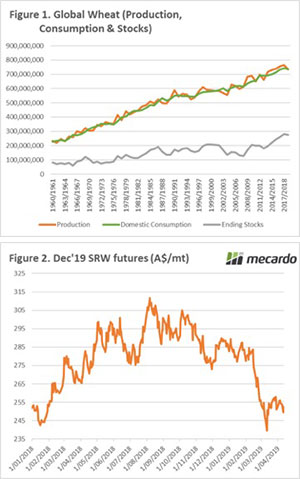

Grain in Australia is a tale of two markets. The country is still in an effective drought, whilst the rest of the world is on course to produce a bumper crop. In this article, we will update on the situation with the A$ and overseas production.

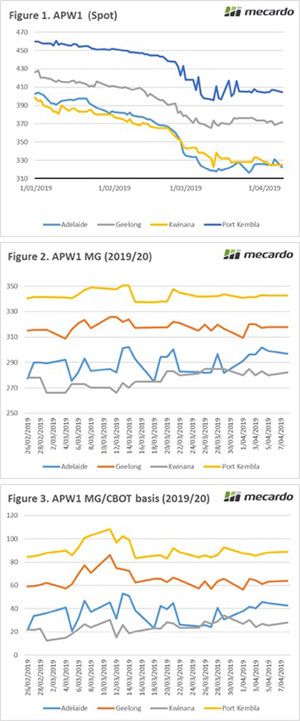

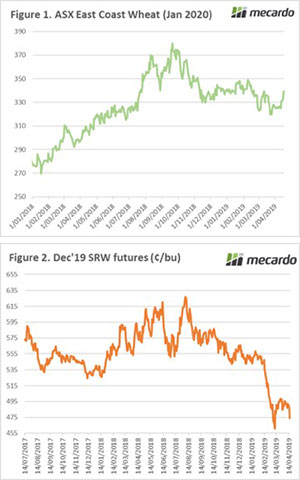

The Futures market continued its downward transition this week, with the December Chicago contract down 2% since the last day of trading before the Easter break. Although the contract has marginally recovered, it was at contract lows yesterday. The contract converted to Australian dollars experienced a gain of 1% to close A$1 higher (Figure 1).

The Australian dollar has provided this gain. Australian inflation has been lower than the RBA target for the past three years. The banks are now expecting that there will be one or two rate cuts. The result has been a fall from 0.7152 to 0.7019 over the past week (Figure 2). This will likely help with those variable rates and improve our attractiveness for exports of all commodities.

The international values have taken a dive in recent weeks, as the world looks likely to produce a substantial wheat crop this year. In recent days, several bearish data points have been released:

- Canada

The Canadians have reduced their canola acreage as a result of the continuing trade concerns with China (see here). In turn, they have increased barley by 10.2% (+662k/acre) and wheat by 3.8% (+939k/acre).

- IGC

The International Grains Council has increased its forecasts for the global wheat crop to 762mmt, 27mmt more than last year. This leads to a year on year increase in global end stocks of 10mmt (274mmt).

- Black sea

The Black Sea continues to perform well. The crop in Russia, Kazakhstan and Ukraine are experiencing favourable conditions with adequate soil moisture. It is likely that the Black Sea nations will continue to be the dominant export players this season.

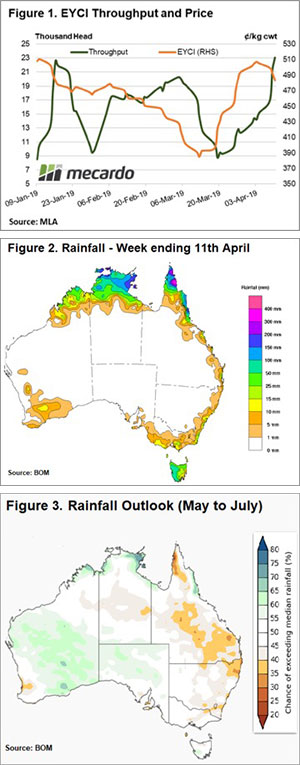

- Australia

Anzac day is the traditional starting point for seeding around the country. However most growing regions have inadequate soil moisture, and rainfall forecasts have tended to tease rainfall on the 14-day forecast, but not eventuated. There is substantial rainfall on the horizon, we just need it to fall.

Next week?

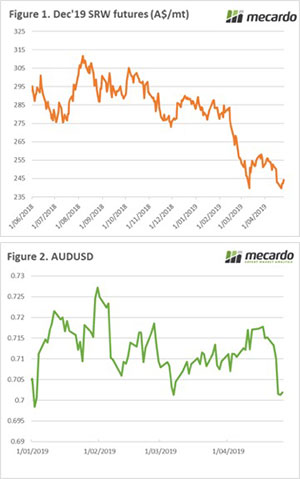

Pricing is a tale of two markets at present: International and domestic.

Barring any major disaster overseas the world is liable to produce a bumper crop, this will keep pricing depressed. At a local level, we are however still in an effective drought phase, which maintains our domestic premiums over the rest of the world.

Overnight the commitment of traders report will be released which will outline the sentiment of the speculators. It will be of great interest to see whether they are still holding a very bearish position.

This buying by consumers is an attempt to ensure that they have some cover as we start the new season marketing period. There is still great uncertainty on how the season will transpire, however, the memory of the past year is fresh – and A$339 is more attractive than a possible >A$400.

This buying by consumers is an attempt to ensure that they have some cover as we start the new season marketing period. There is still great uncertainty on how the season will transpire, however, the memory of the past year is fresh – and A$339 is more attractive than a possible >A$400.