cattle, in April and May. This usually pushes prices in the north lower, and given southern prices remain at a good premium, they should be dragged lower as well.

.

All going well, and with the rain landing in the right places at the right time, Australia can be expected to have a bumper canola crop. This is a story likely to be repeated across the rest of the world with the fall in cereal prices.

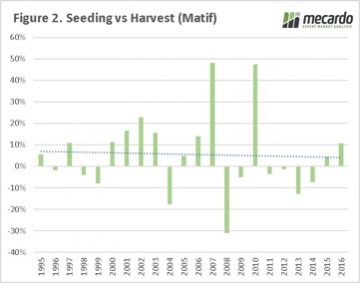

All going well, and with the rain landing in the right places at the right time, Australia can be expected to have a bumper canola crop. This is a story likely to be repeated across the rest of the world with the fall in cereal prices. When the Matif contract is examined a different picture emerges. The price during the Australian harvest has been lower only 10 times out of the past 22 seasons, with an average positive change of 5%. However, if we preclude the large changes in 2007 and 2010 the average drops to a meagre 1%.

When the Matif contract is examined a different picture emerges. The price during the Australian harvest has been lower only 10 times out of the past 22 seasons, with an average positive change of 5%. However, if we preclude the large changes in 2007 and 2010 the average drops to a meagre 1%.

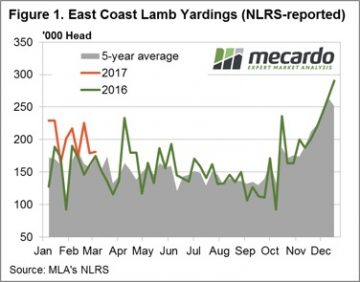

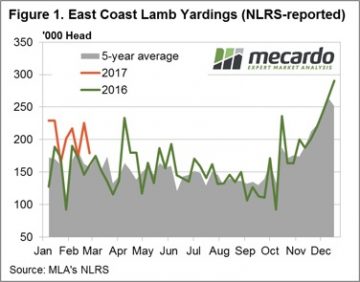

Figure 1 highlights the recent pattern of east coast lamb throughput showing a much more subdued pattern this week, in contrast to the seesaw of the weeks prior. Yarding figures hardly budging with a meagre 1.4% rise to sneak above 181,000 head. The Eastern States Trade Lamb Indicator (ESTLI) responding to the stable throughput settling exactly where is closed this time last week at 611¢/kg cwt. Stability in price the order of the day for most categories of lamb in the national indicators too with 0-1% gains in all classes of lamb, except national restocker lambs, down 3% to $96 per head.

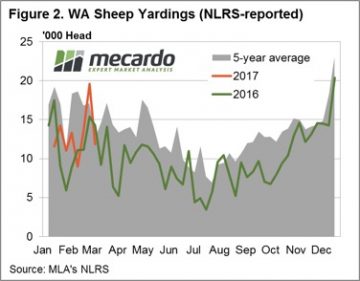

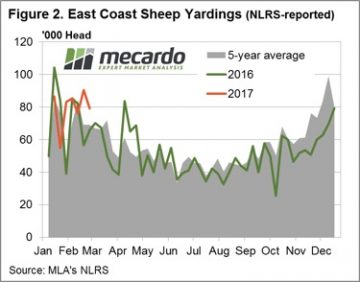

Figure 1 highlights the recent pattern of east coast lamb throughput showing a much more subdued pattern this week, in contrast to the seesaw of the weeks prior. Yarding figures hardly budging with a meagre 1.4% rise to sneak above 181,000 head. The Eastern States Trade Lamb Indicator (ESTLI) responding to the stable throughput settling exactly where is closed this time last week at 611¢/kg cwt. Stability in price the order of the day for most categories of lamb in the national indicators too with 0-1% gains in all classes of lamb, except national restocker lambs, down 3% to $96 per head. In contrast, WA mutton experiencing a stellar performance with an 11% price rise to 478¢/kg cwt. Spurred on by much softer supply (as shown in figure 2) with WA mutton throughput down 39.6%. The impressive performance this season not limited to mutton in the west with the Western Australian Trade Lamb Indicator (WATLI) continuing to press higher this week to close at 629¢ – figure 3. The tighter season and firm export demand helping support WATLI and WA mutton, 31% and 78% higher than this time last year – respectively.

In contrast, WA mutton experiencing a stellar performance with an 11% price rise to 478¢/kg cwt. Spurred on by much softer supply (as shown in figure 2) with WA mutton throughput down 39.6%. The impressive performance this season not limited to mutton in the west with the Western Australian Trade Lamb Indicator (WATLI) continuing to press higher this week to close at 629¢ – figure 3. The tighter season and firm export demand helping support WATLI and WA mutton, 31% and 78% higher than this time last year – respectively. Forecast rainfall between 5-15 mm to much of the sheep bearing regions of the nation next week will give slight relief to the recent dry spell to much of SA and Western Victoria during the last fortnight. This is likely to encourage further price consolidation to continue for the next few weeks for lamb and sheep markets.

Forecast rainfall between 5-15 mm to much of the sheep bearing regions of the nation next week will give slight relief to the recent dry spell to much of SA and Western Victoria during the last fortnight. This is likely to encourage further price consolidation to continue for the next few weeks for lamb and sheep markets.

Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook.

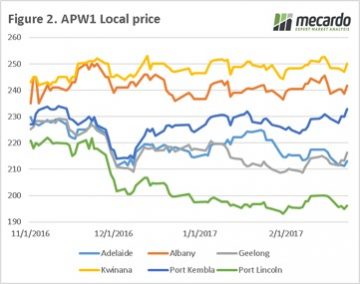

Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook. Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year.

Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year. The ongoing strong auction is providing good opportunities in the forward market with

The ongoing strong auction is providing good opportunities in the forward market with  There were rumours this week that there might be some form of ‘Executive Order’ regarding the amount of Ethanol to be produced in the US. Without boring you with the details, the market took the view that Trump was going to increase the demand for ethanol, which means more corn and oilseeds will be required in the US to make it.

There were rumours this week that there might be some form of ‘Executive Order’ regarding the amount of Ethanol to be produced in the US. Without boring you with the details, the market took the view that Trump was going to increase the demand for ethanol, which means more corn and oilseeds will be required in the US to make it. The grim weather outlook released last week might add a bit of strength to grain prices. From now on many grower will take the view that grain in store is a good drought hedge, with prices likely to have a lift if the autumn break is late, or worst case, non-existent.

The grim weather outlook released last week might add a bit of strength to grain prices. From now on many grower will take the view that grain in store is a good drought hedge, with prices likely to have a lift if the autumn break is late, or worst case, non-existent.

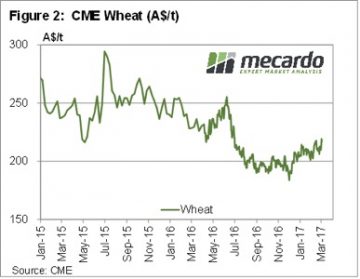

Just as spring price peaks lasted a lot longer in 2016, the autumn price decline appears to be coming early in 2017. While finished cattle prices were relatively steady this week, waning restocker demand appears to be seeing young cattle prices continue easing.

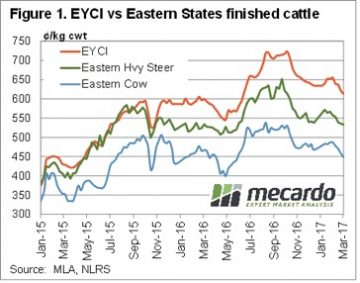

Just as spring price peaks lasted a lot longer in 2016, the autumn price decline appears to be coming early in 2017. While finished cattle prices were relatively steady this week, waning restocker demand appears to be seeing young cattle prices continue easing. Young cattle still have some way to fall before they are back in line with ‘normal’ discounts to the EYCI. Figure 2 shows that despite the fall in the EYCI, Heavy steers remain at a 15% discount to the EYCI, while Cows are at a 25% discount. Heavy slaughter cattle discounts have narrowed marginally from two and five year lows, but are still a long way from their long term averages.

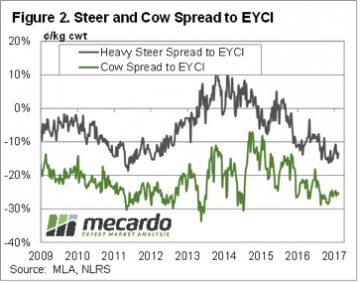

Young cattle still have some way to fall before they are back in line with ‘normal’ discounts to the EYCI. Figure 2 shows that despite the fall in the EYCI, Heavy steers remain at a 15% discount to the EYCI, while Cows are at a 25% discount. Heavy slaughter cattle discounts have narrowed marginally from two and five year lows, but are still a long way from their long term averages. Frequent readers of Mecardo will not find it surprising that long-term annual average local cattle prices have a strong correlation to annual average US prices. This analysis takes a look at the US cattle cycle patterns since 1920 to get a perspective of what the normal cycle looks like, where we are currently in the cycle and the usual price activity during herd growth and herd decline.

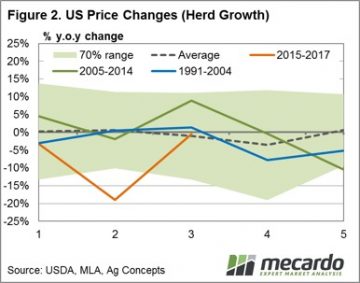

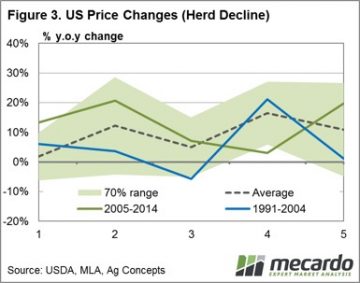

Frequent readers of Mecardo will not find it surprising that long-term annual average local cattle prices have a strong correlation to annual average US prices. This analysis takes a look at the US cattle cycle patterns since 1920 to get a perspective of what the normal cycle looks like, where we are currently in the cycle and the usual price activity during herd growth and herd decline. Given the average cycle lasts ten years and the near 50/50 split between herd rebuild to herd decline during the cycle we took a look at annual price percentage changes during the first five years of each cycle (the herd rebuild) and the final five years of each cycle (the herd decline). Figure 2 shows the annual price change pattern for the first five years of the cycle. Interestingly, the data since 1920 demonstrates that the average price gain pattern for the first five years is reasonably smooth and tends toward 0% price movement, yet can fluctuate plus or minus 15% throughout the period. It suggests that there is a reasonably even chance of price gains or falls of a 15% magnitude during the herd rebuild phase of the US cycle – almost like a toss of a coin.

Given the average cycle lasts ten years and the near 50/50 split between herd rebuild to herd decline during the cycle we took a look at annual price percentage changes during the first five years of each cycle (the herd rebuild) and the final five years of each cycle (the herd decline). Figure 2 shows the annual price change pattern for the first five years of the cycle. Interestingly, the data since 1920 demonstrates that the average price gain pattern for the first five years is reasonably smooth and tends toward 0% price movement, yet can fluctuate plus or minus 15% throughout the period. It suggests that there is a reasonably even chance of price gains or falls of a 15% magnitude during the herd rebuild phase of the US cycle – almost like a toss of a coin. Given where we sit in the current cycle there is the potential for another 2-3 years of further gains to US herd size, albeit at a diminishing rate. Herd decline is expected to start around the end of decade and is likely to see cattle price supported in the US from 2020 onwards.

Given where we sit in the current cycle there is the potential for another 2-3 years of further gains to US herd size, albeit at a diminishing rate. Herd decline is expected to start around the end of decade and is likely to see cattle price supported in the US from 2020 onwards.

SA and WA mutton both faring well this week up 11.8% and 13.1%, respectively. NSW and Vic mutton on marginally softer with falls of 0.7% and 2.1%. Figure 2 showing the weekly decline in East coast mutton throughput not as severe as that for East coast lamb, down only 12.2% to just under 80,000 head.

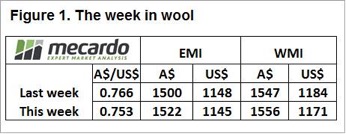

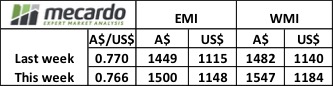

SA and WA mutton both faring well this week up 11.8% and 13.1%, respectively. NSW and Vic mutton on marginally softer with falls of 0.7% and 2.1%. Figure 2 showing the weekly decline in East coast mutton throughput not as severe as that for East coast lamb, down only 12.2% to just under 80,000 head. The broad-based demand evident in the higher EMI in both local and US$ terms, gaining 51A¢ and 33US¢, respectively. The EMI not the only indicator to crack $15 this week with the WMI posting a 65A¢ rise, or 44¢ in US$ terms – Figure 1.

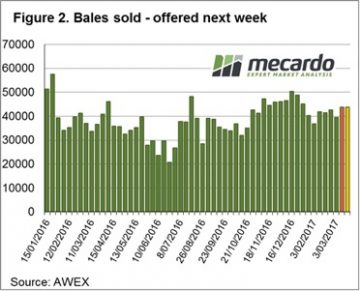

The broad-based demand evident in the higher EMI in both local and US$ terms, gaining 51A¢ and 33US¢, respectively. The EMI not the only indicator to crack $15 this week with the WMI posting a 65A¢ rise, or 44¢ in US$ terms – Figure 1. Some exporter reports of just not having access to enough wool to sell at the moment really fuelling the surge. A total of 40,626 bales offered this week with 39,461 sold on the red-hot demand kept the pass in rate contained to 2.9% – Figure 2.

Some exporter reports of just not having access to enough wool to sell at the moment really fuelling the surge. A total of 40,626 bales offered this week with 39,461 sold on the red-hot demand kept the pass in rate contained to 2.9% – Figure 2.

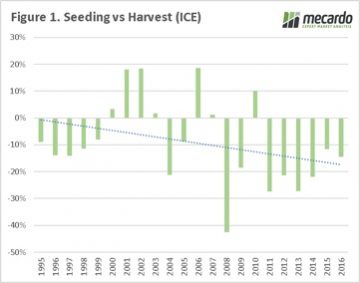

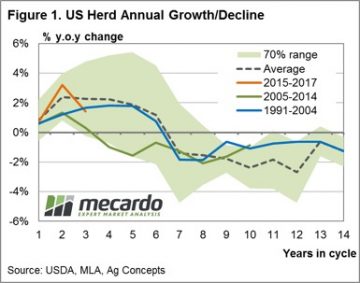

The futures market has improved since the start of harvest, but locally that hasn’t transpired into higher prices. In this week’s comment, we look at the direction of the market since the beginning of November, and where the winners and losers have been.

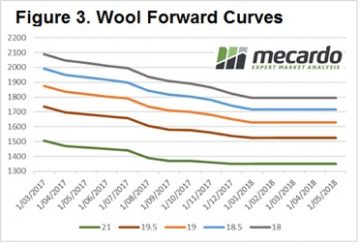

The futures market has improved since the start of harvest, but locally that hasn’t transpired into higher prices. In this week’s comment, we look at the direction of the market since the beginning of November, and where the winners and losers have been. When we look at a local level, at the physical APW1 price (figure 2), the trend across most ports has been for the market to trade in a narrow band and is currently sitting at similar levels to the start of November. The glaring exceptions are Adelaide, Port Lincoln and Geelong which are trading substantially below their start of harvest pricing levels.

When we look at a local level, at the physical APW1 price (figure 2), the trend across most ports has been for the market to trade in a narrow band and is currently sitting at similar levels to the start of November. The glaring exceptions are Adelaide, Port Lincoln and Geelong which are trading substantially below their start of harvest pricing levels. All eyes on the weather. Locally the BOM point towards it being drier than normal for the next three months, which will start to zap away some of that beneficial subsoil moisture that has been retained from the wet winter and spring.

All eyes on the weather. Locally the BOM point towards it being drier than normal for the next three months, which will start to zap away some of that beneficial subsoil moisture that has been retained from the wet winter and spring.