The grain market in Australia has been on a rollercoaster since last year. The excitement has continued, and we see local markets continuing to rise. In this update we take a look the woes in Western Australia and look at whether we will hit last years pricing environment.

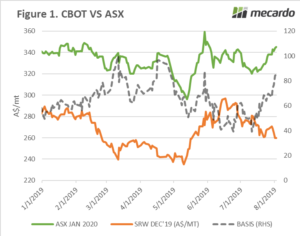

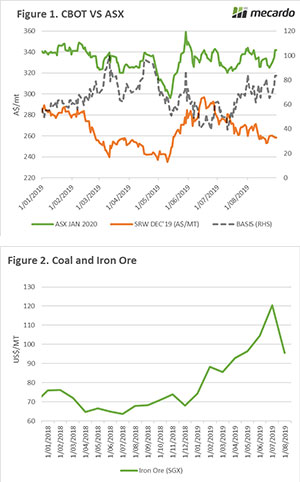

Australian grain markets continue to be focused on local conditions, with little influence from overseas. This is due to the continuing poor conditions within Australia. During last week the ASX contract had lost steam after a sharp rally and had fallen to A$355. This week, the Jan 2020 has slowly crawled back to A$367. The market has however had slim volume (figure 1), with only 421 contracts trading. This equates to 8420mt traded, which is a reduction on the previous weeks 52320mt.

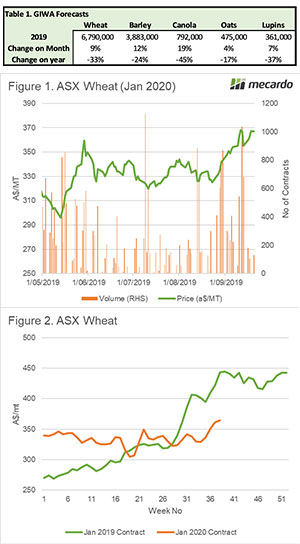

In recent weeks one of the banks were quoted as saying that prices could rise above last years levels. I thought it would be of interest to see how the market is tracking compared to last year. In figure 2, the average price for each of the weeks running up to last years and this year’s contract expiry. As we can see the contract has increased in recent weeks, but not to the same levels.

This time last year the Jan 2019 ASX contract was trading at A$442 whereas the Jan 2020 contract this week is trading A$78 lower. It is not impossible that the price will rise above last year, but we will have to see a very strong rise to exceed the same levels. At this point of the year the price rise is unlikely to come from overseas moves, so will require a further strong reduction in domestic production.

In 2018 the west coast won both the grand final and prize of a large crop. In the past fortnight both have been blown out of contention. The dry weather and frost damage has reduced the potential of the crop, with GIWA showing the following amendments:

Remember to listen to our podcast

What does it mean/next week?:

There have been concerns about frosts in Victoria and South Australia. In the next week the market will get a handle on any losses.

The black sea region is in the process of starting to plant the winter crop. Recently these areas have experienced dry conditions. It will be interesting to see whether there will be a reduction in planting.

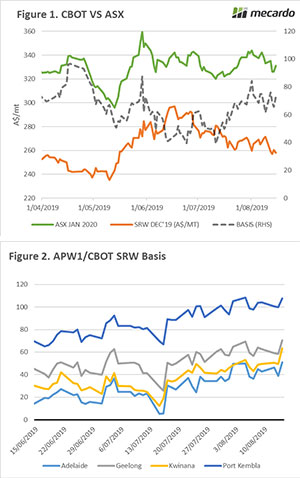

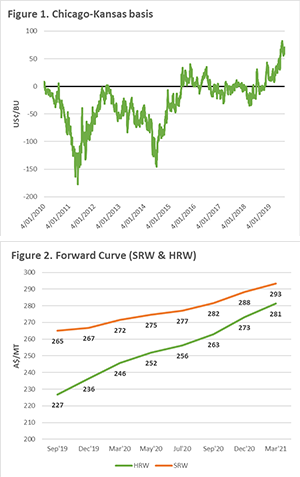

In figure 2, the forward curve is shown for both contracts (in A$/mt). It is always important to examine the curve as it can provide a strong insight into hedging opportunities. As we can see the Kansas contract is at a strong discount to Chicago at present, however it does start to converge further down the horizon.

In figure 2, the forward curve is shown for both contracts (in A$/mt). It is always important to examine the curve as it can provide a strong insight into hedging opportunities. As we can see the Kansas contract is at a strong discount to Chicago at present, however it does start to converge further down the horizon.

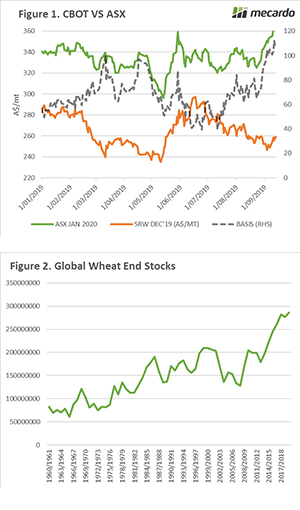

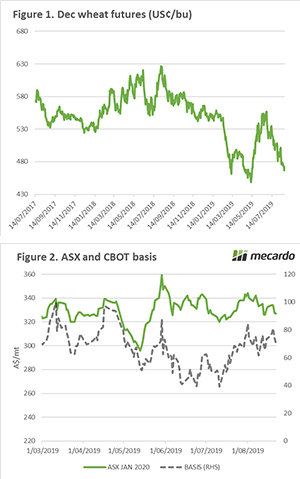

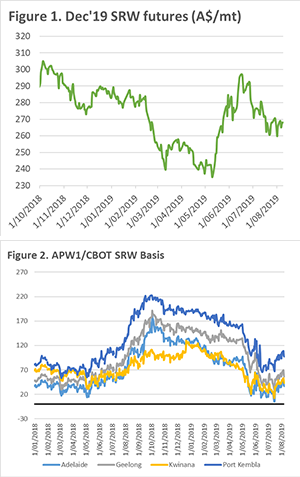

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.