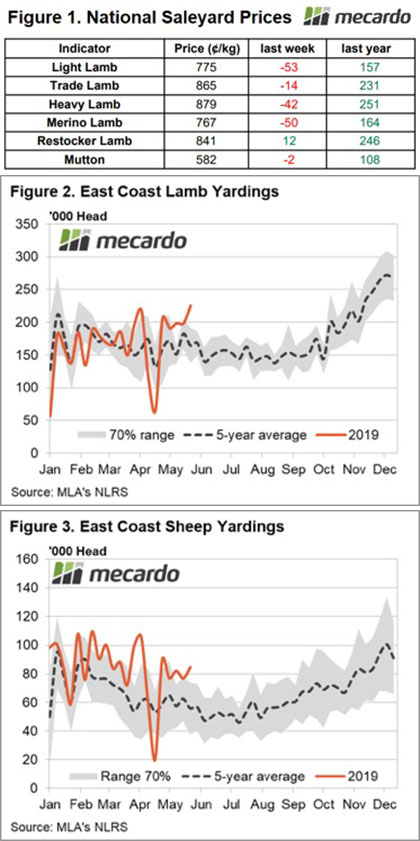

Another week of low offerings, high pass-in rates and price falls.The retracement from the February peak is well and truly happening.

All categories were impacted with the exception of the better prepared crossbred lots, although these were in scarce supply.

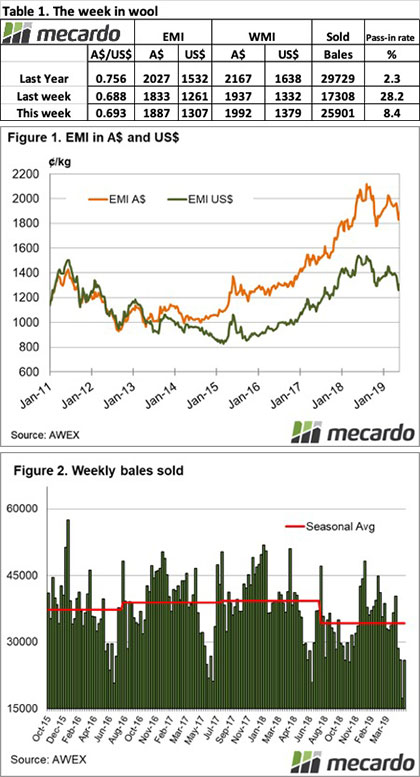

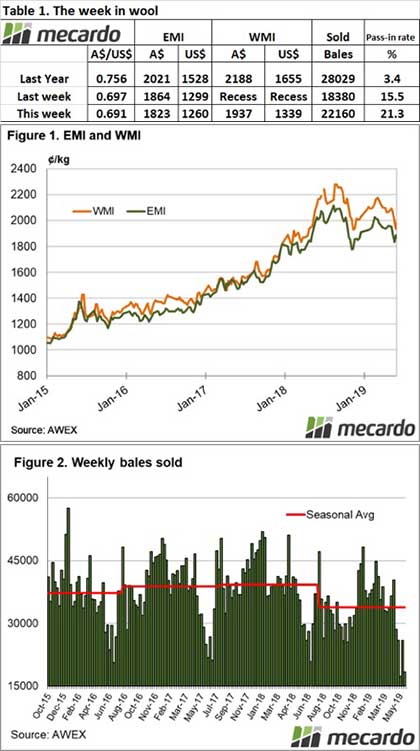

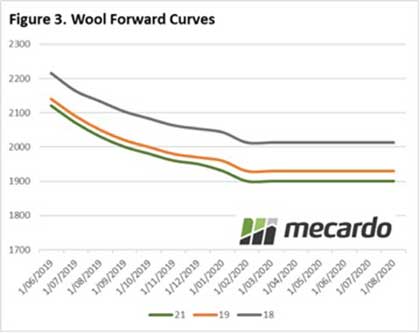

The Eastern Market Indicator (EMI) fell back a further 41 cents this week on top of the 23 cents of last week and closed at 1,823 cents. The Au$ held steady for the week at US $0.691 and as a result, the EMI in US$ terms fell 39 cents in line with the Au$ movement, ending the week at 1,260 US cents (Table 1).

AWEX report the EMI is now 293 cents below the record of 2,116 cents it achieved in August last year and 198 cents lower than the same time last year, a fall of 9.8%.

Fremantle had to catch up to the East coast following its one week recess. This realignment hit hard on Wednesday with a generally lesser continuing fall on Thursday. It was a very small offering of just under 6,000 bales in W.A., however growers passed in 2,400 bales or 40% of the offering. This could be a record pass in rate, even for Fremantle.

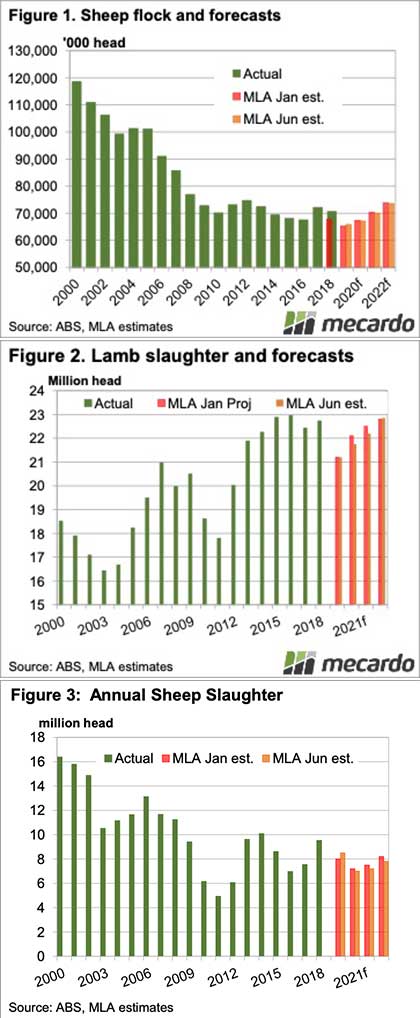

An offering of just 28,140 bales came forward nationally, 6,300 more than last week with Fremantle returning. The pass in rate across the selling centres again was high, at 21.3% for the week, up on last week’s 15.5%. This meant that 22,160 bales were cleared to the trade, 11,300 below the corresponding week last year. In the auction weeks since the winter recess, 1,351,521 bales have been cleared to the trade, 274,560 fewer than the same period last year.

The dollar value for the week was $42.20 million, for a combined value so far this season of $3.119 billion. A simple calculation of $ value divided by bales sold gives us $1,904 per bale across all types for the week.

Crossbred wools also fell on both days with the exception of some of the better prepared fine crossbreds which were slightly stronger. Oddments were cheaper, although some lots with low VM attracted stronger interest, again these lots were few and far between.

The week ahead

Next week a combined offering of just over 19,000 bales was rostered across all selling centres. For the coming weeks 31,000 and 34,000 bales are currently forecast.

The past 5 weeks has seen almost 40,000 fewer bales cleared to the trade compared to the same time last year. It is with interest we await the usual Spring flush of wool to get a feel for the full extent of the supply levels that will be available for the rest of the year.

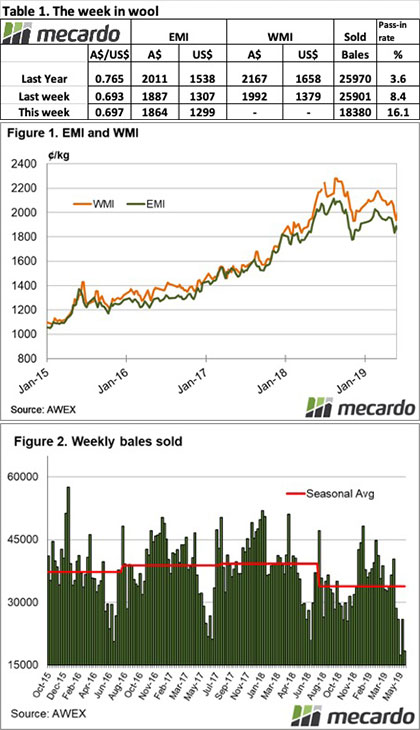

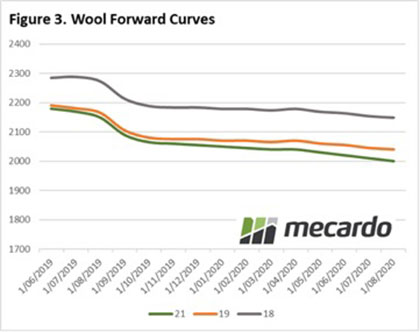

Another solid week in the forwards market, with 21 micron being the main MPG dealt. One trade was dealt for 19 micron wool for August and agreed at 2,180¢. Four trades were dealt for 21 micron wool. One of those was for September at 2,080¢ and one for October at 2,050¢. Two trades were agreed for November at 2,050¢ and 2,075¢ respectively. Two trades were dealt for 28 micron wool and were agreed at 1,100¢ and 1,130¢ for August.

Another solid week in the forwards market, with 21 micron being the main MPG dealt. One trade was dealt for 19 micron wool for August and agreed at 2,180¢. Four trades were dealt for 21 micron wool. One of those was for September at 2,080¢ and one for October at 2,050¢. Two trades were agreed for November at 2,050¢ and 2,075¢ respectively. Two trades were dealt for 28 micron wool and were agreed at 1,100¢ and 1,130¢ for August.