Have you heard the one about the rain on the US Plains? Thought so. It might seem like déjà vu but the story remains the same, with a few twists thrown in this week.

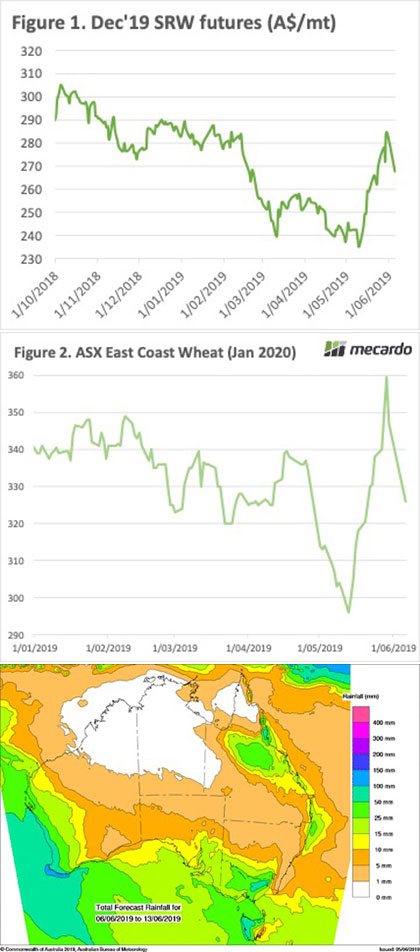

More rain is falling or is forecast to fall across US cropping areas. Northern areas are being most affected, with soft red winter wheat quality now coming into question. This concern, along with further rises in corn, managed to push CBOT back to recent highs last night.

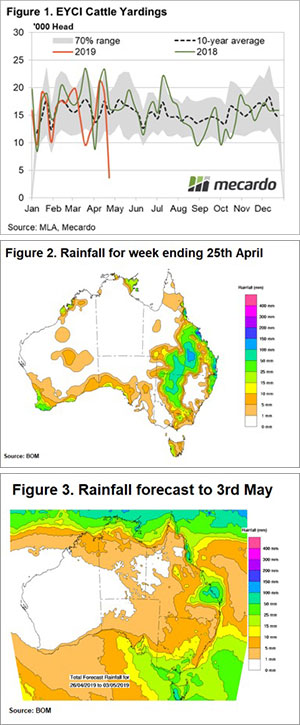

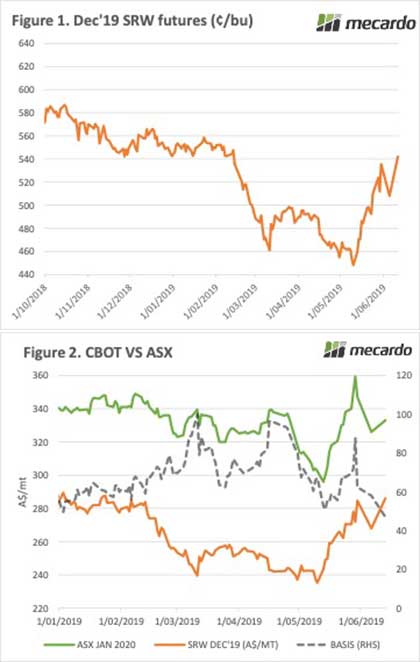

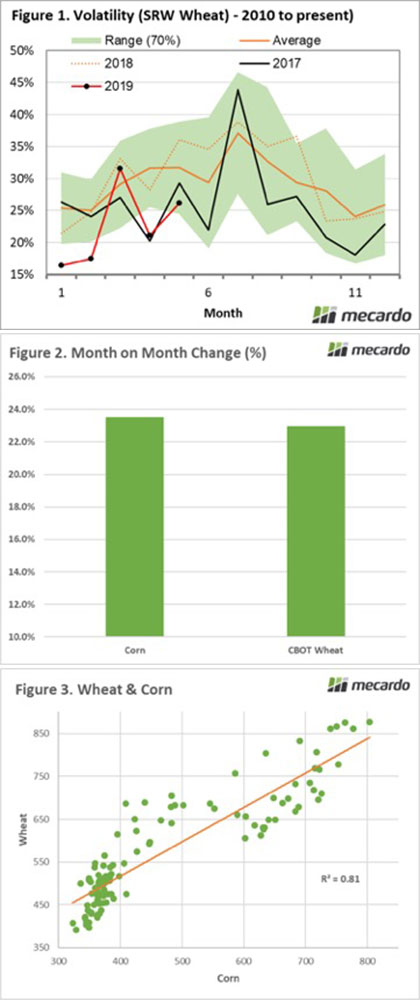

Figure 1 shows the bounce CBOT experienced in US terms, just making a new three month high. With the Aussie dollar relatively steady for the week, CBOT is also back to a three month high in our terms, at $287/t.

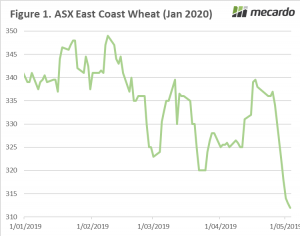

Jan-20 ASX Wheat traded at $333/t yesterday, with the rain across the cropping areas of SA and Victoria helping depress basis. ASX basis is now down back under $50 per tonne (Figure 2) as the southern cereal crop now has enough moisture for the next month. There is a long way to go though.

ASX Feed Barley traded at $278.50/t, and is now at a $55 discount to the wheat contract. Barley rarely gets to such a discount, and this suggests it might be good buying for consumers. World feed prices have been on the rise, with CBOT Corn now at $250/t in our terms, so further downside might be limited.

What does it mean/next week?:

It is now just NSW which needs the rain in a hurry. There is little prospect for the next 8 days, so we’ll have to wait a bit longer. Internationally the heavy supplies of wheat are being offset by tighter supplies of corn. There could be further issues for corn, with the target for many the magic $300/t wheat swap, within reach.

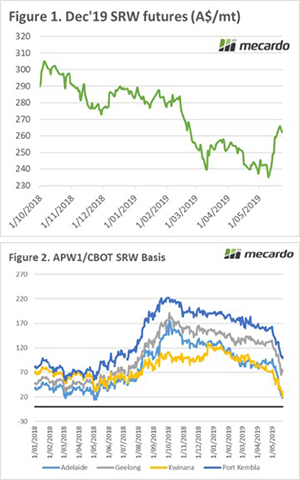

Figure 1 displays the physical contract price for APW1 multigrade and Figure 2 shows the basis versus December Chicago futures. I have selected a number of ports to give a broad spread of the nations’ wheat growing area.

Figure 1 displays the physical contract price for APW1 multigrade and Figure 2 shows the basis versus December Chicago futures. I have selected a number of ports to give a broad spread of the nations’ wheat growing area.

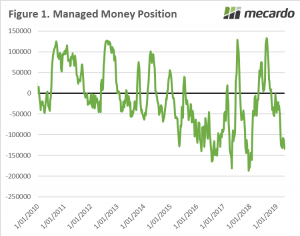

using a futures contract, it is either a long (buy) or short (sell) position.

using a futures contract, it is either a long (buy) or short (sell) position.

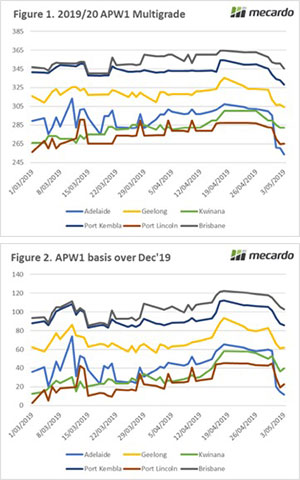

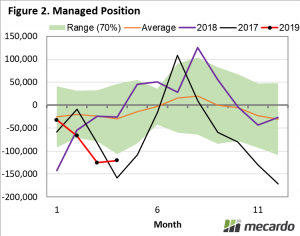

In figure 1, ASX wheat for Jan 2020 is shown since the start of the year. In the past week, the contract has fallen 7% or A$25. The contract is now at its lowest level since April/May last year.

In figure 1, ASX wheat for Jan 2020 is shown since the start of the year. In the past week, the contract has fallen 7% or A$25. The contract is now at its lowest level since April/May last year.