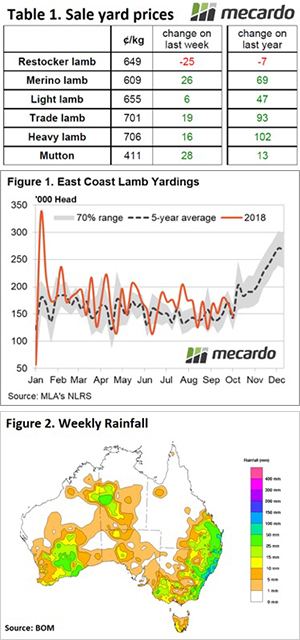

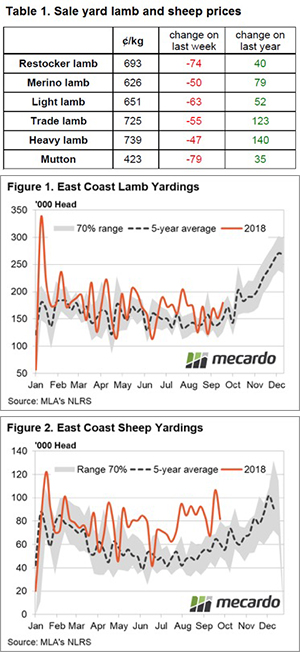

Sheep and lamb slaughter has been on the rise, but so have prices. Both lamb and mutton values rallied this week with significant rain falling just as processors seem to be increasing kills and looking for stock. The question is how much further prices can go?

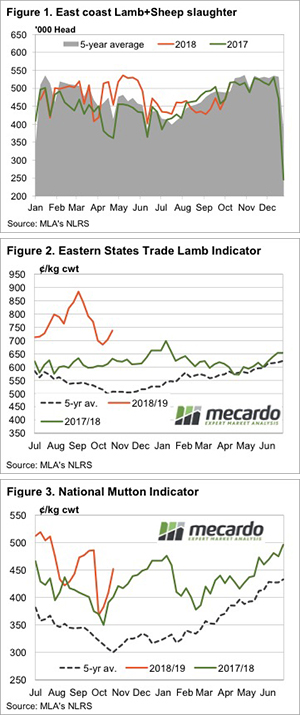

Meat and Livestock Australia’s (MLA) weekly slaughter data is a week old but it tells an interesting story. Lamb slaughter was down 11% on the same week last year, but sheep slaughter was up 27%. The total sheep and lamb slaughter, shown in Figure 1, was almost exactly the same as the same time last year.

It appears the kill space is opening up again as supply improves, and there might be some money in sheep and lambs for processors again, as they are pushing prices higher.

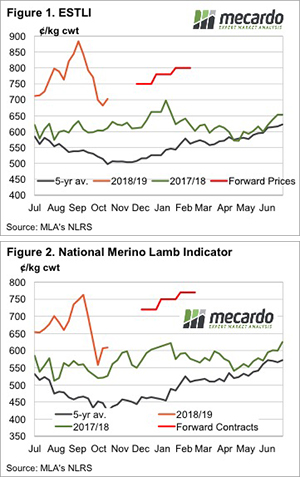

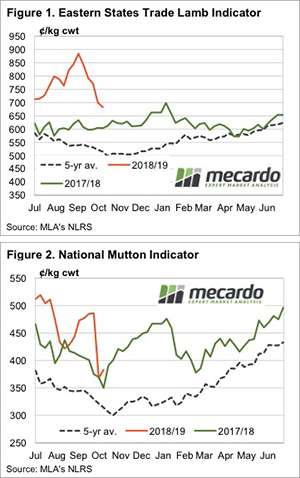

The Eastern States Trade Lamb Indicator (ESTLI) gained 36¢ this week, rallying back to 737¢/kg cwt. Heavy lambs are still the highest price, at 742¢.

Figure 3 shows Mutton values regaining much of the fall seen in early October. While lamb prices have never been higher, apart from recent times, mutton values were indeed stronger in December last year. This suggests mutton might have a bit further to go.

Restocker lambs had the biggest move this week, gaining 90¢ to move to 739¢. There are perhaps some restockers anticipating the rain seen this week will result in some good pasture growth in what’s left of spring.

What does it mean/next week?:

With increasing confidence and renewed restocker demand, it’s hard to see sheep prices falling. Lamb prices might have a blip or two left in them when Victoria’s supply appears in November. Recent forward contracts suggest we might have already seen the low, however.

The market was moving along predictably enough. On Wednesday the Eastern States Trade Lamb Indicator (ESTLI) was down 57¢, hitting a 3 month low to 676¢/kg cwt.

The market was moving along predictably enough. On Wednesday the Eastern States Trade Lamb Indicator (ESTLI) was down 57¢, hitting a 3 month low to 676¢/kg cwt.

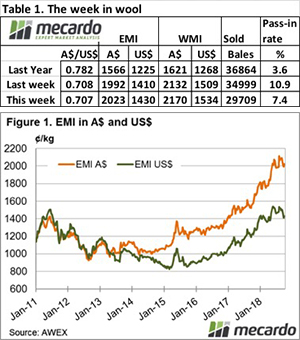

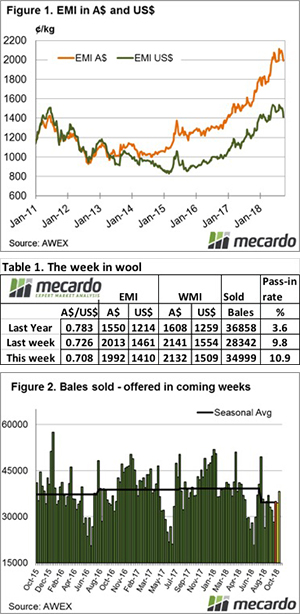

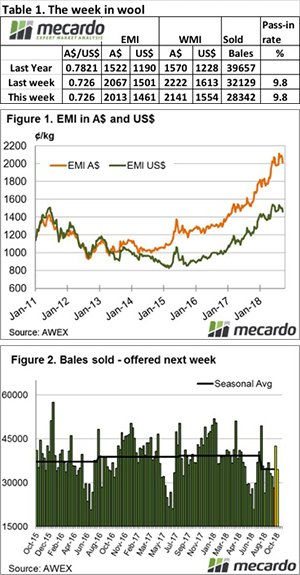

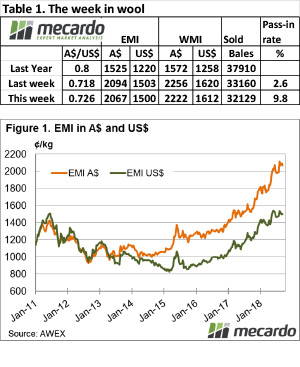

The beginning of the selling week saw the Au$ firm and the wool market ease as a consequence, however on Thursday, it was a different tale as buyers abandoned the poorer quality types but retained focus on well measured good yielding wool.

The beginning of the selling week saw the Au$ firm and the wool market ease as a consequence, however on Thursday, it was a different tale as buyers abandoned the poorer quality types but retained focus on well measured good yielding wool.