You should have started your grain marketing program by now, but if you haven’t it’s time to start keeping an eye on the market. In this series of articles, we will examine the seasonality in pricing for wheat across the country. This week we will start off in Geelong.

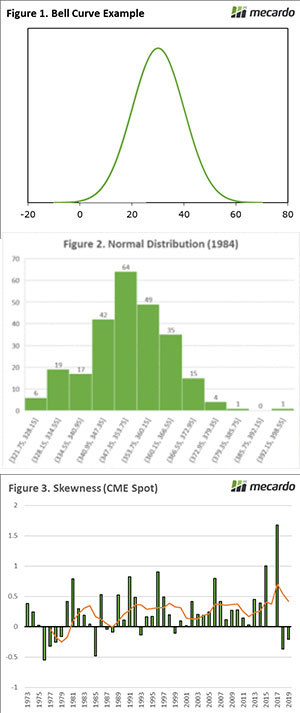

Seasonality can provide an indication of the performance of a commodity, in a similar way to deciles. We regularly use them to show how the market is travelling at present compared to previous points in time and view patterns that might emerge.

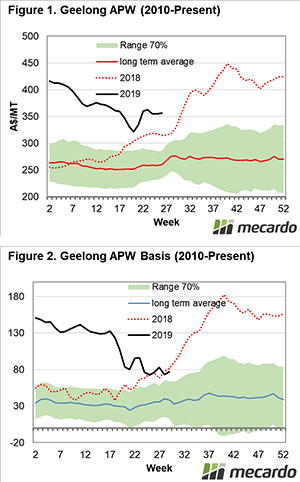

In these seasonality charts, rather than use a min/max for the seasonality banding (green shaded area), we use a 70% range (or 1 standard deviation). The 70% banding is used to remove the extremes in the marketplace, which we believe gives a better indication of the seasonality, as opposed to a min/max which can be extremely volatile. In these charts, we also overlay the average for the timeframe and the recent seasons.

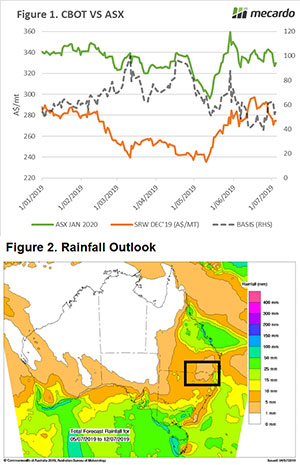

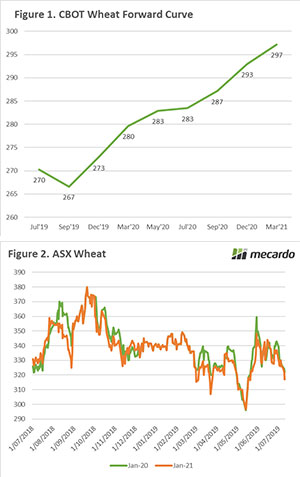

In figure 1, the flat price for APW wheat in Geelong is displayed. The flat price is the price that you will receive from a buyer (the combined futures, basis and FX). During the past year we have experienced extremely high prices. Even now with prices falling close to A$100 since the peak, they still represent strong levels.

In figure 2, the basis level between Chicago and Geelong is displayed. In order to get the best return for your production it is important to understand basis (explanation here). The extreme basis was the reason behind the high prices during the past season. The drought has caused premiums above Chicago to increase due to the scarcity of supply locally.

In both flat price and basis we can see that for the first six months or so they trade in a relatively narrow band. The last half of the year is where any action will arrive, this is where the price will either rise or fall dependent upon how the season progresses – more grain lower basis (and vice versa).

Key Points

- The Geelong market has fallen close to A$100 from this seasons’ peak, however remains at prices which would be historically attractive.

- The first half of the year tends to trade in a narrow range, followed by a bigger spread in the second half of the year.

- Prices are liable to be volatile as we move close to harvest so we may see some downside.

What does it mean/next week?:

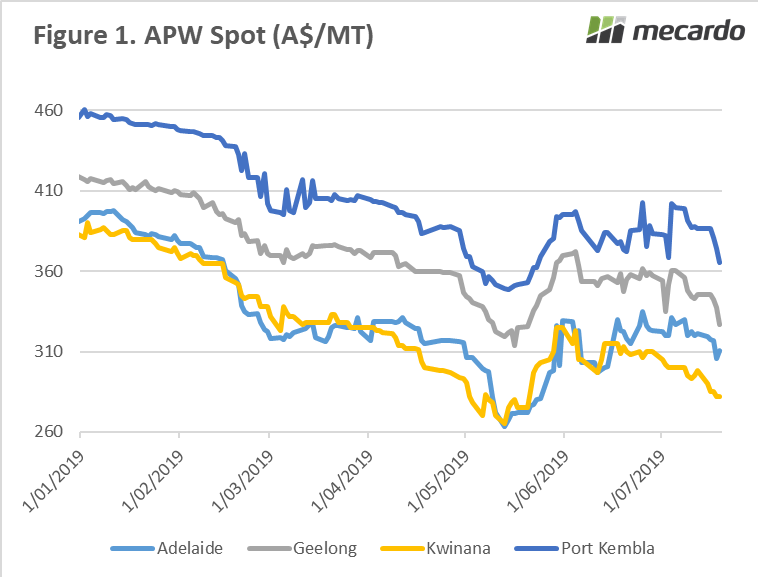

The spot price has declined markedly but due to the rainfall and moisture profile this year, this signals good prospects for the upcoming harvest in regards to production. We are now at the midpoint where the pricing will reflect the supply of Australian wheat. However, until harvest, spot prices are likely to be extremely volatile as pantries remain empty.

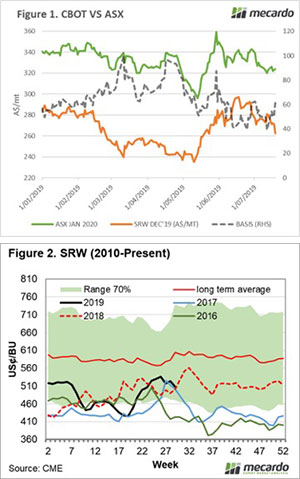

However, when we look further out to next December (2020), we can see that the futures contract is trading at A$293/mt. This may be a more attractive proposition when using CBOT futures as it provides a level which will most likely end with an overall price well above A$300/mt when basis is added.

However, when we look further out to next December (2020), we can see that the futures contract is trading at A$293/mt. This may be a more attractive proposition when using CBOT futures as it provides a level which will most likely end with an overall price well above A$300/mt when basis is added.