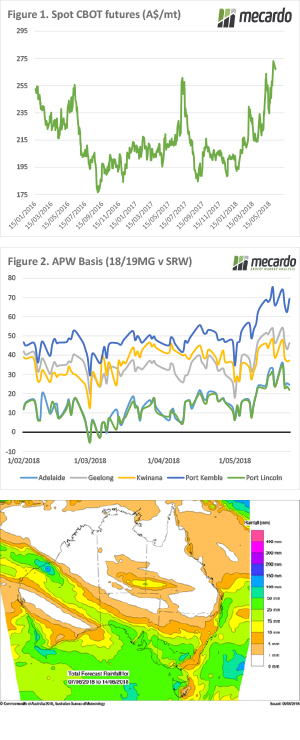

A relatively downbeat week in the grain trade, with the world watching and waiting for the next big driver of pricing. The big data release for the week was the USDA world agriculture supply and demand estimates.

There has been a high degree of volatility in the past week as traders scope for telltale signs of weather impacted yields in the northern hemisphere. The market has recovered A$5 overnight, but week on week the wheat futures market is down 6% or A$14 on the spot contract (Figure 1).

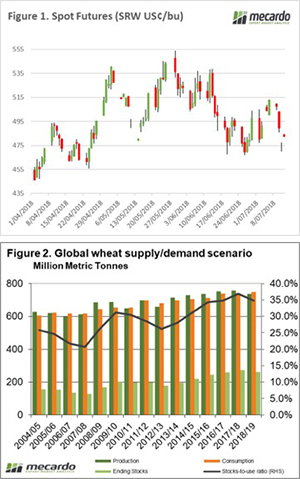

The July USDA report was released overnight. The report called major reductions for wheat production around the world. The global end stocks for the coming season were dropped to 250mmt, the lowest since 2016/17 (Figure 2).

The USDA has lowered consumption of wheat by 2.3mmt, however, this was more than offset by falls in production. Dry conditions around major crop growing regions are the driver of this downward movement in Australia (-2mmt), EU (-4.4mmt), Russia (-1.5mmt), Ukraine (-1mmt).

This report was generally bullish in nature and points towards a tightening global wheat market. Although global wheat stocks will still be the second highest on record, production by the main exporting nations is slipping.

What does it mean/next week?:

This week will see more certainty as the northern hemisphere harvest progresses. There are a few tenders in the next few days which will give some indication of pricing signals.

Locally in Australia VIC, SA & WA are forecast to receive reasonable rainfall events in the next eight days. It however, looks like NSW is set to miss out.

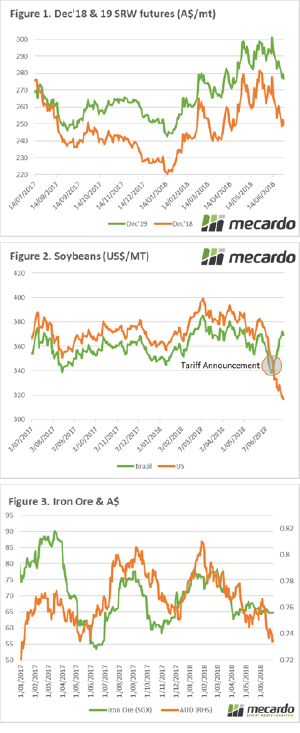

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

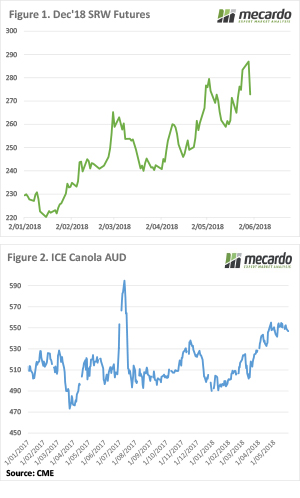

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.

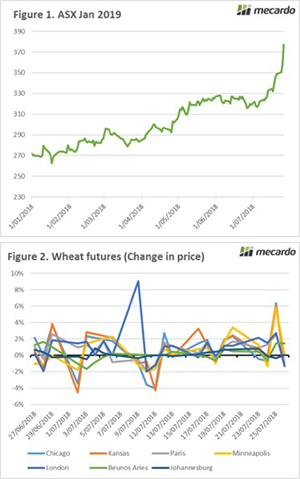

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.  The ASX east coast wheat coast contract has been on a steady climb over recent weeks however this week the market has been on fire. The price has increased a whopping $27 since last Friday (fig1). This is because of continued dry conditions on the east coast in conjunction with the flow on effect from the wider worlds woes.

The ASX east coast wheat coast contract has been on a steady climb over recent weeks however this week the market has been on fire. The price has increased a whopping $27 since last Friday (fig1). This is because of continued dry conditions on the east coast in conjunction with the flow on effect from the wider worlds woes.

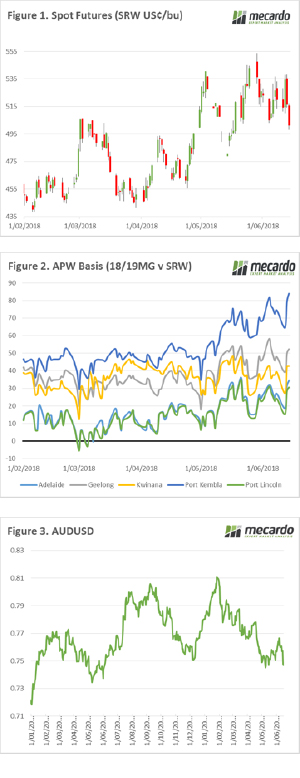

It was a big week in the grain markets with the release of crop forecasts from the US and Australia. The market teeters on the edge of a bull market causing a high degree of volatility. In this weeks market comment we take a look at the A$, futures and new crop basis.

It was a big week in the grain markets with the release of crop forecasts from the US and Australia. The market teeters on the edge of a bull market causing a high degree of volatility. In this weeks market comment we take a look at the A$, futures and new crop basis.

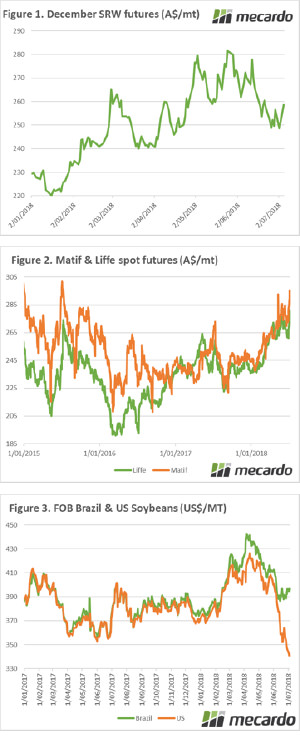

Chicago Soft Red Wheat managed to maintain its upward trend this week. It had an attempt at moving lower but bounced stronger on Wednesday night. Local wheat prices also tried to go lower but found strength on Thursday.

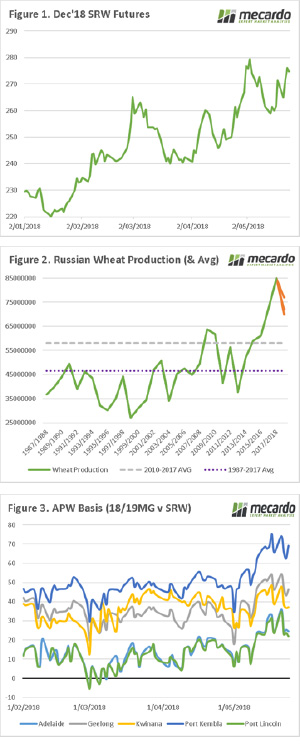

Chicago Soft Red Wheat managed to maintain its upward trend this week. It had an attempt at moving lower but bounced stronger on Wednesday night. Local wheat prices also tried to go lower but found strength on Thursday. The wheat yo-yo continued in the US as they approach harvest. Chicago Soft Red Wheat rallied to new highs this week, before easing back again. The charts are pointing to more upside, but supply will soon start rolling in.

The wheat yo-yo continued in the US as they approach harvest. Chicago Soft Red Wheat rallied to new highs this week, before easing back again. The charts are pointing to more upside, but supply will soon start rolling in. In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.