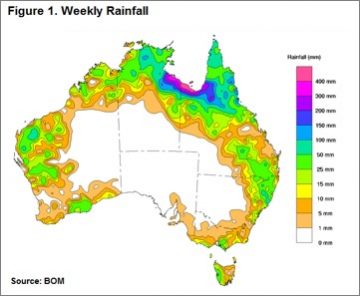

Much of NSW and south-east Queensland has received less than 30mm of rain this week and the drier/hotter than normal spell since the start of the year in the north, combined with the much drier than usual March to May rainfall outlook (recently released from the Bureau), seems to have brought forward some supply with Queensland slaughter levels still tracking higher this week weighing on the broader market.

Much of NSW and south-east Queensland has received less than 30mm of rain this week and the drier/hotter than normal spell since the start of the year in the north, combined with the much drier than usual March to May rainfall outlook (recently released from the Bureau), seems to have brought forward some supply with Queensland slaughter levels still tracking higher this week weighing on the broader market.

Figure 1 highlights the rainfall pattern across the country since the 16th February showing reasonable levels of northern rainfall limited to the far north, a small patch in south east Queensland and north east NSW. Prices responding to the weather with declines averaging 2% noted for nearly all of the NLRS reported saleyard cattle categories this week in both Queensland and NSW, with Queensland trade steers the only group to buck the trend across the two states with a 13% gain to 316¢/kg lwt. Victoria and SA faring better, with SA trade steers leading the pack, up 9% to 327¢/kg lwt and Vic medium steers posting a respectable 5% rise to 316¢/kg lwt.

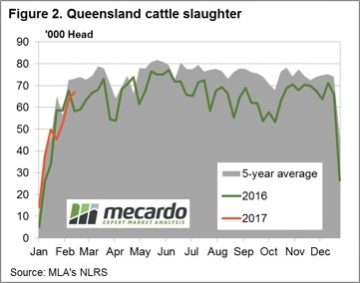

The higher supply being drawn out in the north evident in the slaughter figures for Queensland for the week ending 16th February shown in figure 2. A gain of 5% on the week to see it post slightly over 67,000 head, an increase of 15% on the same week last year.

The northern price declines weighing on the Eastern Young Cattle Indicator (EYCI) to see it drift to lows not seen since June 2016 to close the week down 2.4% to 621.75¢/kg cwt – figure 3.

The northern price declines weighing on the Eastern Young Cattle Indicator (EYCI) to see it drift to lows not seen since June 2016 to close the week down 2.4% to 621.75¢/kg cwt – figure 3.

Although it’s not all doom and gloom with the 90CL beef export price to the US posting a 1.6% gain to see it back above 600¢ in A$ terms and hitting highs not seen since August 2016 to close at 601.3¢/kg CIF.

The week ahead

Despite the spectre of drier than normal seasonal factors weighing on the market this week the relatively tight supply of cattle across the nation and improving export prices, which are likely to continue to be supported as the US move closer toward the “grilling season”, should provide a base to broader cattle prices in the coming few weeks/months.

It’s likely we are in for a bit of sideways movement between 580 – 650¢/kg cwt for the EYCI until the seasonal winter tightening of supply sees it peak around the 700¢ level.

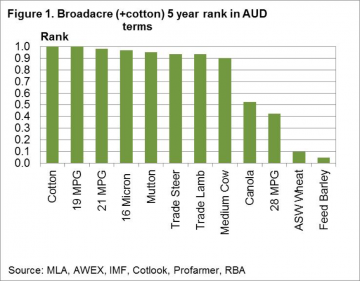

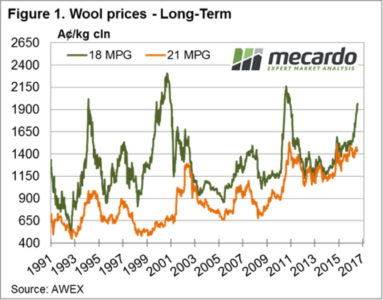

Figure 1 shows the January 2017 five year price rank for a range of broad acre (plus cotton) commodities grown in Australia. The price rank is looked at in Australian dollar terms, as farmers here in Australia see the prices.Basically the news is all good for livestock products (wool and meat) with the exception of crossbred wool (represented here by the 28 MPG). Five year price ranks are all in the top decile, meaning they have traded at lower levels for 90% of more of the past five years. Cotton also is trading in the top decile. At the other end of the scale lie canola, wheat and barley, with canola performing reasonably well by trading at median levels. Wheat and barley are in the bottom decile for the past five years.

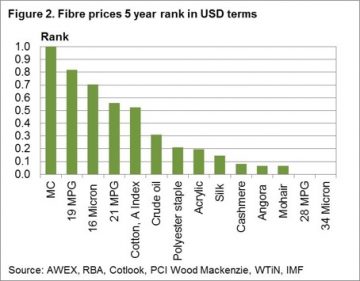

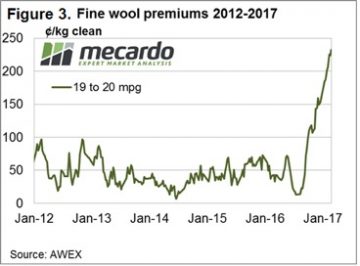

Figure 1 shows the January 2017 five year price rank for a range of broad acre (plus cotton) commodities grown in Australia. The price rank is looked at in Australian dollar terms, as farmers here in Australia see the prices.Basically the news is all good for livestock products (wool and meat) with the exception of crossbred wool (represented here by the 28 MPG). Five year price ranks are all in the top decile, meaning they have traded at lower levels for 90% of more of the past five years. Cotton also is trading in the top decile. At the other end of the scale lie canola, wheat and barley, with canola performing reasonably well by trading at median levels. Wheat and barley are in the bottom decile for the past five years. The next step is to look at these commodity prices from outside of Australia. In this case we use US dollar five year percentiles and break the commodities into groups. Figure 2 looks at fibres, including wool from Australia and a range of other apparel fibres. The price ranks range from a high top decile performance by the Merino Cardings indicator through to bottom decile performances by cashmere, angora, mohair and crossbred wool. The merino combing indicators perform well (ranging from the sixth to the ninth decile) well above oil and the synthetic fibres. Cotton comes in close to the 21 MPG in the sixth decile. The longer the disparity continues between the high merino rankings and lower rankings for the major fibres, the more likely some demand will shift out of merino (especially the broader side of 19 micron) to alternative fibres.

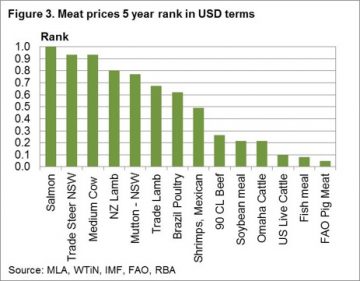

The next step is to look at these commodity prices from outside of Australia. In this case we use US dollar five year percentiles and break the commodities into groups. Figure 2 looks at fibres, including wool from Australia and a range of other apparel fibres. The price ranks range from a high top decile performance by the Merino Cardings indicator through to bottom decile performances by cashmere, angora, mohair and crossbred wool. The merino combing indicators perform well (ranging from the sixth to the ninth decile) well above oil and the synthetic fibres. Cotton comes in close to the 21 MPG in the sixth decile. The longer the disparity continues between the high merino rankings and lower rankings for the major fibres, the more likely some demand will shift out of merino (especially the broader side of 19 micron) to alternative fibres. Figure 3 looks at meat and protein prices from around the world. Salmon is the best performer followed by Australian beef and Australasian sheep meat prices. At the other end of the rankings are range of US beef quotes, along with fishmeal and the FAO pig meat index. The big discrepancy between Australian and US beef price ranks indicates some risk to Australian prices if US prices do not lift.

Figure 3 looks at meat and protein prices from around the world. Salmon is the best performer followed by Australian beef and Australasian sheep meat prices. At the other end of the rankings are range of US beef quotes, along with fishmeal and the FAO pig meat index. The big discrepancy between Australian and US beef price ranks indicates some risk to Australian prices if US prices do not lift.

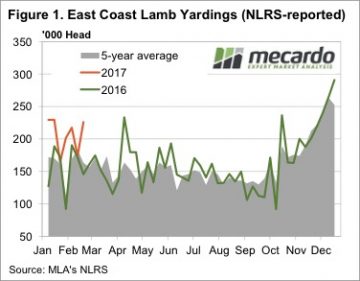

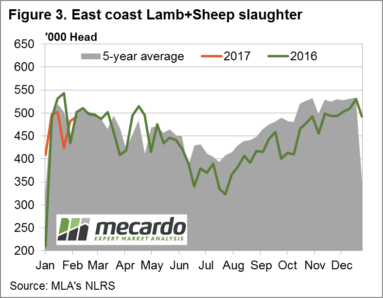

Just when we thought lamb supply was surely starting to wane, this week saw east coast yardings jump to their second highest level for the year. Figure 1 shows east coast lamb yardings, which were 55% stronger than the same time week last year.

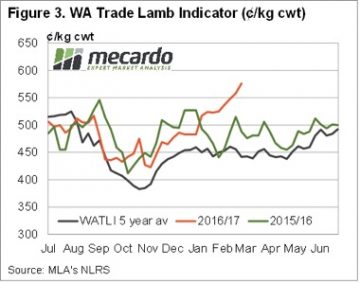

Just when we thought lamb supply was surely starting to wane, this week saw east coast yardings jump to their second highest level for the year. Figure 1 shows east coast lamb yardings, which were 55% stronger than the same time week last year. In WA lamb prices defied the larger yardings, rising 18¢ to 576¢/kg cwt. The WATLI is showing an impressive upward trend, and has hit a 2.5 year high (figure 3).

In WA lamb prices defied the larger yardings, rising 18¢ to 576¢/kg cwt. The WATLI is showing an impressive upward trend, and has hit a 2.5 year high (figure 3).

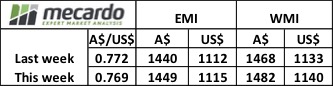

The EMI was up A$0.09, while in US$ terms it improved 3 cents with the Au$ quoted slightly lower for the week. Cardings continue to out-perform, with all 3 selling centres reporting strong increases and the relative Cardings indicators all nudging 1200 cents. (Fig 1.) Note that before 2011 the Cardings indicator rarely bobbed above 600 cents.

The EMI was up A$0.09, while in US$ terms it improved 3 cents with the Au$ quoted slightly lower for the week. Cardings continue to out-perform, with all 3 selling centres reporting strong increases and the relative Cardings indicators all nudging 1200 cents. (Fig 1.) Note that before 2011 the Cardings indicator rarely bobbed above 600 cents. Two points regarding clip preparation are worth noting as the wool market dynamics continue to evolve. These points are at the extreme ends of the micron spectrum with change noted in the fine & superfine market as well as the X Bred market.

Two points regarding clip preparation are worth noting as the wool market dynamics continue to evolve. These points are at the extreme ends of the micron spectrum with change noted in the fine & superfine market as well as the X Bred market. This week Riemann traded solid volumes, with a spread of trades across the 18.5, 19 and 21 MPG types, and for settlements from March 2017 out to July 2018. Price levels were seen as attractive to growers looking to capture some of the market momentum for future clips.

This week Riemann traded solid volumes, with a spread of trades across the 18.5, 19 and 21 MPG types, and for settlements from March 2017 out to July 2018. Price levels were seen as attractive to growers looking to capture some of the market momentum for future clips.

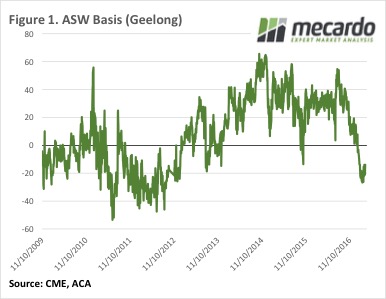

Most of the talk this week has been around ASW, especially in Victoria. With the Shipping Stems showing multiple boats are coming into Melbourne, Geelong and Portland over the coming month, looking for wheat, buyers are having to lift prices to secure supplies.

Most of the talk this week has been around ASW, especially in Victoria. With the Shipping Stems showing multiple boats are coming into Melbourne, Geelong and Portland over the coming month, looking for wheat, buyers are having to lift prices to secure supplies. Plenty of ASW has been bought on CLEAR Grain Exchange, and direct through brokers at around $200/t Port in Geelong and Portland. Port Adelaide has seen action on ASW between $190 and $200/t. In the Melbourne Port Zone ASW had been up to $205/t.

Plenty of ASW has been bought on CLEAR Grain Exchange, and direct through brokers at around $200/t Port in Geelong and Portland. Port Adelaide has seen action on ASW between $190 and $200/t. In the Melbourne Port Zone ASW had been up to $205/t.

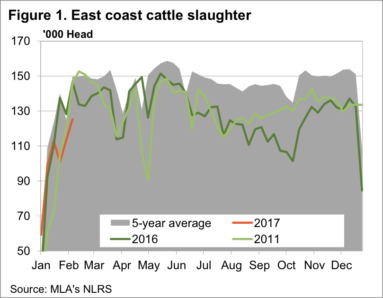

It remains a bit confounding that the supply dearth is concentrated in the southern states, given that the herd liquidation, and subsequent rebuild, should be concentrated in the north.

It remains a bit confounding that the supply dearth is concentrated in the southern states, given that the herd liquidation, and subsequent rebuild, should be concentrated in the north.

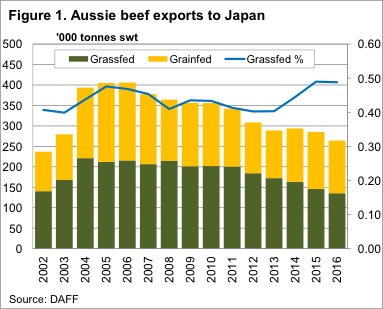

Prices for beef exported to Japan has been easing of late, which is a bit of a concern, given Japan is our major high value export market. With Japanese beef export prices sitting on a key support level, we take a look at what might happen to markets if prices break lower.

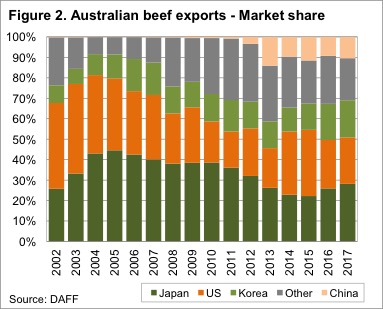

Prices for beef exported to Japan has been easing of late, which is a bit of a concern, given Japan is our major high value export market. With Japanese beef export prices sitting on a key support level, we take a look at what might happen to markets if prices break lower. Australian beef has also found markets other than Japan, where the value is similar. The ‘other’ markets, mainly South East Asian Countries, and China, have increased their share of Australian beef exports to 31% in 2016, up from 12% in 2007 (figure 2).

Australian beef has also found markets other than Japan, where the value is similar. The ‘other’ markets, mainly South East Asian Countries, and China, have increased their share of Australian beef exports to 31% in 2016, up from 12% in 2007 (figure 2). Figure 3 shows the price of Grassfed Fullsets exported to Japan, along with the 90CL Frozen Cow exported to the US, and the monthly average National Heavy Steer Indicator. Since November the Grassfed Fullset has fallen nearly 9%.

Figure 3 shows the price of Grassfed Fullsets exported to Japan, along with the 90CL Frozen Cow exported to the US, and the monthly average National Heavy Steer Indicator. Since November the Grassfed Fullset has fallen nearly 9%.

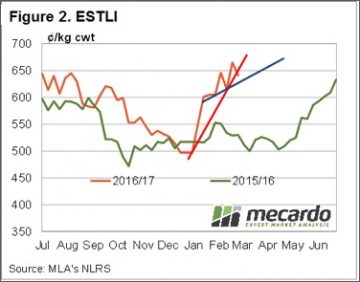

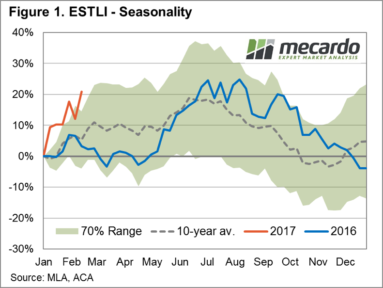

A firm recovery in price across all east coast categories of lamb and mutton reflecting the underlying tight supply anticipated this season to see the Eastern States Trade Lamb Indicator (ESTLI) surge to fresh highs, closing at 664¢/kg cwt yesterday – a gain on the week of 7.4%.

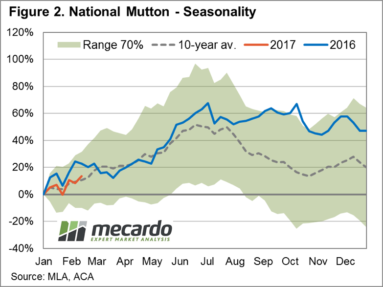

A firm recovery in price across all east coast categories of lamb and mutton reflecting the underlying tight supply anticipated this season to see the Eastern States Trade Lamb Indicator (ESTLI) surge to fresh highs, closing at 664¢/kg cwt yesterday – a gain on the week of 7.4%. East coast mutton also enjoying some upward momentum on the week, reflective of the trade and heavy lamb gains, to see it rise 7.5% to 441¢/kg cwt. Figure 2 showing the seasonal percentage gains for mutton so far this year respectably tracking along the ten-year average pattern. Although the price pattern for mutton not as robust when compared to the ESTLI performance and the pattern set by mutton during the 2016 season.

East coast mutton also enjoying some upward momentum on the week, reflective of the trade and heavy lamb gains, to see it rise 7.5% to 441¢/kg cwt. Figure 2 showing the seasonal percentage gains for mutton so far this year respectably tracking along the ten-year average pattern. Although the price pattern for mutton not as robust when compared to the ESTLI performance and the pattern set by mutton during the 2016 season. To read more about the expected tight supply during 2017 and our ESTLI forecast released in December 2016 click

To read more about the expected tight supply during 2017 and our ESTLI forecast released in December 2016 click

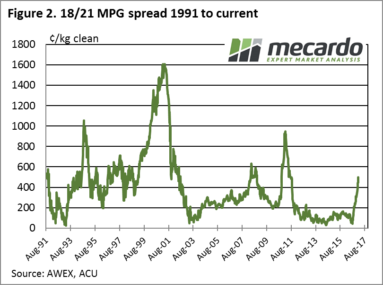

AWEX report a “good solid market over three selling days”; again it was the fine wool leading higher while the rest of the market held firm. Crossbreds also finally found some support and reversed their long downward spiral to see the 28 MPG improve by 19 cents.

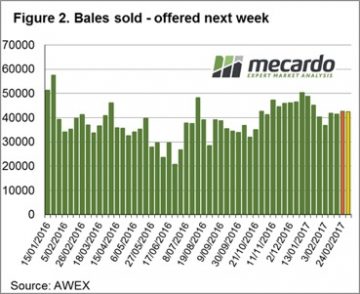

AWEX report a “good solid market over three selling days”; again it was the fine wool leading higher while the rest of the market held firm. Crossbreds also finally found some support and reversed their long downward spiral to see the 28 MPG improve by 19 cents. While 47,000 bales were originally listed, only 45,400 bales were eventually offered with 41,500 sold into a market resulting in a 7.6% Passed In rate. The PI rate was skewed somewhat with growers in Fremantle passing 13.5%.

While 47,000 bales were originally listed, only 45,400 bales were eventually offered with 41,500 sold into a market resulting in a 7.6% Passed In rate. The PI rate was skewed somewhat with growers in Fremantle passing 13.5%. As

As

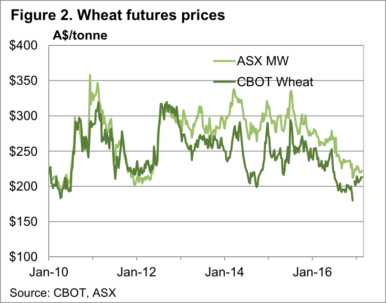

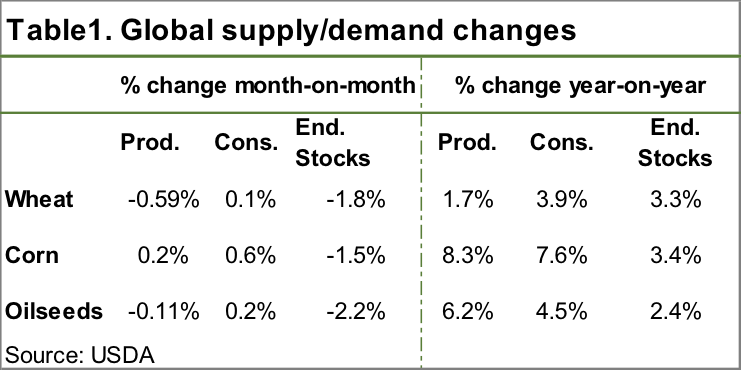

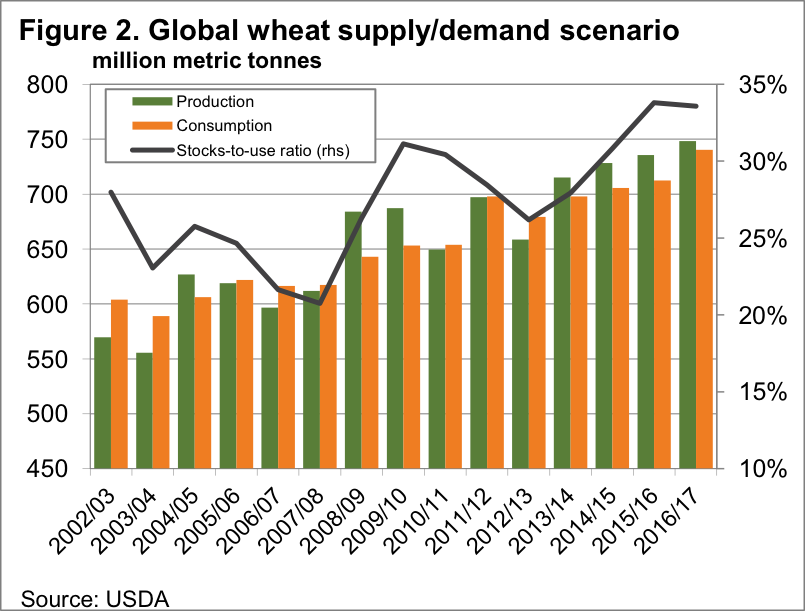

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year.

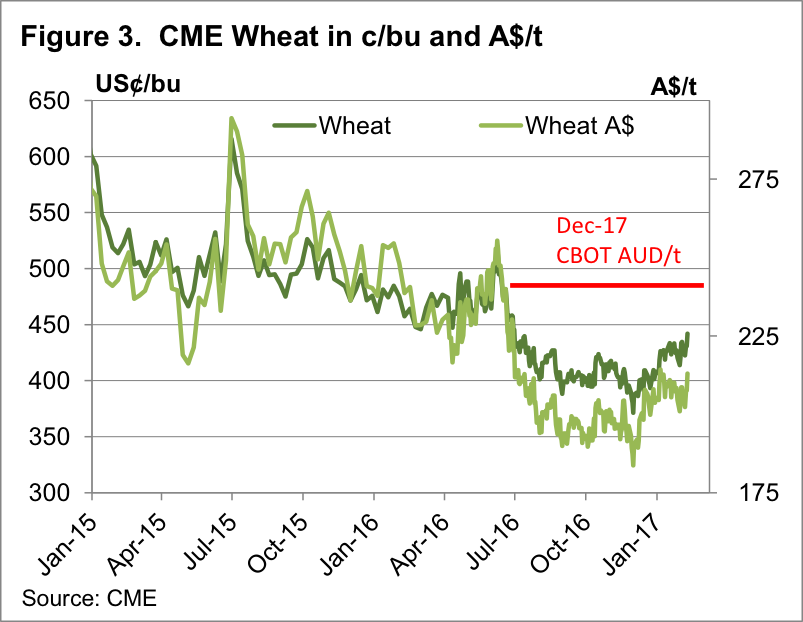

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year. In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016.

In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016. In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.