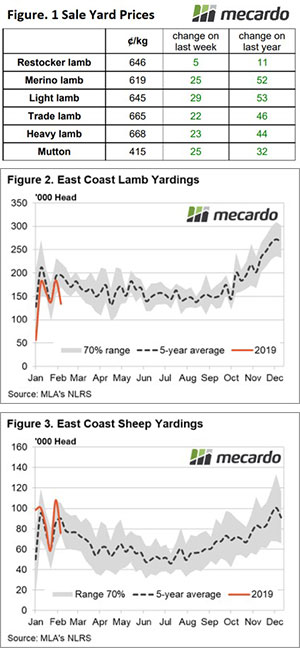

A bit of a mixed bag for lamb price movements this week across the Eastern states, with Restocker, Trade Lambs and Mutton the only categories to see a price lift. Mutton prices remained remarkably strong in the face of elevated yarding and slaughter throughout much of March.

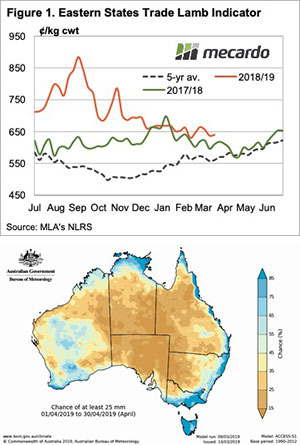

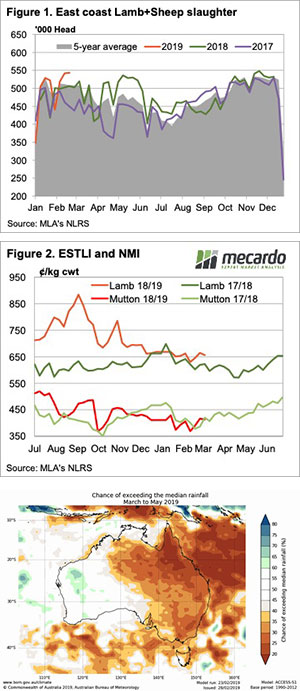

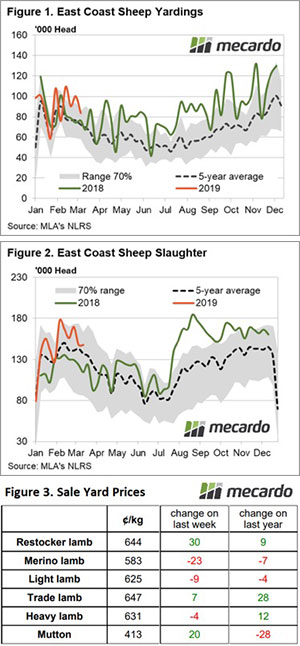

NSW saleyards are where the bulk of the sheep are being presented, with average weekly throughput levels during March sitting 43% above the five-year trend and 30% higher than in 2018. The increased NSW mutton yarding has helped to lift the overall East coast levels during March to see average weekly levels trending 22% above the March average pattern – Figure 1.

Throughput is not the only elevated supply measure for mutton with East coast mutton slaughter also remaining elevated during March – Figure 2. Both NSW and Victorian mutton slaughter are contributing to the increased East coast total slaughter. Average weekly NSW mutton slaughter during March have been running 27% higher than the five-year average, while Victorian mutton slaughter has been 23% higher. The two states combining to see East coast slaughter averaging weekly slaughter levels that are 11% higher than the five-year pattern.

Despite the weight of supply, mutton prices managed to gain nearly 5% this week to creep back above 400¢/kg cwt, closing the week at 413¢. The prospect of rain from tropical cyclones pushing further into the southern regions in the coming week also seemed to spur on Restocker Lamb prices to see them gain over 4% to close at 644¢ – Figure 3.

The benchmark Eastern States Trade Lamb Indicator (ESTLI) managed a milder 1% lift to see it close at 647¢/kg cwt.

What does it mean/next week?:

Remnant moisture from the cyclone activity in Northern Queensland is expected to make its way into Southern regions this week, with NSW benefitting from 10-25mm falls across much of the state. It is probably not heavy enough, nor going to be sustained for long enough, to make a significant impact upon price while supply remains elevated but could encourage some minor gains.